This article looks at the recent developments in the transition from LIBOR to risk-free rates and the likely issues that the local banking and finance market in the Middle East will face as the date for the permanent cessation and non-representativeness of LIBOR approaches. Consideration is given to the technical and legal issues, including the operation of the risk-free rates in typical financings, implementation of credit adjustment spreads, and how finance documents (both for existing financings and new financings) will need to be adapted in light of these imminent changes. Particular focus is given to the specific challenges facing Islamic financings products from the LIBOR transition. Risk consultants advising on the LIBOR transition have also contributed their views on the practical implementation of the LIBOR transition from the operations and processes perspective as well as IT systems upgrades.

INTRODUCTION

It has been nearly four years since the announcement by the UK Financial Conduct Authority (the FCA) that the market has to transition away from LIBOR as an interest rate benchmark. Since then, much work has been carried out by the various working groups established for each of the LIBOR currencies to identify suitable replacements for LIBOR and which has led to the nomination by each of a replacement overnight risk-free rate (RFRs) as the replacement for LIBOR in each of the relevant currencies. These RFRs are determined from transactions in interbank unsecured lending markets or in the case of the Secured Overnight Funding Rate (SOFR) and the Swiss Average Rate Overnight (SARON), from secured lending/ repo markets.

|

* subject to correction and republication during the publication date

** there are currently no plans to cease publishing EURIBOR and therefore existing financings with interest rates determined by reference to EURIBOR are not affected

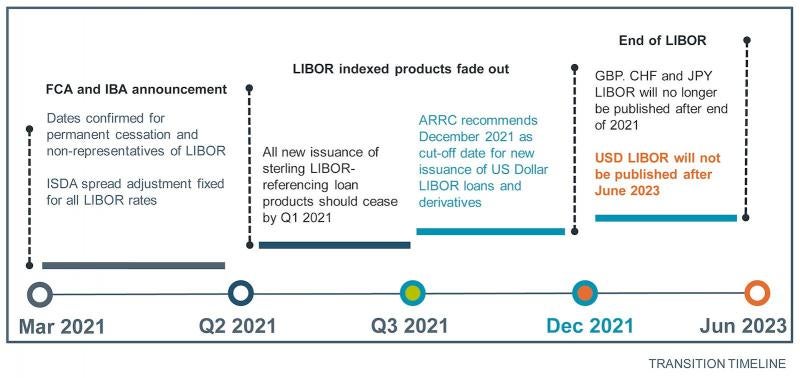

In March 2021, the FCA confirmed the dates for the permanent cessation and non-representativeness of LIBOR, which has resulted in the following updated transition timeline:

This article considers the issues around the LIBOR transition which are most relevant for the local banking and finance market in Qatar including:

-

the operation of RFRs in typical financings;

-

loan documentation;

-

specific issues relating to Islamic financing;

-

practical implementation of RFRs, both from a legal and an operational/ processes perspective; and

-

IT system upgrades.

LIBOR REPLACEMENT

Risk Free Rates

The key differences between LIBOR and the RFRs

|

These RFRs address many of the concerns which contributed to the decision to transition away from LIBOR. RFRs are based on a liquid market based on daily transactions rather than submissions by panel or so-called “reference banks.” As an overnight rate it can be published daily reflecting economic reality, and aggregated over interest periods and the term of a lending to calculate the overall interest that is due. Term bank credit/ liquidity premiums can also be minimised.

As RFRs are overnight rates the working group recommendations and market position is that the rate can only be determined on a backward looking basis. This is in contrast to LIBOR being a forward looking rate, which allowed LIBOR to be fixed and made available at the start of each interest period.

The differences between LIBOR and RFRs will necessitate change across a broad range of banking processes including operational processes, core banking, treasury and loan analytical systems, product designs and risk pricing. On the transactional process, underlying loan templates and new facility agreements will need to be drafted to reference RFRs. Existing facility agreements will need to be reviewed to ascertain the position on LIBOR ceasing to be published and then negotiated with borrowers where necessary to document the transition to RFRs.

Calculation of Risk Free Rates

The market consensus to date is to provide for the determining of RFRs on a compounded in arrears basis by taking the daily RFR on each day during the specified interest period and compounding at the end of the interest period to produce the backward looking term based rate referred to above.

