I. Introduction: On August 23, 2023, the SEC approved a set of final rules under the Investment Advisers Act of 1940 (the “Advisers Act”) applicable to investment advisers of private funds (the “Private Funds Rules”) as well as one rule applicable to all registered investment advisers (the “New Compliance Rule”) 1. The rules were first proposed in February 20222 (“Proposed Rules”) and represent the most impactful changes applicable to investment advisers of private funds since the changes implemented as a part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 in response to the global financial crisis. Although the Private Funds Rules will become effective sixty days following publication in the Federal Register, investment advisers covered by the Private Funds Rules3 will have 12-18 months following publication to comply.4 Nonetheless, we encourage advisers of private funds to understand fully their obligations under the Private Funds Rules and to begin implementing processes to address their new disclosure requirements under these rules.

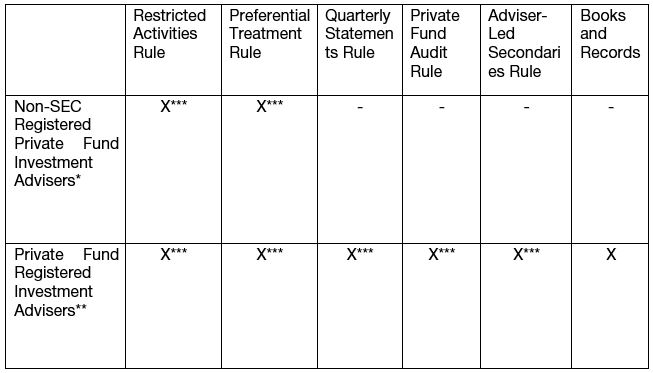

II. Substance of Private Funds Rules: Portions of the Private Funds Rules apply to all investment advisers of private funds,whether or not the investment advisers are registered with the SEC, registered at the state level, or exempt from registration (each, a “private fund investment adviser,” or “PFIA”), and other portions of the Private Funds Rules apply only to SEC-registered investment advisers of private funds (each, a “private fund registered investment adviser,” or “PFRIA”). Note that for the purpose of the Private Funds Rules, securitized assets funds are specifically excluded from the scope of each of the rules, and while non-U.S. advisers are not specifically addressed in the Private Funds Rules, the SEC does provide guidance applicable to such managers within the Release5. The Applicability Matrix at the end of this alert highlights which of the new Private Funds Rules apply to all private fund investment advisers versus just private fund registered investment advisers.

The primary changes applicable to all PFIAs are the following:

- Restricted Activities Rule: Identifies activities that are prohibited, prohibited without consent, and prohibited without disclosure:

- Prohibited:

- Investigation resulting in sanction expense allocation: A PFIA may not charge fees or expenses to a private fund for an investigation that results or has resulted in a sanction for violation of the Advisers Act or rules thereunder;6

- Prohibited:

- Prohibited without disclosure and consent:

- Investigation expense allocation: A PFIA may not charge fees or expenses associated with an investigation of the adviser or its related persons unless the adviser requests consent from all private fund investors and obtains consent from a majority-in-interest of independent investors;7

- Borrowing from private fund: A PFIA may not borrow from a private fund unless the adviser requests consent to such borrowing (and all material terms) from all private fund investors and obtains consent from a majority in interest of independent investors.8

- Prohibited without disclosure:

- Non-pro rata expense allocation: A PFIA may not charge fees or expenses related to a portfolio investment on a non-pro rata basis where multiple clients of the adviser are invested unless: (i) the non-pro rata treatment is fair under the circumstances and (ii) prior to the charge, the adviser provides written notice to each private fund investor of the charge and a description of how it is fair under the circumstances;9

- Examination expense allocation: A PFIA may not charge fees or expenses associated with regulatory, examination or compliance fees or expenses of the adviser unless such fees and expenses are disclosed to investors in writing within 45 days after the end of the fiscal quarter in which such charge occurs;10 and

- Clawback reduction: A PFIA (or its interest holders) may not reduce the amount of a clawback payable to a private fund by actual, potential or hypothetical taxes unless the adviser provides written notice of the reduction to private fund investors within 45 days after the end of the fiscal quarter in which the reduction of clawback occurs.11

Notably, rules requiring consent of the investors would not permit such consent to be provided by a limited partner advisory committee (or LPAC), as is frequently the case when obtaining other consents under the Advisers Act, such as consents to most conflicts of interests. Furthermore, actions will continue to be permitted where compliance with the rule would require amendment of fund documents entered into before the applicable compliance date, except legacy status still will not allow advisers to charge fees or expenses relating to investigations that result in sanctions.

