The conventional mode of investments in the stock market follows a ‘buy low, sell high’ approach wherein an investor looks to buy stocks at a lower price and sell them later at a higher rate, thereby making profits. In such investments, profits are made by anticipating a bullish trend. On the other hand, investors anticipating a fall in market prices of stocks look to benefit from such bearish trends by using a ‘sell high, buy low’ approach, more commonly known as short selling.

Short Selling: Through the Centuries

The concept of short selling dates back to the 1600s when the Dutch East India Company became the first publicly traded company to issue shares of a stock. At the time, short selling was seen as a legitimate and useful practice as it allowed investors to hedge their positions as well as provided liquidity to the market1. However, it became controversial in the early 20th century when some investors used it to manipulate the stock market. In response, the New York Stock Exchange imposed restrictions on short selling in 1938. The rules required short sellers to wait until a stock price had risen before they could sell it short and required them to maintain higher levels of collateral.2 However, the restrictions on short selling were lifted in the 1990s as the stock market became more sophisticated and electronic trading made it easier to monitor trading activities.

Today, short selling is a common trading strategy used by many investors and hedge funds. Nevertheless, short selling remains a controversial strategy that is, at times, blamed for exacerbating market downturns as short sellers can profit from a stock's decline, which can put downward pressure on the stock price. It is speculated that short selling played an important role in aggravating the effect of the 2008 financial crisis, widely regarded as the worst recession since the great depression of 1929.

Most recently, on January 24, 2023, Hindenburg Research, a US-based research firm published a report3 (“Hindenburg Report”), on Adani Group alleging the latter of, inter alia, committing corporate fraud and stock manipulation. As part of its disclosures, Hindenburg revealed that they have taken short positions in Adani Group Companies through U.S. traded bonds and non-Indian-traded derivative instruments. As an aftermath of the Hindenburg Report, the stock prices of Adani Group companies declined catastrophically, and Hindenburg presumably, stood to benefit from this fall.

Mechanics of Short Selling

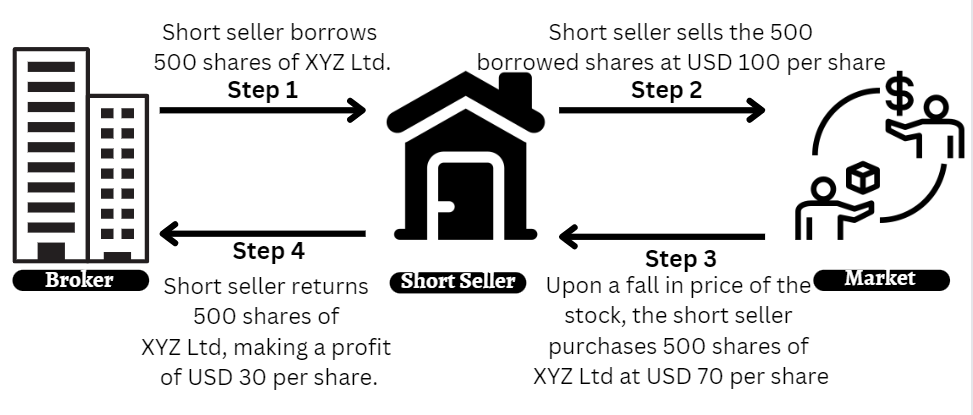

The Indian securities market regulator, the Securities and Exchange Board of India (“SEBI”), vide its circular dated December 20, 2007 defined short selling as “selling a stock which the seller does not own at the time of trade”4. Typically, when an investor sells short, they borrow shares of the stock or asset from the owner of the stock, which is usually a broker, and sell it on the market at the prevailing price, essentially selling something that they do not own. This is done with an intention of buying the stock back later at a lower price and returning the same to the lender, along with the payment of the commission charged by the broker for lending the securities. The difference between the selling price and the buying price (inclusive of commission paid) thus, becomes the profit of the short seller.