The interest period will specify the relevant lookback period for example, a one month interest period with specified lookback of five business days would result in RFRs being compounded for a period (an observation period) starting five business days prior to the first day of the interest period and ending five business days prior to the last day of the interest period. This lag in the lookback period of an interest period is a recommendation of the working groups and is considered necessary to provide sufficient time after the last daily RFR observed to finalise the calculation of interest and for payment of interest to be made. Consideration has been given by working groups and industry associations to this lookback period and conventions are being developed to modify the methodology of its application where circumstances require e.g. weighting in circumstances where reference to number of days in a lookback period differs from those in the corresponding interest period, which has been termed an ‘observation shift.’

Credit Adjustment Spread

A further point to address arises from the fact that credit risk was factored into LIBOR whereas it is not in overnight rates due to their nature. The overnight rates are therefore generally lower than LIBOR.

In order to ensure that there is no transfer of economic benefit between the parties following a transition from LIBOR to one of the RFRs, a credit adjustment spread will need to be aggregated with the RFR in any interest calculation to account for any differences following adoption of the RFR.

Most of the working groups have, to date, not recommended any particular methodology for calculating the credit adjustment spread although:

-

The Alternative Reference Rates Committee (ARRC) is recommending the ISDA “historical five year median methodology” which is based on the difference between LIBOR and SONIA derived over a five year lookback period and then bases the credit adjustment spread on the median of such difference. Refinitiv publishes this for cash products and Bloomberg publishes the same for all currencies for derivatives (FBAK page).

-

The Sterling working group has identified two preferred methodologies. The first is the same “historical five year median methodology” which ARRC has also recommended; and the second is the “forward approach” which calculates the credit adjustment spread based on the forward-looking basis swap market.

The credit adjustment is an aspect of the transition which has seen ongoing and recent developments in relation to SOFR where some market participants are seeking solutions to retain a credit risk component in the replacement interest benchmarks. This has led to certain providers developing credit risk adjusted benchmarks or credit spread adjustments for SOFR as a potential alternative to SOFR. Market participants should be aware that parties who might benefit from these credit sensitive rates may request these as the fallback or as an alternative fallback to SOFR.

Forward Looking Term Rates

As of January 2021, forward looking Term SONIA has been published by two approved providers. However, the Sterling working group has been discouraging the use of such term rates and is keen to see broad adoption of RFRs on a compounded in arrears basis as described above. The working group has further limited the application of Term SONIA to specific “use cases,” which include those where simplicity and certainty are key factors, export and emerging market finance and Islamic finance (the latter is considered separately below).

As of the date of this article, no equivalent term rates have been published for any of the other RFRs under consideration. Further, the Swiss National Bank has confirmed that there will be no term SARON and on 23 March 2021, the ARRC announced that it “will not be in a position to recommend a forward-looking Secured Overnight Financing Rate (SOFR) term rate by mid-2021.” Additionally, the ARRC noted that it cannot guarantee that it will be able to recommend an administrator to publish any term SOFR.

While term rates were once considered as a possible alternative transition from LIBOR, it now seems increasingly unlikely that banks and market participants can depend on this and must instead adapt to RFRs on a compounded in arrears basis.

LMA LOAN DOCUMENTATION

A significant number of financings in the local market are documented using some variation of the Loan Market Association (LMA) standards. For the purposes of this article, we will consider how the LMA has been preparing market participants for the LIBOR transition and the development and use of their standard precedents to provide for the transition from LIBOR to RFRs on a compounding in arrears basis.

Existing Loan Documentation

Most existing loan documentation will have been prepared prior to firm recommendations on what will replace LIBOR that we now have from the various working groups and therefore will not have included detailed provisions that specifically refer to adoption of RFRs. These loan documentation will need to be carefully reviewed to consider what, if any, provisions contemplate the cessation of LIBOR and the effects of these. To the extent, as is likely, that the documentation needs to be amended to include references to and mechanics for calculations of RFRs, consideration must also be given to how such amendments need to be implemented.

