In the 3D virtual world known as the metaverse, pioneering enterprises are exploring ways to capitalize on this new frontier's growing popularity. As expected, the use of company marks and brands is becoming an issue to watch. Take Nike's recent lawsuit against online resale platform StockX. The suit alleges StockX NFTs that incorporate images of Nike sneakers infringe on Nike's famous trademarks. The complaint presents novel legal issues that, once decided, have the potential to define the scope of trademark rights in the world of NFTs.

What is an NFT?

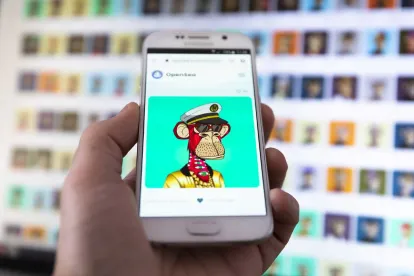

Before we get into infringement, we need to understand the landscape in play. Non-fungible tokens, or NFTs, are unique digital assets stored on the blockchain, which is a digital and non-centralized ledger that publicly discloses who owns a particular NFT. NFTs act as a digital representation of ownership of tangible and nontangible items in the real world, such as artwork, real estate, and video game skins. Each NFT has a unique address associated with its owner that enables proof of ownership. NFTs can exist in any form of digital media, ranging from images to songs. Among some of the famous examples are the Bored Ape Yacht Club NFTs, which act as both a digital avatar and a ticket to an exclusive online social club.

Bored Ape Yacht Club NFTs are represented by a digital avatar of a uniquely designed ape. The middle image is a Bored Ape owned by Tonight Show host, Jimmy Fallon, who purchased the NFT for over $200,000.

While the first NFT was minted back in May 2014, they have only recently gained mainstream attention following celebrity buy-in and reports of NFTs selling for millions of dollars. In 2021, a crypto entrepreneur purchased Twitter founder Jack Dorsey's first-ever tweet as an NFT for $2.9 million. As pricy NFTs garnered mainstream attention, many were left wondering why someone would pay millions of dollars to purchase what appears to be a simple image or video that is readily available to view online for free. While it is possible to screengrab and download copies of digital art that someone has purchased as an NFT, the NFT purchaser still remains the owner of the original work and such ownership is recorded on the blockchain. While someone may have a print of one of Monet’s impressionist landscapes hanging in his or her living room, only one original copy of the painting exists and ownership of that original carries significant value despite the existence of copies.

Nike Swooshes In

Nike brought an action in February 2022 for trademark infringement against StockX, a large online resale marketplace. StockX is a streetwear reseller that, unlike other marketplaces, also acts as an intermediary that provides authentication services to its customers. Recently, StockX expanded this authentication service by launching its own collection of NFTs, which it claims are linked to authenticated physical goods. Many of the NFTs being minted by StockX are comprised of images of Nike sneakers. Nike alleges such use of Nike's famous marks constitutes trademark infringement, false designation of origin, and trademark dilution, among other violations.

StockX's Nike NFTs.

The case hinges on whether StockX's NFTs represent proof of ownership of physical goods or whether the NFTs themselves are virtual products.

StockX contends its NFTs are simply a method to track ownership of physical Nike products sold on the StockX marketplace and held in StockX's custody. In denying that its NFTs are virtual products, StockX points to its redemption process in which NFTs may be redeemed by an owner at any time in exchange for delivery of the physical shoes. Importantly, this novel method for tracking ownership facilitates a more efficient and sustainable resale process. Instead of physical goods that are frequently sold and traded among consumers being repeatedly shipped following each sale, users can simply sell and exchange an NFT.

Nike argues that StockX's Nike-branded NFTs are themselves virtual products, and not simply a representation of ownership of physical Nike sneakers. While StockX touts its customers' ability to redeem an NFT in exchange for possession of the physical product as evidence that their NFTs act simply as proof of ownership, such redemption process is currently unavailable, with no indication as to when, if ever, such service will become available. Instead of presenting a new and efficient method for trading goods, Nike alleges that StockX is minting NFTs to profit from Nike's goodwill and reputation in the streetwear scene. Indeed, the potential profit from selling Nike-branded NFTs is significant – a physical pair of Nike Dunk Low shoes have a resale price of $282 on StockX, but the StockX NFT purportedly linked to this shoe has traded for over $3,000, an almost 1,000 percent price difference between the physical shoe and the NFT. Nike concludes that the StockX NFTs are collectible virtual products, created and distributed by StockX using Nike branding without authorization.

Nike has a particularly strong interest in avoiding brand confusion in this case, as it recently acquired RTFKT Studios (pronounced "artifact"), a digital art and collectibles creative studio engaged in the creation of NFTs, in the hopes of combining blockchain technology with sneaker culture and fashion. Through this new acquisition, Nike has released NFTs through RTFKT, including collectible digital sneakers. Notably, Nike additionally has multiple pending trademark applications before the US Patent and Trademark Office to register its sneakers as virtual goods.

The Nike case is poised to be key to the development of metaverse jurisprudence because of its potential to address the scope of a trademark owner's right to regulate unauthorized uses of its marks in NFTs. While the outcome of this case remains to be seen, other major brands are already seeking protection of their branding in this emerging space by filing trademarks to specifically protect virtual goods and services. Given the nascent uncertainty of how our current legal framework will apply in the metaverse, seeking registration for virtual goods and services is a prudent step for brand owners as we conduct business in the fast-growing digital economy.

/>i

/>i