- Preferential Treatment Rule: Prohibits granting of certain preferential treatment related to liquidity and information-sharing by PFIAs and provides for a disclosure framework for other types of preferential treatment:

- Prohibited Preferential Treatment:

- Liquidity: A PFIA is prohibited from granting an investor in a private fund the ability to redeem its interests on terms that the adviser reasonably expects to have a material, negative effect on other investors in the private fund, except (i) if such redemption right is required by law or (ii) if the adviser has offered the same redemption right to all other investors (and all future investors) in the private fund;

- Information-Sharing: A PFIA is prohibited from providing information regarding portfolio holdings or exposures to an investor if the adviser reasonably expects such information would have a material, negative effect on other investors in the private fund, except if the adviser provides such information to all investors at the same or substantially similar time;

- Disclosure of Preferential Treatment: A PFIA may not provide preferential treatment to investors unless the adviser provides the following written notices:

- Advance notice: Prior to an investor’s investment in a private fund, the adviser must disclose in writing material economic terms that the adviser provides to other investors;

- Commencement notice: PFIAs to designate each private fund as a “liquid fund” (defined as a private fund that is not an illiquid fund) or an “illiquid fund” (defined as a private fund that is not required to redeem interests upon an investor’s request and has limited opportunities, if any, for investors to withdraw before termination of the fund) and to provide the following based on such designation:

- Illiquid fund: as soon as reasonably practicable following the end of the private fund’s fundraising period, written disclosure of all preferential treatment the adviser has provided to other investors in the private fund;

- Liquid fund: as soon as reasonably practicable following the investor’s investment in the private fund, written disclosure of all preferential treatment the adviser has provided to other investors in the private fund;

- Annual notice: On at least an annual basis, written disclosure of all preferential treatment the adviser provided since the prior annual notice was provided.

- Prohibited Preferential Treatment:

As with the Restricted Activities Rule, investment advisers may continue to operate under side letters and other fund documents that were entered into prior to the applicable compliance date that otherwise would be prohibited.

The primary changes applicable to PFRIAs are the following:

- Quarterly Statement Rule12: PFRIAs are required to produce “ILPA-style” quarterly investor statements containing a detailed accounting of fees and expenses paid to the PFRIA and to third parties, as well as fund performance, within 45 days of the end of each quarter other than the last quarter of the fiscal year, which shall be 90 days13. Such quarterly statements shall include the following at a minimum:

- Fund Table14: A table for the private fund that details (both before and after application of any offsets, rebates or waivers) (i) all compensation, fees, and other amounts allocated or paid to the PFRIA or its related persons, with separate line items for all fees (including, management, advisory, sub-advisory or similar fees or payments, and performance-based compensation) and (ii) all fees and expenses allocated or paid by the private fund, with separate line items for organizational, accounting, legal administration, audit, tax, due diligence and travel fees and expenses and (iii) the amount of any offsets or rebates to be carried forward to subsequent periods;

- Portfolio Investment Table15: A table detailing each portfolio investment that allocated or paid the PFRIA or its related persons any amounts attributable to the private fund’s interest in such portfolio investment (including, “origination, management, consulting, monitoring, servicing, transaction, administrative, advisory, closing, disposition, directors, trustees or similar fees or payments”16);

- Performance reporting17: A detailed accounting of fund performance using metrics set forth within the rule. The rule requires PFRIAs to designate each private fund as a “liquid fund” or an “illiquid fund” (as each term is defined above under “Disclosure of Preferential Treatment”) and to provide the following based on such designation:

- Liquid Fund: (i) annual net total returns for each fiscal year over, the shorter of, the past 10 fiscal years or the period since inception; (ii) average annual net total returns over the one-, five- and ten-fiscal year periods; and (iii) the cumulative net total return for the current fiscal year as of the end of the most recent fiscal quarter covered by the quarterly statement.