Figure 1: Mechanics of short selling

Covered and Naked short selling

Short selling can be of two major types – covered or naked. Eponymous to its name, covered short selling is a trading strategy in which an investor sells a security that they do not currently own, but has already borrowed the security from someone else (usually a broker) with the intention of returning the security later. Naked short selling, on the other hand, is the practice of selling a security without first borrowing or locating the shares to sell, and without having a reasonable belief that the shares can be borrowed or located to settle the transaction. In other words, in case of a naked short selling, the seller neither owns the securities they are selling, nor it has any arrangements in place to obtain them.

While covered short sales are permitted in most jurisdictions around the world, naked short selling is generally considered illegal or highly regulated as it has the potential to artificially increase the supply of the security and potentially depress its price. Additionally, naked short selling creates certain risks for investors who buy shares that do not actually exist.

Likewise, SEBI, under its short selling framework,5 has placed a blanket restriction on naked short selling, prohibiting investors from engaging in the same and requiring them to mandatorily honour their obligation of delivering the securities at the time of settlement.

Development of Short Selling Jurisprudence in India

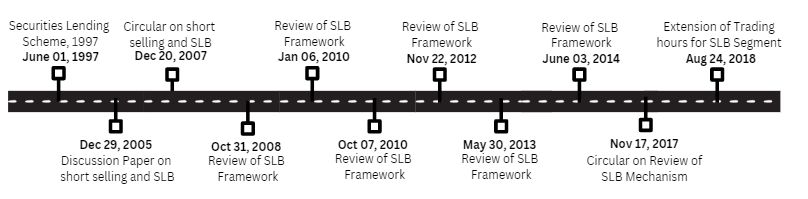

For the longest time, India had negligible rules and regulations related to short selling. While the issue was first deliberated by SEBI in 1996 when it constituted a committee under the chairmanship of Shri B.D. Shah, there were only sporadic updates on the topic till 2007. In December 2002, the Joint Parliamentary Committee on Stock Market Scam and matters relating thereto recommended SEBI to look into the issues related to short sales and “seriously and expeditiously formulate a clear policy taking all aspects into account”. 6

In light of this recommendation, the Secondary Market Advisory Committee of SEBI (“SMAC”) reviewed the policy on short sales and securities lending and borrowing and released a Discussion Paper on Short Selling and Securities Lending and Borrowing7 in 2005.

Pursuant to the recommendations of SMAC, on December 20, 2007, SEBI issued a circular on short selling and securities lending and borrowing8 permitting short sale, subject to a specified broad frameworks for short selling9 (“Short Selling Framework”) and securities lending and borrowing10 (the “SLB Framework”).

Figure 2: Timeline of the development of short selling and SLB Framework

Short Selling Framework

The Short Selling Framework has permitted retail and institutional investors to short sell securities. This permission, however, came with a stipulation mandating the delivery of securities at the time of settlement, thereby restricting naked short selling. In order to ensure the delivery of the securities, the SLB Framework was also put into place. Institutional investors, however, have been restricted from squaring-off their transactions intra-day, i.e., doing day trading. Initially, only the securities traded in the futures and options segment were eligible to be shorted whereas, presently, liquid index ETFs have also been permitted to be shorted.11

To ensure transparency, institutional investors have been mandated to disclose the nature of a short sale upfront (at the time of placement of an order) whereas retail investors are given time until the end of the trading hours on the transaction day to make such disclosure. The framework also mandated brokers to collect details of short sales, including positions details and inform the same to the stock exchanges, who were in turn required to consolidate the information and disseminate the same on their websites.

The SLB Framework

To ensure that the short positions of investors were covered and honored at the time of settlement, a full-fledged SLB Framework for all market participants was put in place by SEBI.

The SLB Framework facilitates the operation of SLB through clearing corporations / clearing houses of stock exchanges having nationwide terminals, which are registered as Approved Intermediaries (“AIs”), and are responsible for providing an automated, screen-based, order-matching platform, independent from other trading platforms. Investors looking to borrow / lend securities could access the platform through their banks and custodians authorized by the AIs.

