Did you know that the IRS tax treatment of annuities systematically penalizes women? Or how generic life tables used by annuity providers can lead to more favorable outcomes for certain segments of the public?

Annuities have mysteries, and unlocking them can make you a better adviser for your clients.

Two fundamental concepts are the IRS Annuity Exclusion Ratio and the Money’s Worth Calculation. Unfortunately, the literature does not appear to provide joint treatments of these concepts (1). Here, we will explain both, highlighting similarities and differences, this will enhance your understanding more than looking at each individually.

The IRS exclusion ratio determines the non-taxable portion of annuity payments based on the investment-to-expected-return ratio. The Money's Worth Ratio (MWR) measures an annuity's actuarial fairness. It is calculated as the discounted present value of expected future payments divided by its cost.

Equation 1

Equation 2

It appears that the two ratios are the inverse of each other. However, they have different purposes and are calculated differently. Still, comparing them will be a valuable exercise in understanding both better and learning about annuities at the same time.

Exclusion Ratio (or Exclusion Percentage)

The Exclusion Ratio or Percentage is part of the IRS's General Rule (2). The general rule is primarily used for nonqualified plans such as private annuities, purchased commercial annuities, nonqualified employee plans, and certain qualified plans with specific conditions.

In contrast, the simplified rule is generally used for qualified plans, including qualified employee plans and tax-sheltered annuities. It simplifies the process using a standard worksheet from IRS Publication 575.

The exclusion ratio is crucial for the tax treatment of non-qualified annuities because they are purchased with after-tax dollars. Only the earnings portion of the withdrawals is taxable since the principal was already taxed at the time of contribution. The exclusion ratio is used to determine the taxable and non-taxable portions of each payment.

The annuity exclusion ratio reflects the non-taxable portion of an annuity payment, specifically the return of the principal investment made with after-tax dollars. A simplified example will make this clear.

Calculation and Practical Application:

Example 1: For an immediate life annuity purchased at $100,000, promising a monthly benefit of $565 over an anticipated life expectancy of 20 years (240 payments), the total expected return would be 240 * $565 or $135,600. Here, $100,000 is the return of the principal, with the remaining $35,600 representing taxable growth. Note that the time value of money is ignored. This is in distinction to tax calculations that are used, for example, in the charitable remainder trust context (3).

According to equation 1, we divide the investment in the contract ($100,000) by the total payouts ($135,600), resulting in an exclusion ratio of 0.73746 73.746% of each payment is tax-free, equating to $416.67 of each $565 payment; the remainder ($148.33) is taxable.

Key Aspects of the Annuity Exclusion Ratio:

- Determination Method: The calculation for variable annuities and other modern annuity products can be complex. Because of this, the insurer will often provide the annuity exclusion ratio. The exclusion ratio indicates the portion of each payout derived from the initial principal and is thus not subject to income tax (excluded).

- Taxable Portions: Withdrawals attributable to accrued interest or gains from variable annuity subaccounts are taxable upon distribution.

- Fixed-Term Annuities: These annuities provide payments for a specific period. The exclusion ratio for these is generally straightforward as the term and payout are predefined.

- Life Annuities: Payments are based on the client's life expectancy. The exclusion ratio utilizes the IRS actuarial tables to determine expected total returns over the client’s life expectancy.

IRS Annuity Tables

We wrote about the tables used for charitable remainder trusts in the article IRS Life Tables: Critical Insights for Estate Planning (2). To calculate the estimated payout of an annuity over the life of an annuitant, we need to know their average life expectancy. Life tables for annuities are published in 26 CFR § 1.72-9 - Tables (3). Effective July 1, 1986, the IRS adopted new annuity Tables V through VIII, in which sex at birth is not considered when determining the ‘applicable factor.’ The applicable factor is, in effect, the average life expectancy of men and women combined (‘person’ life expectancy).

Additional Considerations for Legal and Tax Advisors:

- Life Expectancy Overruns: If a client outlives their actuarially determined life expectancy, subsequent payments become fully taxable—a crucial aspect of longevity planning. Since the ‘factors’ are an amalgam of male and female life expectancy, women are systematically disfavored. Their average life expectancy is higher than the joint male-female rate. This is taken into consideration by the annuity provider in pricing the annuity, but not by the IRS for taxation.

- Annuity Type Differences: While fixed annuities provide a steady exclusion ratio due to consistent payments, variable annuities require recalculating the exclusion ratio with each payment due to market fluctuations. The calculations become complex, and the annuity provider will provide the exclusion ratio.

The Money’s Worth Calculation

“Money’s Worth” is a technical term in the annuity literature. Money’s Worth is determined by the ratio of the expected present value (EPV) of its payouts to its premium, typically expressed per $100,000. A ratio of 1 suggests that consumers would expect to recover the full amount of their premium over their lifetime. However, the value for insurance products like annuities is usually less than 1 because these commercial products are generally not actuarially fair and include expenses and profits for the insurance provider (6).

Note that the Money’s worth ratio is the ratio of payout to premium (Equation 2), while the exclusion ratio is the ratio reversed (Equation 1).

Let’s return to our example 1 above. According to equation 1 for the IRS Exclusion Percentage, we divided the investment in the contract ($100,000) by the total payouts ($135,600), resulting in an exclusion ratio of 0.73746. This means that 73.746% of each payment is tax-free, equating to $416.67 of each $565 payment; the remainder ($148.33) is taxable.

