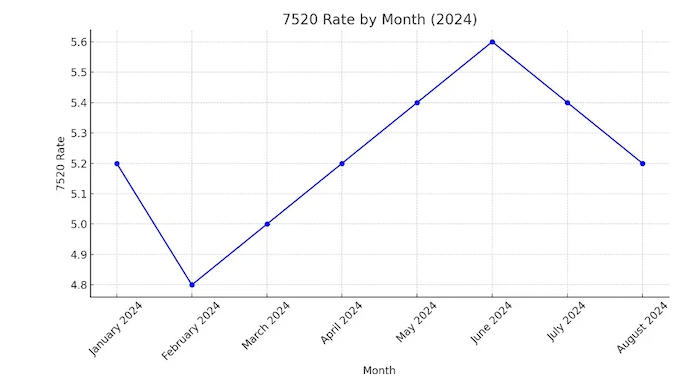

This year, we have seen an inflection point in the IRS 7520 rates. We previously advised to ‘Get Charitable Remainder Trusts While They Are Hot This Summer’ (1); however, we also see a trend of decreasing inflation and lower federal funds rates, which makes Charitable Lead Trusts (CLTs) more attractive again (Fig. 1).

Figure 1: The IRS 7520 rate had an inflection point in June 2024 and has been coming down since.

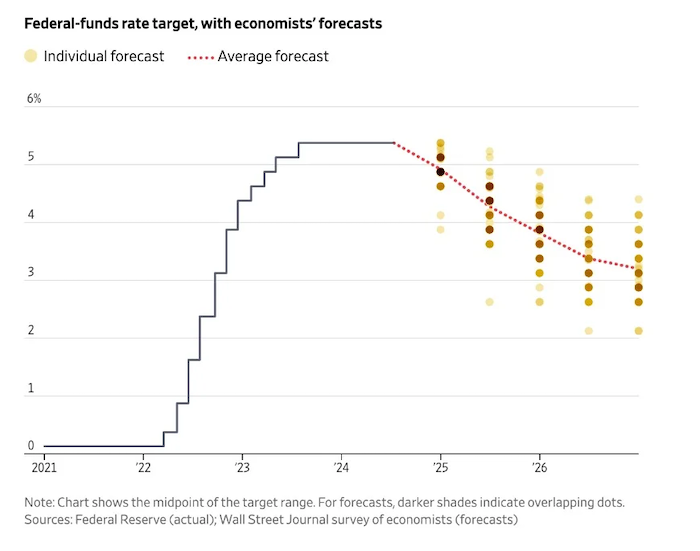

The IRS 7520 rate is 120% of the applicable federal midterm rate, and economists forecast a significant drop in the federal funds rate (Figure 2) (2).

Figure 2: The federal funds rate is expected to continue its downward trend. Wall Street Journal.

The Effect of the IRS 7520 Rates on the Immediate Income Tax Deduction

Higher 7520 rates favor Charitable Remainder Trusts, while lower rates favor Charitable Lead Trusts. Table 1 calculates the potential income tax deduction for a Charitable Lead Annuity Trust (CLAT) compared to a Charitable Remainder Annuity Trust (CRAT) with two different 7520 rates, 0.6% and 5.6%. We have experienced these rates in the recent past: 0.6% in June 2020 and 5.6% in June 2024.

| CLAT - 0.6% | CLAT - 5.6% | CRAT - 0.6% | CRAT - 5.6% | |

| Immediate Income Tax Deduction | $483,890.00 | $375,080.00 | $516,110.00 | $624,920.00 |

| Remainder Beneficiary | non-charitable | non-charitable | charity | charity |

| Nominal Remainder Amount Based on 7520 Rate | $516,110.00 | $624,920.00 | $516,110.00 | $624,920.00 |

Table 1. Income Tax Calculations for a CLAT and CRAT applying different 7520 rates. The trust is being funded with $1,000,000 and has a fixed duration of 10 years.

Looking at Table 1, we note that in the case of CLATs, the income tax deduction is higher with a lower 7520 rate, and the reverse is true for CRATs; a higher 7520 rate results in a higher tax deduction.

However, In this example, the income tax deduction for the same 7520 rate is lower for a CLAT than a CRAT across different rates. This is because the deduction for a CLAT is based on the present value of the annuity payments to the charity, which is lower than the remainder interest value calculated for a CRAT under these conditions.

This point emphasizes that careful scenario planning and exploring different options are required to optimize client solutions.

Charitable Lead Trusts as Freeze Devices

A Charitable Lead Trust (CLT) functions as a “freeze device,” effectively locking in the value of assets transferred into the trust for estate and gift tax purposes. Here’s a detailed explanation:

- Asset Transfer and Growth: When assets are transferred into a CLT, their value at the time of transfer is used to calculate the gift tax. Any appreciation in the value of these assets during the trust term occurs within the trust and is excluded from additional gift or estate taxes upon termination of the trust.

- Charitable Payments: The trust makes regular payments to a designated charity for a specified period. These payments can be structured as a fixed annuity (Charitable Lead Annuity Trust, CLAT) or a percentage of the trust’s assets (Charitable Lead Unitrust, CLUT).

