After issuing two proposals, the Securities and Exchange Commission (SEC) adopted final rules (Final Rules) to establish its trading regime for security-based swaps (SBS) as required under the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Titled "Regulation SE,"1 the Final Rules create a trading regime for the registration and regulation of SBS execution facilities (SBSEFs) and address other issues relating to SBS execution generally, including the cross-border application of the trading regime, exceptions/exemptions from SBSEF registration and exceptions from the application of certain trading requirements and other securities law requirements implicated by SBS trading. The Final Rules also implement Section 765 of the Dodd-Frank Act to mitigate conflicts of interest at SBSEFs and national securities exchanges (NSEs) that list SBS. The SEC approved Regulation SE along party lines on November 2.2

While swap market participants, swap execution facilities (SEFs) and other entities operating within the Commodity Futures Trading Commission's (CFTC) regulated swaps market will be happy to find that the new SBSEF regime is largely familiar and very similar to the CFTC's SEF regime3 in several important ways, there are some notable differences, which will likely present a few challenges for market participants and SBSEFs in terms of implementation. In general, the Final Rules diverge from the CFTC's SEF regime where there are differences in the SEC's statutory authority under the Securities Exchange Act of 1934, as amended (SEA), relative to the CFTC's statutory authority under the Commodity Exchange Act (CEA), or there are meaningful differences in the SBS market relative to the swaps market. With respect to the latter point, the SEC noted that the benefits of deviating from the CFTC rules would otherwise justify burdens and costs associated with imposing different or additional requirements than the requirements imposed by the corresponding CFTC rule.

Although the SEC has made several substantive modifications to its SBSEF proposal (SBSEF Proposal) from April 6, 2022, in response to public comments received from interested parties, the SEC adopted the SBSEF Proposal largely as proposed. Some noteworthy substantive modifications adopted in the Final Rules include removal of the proposed "block trade" definition (and leaving the definition as reserved in the Final Rule), modifications to the content and timing of daily market data reports published by SBSEFs, establishment of an exception to ownership and conflicts of interest restrictions for SBSEFs, and providing guidance regarding the treatment of SBS transactions that are intended to be cleared, but are not accepted for clearing by an SEC‑registered clearing agency.

