On March 6, the Securities and Exchange Commission (SEC) voted three to two to pass the much-anticipated final rules regarding the enhancement and standardization of climate-related disclosures for investors (Final Rules). The Final Rules will impose significant new requirements on public companies to disclose climate-related data in their registration statements and periodic reports, including their direct greenhouse gas emissions, information regarding climate-related risks and impacts on their businesses, operations or financial conditions, and other climate-related metrics.

Compliance Entities and Dates

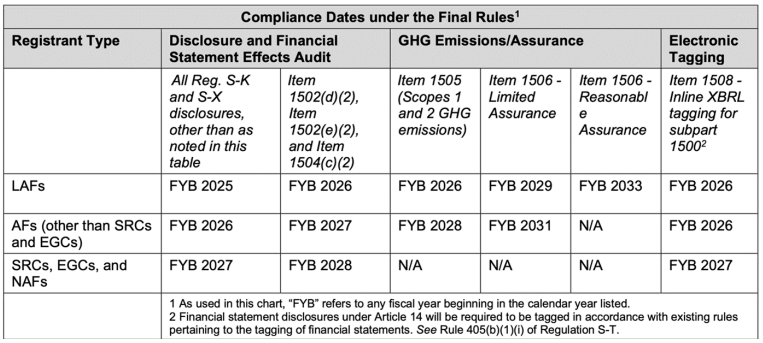

The Final Rules cover both domestic public companies and foreign private issuers other than registered investment companies, asset-backed issuers and Multijurisdictional Disclosure System (MJDS) filers (which allows certain Canadian issuers to register their securities with the SEC). The Final Rules do not exempt business development companies, REITs or issuers of registered non-variable insurance contracts. The first compliance period begins in 2025 for large accelerated filers. Table 1 from the SEC's fact sheet provides the compliance timelines for each filer type.

Table 1. Compliance Timelines1

LAFs – Large accelerated filers| AFs – Accelerated filers | NAFs – Non-accelerated filers | SRCs – Smaller reporting companies | EGCs – Emerging growth companies

Overview of the Final Rules

While the Final Rules are considered among the most drastic climate-related regulatory actions in recent US history, aspects of the Final Rules have been scaled back from the SEC's original proposed climate-related disclosure rules released in March 2022 (Proposed Rules).

Notably, the requirement to report Scope 3 emissions data has been removed altogether from the Final Rules. Further, only accelerated and large accelerated filers are required to disclose material Scope 1 and Scope 2 emissions data, and subject filers may report their emissions data in their second quarterly report after the end of their fiscal year rather than in their annual reports as was originally proposed.2

The SEC also has extended the phase-in periods for compliance as described in the above Table 1. Large accelerated filers and accelerated filers will be required to submit attestation reports for their material Scope 1 and Scope 2 emissions at the limited assurance level beginning 2029 and 2031, respectively, and at the reasonable assurance level for large accelerated filers only beginning 2033.

Additionally, the SEC has removed the requirement to disclose whether any board member has climate-related risk expertise.

Public companies should consider assessing and updating their current corporate charters, policies and internal disclosure controls and procedures, as necessary, to ensure compliance with disclosure requirements in the Final Rules. In particular, public companies should consider the following items:

- Reg. S-K Item 1501 – Governance. Oversight by the board of directors and the role of management in assessing climate-related risks and risk management;

- Reg. S-K Item 1502 – Strategy. Climate-related risks that have materially impacted or are reasonably likely to have a material impact on the registrant, including on its strategy, results of operations, or financial condition, along with a description of such impacts (including, e.g., the use of internal carbon pricing);

- Reg. S-K Item 1503 – Risk Management. Any processes the company has for identifying, assessing and managing material climate-related risks;

- Reg. S-K Item 1504 – Targets and Goals. Climate-related targets or goals that have materially affected or are reasonably likely to materially affect the company's business, results of operations or financial condition, including (i) material expenditures and impacts on financial estimates and assumptions as a direct result of the target or goal; and (ii) the use and cost of carbon offsets and renewable energy credits or certificates that the company has used as a material part of its plans to achieve its climate-related goals or targets;