One of the LMA’s starting points on LIBOR transition guidance was the publishing of a recommended form of replacement screen rate clause, which has been available since 2018 and was as much as lenders and borrowers could provide in loan documentation owing to uncertainties in LIBOR transition at that stage that precluded any more prescriptive provisions to document the transition. The replacement screen rate clause permitted parties to a financing to amend the methodology of interest calculations with greater flexibility (i.e. amendments to require less than all-lender consent) than the standard documentation previously allowed. In our experience, most syndicated facilities in the local market have incorporated at least a version of this replacement screen rate clause, often having been included in a recent amendment or facility extension.

Most financing agreements based on LMA standard documentation will contain fallback provisions if LIBOR is not published or is otherwise unavailable. These provisions usually only envisage a temporary cessation of LIBOR rather than the permanent non-publication of LIBOR. As such, these provisions may not offer either a suitable or commercially viable solution for LIBOR transition particularly where they provide for fallback options based on banks’ actual cost of funding or the most recently published LIBOR rate - the latter potentially leading to the anomaly of a floating rate financing being converted to a fixed rate financing as a result of “frozen LIBOR.”

Tough Legacy Contracts

Some financing agreements may operate to prevent a transition to any LIBOR replacement rates. This may be because the fallback provisions could operate (albeit unfairly for one of the parties) e.g. where LIBOR is to be replaced with a poll, survey or requests for quotes concerning interbank lending rates based on LIBOR. This may also be because the agreements have fallback provisions based on LIBOR even though LIBOR ceases to be published (e.g. frozen LIBOR provisions referred to above). There may even be agreements which do not permit amendments or the amendment process is such that it results in the agreement being incapable of being amended. In these cases, there may not be an easy way for the parties to agree to negotiate any amendments required to transition away from LIBOR. While the approach for these “tough legacy contracts” has been left to the parties themselves to resolve, the State of New York recently approved legislation that intervenes in such “tough legacy contracts” to impose the relevant RFR to these contracts and to safe harbour such contracts from potential litigation as a result of the RFR being imposed by law. Federal legislation dealing with “tough legacy contracts” would allow the parties to select another benchmark than the RFR if that would be more appropriate to do so and will not impose SOFR by default. While the New York law and Federal legislation would only be applicable to agreements governed by these laws, the legislation could nevertheless provide a strong argument as to how other tough legacy contracts should and can be dealt with by the courts of other jurisdictions should the need arise.

Documenting New Facilities

The LMA published an exposure draft of its multicurrency term and revolving facilities agreement in September 2020. This exposure draft incorporated provisions for rate switching on a lookback basis operating with and without an observation shift. Facilities would automatically switch to the relevant RFR either on a specified date or following a specified trigger event occurring. In keeping with being an exposure draft, matters such as the lag time on the lookback period, the inclusion of a credit adjustment spread in the total applicable interest rate, the applicability of zero floor and break costs provisions are left as points of commercial negotiation between the parties. In January 2021, the LMA published a further exposure draft of a multicurrency compounded rate/ term rate facilities agreement, which also works on a lookback basis operating with and without an observation shift for new transactions based on RFRs at the outset instead of an initial LIBOR rate switching to RFR during the term of the facilities. This is likely to be the more relevant form of LMA precedent given that as of the date of this article, all Sterling denominated facilities should cease to reference LIBOR and instead reference SONIA and the same recommendation shall apply to USD denominated facilities and correspondingly SOFR from June 2021. We would note that as at the date of this article, the LMA has indicated that there are no plans to provide for updates to the LMA standard precedents to reference Term SONIA.

The LMA exposure drafts together with several financings in the European and US markets which have, in the past 12 months, been successfully concluded referencing RFRs can all act as useful pathfinders and precedents now for banks and borrowers contemplating new RFR referencing facilities or those involved in amending existing LIBOR referencing facilities to transition to RFRs.

ISLAMIC FINANCE CHALLENGES

Of particular relevance to local banks is the impact the discontinuation of LIBOR will have for Shariah compliant financings. One immediate issue with RFRs being calculated on a compounded in arrears basis is that this does not facilitate the calculation in advance of any floating profit rates in Islamic financing transactions to comply with the Shariah principle of gharar (uncertainty). This principle requires all fundamental terms of an Islamic financing transaction to be capable of being ascertained with absolute certainty.