If we flip the calculation around to calculate a naive Money’s Worth ratio (equation 2), we get a ratio of 1.356. This is a nonsensical result. For every dollar you pay in premium, the insurance company returns 1 dollar and 35 cents. A deal that is too good to be true, of course. The key difference is that the payouts over time need to be discounted.

Assuming annual discounting (compounding), we have 12 * $416.67, which is $5,000 per year. Discounted over 20 years at a discount rate of 3% (as an example), we have $ 74,387.37. In this case, our Money’s worth ratio is 0.744.

Some Money’s Worth Insights

With decreasing life expectancies and lower interest rates (until recently), one would expect an increasing Money’s Worth ratio over time. This has not happened as annuity providers adjusted the annuity cost accordingly (7).

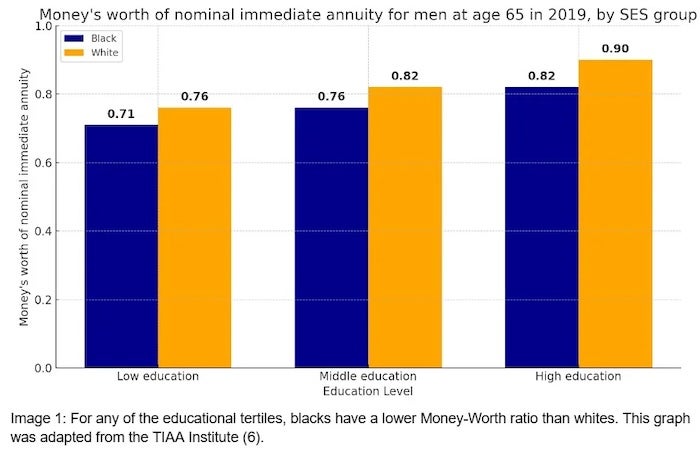

However, Money’s Worth compared between blacks and whites and tertiles of educational attainment show persistent differences (see Figure 1). These discrepancies are caused by disparities in life expectancies between clients with these characteristics. In contrast to overall life expectancies and health history, annuity providers may find it difficult to justify pricing adjustments based on these factors.

Wealth Equivalent

Money’s Worth is a useful metric but does not express an annuity's insurance value. Annuities are, in essence, longevity insurance, and even products with lower Money’s Worth ratios may still appeal to the risk-averse retiree. Annuity equivalent wealth (AEW) is the share of starting wealth an individual would require to be as well off with annuitization as they would be without access to the annuity (for example, one might need only 0.85 as much wealth in a world with annuities to be as well off as in a world without annuities) (6). AEW is what economists call a utility function. AEW reflects the fact that an annuity provides a greater utility to a risk-averse individual than an actuarially equivalent lump sum.

As with all utility functions, the results are heavily dependent on the assumptions. Calculations that come from a source with a specific agenda, such as selling annuities, need to be critically examined. We are mentioning this metric here only to provide context and will examine this in more detail in future articles.

Conclusion

Understanding both the IRS Annuity Exclusion Ratio and the Money’s Worth Calculation enhances one’s grasp of annuities beyond what isolated analysis can provide. The IRS Annuity Exclusion Ratio determines the non-taxable portion of annuity payments based on the investment-to-expected-return ratio, which is crucial for tax purposes (General Rule for non-qualified plans). In contrast, the Money’s Worth Ratio (MWR) measures an annuity’s actuarial fairness by comparing the discounted present value of expected future payments to the contract cost.

While these ratios might appear inversely related, they serve different purposes and are calculated differently. The Exclusion Ratio informs on the taxable portion of annuity payments, crucial for compliance with IRS rules, whereas the MWR evaluates the financial actuarial fairness of an annuity, which, together with the Wealth Equivalent, helps evaluate the overall desirability of an annuity product.

An enhanced understanding of these metrics will make you a better tax or legal adviser. This comparative analysis underscores the importance of considering both tax efficiency and actuarial fairness when evaluating annuity products.

References

- Literature search conducted on 20 July 2024 https://consensus.app/results/?q=IRS%20Annuity%20Exclusion%20Ratio%20and%20the%20Money%E2%80%99s%20Worth%20Calculation&copilot=on&lang=en

- Publication 939 (Rev. December 2022) Cat. No. 10686K General Rule for Pensions and Annuities https://www.irs.gov/pub/irs-pdf/p939.pdf

- National Law Review 5 July 2024. Charitable Remainder Trusts: Get Them While They Are Hot This Summer. https://natlawreview.com/article/charitable-remainder-trusts-get-them-while-they-are-hot-summer

- National Law Review 12 July 2024. IRS Life Tables: Critical Insights for Estate Planning. https://natlawreview.com/article/irs-life-tables-critical-insights-estate-planning

- 26 CFR § 1.72-9 - Tables https://www.law.cornell.edu/cfr/text/26/1.72-9

- TIAA Institute February 2021. What is the value of retail annuities? https://www.tiaa.org/content/dam/tiaa/institute/pdf/insights-report/2021-02/tiaa-institute-value-of-retail-annuities-ti-munnell-wettstein-february-2021.pdf

- Wettstein, G., Munnell, A., Hou, W., & Gok, N. (2021). The Value of Annuities. DecisionSciRN: Financial Decision-Making (Topic). https://doi.org/10.2139/ssrn.3797822.

A podcast that summarized the points of this article is available here:

/>i

/>i