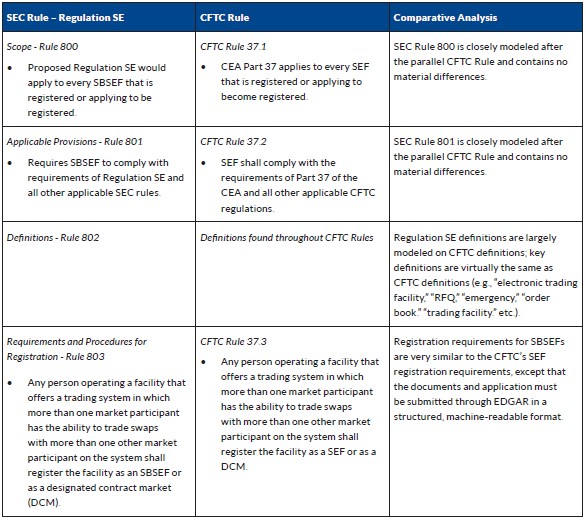

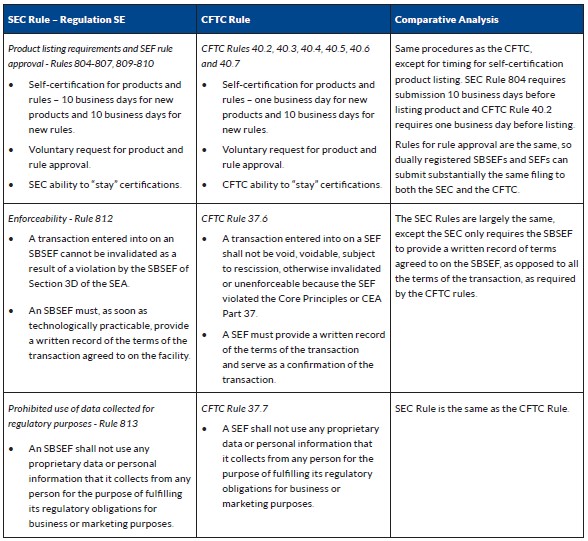

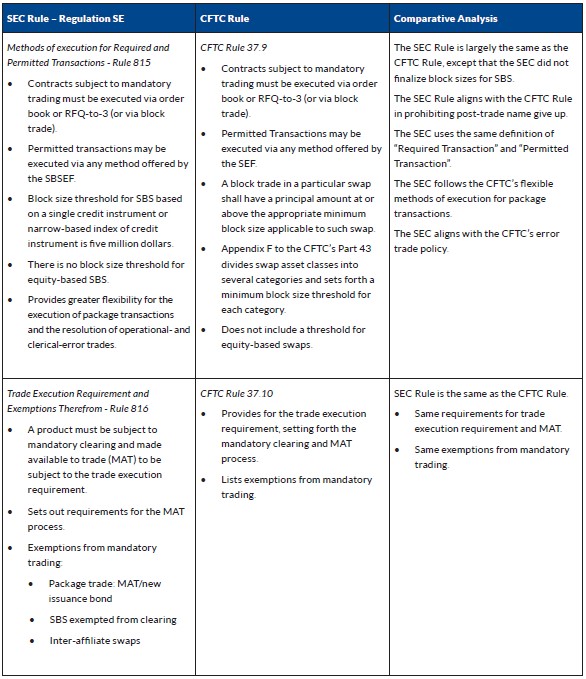

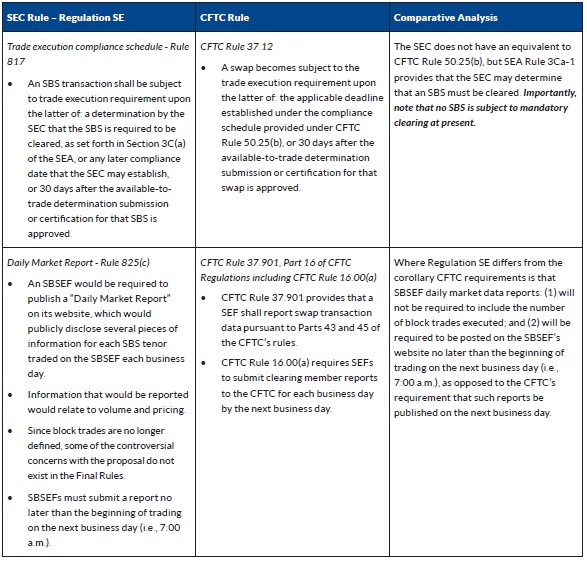

A more detailed discussion of several aspects of Regulation SE is set forth below along with an explanation of Regulation SE's compliance schedule and inclusion of a summary chart, which sets forth a rule-by-rule comparison of the SEC's Final Rules alongside their comparable CFTC SEF rules.

Harmonization with the CFTC's SEF Regime

In adopting the Final Rules, the SEC recognized that the entities that are most likely to register as SBSEFs are existing CFTC-registered SEFs, which have already made substantial investments in systems, policies and procedures to comply with and adapt to the CFTC's Dodd-Frank regulatory regime under the CEA. In consideration of this fact, the SEC's Final Rules prioritize harmonization between the SEC's SBSEF rules and the CFTC's SEF rules in many respects. SEC Chairman Gary Gensler remarked that the SEC "heard from many market participants suggesting that [the SEC] should look to the [CFTC] rules for swap execution facilities as [the SEC's] template. I believe aligning the SEC's regime closely with the CFTC's garners many of the same benefits — bringing together buyers and sellers with transparent, pre-trade pricing. That lowers risk in the marketplace and protects investors." Indeed, the SEC notes in several places in the Final Rules release that, except in certain instances such as SBSEF financial resource requirements and the cross-border application of the SBSEF rules, the SEC intends for its SBSEF rules to facilitate the ability of entities to dually register and minimize costs by allowing incumbent SEFs to use their existing systems, policies and procedures to comply with the SBSEF rules.

Definition of SBSEF, Registration Requirements and Minimum SBSEF Functionality

SBSEF Definition. Section 3D(a)(1) of the SEA prohibits any person from operating a multilateral facility for the trading or processing of SBS through any means of interstate commerce, unless such facility is registered as an SBSEF, an NSE or is otherwise exempted from the SBSEF definition. SEC Rule 802 defines the term SBSEF by cross-referencing the definition of that term in Section 3(a)(77) of the SEA, which is similar to the CFTC's SEF definition and includes the multiple-to-multiple concept (i.e., a facility that brings together many buyers and sellers for trading swaps/SBS). Further, the Final Rules make clear that single dealer or one-to-many platforms are outside of the scope of the statutory and regulatory SBSEF definition.

Relatedly, the SEC expressly rejected the idea of incorporating CFTC staff guidance issued in September 2021,4 where CFTC staff provided further clarity regarding the multiple-to-multiple concept. The SEC noted that it is too premature for the SEC to provide an interpretation that addresses the same interpretive points in the CFTC staff guidance.

SEC Rule 802 also creates a carve-out from the SBSEF definition for an entity that is registered with the SEC as a clearing agency pursuant to Section 17A of the SEA and limits its SBSEF functions to the operation of forced trading sessions (i.e., required end-of-day trading sessions for clearing members that are designed to further the accuracy of end-of-day valuations).