While the Sterling working group has specifically suggested that Islamic financing is an acceptable use case for forward looking term rates i.e. Term SONIA, this is not necessarily a solution to many Islamic market participants for several reasons. First, while the Sterling working group have agreed on providers to publish forward looking term rates, at the time of this article, none of the other currencies have reached this stage or indeed have indicated an intention to provide such forward looking term rates. Secondly, even if forward looking term rates are eventually published for all currencies, it now appears unlikely that the market for conventional financing will adopt such forward looking term rates. This would create a disparity between the Islamic and conventional financing markets which traditionally have a symbiotic relationship, whereby each structures financial products in a manner which are comparable to the other. Market participants are then able to benefit from diverse sources of financing and the ability to build syndicates comprising both conventional and Islamic financiers in split tranche conventional and Islamic financings. Any perceived inequalities concerning fundamental terms such as the interest/ profit rate calculation will create challenges for such split tranche financings which typically rely on equal treatment of creditors across the financing structure to be viable.

A number of potential methods to structure profit calculations based on RFRs on a compounding in arrears basis have been suggested and put into practice, these include:

-

Balancing/ true-up payments – a purchase contract under a murabaha facility is entered into specifying the usual terms including, amongst other things, the cost price and profit rate. At this stage the profit rate will be set in advance using the available backward looking RFR. On the deferred payment date of that murabaha contract, the actual profit rate for the relevant transaction period is calculated using the corresponding backward looking RFR. Any differences in the amounts actually paid based on the specified profit rate and the amount that should have been paid based on the recalculated actual profit rate shall be recovered or reimbursed (as applicable) in the subsequent purchase contract. For the final purchase contract where there is no subsequent purchase contract that can be used to effect the recovery or reimbursement, an undertaking between the parties to pay such difference can be provided for.

-

Initial high profit rate with purchase undertakings – a purchase contract under the murabaha facility is entered into specifying the usual terms including, amongst other things, the cost price and profit rate. The profit rate in this instance would be at a fixed rate, where such fixed rate is greater than the anticipated profit rate at any time during the term of the murabaha facility). On each deferred payment date, the purchaser may elect to pay profit at the rate based on the relevant RFR and the credit spread rate. On the final maturity date, where the profit amounts paid by the purchaser are lower than the profit amount due at the agreed rate under the murabaha agreement, the purchaser shall undertake to pay the difference to the bank. A series of purchase undertakings will be entered into between the purchaser and the bank to provide for spot commodity trades to repay any excess amounts back to the purchaser or, in the remote possibility of there being a shortfall in the amount initially fixed in the murabaha agreement and the actual amount due by reference to the relevant RFR and the credit spread rate, for the purchaser to make the additional payment to the bank. This method raises obvious issues in jurisdictions with strict usury laws which may prevent a high enough profit rate from being set at the beginning. Additionally, there may be issues in accounting treatment for the initial high profit rate which the bank will not be receiving.

-

Multiple purchase contracts – a purchase contract is entered where the profit rate is set as relevant credit spread rate, this will facilitate the periodic payment of the required credit spread. Additional and separate purchase contracts will also be entered into at the end of each transaction period with a profit rate based on the actual RFR for that period.

PRACTICAL STEPS FOR IMPLEMENTATION

Implementation Plan

For banks and borrowers involved in current LIBOR based facilities, the ultimate goals are to:

- agree on new RFR based benchmarks and credit adjustment spreads with counterparties before the end of 2021; and

- ensure, through adjustments, the maintenance of the economic value of the financing.

These goals will be achieved by:

-

agreeing on standard fallback language – including using industry standard fallback languages proposed by ISDA, the LMA or the ARRC in the US;

-

identifying and validating existing contracts – build up a repository of all legal documentation where there is a need to agree with the client to amend;

-

classifying existing contracts – depending on contract type (bilateral, syndicated, master agreement, MTN program), currency or maturity (before/ after December 2021) or instrument type (cash, derivative) to ascertain whether amendments are actually required and if so, the conventions applicable to the product which the contract governs;

-

identifying clients (client groups) – identify the counterparts and co-ordinate the discussion to ensure coherent communication across different products;

-

developing a communication strategy – for the existing portfolio of LIBOR products to ensure generic and specific awareness of the benchmark transition. It is important to allow ample time for clients to make an informed decision to give consent to new benchmarks in order to avoid any conduct risks; and

-

agreeing on an implementation timeline and budget – assess the lead time required for contractual remediation. At an agreed time, all contracts need to have the standard fallback language or a new benchmark selection agreement to allow a switch to new benchmarks.