- Remainder to Non-Charitable Beneficiaries: After the trust term ends, the remaining assets are distributed to non-charitable beneficiaries, typically family members. The initial gift’s value, determined at the trust’s inception, is used for tax purposes, ensuring that any asset appreciation during the trust term is not subject to further gift or estate taxes

Fundamentally, as asset freeze devices, Charitable Lead Trusts benefit wealthy clients who may be most affected by the federal estate tax. This is in distinction to Charitable Remainder Trusts, which can benefit a broader spectrum of clients: those seeking to convert appreciated assets into a lifetime income stream without incurring immediate capital gains tax and who want to help a charity at the end. Table 2 is a more detailed comparison of Charitable Lead and Remainder Trusts.

| Aspect | Charitable Lead Trust (CLT) | Charitable Remainder Trust (CRT) |

| Overall Organization | Pays annuity or unitrust amount to charity for a term of years, remainder passes to family members or other non-charitable beneficiaries | Pays annuity or unitrust amount to non-charitable beneficiaries for a term of years or life; the remainder goes to charity |

| Trust Tax Status | Typically taxed as a grantor trust or non-grantor trust (depending on structure)* | Generally tax-exempt |

| Private Foundation Excise Tax on Net Investment Income | Yes (if structured as a private foundation) | No (tax-exempt) |

| Gift to Remainder Beneficiaries | Amount Transferred to Trust - Present Value (PV) of annuity or unitrust payments to charity | Amount Transferred to Trust - PV of annuity or unitrust payments to non-charitable beneficiaries |

| Annuity vs. Unitrust | Annuity Trust: Fixed payments to charity | Annuity Trust: Fixed payments to non-charitable beneficiaries |

| Unitrust: Payments to charity vary with the trust's investment performance | Unitrust: Payments to non-charitable beneficiaries vary with the trust's investment performance | |

| IRS Duration Limits | No specific term limit; usually for a term of years or the lifetime of the donor | For a term of years (up to 20 years) or for the life/lives of the beneficiary(ies) |

| Payout Limits | None | 5% - 50% of initial fair market value (Annuity Trust) or annual fair market value (Unitrust) |

| Measuring Life for PV Calculation | Limited; specific rules apply (see 26 CFR § 1.170A-6) | Not limited; can be for one or more lives or a term of years |

Table 2: Difference between Charitable Lead Trusts and Charitable Remainder Trusts

* For income tax purposes, CLTs can be set up as either a grantor or non-grantor trust. When a CLT is structured as a grantor trust, the donor gets an immediate charitable income tax deduction upon the trust’s creation and must pay income taxes on the trust’s future income. In contrast, a non-grantor trust creates a separate taxpaying entity that can take an unlimited charitable income tax deduction under Sec. 642(c) for the income distributed to charity. It is crucial to understand that donors to a non-grantor CLT do not receive a charitable itemized income tax deduction.

What is a Zeroed Out CLAT?

A “zeroed-out” Charitable Lead Annuity Trust (CLAT) is a specific type of CLAT structured so that the present value of the annuity payments to the charity equals the value of the assets transferred into the trust. This effectively “zeros out” the taxable gift, minimizing or eliminating any immediate gift tax liability.

However, zeroing out does not mean that the actual amount available to the remainder beneficiaries (non-charitable beneficiaries) is zero when the payments to charity have ended: Any appreciation of the trust assets beyond the annuity payments made to the charity will pass to the non-charitable beneficiaries (often the donor’s heirs) free of additional gift or estate taxes.

For the strategy to be effective, the trust assets must appreciate at a rate higher than the Section 7520 rate. If the assets do not perform as expected, the remainder beneficiaries may receive little to nothing.

During recent periods of low interest rates, such as post-2008 and the COVID-19 pandemic, the stock market experienced higher-than-average returns; however, this experience may not translate into the future.

Conclusion

As we observe a trend of decreasing IRS 7520 rates, the attractiveness of Charitable Lead Trusts (CLTs) is increasing once again. These trusts serve as effective estate planning tools, particularly in a low-interest-rate environment, where they offer significant tax advantages and the potential for substantial growth in trust assets.

Historically, higher 7520 rates have favored Charitable Remainder Trusts (CRTs) due to the higher present value of the remainder interest, resulting in larger immediate tax deductions. Conversely, lower 7520 rates enhance the tax benefits of CLTs by increasing the present value of annuity payments to the charity, thereby providing a higher immediate tax deduction.

The current economic environment, characterized by forecasts of a significant drop in federal funds rates, suggests that the IRS 7520 rate will continue its downward trend. This shift makes CLTs appealing to wealthy clients who aim to minimize their estate and gift tax liabilities while fulfilling philanthropic goals.

Moreover, zeroed-out CLATs present an efficient strategy for transferring wealth. They allow any appreciation in trust assets to pass to non-charitable beneficiaries free of additional taxes, provided the assets outperform the 7520 rate.

In conclusion, as we anticipate continued low interest rates, now is an opportune time to consider CLTs as a component of estate planning. Advisors should engage in careful scenario planning and explore different options to optimize solutions for their clients, leveraging the benefits of CLTs in the current economic climate.

In addition to the favorable interest rate environment, the potential sunsetting of the Tax Cuts and Jobs Act (TCJA) adds another layer of uncertainty and opportunity. The TCJA, which significantly increased the federal estate tax exemption, is set to expire at the end of 2025 unless Congress acts to extend it. If the TCJA sunsets and the exemption reverts to pre-2018 levels, many more clients could be exposed to estate taxes. This possibility underscores the importance of proactive estate tax planning, as clients may need to leverage strategies like CLTs to manage their estate tax exposure effectively.

References:

- National Law Review. Friday, July 5, 2024. Charitable Remainder Trusts: Get Them While They Are Hot This Summer. https://natlawreview.com/article/charitable-remainder-trusts-get-them-while-they-are-hot-summer

- WSJ July 18, 2024 5:30 am ET. Where Do Economists Think We’re Headed? These Are Their Predictions. https://www.wsj.com/economy/central-banking/where-do-economists-think-were-headed-these-are-their-predictions-b3db91ea?mod=economy_lead_story

A podcast that summarized the points of this article is available here:

This is part 3 of the series “Quantitative Estate Planning”

/>i

/>i