Registration Process. SEC Rule 803 sets forth a process for SBSEF registration, which is closely modeled after the CFTC's equivalent rules. An SBSEF applicant is required to file electronically a complete Form SBSEF, and all information and documentation described in such forms with the SEC using the SEC's Electronic Data Gathering, Analysis and Retrieval (EDGAR) system. Once filed through EDGAR, the SEC has 180 days to approve or reject such application. The SEC's approval would take the form of an order granting registration upon the SEC determining that the applicant has demonstrated compliance with the SEA and the Final Rules. The determination as to when an application is complete would be at the SEC's sole discretion.

Unlike other SEC-registered entity reviews (e.g., the review process for SBS data repositories), the SEC's SBSEF review and approval process does not require that the application be open for public comment.

While the SEC has used the CFTC's SEF application review process as a basis for its process for registering SBSEFs, the Final Rules do not permit SBSEF applicants that are currently registered as SEFs to simply provide copies of Form SEF exhibits in lieu of Form SBSEF exhibits. The Form SBSEF content and exhibits may closely match the form and content of Form SEF, but the Final Rules require that exhibits be submitted through EDGAR in a structured, machine-readable format.

SBSEF Minimum Functionality. With respect to minimum trading requirements, SEC Rule 803(a)(2) would require an SBSEF, at a minimum, to offer an order book. The Final Rules define an order book as "an electronic trading facility, a trading facility or a trading system or platform in which all market participants in the trading system or platform have the ability to enter multiple bids and offers, observe or receive bids and offers entered by other market participants, and transact on such bids and offers."

Other Issues. An entity that meets the definition of SBSEF also would meet the "broker" definition in Section 3(a)(4) of the SEA. Given this overlap, the SEC adopted Rule 15a-12, which provides that an SBSEF that does not engage in any securities activity other than facilitating the trading of SBS on or through the SBSEF is exempt from most provisions, rules and requirements applicable to broker-dealers.

Likewise, an entity that meets the SBSEF definition also would likely meet the definition of "exchange" set forth in Section 3(a)(1) of the SEA, and the interpretation of that definition set forth in SEC Rule 3b-16. As such, the SEC adopted Rule 3a1-1, which exempts from the definition of "exchange" any registered SBSEF that permits trading in no securities other than SBS. New SEC Rule 3a1-1 also exempts from the definition of "exchange" any registered clearing agency that limits its exchange functions to the operation of a trading session that is designed to further the accuracy of end-of-day valuations of SBS.

Product and Rule Filings by SBSEFs

The Final Rules adopt a rule and product review process for SBSEFs under SEC Rules 804 to 810, which is closer to the CFTC's Part 40 rules than to the SEC's process through which NSEs and other self-regulatory organizations submit rule and product filings to the SEC. The SEC noted that the CFTC's filing procedures are an appropriate model upon which to base the SEC's own filing procedures for rules and product listings given the likelihood that most, if not all, SBSEFs will be dually registered with the CFTC as SEFs, and that many rule changes for a dual registrant will affect both its SBS and swaps trading businesses.

Notwithstanding the CFTC's 2023 proposal to amend the rules that govern how CFTC-registered entities submit self-certifications and requests for approval of their rules, rule amendments, and new products for trading and clearing, the SEC decided to adopt requirements similar to the requirements set forth in the CFTC's current Part 40 rules, which include both an expedited self-certification process for review as well as a more formal SEC approval process.

Product Filings. As a general matter, SEC Rules 804 and 805 set forth voluntary submission and self-certification requirements that are substantively like the CFTC's comparable requirements, except for SEC Rule 804(a)(2), which requires SBSEFs to file a new product with the SEC 10 business days before the product's listing. In contrast, existing CFTC Rule 40.2(a) provides that SEFs must file new products only one business day before the product's listing. The SEC explained its variation from CFTC Rule 40.2 as a need for a longer period to review potentially novel and complex products. Other than this difference, the processes by which SBSEFs may file to list new products, both by certification and voluntary submission, are materially the same as the CFTC processes.

Rule Filings. SEC Rules 806 and 807 provide the processes for SBSEFs to submit new rules and rule amendments through voluntary submission and self-certification, respectively. Both SEC Rules adapt the corresponding CFTC rules without any material differences. Closely harmonizing the SEC's filing procedures with the CFTC's would allow dually registered entities to submit the same (or substantially the same) filing to both agencies for review. SEC Rule 806, closely modeled on CFTC Rule 40.5, sets forth the steps that SBSEFs should take to submit a new rule proposal. SEC Rule 807, modeled on CFTC Rule 40.6, lays out the procedures by which SBSEFs may self-certify rules and rule amendments. Like CFTC Rule 40.6, SEC Rule 807(a) provides that the SEC must receive submission of a new rule at least 10 business days before the SBSEF implements the rule.