IT System Upgrades

Operational systems are generally set-up based on forward-looking term rates so will need to be adapted to function with backward looking RFRs.

Conventions relating to the application of RFRs e.g. lookback and observation shift, need to be considered and built into any IT System upgrade.

Adapting to a multi-curve environment where system providers should proceed on the basis that functionality will be required to support financings based on RFRs based on overnight rates compounded in arrears whilst leaving the system capable of dealing with any potential forward looking rates (e.g. Term SONIA) which may become relevant in the future.

Migration or re-booking of legacy transactions – facility agreements may be negotiated on a bilateral basis or there may be batch switching to RFR rates based on trigger events in certain cases, IT systems should be capable of efficiently re-booking the likely volume of legacy transactions.

WIDER IMPLICATIONS BEYOND BANKING AND FINANCE

While this article is focused on the banking and finance aspects of the transition from LIBOR to RFRs, the prevalence of LIBOR in the commercial world means that the transition requires consideration beyond the banking and finance market participants to include corporates and those involved in dispute resolution, particularly concerning arbitration.

Many corporates will have entered into commercial contracts and trade contracts that will refer to LIBOR in provisions such as default interest calculations for late payment of amounts due and payable under such commercial or trade contract. These will need to be reviewed and amendments, where necessary, agreed between the parties to ensure that these provisions will continue to work following the discontinuation of LIBOR.

Arbitration agreements may contain references to LIBOR being used as the basis for determining the amount of any arbitral award (including the interest). These references will need to be amended, if not done so as part of a broader review and amendment of the relevant agreement which contains the arbitration agreement, to ensure there is no possibility of an arbitrator calculating an award based on a non-existent reference rate even though the arbitrators are, under the governing law, arguably empowered to preserve the deal struck by the parties. However, this may not definitively fend off the possibility of arbitrators declaring any LIBOR-benchmarked obligations impossible to perform. Issues that will also require discussion with arbitration practitioners include those which may arise if revisions are required to arbitral awards which reference LIBOR and which will be affected by the cessation of publication of LIBOR including awards that have already been made but have not been fully paid yet.

CONCLUSION

The issues around the LIBOR transition are constantly changing and certain positions, deadlines and recommendations referred to in this article may or will be revised or superseded as the transition process progresses, nevertheless it is becoming increasingly clear that the RFRs will be the successor for LIBOR. In light of this, much work remains to be done to ensure that financings are documented in a manner that either allows for an orderly transition from LIBOR to RFRs or the correct referencing of RFRs in the case of new financings. Financing documentation will only take the parties so far in the implementation of the LIBOR transition and it is paramount that banks’ systems and operations are correctly implemented so that the fundamentally different basis of calculating interest rates highlighted in this article are operationally available from the moment the transition is required to take effect.

Legal and financial advisors and consultants should be engaged at an early enough stage in the process to identify all legal, financial and operational risks that need to be addressed as part of the transition program and to formulate plans and processes to address such risks. Legal and financial advisors can also assist in negotiations with third parties e.g. borrowers or other syndicate banks at an early stage so that any amendments to contracts can be discussed, agreed and executed in time for the transition to LIBOR to ensure that there is no disruption in interest income for banks. In the case of Islamic financings, Shariah supervisory boards may additionally need to be consulted for guidance on acceptable methods of ensuring RFRs are implemented into Islamic financings.

While the Qatar Central Bank (or other applicable regulators) may recommend a preferred replacement reference rate and associated conventions for the transition to LIBOR and require banks to be prepared for and comply with such new replacement reference rate, it is not the responsibility of the regulator to assist banks regulated by it to prepare or implement a transition program, these are solely the responsibility of the regulated entity although it is worth noting that the regulator has the right, within its supervisory powers, to require its regulated entities to report on progress with any implementation programs.

/>i

/>i