On October 15, 2024, the United States Court of Appeals for the Tenth Circuit affirmed the dismissal of a putative securities class action against online retailer Overstock.com (“Overstock” or the “Company”) and certain of its current and former senior executives. In re Overstock Securities Litigation, No. 21-4126 (10th Cir. Oct. 15, 2024). In an opinion addressing issues of first impression, the Court held that: (i) plaintiff, a short seller, failed to adequately allege that its stock purchases were made in reliance on the challenged statements; and (ii) a corporate transaction that artificially increased the Company’s share price was not “manipulative” absent evidence that the defendants intended to deceive investors.

The Legal Framework

Although the fact pattern in Overstock is nuanced, the legal framework itself is well-established. Amid a precipitous drop in Overstock’s share price, a short seller commenced a putative class action pursuant to Section 10(b) of the Exchange Act and Rules 10b-5(a)-(c) thereunder. Section 10(b) of the Exchange Act prohibits deception in connection with the purchase or sale of securities. Rule 10b-5(b), which prohibits making “any untrue statement of a material fact,” gives stockholders who purchased stock in reliance on purportedly misleading statements a private right of action against the issuer. Similarly, Rules 10b-5(a) and (c) give stockholders a private right of action against issuers that undertake manipulative acts in connection with the purchase or sale of securities.

Overstock’s “Short Squeeze”

In 2019, online retailer Overstock experienced significant short seller interest. Cognizant that more than half of its outstanding shares sold short, Overstock’s CEO allegedly sought to create a “short squeeze.” To effectuate this purported plan, Overstock announced that it would issue a blockchain-based dividend that would not be registered with the SEC, meaning that it could not be transferred for six months after issuance. That “lock up” period was problematic for short sellers that had borrowed Overstock shares to place their short positions and were thus contractually obligated to transmit any dividends to the brokers lending them shares. Accordingly, if the short sellers’ positions “remained open on the dividend’s record date, [they] would receive an untransferable security that [they were] contractually obligated to transfer.”

Amid news of the dividend, numerous short sellers purchased Overstock shares to cover their positions, causing the Company’s share price and trading volume to increase. In the aftermath of these events, Overstock’s CEO, who had resigned his position shortly after announcing the dividend, published a blog post in which he allegedly confirmed that he had designed the dividend “carefully” and with knowledge that it “put legitimate short sellers in a bind.”

Ultimately, the dividend never came to fruition as originally conceived. On September 18, 2019, the Company announced that it would postpone the dividend amid concerns voiced by the SEC. Nearly a week later, on September 24, 2019, Overstock filed a registration statement for the dividend. These events, coupled with a lackluster earnings report, allegedly caused the Company’s stock price to decline.

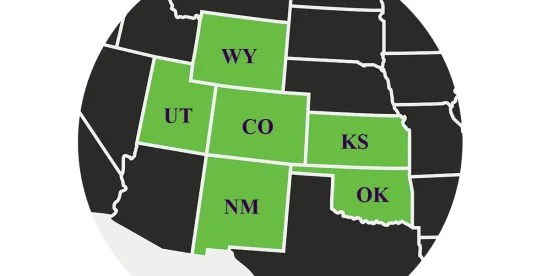

Plaintiff, a short-seller hedge fund that covered its short position in response to the dividend plan, filed suit in the United States District Court for the District of Utah. Its complaint alleged several Exchange Act violations, including (i) making false or misleading statements about the Company’s financial performance in violation of Section 10(b) and Rule 10b-5(b), and (ii) manipulating the market through an artificial short squeeze in violation of Rules 10(b)-5(a) and (c). The District Court granted defendants’ motion to dismiss, finding that plaintiff had failed to plead both reliance on the alleged misstatements and scienter. Plaintiff appealed.

The Tenth Circuit’s Decision

The Tenth Circuit’s affirmance proved a decisive victory for Overstock. At the outset, the Court agreed that plaintiff had failed to state a Rule 10b-5(b) claim because it had not plausibly alleged the necessary element of reliance. Reliance under the Exchange Act may be pled in one of two ways. The first is by showing actual reliance on a defendant’s alleged misrepresentation. The second is by leveraging the “fraud-on-the-market” presumption of reliance articulated in Basic Inc. v. Levinson, 485 U.S. 224 (1988). Plaintiff in Overstock invoked the latter and argued that the “fraud-on-the-market” presumption could not be rebutted prior to discovery. The Tenth Circuit disagreed, holding that defendants had successfully “rebutted [that] presumption with statements in Plaintiff’s complaint” showing that its purchases were catalyzed not by any alleged misstatements, but rather by “Overstock’s looming crypto dividend.” In so holding, the Court reasoned that “Plaintiff [could not] have it both ways: if Plaintiff bought its shares to avoid breaching its lending contracts, it cannot also have bought its shares because of Defendant’s alleged misstatements.”

As to plaintiff’s Rule 10b-5(a) and (c) claims for market manipulation, the Tenth Circuit held that “for market activity to ‘artificially’ affect the price of securities, the manipulative conduct must be ‘aimed at deceiving investors as to how other market participants have valued a security.’” As such, conduct resulting in an artificial price increase is not, on its own, enough to establish either manipulative conduct or manipulative intent. The Tenth Circuit explained that Overstock’s “truthful” disclosures regarding “the terms of the upcoming dividend transaction” gave market participants ample “notice that short sellers might buy [the Company’s] stock to cover their positions before the dividend’s record date.” Investors therefore “possessed sufficient information to form judgments about how Overstock’s dividend would impact Overstock’s share price,” such that plaintiff had failed “to allege that [the Company] ‘deceived investors as to how other market participants have valued a security.’”

Potential Implications

Although class actions stemming from short squeeze transactions are rare, this case may have broader implications for plaintiffs and issuers alike. First and foremost, the Overstock decision suggests that securities plaintiffs may not always be entitled to the fraud-on-the-market presumption of reliance, even at the pleading stage. Although the Tenth Circuit made clear that it was not adopting a brightline rule barring short sellers from invoking the Basic presumption, it nonetheless created an aperture for companies defending against securities claims to argue that plaintiffs’ investment decisions were not motivated by the challenged public statements. Even if a complaint lacks the same admissions that proved key to the Tenth Circuit’s analysis, issuers may still use discovery to establish that distinct motivations make plaintiff stockholders inadequate class representatives, thus widening the scope of defenses issuers may use to oppose class certification.

Of equal importance, the Tenth Circuit’s decision provides clarity on the pleading standards for market manipulation claims under Rules 10b-5(a) and (c). In a move that increased the applicable pleading threshold, the Tenth Circuit instituted a requirement that claims for market manipulation contain adequate allegations of deceit. Thus, regardless of whether a transaction is designed to “artificially” inflate a company’s share price, there is no valid claim of market manipulation if the issuer is transparent with the market. As such, the Tenth Circuit’s decision may provide a blueprint for public companies seeking to defend against significant short-seller activities. Put simply, the decision creates a pathway for issuers to affect corporate transactions solely for the purpose of creating short squeezes without running afoul of the Exchange Act’s antifraud provisions as long as they properly disclose the transaction to stockholders.

While it remains to be seen how far-reaching Overstock’s impact will be, at a minimum, it signifies a turning point in how Tenth Circuit courts will address stockholders’ pleading stage burdens.

/>i

/>i