The SLB Framework, since its operationalization, has undergone substantial amendments. The extant SLB Framework provides the discretionary power to AIs to decide the tenure of the borrowing / lending contract ranging from 1 day to 12 months based on the need of the market participants.

Moreover, the SLB Framework specifies the position limits in SLB, as well as the treatment of corporate actions during SLB, viz treatment of dividend, stock split, bonus, merger, amalgamation, etc.

Short Selling by FPIS

SEBI (Foreign Portfolio Investors) Regulations, 2014 (“FPI Regulations”)12, Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 (“NDI Rules”) and Foreign Exchange Management (Debt Instruments) Regulations, 2019 (“DI Regulations”) and the Master Circular for Foreign Portfolio Investors (“FPIs”), Designated Depository Participants and Eligible Foreign Investors (“Master Circular”)13 govern FPI investments in India. The FPI Regulations and the Master Circular prohibit FPIs from engaging in short selling, except in accordance with the securities lending and borrowing framework issued by SEBI. Further, the Reserve Bank of India (“RBI”) vide a master direction on foreign investment in India14 permitted short selling of equity shares by FPIs subject to certain conditions.

Short selling may be undertaken by FPIs only in equity shares of companies that have at least 2% headroom for total foreign investment and/or the aggregate FPI limit; or are not in the caution list or ban list published by the RBI or any such restrictive list published any authority designated to do so. Further, FPIs may borrow equity shares solely for delivery into a short sale. While FPIs are required to maintain margins / collaterals as applicable in the cash and futures and options segment, payment of interest on margin / collateral is prohibited. Moreover, for monitoring by RBI, designated custodian banks of FPIs have been mandated to report all transactions related to short selling and lending and borrowing of equity shares by FPIs in their daily reporting.15

Global Comparative Analysis

European Union

The financial crisis of 2008 pushed many European Union (the “EU”) nations to take action against short selling such as suspending or banning it. However, these individual actions were not very effective as investors circumvented restrictions in one jurisdiction by carrying out transactions in another EU nation. To bring a one-stop solution to this issue, the EU adopted Regulation 236/2012 on Short Selling and Certain Aspects of Credit Default Swaps (the “EU Regulation”) in 2012.

The EU Regulation gives the national regulators of the EU nations, the power to temporarily restrict or ban short selling of any financial instrument in exceptional circumstances, subject to coordination by the European Securities and Markets Authority (“ESMA”), and is aimed to achieve better transparency of short positions by reducing settlement risk and other risks linked with naked short selling.

The EU Regulation permits short selling in shares issued by a company and in debt instruments issued by a sovereign issuer. Naked short sale of shares and sovereign debt is prohibited by Articles 12 and 13 of the EU Regulations, respectively. Consequently, the EU Regulation mandates the borrowing, or making alternative provisions resulting in similar legal effects, confirming that the securities have been located, before entering into a short position.

Further, the EU Regulations require holders of net short positions in shares and sovereign debts to notify the competent authorities and public disclosures once certain thresholds are breached.

Additionally, the EU also gives powers of intervention to competent authorities and to ESMA to impose certain restrictions on the provisions of EU Regulations in exceptional circumstances. 16

United States

A regulation related to short sale was first adopted by the United States in 1938 to address concerns with respect to naked short selling. These short-selling provisions were updated in 2005, vide Regulation SHO17 in light of numerous market developments that took place since 1938.

Regulation SHO18

Regulation SHO compulsorily requires broker-dealers to mark sales in all equity securities as long, short, or short exempt. Rule 201 of Regulation SHO which was adopted in 2010, stipulates trading centers to establish, maintain, and enforce written policies and procedures designed to restrict the price at which short sales may be effected when a stock has experienced a price decline of at least 10% in a single day. This has been designed to prevent potentially manipulative or abusive short selling from further driving down the price of a security that has already experienced a significant intra-day price decline, and to facilitate the ability of long sellers to sell first upon such a decline.

