Start-ups, social-media savvy companies, and other private issuers may soon have a new way to raise capital thanks to key provisions of the recent Jumpstart Our Business Startups Act1 (the “JOBS Act”) and proposed implementing rules2 announced last week by the Securities and Exchange Commission (the “SEC”). The long-awaited “crowdfunding” rules were unanimously adopted by the SEC commissioners and will allow issuers to raise up to $1 million per year through unregistered, internet-based public offerings marketed to the general public. The proposed rules will now undergo a public comment and review period before being finalized.

Background on Crowdfunding

Crowdfunding is an innovative new means of capital generation that has already gained prominence in non-securitiesbased financing campaigns for projects such as films and other artistic endeavors. The concept is simple: provide smallscale investment opportunities to the public at large—i.e. the “crowd”—through internet-based platforms. By aggregating the investments of a large number of individuals, the issuer is able to raise significant capital. Likewise, by combining the knowhow and insights of its many members, the crowd is ostensibly able to make informed decisions about which prospective issuers deserve investment.

This capital strategy is most appropriate for small businesses and innovative start-ups that can take advantage of social media and other electronic resources to mobilize a large number of individual investors. In addition, the SEC views crowdfunding as a way to open the venture capital and private equity markets to the public at large.

Overview of Proposed Rules

The proposed rules – via a new “Regulation Crowdfunding” – would implement the JOBS Act crowdfunding exemption, subject to certain dollar amount caps, restrictions on resale, regulations for intermediaries, disclosure requirements, advertising regulations, and various other rules and provisions, as summarized below.

Dollar Amount Caps

The JOBS Act placed a $1 million cap on crowdfunding offerings in a 12-month period. However, the SEC provides some relief from this limit by proposing to count only amounts actually raised pursuant to the crowdfunding exemption toward the $1 million cap. Therefore, amounts sold in reliance on other exemptions are not counted toward the cap, nor are amounts raised through other sources such as donations from separate, non-securities based crowdfunding offerings or targeted amounts not actually realized. However, the $1 million cap does include amounts raised in reliance on the crowdfunding exemption by entities controlled by the issuer or under common control with the issuer.

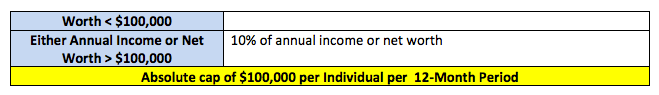

Individual investors are also subject to a dollar limit on the amount they can contribute during a 12-month period. The proposed rules clarify the JOBS Act with respect to these limits and create the following caps:

![]()

In other words, if the individual investor’s net worth or annual income is less than $100,000, then the investor is limited to the greater of either $2,000 or 5% of the investor’s annual income. If either annual income or net worth exceeds $100,000, then the cap is the greater of either 10% of the investor’s annual income or 10% of the investor’s net worth. Ahard cap of $100,000 applies to all investors, regardless of income or net worth. The proposed rules also provide that an investor’s annual income and net worth may be calculated jointly with his or her spouse.

Restrictions on Resale

Securities purchased under the crowdfunding exemption will have retransfer limits that prevent the sale, gift, or other transfer of the security to anyone that other than: (1) the issuer of the securities; (2) an accredited investor; (3) as part of a registered securities offering; or (4) to a family member of the purchasing investor (or equivalent persons). The proposed rules generally track these statutory requirements and provide additional details. An “accredited investor” will have the same definition as under Regulation D, and qualifying family members will include children, grandchildren, parents, stepparents, grandparents, spouses/spousal equivalents, siblings, mothers-in-law, fathers-in-law, sons-in-law, daughtersin-law, brothers-in-law, and adoptive relations.

Intermediary Requirements

The proposed rules would also regulate the means by which the securities are marketed and sold. Specifically, the offering must be conducted through either: (1) a broker registered with the SEC, or (2) a registered “funding portal.” In the interest of concentrating investment opportunities and encouraging “crowd dialogue,” the issuer may only use one such intermediary, and the offering must be conducted entirely online through web-based “platforms.” The proposed rules envision such platforms taking the form of Internet websites available on computers, smart phones, and other digital media devices. In addition, intermediaries must provide means by which investors can communicate and share information pertaining to the investment opportunity. (However, intermediaries may not themselves provide advice pertaining to the investment opportunity.) Although these communication channels are not required by statute, the SEC believes that such avenues of discourse will help achieve the information-sharing goal of the crowdfunding exemption.

