"Just when I thought I was out . . . they pull me back in"

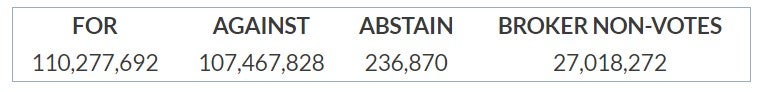

In news that should cheer hearts in Delaware, the stockholders of Fidelity National Financial, Inc. last week failed to approve a proposal to convert the corporation from a Delaware to a Nevada corporation. I characterize this as a "failure to approve" rather than a rejection of the proposal because a majority of the shares voted were cast in favor of the proposal. However, according to the company's proxy statement, the vote required the "affirmative vote of a majority of the shares of our outstanding common stock entitled to vote thereon". See DGCL § 266(b). Thus, abstentions and broker non-votes had the effect of votes against the proposal. Here is the vote tally according to the company's Form 8-K:

According to the company's proxy statement, the proposal in part appears to have been motivated by the company's unhappiness with stockholder litigation in Delaware:

Two separate but integrally-related lawsuits recently involving the Company, now both resolved, illustrate the challenges public companies in Delaware can face. More specifically, in August of 2020, a Company stockholder filed a derivative lawsuit, purportedly on behalf of the Company, alleging breach of fiduciary duty claims and conflicts of interest against certain directors and officers on the purported basis that, among other things, the Company overpaid in acquiring FGL Holdings, Inc. (F&G). At the same time as the Delaware lawsuit was pending, former stockholders of F&G filed an appraisal petition in the Cayman Islands (F&G’s place of incorporation), alleging that the price the Company paid for F&G was too low.

With respect to the Delaware derivative litigation, the Board determined that although the Board believed the price the Company paid for F&G was fair to, and in the best interests of, the Company and its stockholders, the Delaware court was unlikely to dismiss the action at the pleading stage, and, accordingly, the Board appointed a special litigation committee to investigate the claims and determine how the Company should respond. In addition to the Company indemnifying the directors and officers who were named as defendants in the lawsuit for their legal fees and expenses in defending the litigation and responding to the special litigation committee, the special litigation committee also retained its own independent legal and financial advisors at considerable expense to the Company. Ultimately, to avoid the time, burden, expense (estimated to be millions of additional dollars to take the case to trial), and uncertainty of litigation in Delaware, the matter was settled for, among other things, a payment of $20 million to the Company (see the Company’s Form 8-K dated April 5, 2022). The settlement payment was largely funded through D&O insurance proceeds, and the plaintiff’s counsel who filed the claims recovered a Fee and Expense Award of $4.4 million. Although the Company received the net proceeds of the settlement in this matter, except for the legal fees paid to plaintiff’s counsel, the Company’s D&O premium increased when subsequently renewed, in part, because of this settlement, increasing from approximately $3.68 million in 2021-22 to approximately $4.87 million in 2022-23 (and subsequently slightly decreasing due to a more favorable market for such coverage to $4.329 million in 2023-24).

/>i

/>i