The Trading Requirement and Made Available to Trade Process

Mandatory Trading Requirement. Like the CFTC's SEF regime, Regulation SE adopts the concepts of "required transactions" and "permitted transactions." SEC Rule 815(a)(1) defines a required transaction as a transaction involving an SBS that is subject to the SEC's mandatory trade execution requirements. An SBS transaction will not be subject to the mandatory trade execution requirement unless the SBS is first subject to mandatory clearing, and it has been "made available to trade." A permitted transaction is defined as a transaction that is not a required transaction.

Adapted from CFTC Rule 37.9, SEC Rule 815(a)(2) requires that, except for block trades (which the SEC has decided not to define), qualifying transactions between affiliates or transactions executed on an NSE or exempted SBSEF (as described below), the Final Rules mandate that all required transactions be executed on an SBSEF's required transaction protocols, i.e., through an order book or a request-for-quote (RFQ) system to three unaffiliated market participants, which works in conjunction with an order book.

Block Trade Threshold Not Defined. Persuaded by commenters, the SEC decided not to finalize the term block trade since the five-million-dollar block trade threshold in the SBSEF Proposal would not be sufficiently tailored to the unique and varying trading and risk characteristics of the full range of credit SBS, creating the potential for the adverse market risks that commenters pointed out might arise from having a one-size-fits-all block threshold.

Made Available to Trade Process. To make a mandated-to-clear SBS available to trade, SEC Rule 816 (like CFTC Rule 37.10) requires an SBSEF to first list the SBS pursuant to a filing with the SEC under Rules 806 (self-certification within 10 business days) or 807 (SEC full approval) and then follow the made-available-to-trade determination process. The SBSEF's made-available-to-trade determination filing under SEC Rule 816 would have to: include a discussion supporting the conclusion that the SBS product is subject to the made-available-to-trade determination; be supported by detailed analysis and documentation; address, as appropriate, a number of relevant factors, including whether there are ready and willing buyers and sellers; the frequency or size of transactions; the trading volume; the number and types of market participants; the bid/ask spread; and the usual number of resting firm or indicative bids and offers. Despite commenters' requests to add additional criteria and/or numerical trading volume thresholds, the SEC chose to match the CFTC's made-available-to-trade criteria.

Exceptions and Exemptions. The SEC adopted exceptions and exemptions from the mandatory trading requirements in SEC Rule 816(e), which are nearly identical to the CFTC's exceptions and exemptions for made-available-to-trade swaps. SEC Rule 816(e)(1) provides an exception for an SBS transaction that is executed as a component of a package transaction. The definition of package transaction and qualifying categories of packages under Regulation SE are identical to the CFTC's definition and categories of packages.

SEC Rule 816(e)(2) creates an exception for exceptions and exemptions from mandatory clearing. Since the SEC neither has a mandatory clearing requirement, nor any specific rule exemptions from mandatory clearing, Regulation SE only generally cites to such exemptions.

Finally, SEC Rule 816(e)(3) provides an exemption for SBS transactions that are executed between counterparties that qualify as "eligible affiliate counterparties". This exemption was adopted directly from CFTC Rule 36.1(c). Counterparties would be "eligible affiliate counterparties" for purposes of Rule 816(e)(3) if: (i) one counterparty, directly or indirectly, holds a majority ownership interest in the other counterparty, and the counterparty that holds the majority interest in the other counterparty reports its financial statements on a consolidated basis under Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), and such consolidated financial statements include the financial results of the majority‑owned counterparty; or (ii) a third party, directly or indirectly, holds a majority ownership interest in both counterparties, and the third party reports its financial statements on a consolidated basis under GAAP or IFRS, and such consolidated financial statements include the financial results of both of the counterparties. Counterparties also would be "eligible affiliate counterparties" if they directly or indirectly hold most of the equity securities of an entity, or the right to receive upon dissolution, or the contribution of, a majority of the capital of a partnership.