Further, Rules 203 (b)(1) and (2) of Regulation SHO establish ‘locate requirements’ which necessitates a broker-dealer to have reasonable grounds to believe that the security can be borrowed so that it can be delivered on the due date of the short sale. It also requires documentation of the locate prior to effecting the short sale.

NDA Views

Short selling has always been a tricky pursuit for investors - both veterans and novices alike. Since the entire transaction is based on an anticipated fall in the price of the stock, the investor stands to lose money in case the stock prices rise From the market’s perspective, as short sellers earn profits from a stock's decline, the slump may be artificially created at times.

These substantial risks involved in short selling are inadvertently followed by the critiques of short selling. However, some of these risks can be avoided with adequate education on the process. For the most part, short selling aids in unearthing overvalued companies and is therefore considered a legitimate activity. However, short sellers are often the scapegoats when share prices fall sharply. Although the working mechanism of short selling can become arcane due to its complex behavior and ramifications in the securities markets, by supporting liquidity and risk management, and increasing market confidence, it also plays a crucial role in the efficient operation of financial markets. Other than the stimulus short selling offers in the securities markets, another focal point to be emphasized is that it helps verify that both favorable and unfavorable information about corporations is accurately and immediately reflected in the prices of securities, which improves the efficiency of prices and also prompts whether a stock is overvalued or not.

As evident from the legal recognition given to short selling by the securities markets’ regulators in most countries, a blanket ban on short selling is not a solution. This position has been supported by the International Organization for Securities Commissions (“IOSCO”), which in its consultation paper on the Regulation of short selling 19, examined the practices of securities lending and short selling in several markets and recommended transparency rather than outright bans on the short selling practices.

Despite increased activity in the short selling space, SEBI, recently has indicated that regulated short selling is a necessity in today’s markets for the reasons mentioned above. At the backdrop of the Hindenburg Report and the effect it had on the Indian securities market, it may be seen how to further strengthen different contours of the short selling market.

FOOTNOTES

1 https://www.worldsfirststockexchange.com/2020/11/27/going-short-in-1608/

2 Jones, Charles M.: Short https://www0.gsb.columbia.edu/mygsb/faculty/research/pubfiles/3233/JonesShortingRestrictions4a.pdf

3 Available at: https://hindenburgresearch.com/adani/

4 SEBI annexure on Broad framework for short selling, available at: https://www.sebi.gov.in/sebi_data/commondocs/ssframe_p.pdf

5 ibid

6 Para No. 9.158 of the report of Joint Parliamentary Committee on Stock Market Scam and matters relating thereto, available at https://eparlib.nic.in/bitstream/123456789/783370/1/JPC_13_Stock_Market_Scam_2002_Vol_I.pdf

7 Available at: https://www.sebi.gov.in/sebi_data/commondocs/rep40_p.pdf

8 Available at: https://www.sebi.gov.in/legal/circulars/dec-2007/short-selling-and-securities-lending-and-borrowing_9463.html

9 Broad framework for short selling. Available at: https://www.sebi.gov.in/sebi_data/commondocs/ssframe_p.pdf

10 Broad framework for securities lending and borrowing. Available at: https://www.sebi.gov.in/sebi_data/commondocs/slbframe_p.pdf

12 PI Regulations https://www.sebi.gov.in/legal/regulations/jan-2014/sebi-foreign-portfolio-investors-regulations-2014_26906.html

13 Master Circular, available at: https://www.sebi.gov.in/legal/master-circulars/dec-2022/master-circular-for-foreign-portfolio-investors-designated-depository-participants-and-eligible-foreign-investors_66356.html

14 Available at: https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=11200

15 Ibid

16 Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32012R0236&from=EN

17 Available at: https://www.sec.gov/rules/final/2010/34-61595.pdf

18 Ibid

19Available at: https://www.iosco.org/library/pubdocs/pdf/IOSCOPD289.pdf

/>i

/>i