As public company issuers prepare for the 2025 reporting season, issuers should be reminded (or made aware) of the new executive compensation-related disclosure requirements. On December 14, 2022, the Securities and Exchange Commission (SEC) adopted rules setting forth new disclosure requirements for awards of stock options and stock appreciation rights (SARs) under new Item 402(x) of Regulation S-K (Item 402(x)). For a public company with a fiscal year that ended December 31, 2024, these new disclosure requirements will take effect beginning with its forthcoming annual report on Form 10-K (or, if applicable, the proxy statement for its annual meeting) to be filed in 2025.

General Instruction G(3) to Form 10-K provides, in part, that the information required by Part III (which includes the Item 402(x) disclosure) may be incorporated by reference from the reporting company's definitive proxy statement filed pursuant to Regulation 14A for a meeting of shareholders involving the election of directors (an "annual meeting proxy statement"), if such annual meeting proxy statement is filed with the SEC not later than 120 days after the end of the fiscal year covered by the annual report on Form 10-K (for this new Item 402(x) disclosure, such date is April 30, 2025). If a reporting company's annual meeting proxy statement is not filed with the SEC in the 120-day period, then the new Item 402(x) disclosure must be filed as part of the annual report on Form 10-K, or as an amendment to the Form 10-K, not later than the end of the 120-day period.1

Item 402(x) Purpose

Item 402(x) requires narrative and tabular disclosure on a public company's policies and practices relating to awards of stock options and SARs that are granted close in time to the disclosure of material nonpublic information (MNPI). For these purposes, "close in time" means within a period starting four business days before and ending one business day after the filing or furnishing of a quarterly report on Form 10-Q, an annual report on Form 10-K or a current report on Form 8-K that discloses MNPI (such period, the Covered Period). Item 402(x) serves to increase transparency and protect against actual or perceived timing issues (e.g., potential insider trading concerns) surrounding awards of stock options or SARs that are granted "close in time" to the disclosure of MNPI that would boost the value of the underlying stock price shortly after grant.

Narrative Disclosure Requirement

Narrative disclosure on a public company's policies and practices relating to the timing of awards of stock options and SARs in relation to the disclosure of MNPI is required whether or not the company has granted such awards within the Covered Period. This disclosure is not required for full-value awards, such as awards of restricted stock or restricted stock units. Specifically, the narrative disclosure must describe the following:

- how the board of directors determines when to grant such awards (e.g., whether such awards are granted on a predetermined schedule);

- whether and how the board of directors takes MNPI into account when determining the timing and terms of such award; and

- whether the company has timed the disclosure of MNPI for the purpose of affecting the value of executive compensation.

Tabular Disclosure Requirement

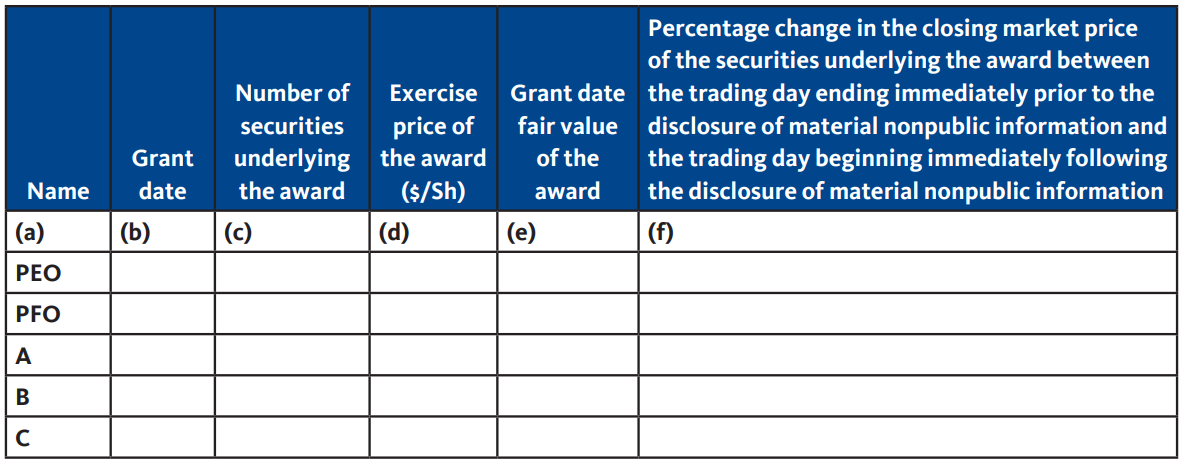

If, during the last completed fiscal year, a company granted awards of stock options or SARs to one or more named executive officers during the Covered Period, the company must disclose in a tabular format, as illustrated below,2 the following with respect to each such grant: (1) the name of the named executive officer; (2) the grant date of the award; (3) the number of securities underlying the award; (4) the per-share exercise price of the award; (5) the grant date fair value of the award; and (6) the percentage change in the closing market price of the underlying securities between the trading day ending immediately prior to and the trading day beginning immediately following the disclosure of MNPI.

Inline XBRL Requirement

Consistent with other recently promulgated disclosure rules, the information required to be disclosed pursuant to Item 402(x) (i.e., both tabular and narrative disclosure) must be tagged in Inline XBRL.

Action Items

Public company issuers should consider adopting formal equity grant practices, policies or guidelines that align with the new disclosure requirements or revisiting their existing equity grant practices, policies or guidelines to address the timing of awards of stock options and SARs in relation to the disclosure of MNPI. Issuers should also consider implementing policies and procedures to prevent the granting of equity awards within the Covered Period if the additional scrutiny that might come with tabular disclosure would be undesirable.

1 The first applicable fiscal year covered by the new disclosure requirements is the first full fiscal year beginning on or after April 1, 2023. For public companies (other than smaller reporting companies) with a fiscal year [that] ended on or after March 31, 2024, the new disclosure requirements must have been satisfied (or must be satisfied) on the annual report on Form 10-K covering such fiscal year.

For smaller reporting companies, the first applicable fiscal year covered by the new disclosure requirements is the first full fiscal year beginning on or after October 1, 2023 (i.e., the new disclosure requirements must be satisfied on the annual report on Form 10-K and annual meeting proxy statement for fiscal years ending on or after September 30, 2024).

/>i

/>i