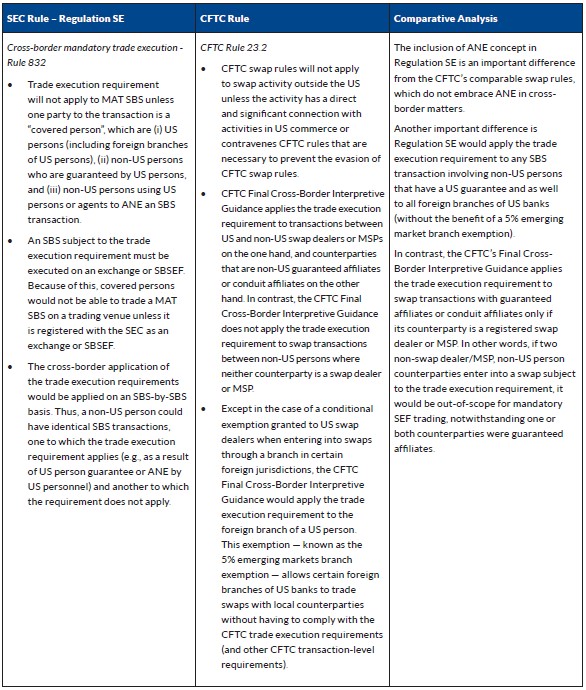

Cross-Border Application

Unlike a substantial portion of Regulation SE, with respect to cross-border SBS transactions, the Final Rules follow the SEC's existing Cross-Border Rules and Guidance.5 This difference in approach will have some implications for both SBS dealers and SBSEFs, including creating differences in compliance and trading practices as between SBS- and CFTC-regulated swaps. Relatedly, to the extent that Regulation SE applies to market participants executing cross-border SBS transactions, it will trigger SBSEF registration requirements for foreign platforms that help facilitate the trading of SBS by "covered persons" (as such term is defined below).

Cross-Border Trade Execution. SEC Rule 832 was designed to address when trade execution requirements apply to a cross-border SBS transaction. SEC Rule 832(a) would provide that the trade execution requirement set forth in Section 3C(h) of the SEA shall not apply to an SBS unless at least one counterparty to the SBS is a "covered person." Paragraph (b) defines "covered person" as: (i) any person that is a US person (including foreign branches of US persons); (ii) a non-US person whose performance under an SBS is guaranteed by a US person; or (iii) a non-US person who, in connection with its SBS dealing activity, uses US personnel located in a US branch or office, or personnel of an agent of such non-US person located in a US branch or office, to arrange, negotiate or execute (ANE) an SBS transaction.

Two components of this covered person definition — the inclusion of the ANE concept and an expanded application of US guarantees — will result in important differences in the compliance and trading practices of SBS- versus CFTC-regulated swaps. In addition, the SEC's covered person definition would largely apply to foreign branches of US persons in the same way as the CFTC's cross-border application of its trade execution requirements, except the SEC's Cross-Border Rules do not provide a "5 percent emerging markets" exemption like the CFTC's Final Cross-Border Interpretive Guidance. As a result, the discord between the SEC's and CFTC's application of their respective trading requirements would have a chilling effect on US SBS dealers' current trading and market-making on foreign trading facilities. In addition, this discord would likely lead many foreign trading facilities to disallow US SBS dealers' foreign branches from accessing facilities' platforms for fear of becoming captured by the SBSEF registration requirement (as discussed below).

ANE Transactions. The inclusion of the ANE concept in Regulation SE is an important difference from the CFTC's comparable swap rules, which do not embrace the ANE concept in cross-border matters. In the Final Rules, the SEC noted that the ANE concept is "necessary or appropriate as a prophylactic measure to help prevent the evasion of the provisions of the SEA that were added by the Dodd-Frank Act...."

In practice, the difference between the SEC's approach and the CFTC's approach could result in SBS ANE transactions being in scope of the SEC's trading requirements, while that same activity for swaps is not in scope. Some SBS dealers and SBSEFs might consider tagging personnel that use SBSEFs to address the ANE considerations.

While the inclusion of the ANE concept is consistent with other SEC rulemakings, it will effectively create an inconsistency between otherwise comparable cross-border approaches adopted by the SEC and the CFTC. Based on previous experience with the CFTC's SEF trading rules, it is possible that foreign platforms may adapt by denying access to any trader with any connection to the United States, no matter how remote, for fear of being captured by the SEC's regime.

Guarantees by a US Person. Similarly, SEC Rule 832(b) extends the SEC's trade execution requirement to non-US persons that are guaranteed by a US person (Guaranteed Entities), irrespective of whether the Guaranteed Entities' counterparties are registered SBS dealers. This provision very likely will impact SBS dealers' non-US affiliates and foreign branch offices looking to offer liquidity on foreign trading platforms, which do not wish to be subject to the SEC's SBSEF rules.

Regulation SE's application of the trade execution requirement to any SBS transaction involving Guaranteed Entities contrasts with the CFTC's Final Cross-Border Interpretive Guidance,6 which applies the CFTC's trade execution requirement to swap transactions between guaranteed affiliates or conduit affiliates and their counterparties, only to the extent that those counterparties are registered swap dealers or major swap participants (MSPs). As a result, any SBS dealers' non-US affiliates that are Guaranteed Entities (irrespective of whether those non-US affiliates are registered with the SEC as SBS dealers) would be required to comply with the SEC's trade execution requirement for SBS.

Foreign Branches of US Persons. Further, Regulation SE extends the SEC's trade execution requirement to all foreign branches of US person SBS dealers. As noted above, the application of the trade execution requirement to foreign branches of US person SBS dealers would be somewhat different from the CFTC's cross-border application of its swap trade execution requirements in that the SEC's trade execution requirements (and the application of its cross‑border rules) do not include a "5 percent emerging markets branch" exemption similar to that found in the CFTC's Final Cross-Border Interpretive Guidance. This exemption permits certain foreign branches of US swap dealers (i.e., those branches outside of Australia, Canada, the EU, Hong Kong, Japan, Switzerland and the UK) from having to comply with CFTC trading requirements (and other CFTC transactional-level requirements under the CFTC's Final Cross-Border Interpretive Guidance) if certain conditions are satisfied.