- Reg. S-K Item 1505 – GHG Emissions Metrics. For accelerated and large accelerated filers only, Scope 1 and Scope 2 emissions data collection and disclosures, including a description of the methodology, significant inputs and significant assumptions used to calculate the company's emissions;

- Reg. S-K Item 1506 – Attestation of Scope 1 and Scope 2 Emissions Disclosure. For accelerated and large accelerated filers only, a third-party attestation report covering such Scope 1 and Scope 2 emissions data collection and disclosures; and

- Reg. S-X 14-02 – Disclosures related to severe weather events and other information. Climate-related financial statement disclosures, including a footnote in a company's consolidated financial statements disclosing capitalized costs, expenditures expensed, charges and losses incurred as a result of severe weather events if the aggregate amount equals or exceeds 1 percent thresholds.

Coexisting With Other Disclosure Regimes

While the SEC stated that the Final Rules are modeled after the GHG Protocol and Task Force on Climate-related Financial Disclosures (TCFD), stakeholders should be aware that adherence to GHG Protocol or TCFD principles does not ensure compliance with the Final Rules. Accordingly, public companies should be prepared to adjust their data collection and reporting practices to account for the nuances of the Final Rules that differ from other reporting schemes.

For example, unlike the Final Rules, neither TCFD nor the GHG Protocol requires reporting companies to include an attestation report from an independent attestation service provider covering material Scopes 1 and Scope 2 emissions disclosures. The Final Rules also require public companies to disclose their internal carbon prices along with certain information about the company's use of internal carbon pricing if such use is material to how it evaluates and manages a climate-related risk that has materially impacted or is reasonably likely to materially impact the company's business strategy, results of operations or financial condition. TCFD, on the other hand, merely suggests that companies disclose their internal carbon prices.

Additionally, while the Final Rules do not apply as broadly as many aspects of either California's AB 1305, SB 253 and SB 261 or Europe's Corporate Sustainability Reporting Directive (CSRD), public companies that are required to report under CSRD and/or California's climate-related disclosure regime in addition to the Final Rules should not assume that their current reporting practices adequately cover the requirements under the Final Rules or vice versa.

Legal Challenges

Immediately following the release of the Final Rules, 10 US states filed legal challenges against the rules in the Eleventh Circuit, arguing that the rules are an overreach of the SEC's delegated authority to act as "necessary or appropriate in the public interest or for the protection of investors."3 The SEC continues to receive much criticism as attempting to regulate climate-related matters, which absent more explicit Congressional authorization, is argued to be outside of the SEC's purview.

Challenges to the Final Rules are the latest in a slew of litigation aimed at limiting federal agency discretionary action. For example, the US Supreme Court recently ruled to limit federal agency discretion through its decision in West Virginia v. EPA,4 where the Court determined that without a clear delegation of authority from Congress, the Environmental Protection Agency (EPA) could not rely on a vague and infrequently used section of the Clean Air Act to change the entire energy-industry landscape. Additionally, recent challenges to eliminate the Chevron doctrine,5 which grants federal agencies deference to interpret statutory authority to act absent explicit Congressional authorization, are likely to support arguments that the SEC has overstepped its delegated authority to enact the Final Rules.

Additionally, and in line with Commissioner Hester Peirce's dissent to the Final Rules, challengers are expected to bring claims that the rules give special treatment and disproportionate attention to climate-related disclosures on financial statements. The Final Rules also are vulnerable to challenges on the basis that the required disclosures are unconstitutional because they constitute "compelled speech" under the First Amendment of the US Constitution.

Larger Filers May Already Be Well-Positioned for Compliance

While the Final Rules impose certain additional disclosure requirements and nuances to existing disclosure regimes, larger companies may already collect and disclose much of the required climate-related information required to be reported under the Final Rules. In many instances, the disclosures companies already report under voluntary and/or compliance regimes, may be more expansive than the climate-related information required to be collected and reported under the Final Rules.

/>i

/>i