On December 1, 2020, the U.S. Commodity Futures Trading Commission (“CFTC”) Division of Enforcement released its Annual Report, which details a “record-breaking” fiscal year 2020 (“FY 2020”), despite the challenges presented by the COVID-19 pandemic.

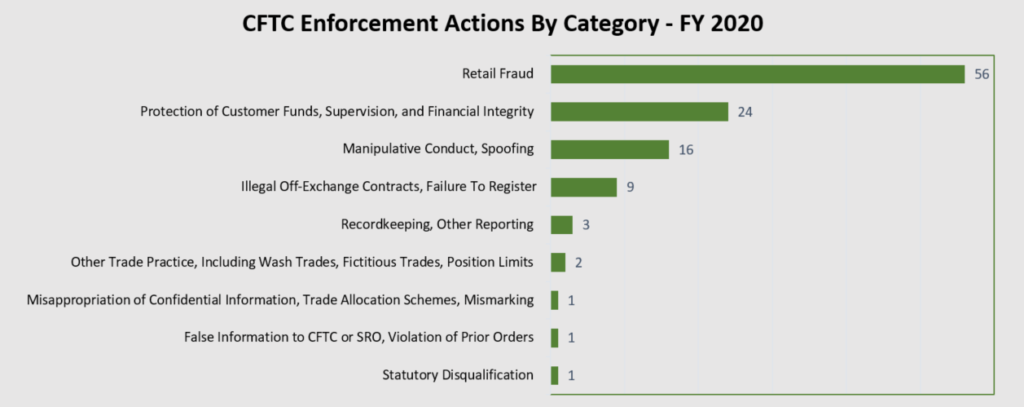

Notably, the CFTC filed a historic 113 enforcement actions—up from 69 filed in FY 2019, 83 filed in FY 2018, and an increase over the previous high of 102 filed in FY 2012. The chart below shows the breakdown of enforcement actions by category, and Appendix B of the Annual Report provides individual case citations.

CFTC Enforcement explained that “approximately 65% of the matters filed in FY 2020 involved commodity fraud, manipulative conduct, false reporting, or spoofing”—“some of the most pernicious forms of market misconduct.”

Central to the increase in enforcement activity in FY 2020 were the 56 retail fraud actions, the most brought by the CFTC in a fiscal year. Of those 56, a record seven involved digital assets, an area that CFTC Enforcement “continued to aggressively prosecute” and that CFTC Chairman Heath Tarbert has noted as an enforcement priority.

Another 16 of the enforcement actions involved spoofing and manipulative conduct. Penalties and fines associated with these 16 actions accounted for over 75% of the $1.3 billion in total monetary relief ordered in FY 2020. However, while this $1.3 billion total was the fourth largest in CFTC history, it was only a $7 million increase from FY 2019 and was markedly less than the record $3.2 billion in relief ordered in FY 2014.

In line with its stated prioritization of cooperative enforcement over the past three years, CFTC Enforcement reported its parallel efforts with criminal authorities and regulatory agencies in FY 2020, which were explained as “critical to deterring violators, punishing misconduct, preserving market integrity, and protecting market participants.” As in FY 2019, the CFTC brought 16 enforcement actions with parallel criminal filings. Additionally, the report highlighted the largest joint enforcement action filed in the CFTC’s history, involving 30 state financial regulators and alleging a $185 million elder fraud scheme. The report stated that “[t]he division looks forward to continued cooperation and coordination with enforcement counterparts on matters of mutual interest.”

CFTC Enforcement also reported that its whistleblower program “continued to experience significant advancement” in FY 2020, during which it granted 16 applications for whistleblower awards totaling approximately $20 million. CFTC Enforcement noted that it expects the program to continue to grow and that between 30% and 40% of ongoing investigations now involve a whistleblower component.

In addition to emphasizing certain quantitative results obtained in FY 2020, the report recognized qualitative efforts to provide more detailed guidance to market participants through the Enforcement Manual, which was introduced in FY 2019. Specifically, CFTC Enforcement issued its first guidance since 1994 outlining its consideration factors for civil monetary penalties as well its first publicly distributed guidance detailing consideration used when evaluating corporate compliance programs in connection with enforcement matters. Both guidance documents were issued in furtherance of the agency’s “dedicated approach to increased transparency.”

CFTC Enforcement stated that it will continue to focus enforcement efforts on four priorities: “(1) preserving market integrity; (2) protecting customers; (3) promoting individual accountability; and (4) coordinating with other regulators and criminal authorities on parallel matters.”

/>i

/>i