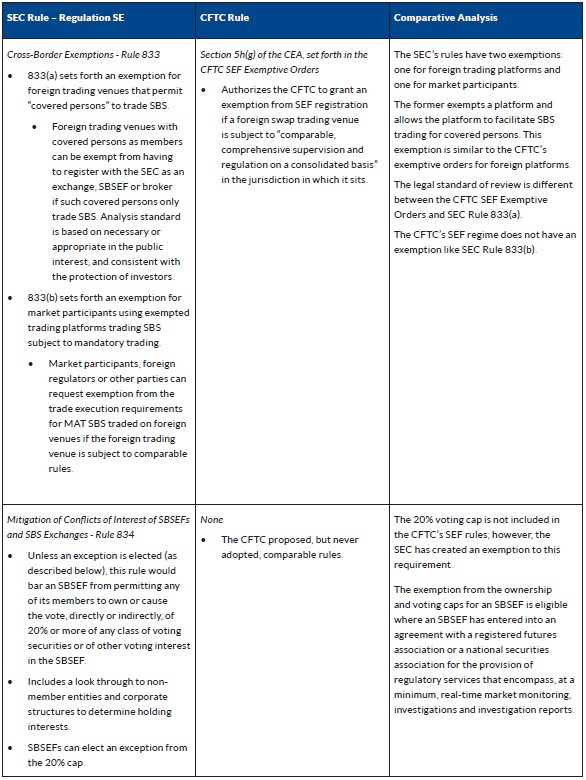

Foreign Platform Registration and Exemption; Exemption Relating to Trade Execution Requirement. As noted above, the Final Rules also trigger SBSEF registration requirements for foreign platforms that facilitate SBS transactions for covered persons. SEC Rule 833 provides exemptions from different requirements of the SEA and is also directed at different entities.

The first exemption in SEC Rule 833(a) provides relief from SBSEF registration requirements for foreign trading venues under certain circumstances. In particular, this provision allows a foreign trading venue with one or more participants who are covered persons to be exempt from SBSEF registration if such venue submits an application for exemption from SBSEF registration. The relief also provides an exemption from the definition of "exchange", the definition of "broker" and the prohibition in Section 3D(a)(1) of the SEA, which provides that no person may operate a facility for the trading or processing of SBS unless the facility is registered as an SBSEF or as an NSE. This SBSEF exemption is somewhat similar to a CFTC exemption for SEFs outlined in a series of orders adopted by the CFTC (CFTC SEF Exemptive Orders),7 but with one major difference. The CFTC SEF Exemptive Orders require a foreign trading venue to have comparable rules and regulations in order to be granted an exemption from having to register as a SEF with the CFTC. In contrast, SEC Rule 833(a) does not require the foreign trading venue (or a third party submitting an exemption request) to submit a comprehensive analysis that the laws of the foreign jurisdiction in which the trading venue sits to have comparable rules to those of the SEC.

The SEC noted in the Final Rules release that it does not intend to immediately extend its exemptive authority to the 53 platforms currently exempt from SEF registration, noting that the statutory language of the SEC's exemptive authority differs from the CFTC's authority. The SEC is statutorily required to grant exemptions that are "necessary or appropriate in the public interest, and consistent with the protection of investors," while the CFTC must find that a foreign trading venue "is subject to comparable, comprehensive supervision." Notwithstanding this difference, it is unclear whether this technical statutory difference in exemptive authority will preclude the SEC from quickly determining exempt SEFs to be exempt SBSEFs.

The second exemption in SEC Rule 833(b) provides relief to the counterparties of an SBS transaction with respect to the trade execution requirement for SBS that are executed on a foreign trading venue. The relief is somewhat similar to a substituted compliance comparability request. That is, this relief must be submitted through an application seeking exemptive relief from the SEC, which can be submitted by a foreign jurisdiction, a foreign trading venue or a group of venues. When considering the application, the SEC may consider: (1) the extent to which the SBS traded in the foregoing jurisdiction covered by the request is subject to a trade execution requirement comparable to that in the SEA; (2) the extent to which trading venues in the foreign jurisdiction covered by the request are subject to regulation and supervision comparable to that under the SEA; (3) whether the foreign trading venue or venues where covered persons intend to trade SBS have received an exemption order contemplated by Rule 833(a); and (4) any other factor that the SEC believes is relevant, in the public interest and consistent with investor protection.