- Illiquid Fund: the following performance metrics calculated from inception to the end of the applicable quarter, in each case, computed both with and without the impact of any subscription facilities:

- Gross internal rate of return (“IRR”) of the private fund;

- Net IRR of the private fund;

- Gross IRR of the realized portion of the fund’s portfolio;

- Gross IRR of the unrealized portion of the fund’s portfolio;

- Gross multiple of invested capital (“MOIC”) of the private fund;

- Net MOIC of the private fund;

- Gross MOIC of the realized portion of the fund’s portfolio; and

- Gross MOIC of the unrealized portion of the fund’s portfolio.

- Private Fund Audit Rule18: A PFRIA must cause each private fund it advises to obtain annual audited financial statements and distribute the same to private fund investors. For private funds that it does not control, the PFRIA must take all reasonable steps to cause the audit to occur (or else be prohibited from advising the private fund).

- Adviser-Led Secondaries Rule: Requires a PFRIA to obtain either a fairness opinion or valuation opinion from an independent third-party provider in respect of a GP-led secondary transaction19. In addition to the opinion, the PFRIA must distribute to the private fund’s investors a summary of business relationships with the third-party opinion provider over the last two years.

- Books and Records Amendments20: Requiring PFRIAs to maintain appropriate books and records to document compliance with the new rules.

III. Implications for Non-U.S. Advisers: In the case of both PFIAs and PFRIAs, the Private Funds Rules make no exceptions for non-U.S. advisers; however, in the text of the Release, the SEC provides guidance that the SEC does not intend to apply the Private Funds Rules to certain aspects of a non-U.S. adviser’s business. Therefore, the SEC’s approach for non-U.S. advisers is not fully expressed in the Private Funds Rules themselves – but, instead, its position is separately provided in the Release and other historical guidance providing that most of the substantive provisions of the Advisers Act do not apply with respect to the non-U.S. clients of a non-U.S. adviser registered with the SEC.

In the Release the SEC indicates “We have previously stated, and continue to take the position, that we do not apply most of the substantive provisions of the Advisers Act with respect to the non-U.S. client (including private funds) of an SEC registered offshore adviser.” The SEC hedges the weight of such guidance, indicating “[the cited SEC statements in the prior sentence] represent the views of the staff. They are not a rule, regulation, or statement of the Commission. Furthermore, the Commission has neither approved nor disapproved their content. These staff statements, like all staff statements, have no legal force or effect: they do not alter or amend applicable law, and they create no new or additional obligations for any person.” Even though, as a technical matter, the SEC intends not to be bound by these positions, market participants rely on them to craft their compliance programs and to assess U.S. regulatory risk, and such parties can determine reasonably that they can rely on the SEC’s statement that “The quarterly statement rule, audit rule and adviser-led secondaries rule are substantive rules under the Advisers Act that we will not apply with respect to the non-U.S. private fund clients of an SEC-registered offshore adviser (regardless of whether they have U.S. investors).”21

In addition to the “substantive provisions” referenced in the foregoing paragraph, the SEC went further indicating that “none of the final rules or amendments apply with respect to the offshore fund clients of an SEC-registered offshore adviser”.22 For unregistered offshore advisers, the SEC clarified that “the restricted activities rule and the preferential treatment rule do not apply to offshore unregistered advisers with respect to their offshore funds (regardless of whether the funds have U.S. investors)”.23

IV. Conclusion: While many of the most stringent aspects of the original Private Funds Rules proposal have been made more permissive, adoption of the Private Funds Rules still represents a significant shift in the regulatory landscape with respect to private fund management. Many private fund managers surely breathed a sigh of relief when the final rule eliminated some of the most draconian proposals, such as requiring all side letter provisions to be disclosed to all investors in advance, prohibiting indemnification resulting from an adviser’s negligence or recklessness and requiring general partners to pay clawbacks gross of taxes. On the other hand, there is no relief for managers of small funds where costs of compliance could threaten their business models, certain prohibitions under the Preferential Treatment rule still materially differ from established international market practices and expenses associated with most fund restructurings are likely to materially increase.

