FROM CLICK TO BRICK: PROPOSAL TO EXPAND PAYMENT AGGREGATOR GUIDELINES FOR ONLINE AND OFFLINE TRANSACTIONS

Earlier this year, the Reserve Bank of India (RBI) released draft directions proposing to amend the currently applicable Payment Aggregators guidelines issued on March 17, 2020 followed by clarifications on March 31, 2021 (PA Guidelines). The proposed draft directions largely intend to cover in-person payment options which will bring forth a significant change in the applicability of the PA Guidelines, especially in relation to various offline fintech business models (PA-P Circular).

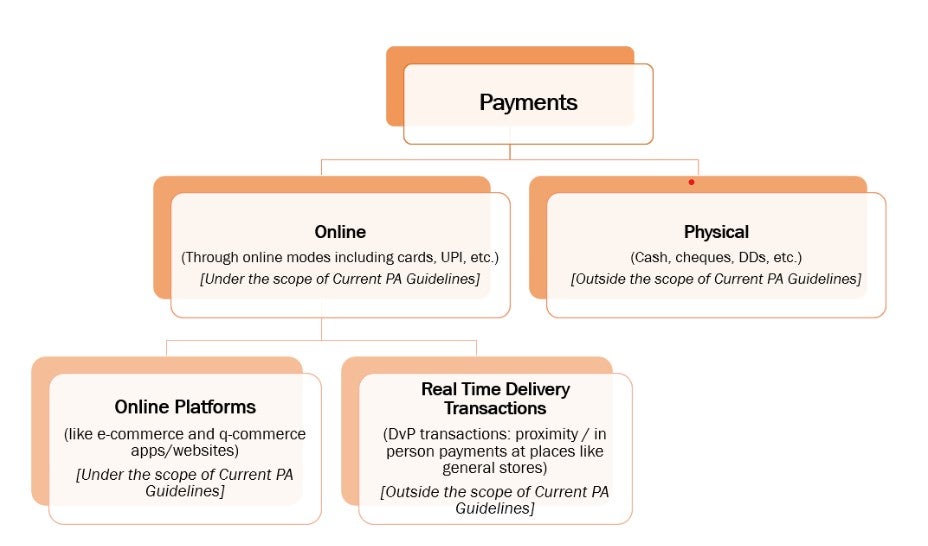

As a background, the PA Guidelines define payment aggregators (PAs) in a manner that limits the scope of such entities to transactions in the online and e-commerce space. However, the PA Guidelines did not apply to Delivery vs Payment (DvP) transactions (DvP Exemption). While the scope of DvP transactions was not defined, on a holistic reading of the guidelines, DvP transactions were understood to be transactions involving payment for real-time delivery of a good and/or service. Below is an illustration of the scope of PA Guidelines, as applicable to various kinds of payments:

The intention behind the PA Guidelines was to provide for an actively regulated ecosystem for PAs involved in online payments but a lot of fintech models associated with offline / in-person payments were not always regulated. On September 30, 2022, the RBI released a Statement on Developmental and Regulatory Policies (Statement) wherein it was proposed to apply the PA Guidelines to entities involved in payments made during “proximity/face-to-face transactions.”

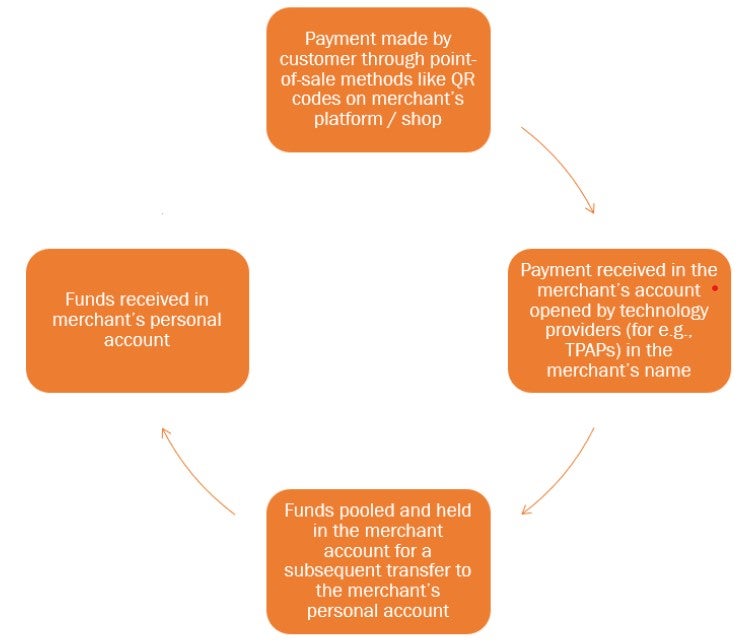

It has been reported that the lack of regulation of fintech models associated with offline / in-person payments led to issues including an increase in high-value one-time transactions at point-of-sale (POS) terminals, which may be due to merchants allowing individuals to undertake these transactions in exchange for cash. Entities aggregating payments made through POS terminals were largely unregulated by the RBI, since they did not fall under the scope of the PA Guidelines due to the DvP Exemption along with the agency exemption under the Payments and Settlement Systems Act, 2007 (PSA). Additionally, creative models including UPI-based third-party application providers implemented QR code-based payments where a “merchant account” was created for respective merchants by the technology service provider, and UPI payments were collected and settled with merchants on a periodic basis. An illustrative payment model involving UPI QR code is as follows:

As an analysis of the model illustrated above, technology companies have been (i) facilitating payments, (ii) enabling merchants to receive payments from customers, (iii) receiving payments from customers, (iv) pooling the funds, and (v) transferring the funds to the merchants after a specified period. However, it could be argued that technology companies in spirit may have been playing the role of a PA but remained unregulated based on the DvP Exemption and the PSA agency exemption.

Going forward, as per the draft PA-P Circular, RBI has not only expanded the scope of the definition of PAs, but has also diluted the DvP Exemption. Based on the draft PA-P Circular, PAs are entities that facilitate aggregation of payments in online or physical point of sale payment modes through a merchant’s interface (physical or virtual), and subsequently settle the collected funds to such merchants. Further the draft PA-P Circular defines PA-P as PAs which facilitate face-to-face / proximity payment for DvP transactions.

Based on the above, DvP transactions that were previously exempted could be regulated, hence bringing real-time physical payments made in an online form, especially including POS and QR code payments within the scope of the PA Guidelines. However, cash-on-delivery payments continue to be exempted and outside the scope of the PA Guidelines.

While the Statement clearly mentions that the RBI seeks to synergize the regulation of PAs, it appears that one of the intentions behind the introduction of the draft PA-P Circular was to regulate technology companies that have been acting akin to PAs (by facilitating payments) without any authorization from the RBI. Once the draft PA-P Circular is implemented, various fintech companies involved in the payment ecosystem will now be required to seek authorization from the RBI and comply with requirements as applicable to existing PAs.

/>i

/>i