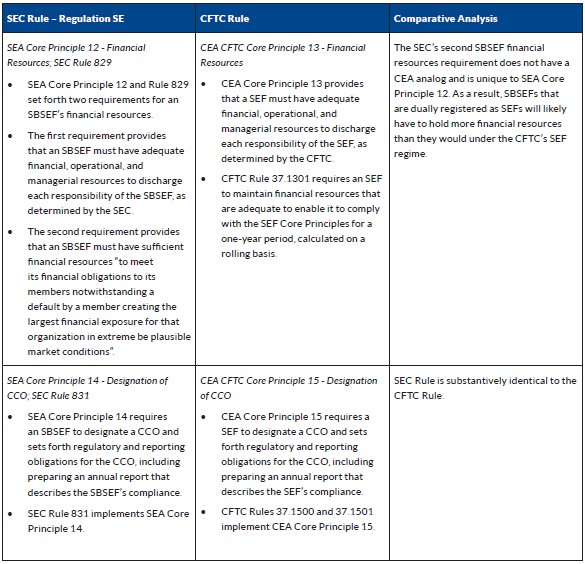

Core Principles, Conflicts of Interest and Other Compliance Matters

Regulation SE's core principles closely harmonize with the CFTC rules that implement SEF core principles, with only a few substantive differences, such as the absence of a core principle relating to position limits or accountability limits. Some of the noteworthy similarities and differences are discussed below.

Core Principle 2 Impartial Access Requirements. Of note, with respect to the impartial access requirements in Regulation SE's Core Principle 2, the Final Rules set forth guidance that is consistent with CFTC staff's 2013 SEF impartial access advisory.8 As a result, the SEC will view an SBSEF's practices or policies as not providing impartial access in several scenarios, including where the SBSEF's membership is limited to (1) self-clearing members; (2) registered SBS dealers; (3) banks or liquidity providers with a minimum amount of Tier 1 capital; (4) liquidity providers that have been "enabled" by, or have bilateral documentation with, a minimum number of other liquidity providers; or (5) liquidity providers with a minimum amount of transaction volume.

Use of Third-Party Regulatory Service Providers. SEA Core Principle 2 also includes a discussion regarding regulatory services provided by a third party. Regulation SE makes explicit that SBSEFs are permitted to contract with CFTC-registered designated contract markets (DCMs) for the provision of regulatory services. The SEC notes in the Final Rules that DCMs have well-established regulatory protocols, are subject to CFTC oversight and are permitted to act as regulatory service providers to SEFs. The SEC cautions, however, that SBSEFs will always remain responsible for the performance of any regulatory services received and retain exclusion authority in all substantive decisions made by its regulatory service provider.

Daily Market Data Reports. Consistent with the CFTC's disclosure requirements for SEFs, the SEC in Rule 825(c)(1) requires SBSEFs to publish daily information on price, trading volume and trading data on SBS. Where Regulation SE differs from the corollary CFTC requirements is that SBSEF daily market data reports: (1) will not be required to include the number of block trades executed; and (2) will be required to be posted on the SBSEF's website no later than the beginning of trading on the next business day (i.e., 7:00 AM), as opposed to the CFTC's requirement that such reports be published on the next business day.

Core Principle 12 Financial Resources. SBSEFs that are dually registered as SEFs will likely have to hold more financial resources than they would under the CFTC's SEF regime. SEA Core Principle 12 and SEC Rule 829 set forth two requirements for an SBSEF's financial resources. The first requirement provides that an SBSEF must have adequate financial, operational and managerial resources to discharge each responsibility of the SBSEF, as determined by the SEC. This requirement is substantively identical to CEA Core Principle 13 for SEFs.

The second requirement does not have a CEA analog and is unique to SEA Core Principle 12. This core principle provides that an SBSEF must have sufficient financial resources "to meet its financial obligations to its members notwithstanding a default by a member creating the largest financial exposure for that organization in extreme be plausible market conditions." SEC Rule 829(a)(2)(i) repeats the statutory provision, notwithstanding commenters' objections. On this point, the SEC noted that, while the SEC has generally strived to harmonize with the CFTC, Regulation SE will continue to require that an SBSEF have adequate resources to meet its financial obligations to its members, even in the case of a member default creating the largest financial exposure.

Core Principle 14 Designation of Chief Compliance Officer. SEA Core Principle 14 is substantively identical to CEA Core Principle 15 and requires an SBSEF to designate a chief compliance officer (CCO). The CCO must, among other things, review the SBSEF's compliance with the SEA Core Principles, resolve conflicts of interest, be responsible for establishing and administering policies and procedures required under the Core Principles, establish procedures for the remediation of noncompliance, prepare and sign an annual report that describes the SBSEF's compliance, certify that the report is accurate and complete, and submit the report to the SEC. SEC Rule 831, which is closely modeled after Subpart P of Part 37 of CFTC Rules, would implement SEA Core Principle 14. The SEC in the Final Rules release noted that for a dually registered SEF/SBSEF, "[t]here are strong economic incentives for a dually registered entity to appoint the same individual to serve as the CCO for both the swap and SBS businesses, and for the CCO to carry out their functions under a similar set of rules . . . The [SEC] does not observe any differences in the SBS market relative to the swaps market that warrant imposing different or additive CCO requirements on SBSEFs relating to the CCO."

