Why are they hot this Summer?

There are two reasons:

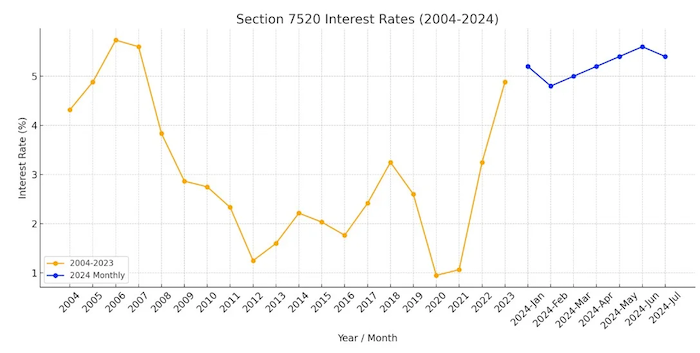

1) Establishing a Charitable Remainder Trust (CRT) immediately results in an income tax deduction. All other things being equal, the higher the IRS 7520 rate, the higher the deduction. Now is a good time to take advantage of this: The 7520 rate has increased significantly in recent years but may be coming down again.

2) The unprecedented performance of stocks like NVIDIA and Tesla over the last five years has created many new millionaires whose stock positions are highly concentrated and, therefore, risky. Upon diversification, these positions would trigger substantial capital gains taxes, but not so with a CRT.

A recap: Advantages of a Charitable Remainder Trust

- Tax Efficiency on Asset Sales: The tax-exempt trust can sell and diversify highly appreciated assets without incurring capital gains tax. The CRT grows from a higher base.

- Income Provision: Provides lifetime or fixed-term income to the donor, offering financial security or supplementary income.

- Immediate Tax Deduction: The donor receives an immediate tax deduction for the present value of the remainder interest that will eventually go to charity.

- Charitable Contribution: After the donor's death, the remainder of the trust goes to one or more named charities that support the donor's philanthropic goals.

- Estate Tax Benefits: Since the remainder interest is irrevocable and the donor cannot access or control it, it is not subject to estate tax, potentially reducing the donor's estate tax liability.

What is the 7520 rate and what is it used for?

The Section 7520 interest rate (1) is used to determine the value of split-interest trusts, such as CRTs, Charitable Lead Trusts, Qualified Personal Residence Trusts, and Grantor-Retained Annuity Trusts. For a CRT, the IRS starts by discounting the annual payouts over the duration of the trust to the non-charitable beneficiaries (1). This is known as a present value of an annuity calculation (2): PV = PMT * (1 - (1 + r)^-n) / r (PMT: yearly payment: r: rate; n: number of years).

Let’s assume the following for our calculations:

- Annual payout (PMT) to non-charitable beneficiaries: $10,000

- Duration of the trust (n): 10 years

With a 7520 rate of 1.5%: The present value of the payouts is $92,867.

With a 7520 rate of 5.5%: The present value of the payouts is $75,382.

This PV is then subtracted from the current fair market value of the CRT, resulting in the charitable remainder. This remainder is the income tax deduction. If the discount is higher, the non-charitable PV shrinks, and the charitable remainder increases, and so does the tax deduction. The 7520 rate is assumed to be operative during the duration of the trust, but in practice, that doesn’t happen. There are some differences in how the IRS calculates the income tax deduction applicable to Charitable Remainder Annuity Trusts and Charitable Remainder Unitrusts, but the principle is similar.

If the 7520 rate is high the income tax deduction may be higher but wouldn’t my client’s income be worth less?

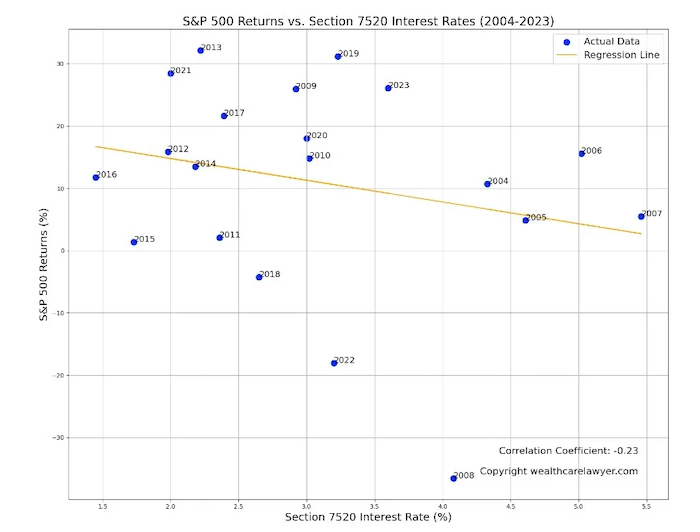

No. While the 7520 rate is critical for tax calculations, the actual financial health and benefits of a CRT depend on the real rate of return of the CRT investments, driven by equity performance and inflation. We performed a correlation analysis between the returns of the S&P 500 inclusive of dividends and the 7520 rate from 2004 - 2023 and found only a small negative correlation (-0.23).

How is the 7520 rate determined?

Each month, the IRS publishes various prescribed rates for federal income tax purposes, known as Applicable Federal Rates (AFRs). These rates are regularly issued as revenue rulings. The 7520 rate (3), which is 120% of the midterm AFR for the month of valuation and compounded annually, is also included. This rate is rounded to the nearest two-tenths of 1% and is typically published by the IRS around the 20th of the month to apply for the following month.

The AFR reflects the average market yield of U.S. obligations, causing the 7520 rate to fluctuate with prevailing interest rates. Once established, the 7520 rate serves as a fixed discount rate for the duration of the trust and is used to value the remainder interest at the inception of a CRT (see above). Even if prevailing interest rates decrease, there is no clawback.

Help! The 7520 rate is going down!

You may still be able to take advantage of a higher rate even if the rates are coming down: The donor can choose to use the 7520 interest rate for the month of the gift or for either of the two months before the gift was made to calculate the present value of the interest transferred (4).

Conclusion

Charitable Remainder Trusts (CRTs) are especially attractive this summer for two primary reasons:

- Maximized Tax Deductions: The IRS 7520 rate, which influences the income tax deduction for establishing a CRT, has recently increased. This higher rate means a greater immediate tax deduction. However, this advantageous rate may not last long, so it’s a prime time to take action and establish a CRT.

- Capital Gains Tax Savings: The remarkable stock performance of companies like NVIDIA and Tesla has created many new millionaires. These individuals often have highly concentrated and risky stock positions. Diversifying these positions would typically incur substantial capital gains taxes. However, using a CRT allows for diversification without the immediate tax hit, providing a significant financial advantage.

References:

- Internal Revenue Service. Section 7520 Interest Rates. Available at: https://www.irs.gov/businesses/small-businesses-self-employed/section-7520-interest-rate.

- Wikipedia. Present Value. Available at: https://en.wikipedia.org/wiki/Present_value.

- Internal Revenue Service. Charitable Remainder Trusts. Available at: https://www.irs.gov/charities-non-profits/charitable-remainder-trusts#charitable.

- United States Code. Title 26, Section 7520. Available at: https://www.govinfo.gov/content/pkg/USCODE-2023-title26/html/USCODE-2023-title26-subtitleF-chap77-sec7520.htm.

A podcast that summarized the points of this article is available here:

This is part 1 of the series “Quantitative Estate Planning”

/>i

/>i