The proposed rules also elaborate on the JOBS Act requirement that intermediaries participate in the disclosure and compliance process. Specifically, before accepting an investment, intermediaries must provide to the investor basic background information about the offering, the risks of investing, restrictions on resale, and other pertinent information.

These disclosures must be written in plain language. Intermediaries must also ensure that the issuer’s required disclosures are publicly available at least 21 days prior to the offering. Intermediaries must also have a reasonable basis for believing that an investor has not exceeded his or her individual investment cap before accepting an investment.

Cognizant of the difficulties inherent in trying to police so many individuals, the SEC will allow the intermediary to rely on representations made by the individual concerning compliance with the investment limitations. Finally, the proposed rules offer details about the registration process for intermediaries wishing to become a registered funding portal. The proposed registration process would require a filing similar to — though less extensive than — the Form BD process that is required for broker-dealers.

The applicant would provide information about its principal place of business, legal organization and disciplinary history, business activities (including types of compensation to be received in the offering), control affiliates and their disciplinary history, FINRA membership, and the funding portal’s web address. In addition, some ongoing disclosure requirements would be put into place, and the funding portal would be required to obtain a fidelity bond covering any associated person with a minimum coverage amount of $100,000. This fidelity bond is not mandated as part of the JOBS Act, but the SEC believes that it will help insure against investor loss.

Disclosure Requirements

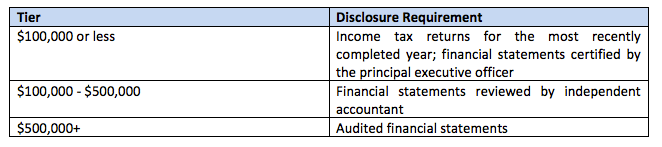

The new crowdfunding exemption also requires the issuer to provide a number of disclosures on a new Form C to investors, potential investors, and the SEC. Basic organizational background information (e.g., name, legal status, physical and web address, and officers and directors) is required, and the issuer must also describe its business, anticipated business plan, target offering amount, offering price, capital structure, intended use of the proceeds, and material risk factors. The proposed rules would require additional financial disclosures based on the amount of crowdfunding securities actually sold within the preceding 12 months, including discussion of the issuer’s financial condition and the information summarized below.

This listing of disclosure requirements is not comprehensive, and a number of other requirements have been proposed, including ongoing disclosures and narrative financial reports. Fortunately, the proposed rules are flexible in terms of form and would require investors to consent to electronic delivery of disclosures and other information.

Advertising

One of the more controversial aspects of the crowdfunding exemption is a partial ban on advertising. Specifically, the JOBS Act provides that an issuer may not advertise the terms of the offering, except for notices which direct investors to the funding portal or broker. However, the SEC’s proposed rules are somewhat lenient with respect to advertising and would allow the issuer to distribute public notices in any available format, including in newspapers and social media sites. These notices are strictly limited in terms of content and may include only the terms of the offering and directions for accessing the intermediary’s online offering platform. The reasoning behind the proposal is that notices and advertisements should direct investors to the intermediary’s platform, where crowd-based discussions and disclosures are intended to help foster good investment decisions. Any promoter that has been compensated for its services must also disclose that fact.

Additional Rules and Provisions

As with other securities sales, transactions pursuant to the crowdfunding exemption are subject to the various antifraud and other rules prohibiting transmission of false or misleading information. Similarly, the proposed rules contain a number of provisions that would result in the disqualification of an issuer’s or intermediary’s ability to utilize the crowdfunding exemption upon the occurrence of certain qualifying events. Finally, certain companies would be ineligible to use the crowdfunding exemption, including non-US companies, companies that are already SEC reporting companies, and others who fail to company with the rules explained above.

Action Items; Contact

The SEC’s proposed crowdfunding rules are open for public comment and review for a period of 90 days following their release. If you have a comment, please see pages 1 and 2 of the SEC Release for instructions on how to submit your thoughts directly to the SEC.

1 Pub. L. No. 112-106, 126 Stat. 306 (2012); for more information on the JOBS Act, see our Client Alert from April 2012. Title III of the JOBS Act added new Section 4(a)(6) of the Securities Act of 1933, as amended (the “Securities Act”), which provides an exemption from the Securities Act registration requirements for certain crowdfunding transactions.

2 See Crowdfunding Disclosure, Release Nos. 33-9470 and 34-70741, which may be found at: http://www.sec.gov/rules/proposed/2013/33-9470.pdf (October 23, 2013) (the “Proposing Release”).

/>i

/>i