Conflicts of Interest. The SBSEF Proposal included a controversial provision relating to cap sizes on the voting rights of individual members of SBSEFs or SBS exchanges. The SEC proposed this cap in accordance with Section 765 of the Dodd-Frank Act in order to mitigate potential conflicts of interest in an individual's trading activities and its ownership of the SBSEF or SBS exchange. In the Final Rules, the SEC moved forward in Rule 834 with imposing the cap on the size of the voting rights that an individual member of an SBSEF or SBS exchange may own or direct, barring SBSEF or SBS exchange from permitting any of its members, either along or together with any officer, principal, or SBSEF employee, to directly or indirectly own 20 percent or more of any class of voting securities or interest in the SBSEF or SBS exchange, or directly or indirectly vote (or cause the vote of) any interest that exceeds 20 percent of the voting power of any class of securities.

In consideration of comments, however, the SEC revised Rule 834 to provide an exemption from the ownership and voting caps for an SBSEF that has mitigated the potential conflict of interest with respect to compliance with the SBSEF's rules by entering into an agreement with a registered futures association or a national securities association for the provision of regulatory services that encompass, at a minimum, real-time market monitoring, investigations and investigation reports. The SEC noted that it appreciated the concerns expressed by commenters that a 20 percent cap on voting interests in all cases could prevent would-be SBSEFs from onboarding their affiliated introducing brokers, and that the burdens imposed in setting up an SBSEF that is legally remote from affiliated introducing brokers may dissuade current SEFs from registering as SBSEFs.

Post-Trade Name Give Up. Consistent with the CFTC's 2020 adoption of a ban on the practice of post-trade name give-up with respect to anonymously SEF-executed cleared swaps, SEC Rule 815(f) adapts for cleared SBS the requirements of CFTC Rule 37.9(f) that prescribe counterparty anonymity and impose a prohibition on post-trade name give-up. The SEC's ban, like the CFTC's, prohibits any person from disclosing the identity of a counterparty to an SBS that is executed anonymously on an SBSEF and intended to be cleared.

The Compliance Schedule and Expiration of Temporary Relief; Implications

The Final Rules will become effective 60 days following the date Regulation SE is published in the Federal Register (Effective Date). The Final Rules allow any entity that meets the SBSEF definition to file an application to register with the SEC at any time after the Effective Date.

Compliance Schedule. In terms of compliance dates, the Final Rules establish two key dates. Any entity that meets the SBSEF definition would need to file a Form SBSEF with the SEC within 180 days of the Effective Date. Second, such applicant entities will be required to have their SBSEF application completed (i.e., having responded to all SEC staff requests for revisions or amendments) within 240 days of the Effective Date in order to continue operating as an SBSEF while its application is pending. Such applicant would be able to continue benefitting from the registration exemption until 30 days after the SEC has acted to approve or disapprove the entity's application.

An entity would have to immediately cease operations as an SBSEF if it does not meet either of the two compliance dates above.

Expiration of Temporary Relief; Implications. Somewhat relatedly, the Final Rules release withdraws a temporary exemption from the requirement to register as a clearing agency that the SEC issued in 2011 (2011 Clearing Agency Exemption).9 As background, the 2011 Clearing Agency Exemption provides a temporary exemption from clearing agency registration to persons that provide collateral management services, trade matching services, tear-up and compression services and/or substantially similar services for SBS.

In addition, in 2020, the SEC adopted Rule 17Ad-24 to exempt from the definition of "clearing agency" certain entities, including a registered SBSEF, that would be deemed to be a clearing agency solely by reason of: (1) providing facilities for comparison of data respecting the terms of settlement of securities transactions effected on such registered SBSEF; or (2) acting on behalf of a clearing agency or participant therein in connection with the furnishing by the clearing agency of services to its participants or the use of services of the clearing agency by its participants. The SEC anticipates that a portion of the persons currently relying on the 2011 Clearing Agency Exemption will register as SBSEFs, and therefore, will be able to rely on the clearing agency exemption set forth in SEC Rule 17Ad-24.

However, persons currently relying on the 2011 Clearing Agency Exemption who do not intend to register as an SBSEF will need to register with the SEC as a clearing agency. Such persons must file a Form CA-1 with the SEC within 180 days after the Effective Date.

Rules Summary Chart

The following chart compares the SEC rules in Regulation SE by topic with the corollary CFTC rules applicable to SEFs.

/>i

/>i