On October 8, the governor of New York signed Bill No. AO-2260A to assist borrowers who need accommodation for visual impairments. Bill No. AO-2260A is “an act to amend the general business law, in relation to requiring debt collectors to inform debtors that written communications are available in large print format” (or other different formats). In short, this law will require “principal creditors” and “debt collectors” to inform a consumer in their “initial communication” that the consumer may request future communications in a “reasonably accommodatable format” such as large print, braille, audio compact disc, or other alternatives. This law becomes effective November 7, 2021.

The new law will amend New York’s Debt Collection Procedures Act, N.Y. Gen. Bus. Law § 600. Specifically, the amendment adds § 601-b, which provides:

Each and every principal creditor or debt collector shall, in each initial communication, clearly and conspicuously disclose to the debtor that each communication can be provided in an alternative, reasonably accommodatable, format. Such disclosure shall substantively contain the following:

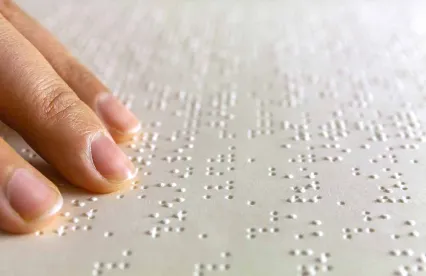

(a) A statement that the consumer may request the letter in an alternative, reasonably accommodatable format selected by the principal creditor or debt collector such as large print, braille, audio compact disc, or other means; and

(b) A business phone number that the consumer may call to make such a request.

The amendment provides that “a principal creditor or debt collector providing reasonable accommodation in compliance with the Americans with Disabilities Act of 1990 shall not be deemed to have violated” the new law.

We note that the bill states that the creditor or debt collector, not the consumer, can elect which alternative format will be made available. We envision future disputes from consumers who are blind if the only alternative format available to them is large print.

Additionally, the amendment adds several key definitions, including “communication,” “debt,” and “debt collector.” The definitions of “communication” and “debt” mirror those found under the FDCPA, but the definition of “debt collector” slightly differs. The current version of the act already defines “principal creditor,” which is the owner of a “consumer claim,” and “consumer claim,” which is an obligation “alleged to be in default and which arises out of a transaction” with a natural person and “was primarily for personal, family or household purposes.”

Finally, New York amended the “Violations and Penalties” section of the existing law to clarify that any person who violates § 601’s existing prohibited practices or the new large-print notice requirement is guilty of a misdemeanor. The new law also provides that a violation by any person of § 601-a is subject to monetary penalties – a first offense is punishable by a civil penalty not to exceed $250 and any subsequent offense is punishable by a penalty of $500. Section 601-a is part of the existing law, which prohibits principal creditors and debt collectors from making “any representation that a person is required to pay the debt of a family member in a way that contravenes with the Fair Debt Collection Practices Act” or from making “any misrepresentation about the family member’s obligation to pay such debts.”

Takeaway

With such a short window before compliance with the alternative notice requirement is set to begin, those with compliance obligations under the law should act quickly to implement a plan to provide the required notices. Additionally, as part of the plan, it is imperative to fully understand what options you can make available to consumers – large print, braille, audio, or other means – and the potential risks associated with each of those accommodations. Finally, the civil penalty section appears to reference a limited portion of the existing law instead of the new section regarding the alternative notices, but this seems incongruent with the legislative history on the law. Hopefully, those impacted by the law will receive additional guidance as it relates to the civil penalty section.

/>i

/>i