That said, implementation of the new obligations will substantially increase the regulatory compliance burden to advisers of private funds. Advisers to private funds have a relatively short 12-18 months to build and implement policies, procedures and systems to address all of the Private Funds Rules. Thus, advisers should begin the process. Furthermore, because the New Compliance Rule will already be in effect before most private fund advisers’ annual compliance review cycles, it would be prudent for advisers to begin planning for these procedures, even if they do not need to be fully implemented until much later. In order to assist in your understanding of the Private Funds Rules, we anticipate issuing additional alerts targeted at specific issues faced by our clients. Should you have any questions regarding the Private Funds Rules, please reach out to your Polsinelli attorney.

Applicability Matrix

Private Funds Rules

*Includes all investment advisers to private funds, including exempt reporting advisers and state-registered investment advisers, but excludes managers of securitized asset funds.

**Includes all registered investment advisers to private funds, but excludes managers of securitized asset funds.

***Release language excludes the activities of investment advisers with a principal office and principal place of business outside the United States with respect to non-U.S. private fund clients.

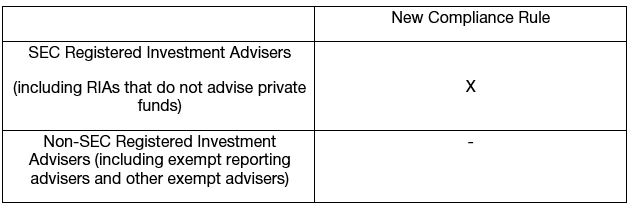

New Compliance Rule

[1] Final Rule, Private Fund Advisers; Documentation of Registered Investment Adviser Compliance available at https://www.sec.gov/files/rules/final/2023/ia-6383.pdf (the “Release”).

[2] Proposed Rule, Private Fund Advisers; Documentation of Registered Investment Adviser Compliance IA-5955, available at https://www.sec.gov/files/rules/proposed/2022/ia-5955.pdf.

[3] This alert focuses on the Private Funds Rules, which apply to investment advisers of private funds, which are vehicles that rely on exemptions set forth in Section 3(c)(1) (the “100 and under” exemption) or 3(c)(7) (the “qualified purchaser” exemption) of the U.S. Investment Company Act. Securitized assets funds are largely carved out of the Private Funds Rules. As a part of the same package of final rules, the SEC adopted the New Compliance Rule (a rule requiring that a registered investment adviser’s annual review of its compliance policies and procedures be memorialized in writing). The New Compliance Rule applies to all registered investment advisers (whether or not the RIA advises private funds and whether or not the RIA advises securitized assets funds), and it becomes effective sixty days following publication in the Federal Register. The New Compliance Rule is not the subject of this alert.

[4] Larger private fund advisers with $1.5 billion or more of private fund assets under management have a 12-month transition period, while private fund advisers with less than $1.5 billion of private fund assets under management have an 18-month transition period. The transition period with respect to the Quarterly Statement Rule and Private Fund Audit Rule is 18 months for all registered advisers. Release at p. 308.

[5] See Section III (“Implications for non-U.S. advisers”) of this alert.

[6] Rule 211(h)(2)-1(a)(1).

[7] Rule 211(h)(2)-1(a)(1).

[8] Rule 211(h)(2)-1(a)(5).

[9] Rule 211(h)(2)-1(a)(4).

[10] Rule 211(h)(2)-1(a)(2).

[11] Rule 211(h)(2)-1(a)(3).

[12] Rule 211(h)(1)-2.

[13] With respect to funds of funds, such reporting shall be made within 75 days from the end of each fiscal quarter other than the last quarter of the fiscal year which shall be made within 120 days from the end of such quarter.

[14] Rule 211(h)(1)-2(b).

[15] Rule 211(h)(1)-2(c).

[16] See definition of “portfolio investment compensation” within Rule 211(h)(1)-1.

[17] Rule 211(h)(1)-2(e).

[18] Rule 206(4)-10.

[19] Rule 211(h)(1)-1 defines “adviser-led secondary transaction” as “any transaction initiated by the investment adviser or any of its related persons that offers private fund investors the choice between (1) selling all or a portion of their interests in the private fund; and (2) converting or exchanging all or a portion of their interests in the private fund for interests in another vehicle advised by the adviser or any of its related persons.”

[20] Rule 204-2.

[21] Release at p. 47-48.

[22] Release at p. 48.

[23] Release at p. 49. Note also that the quarterly statement rule, audit rule and adviser-led secondaries rule would not apply to unregistered offshore advisers due to the fact that the scope of such rules only covers registered advisers.

/>i

/>i