The Division of Data (DOD) of the Commodity Futures Trading Commission (CFTC or the Commission) published updated post-initial appropriate minimum block sizes and post-initial cap sizes under Part 43 of the CFTC’s regulations, effective October 7. In alignment, the Division of Market Oversight (DMO) extended its no-action position on failing to comply with the “Block and Cap Amendments” to October 7 as well, through CFTC Letter No. 24-06 that modifies CFTC Letter No. 23-15. Based on industry data, block and cap sizes have increased over time to reflect the growing market value of swaps.

Block trades are defined as publicly reportable swap transactions that have a notional or principal amount at or above the minimum block size. To maintain the anonymity of market participants to certain large identifiable swaps, there is a generic notional “cap” for the public disclosure of this swap data. Swap transactions meeting or exceeding these notional thresholds can be negotiated outside of a swap execution facility (SEF), or "off-SEF," and are not required by the CFTC to be traded on-SEF.

Under CFTC Regulations 43.6(g) and 43.4(h), the CFTC must determine post-initial appropriate minimum block and cap sizes no less than once each calendar year. On May 23, the DOD announced updated Block and Cap Amendments based on a review of this past year’s swap transaction and pricing data.

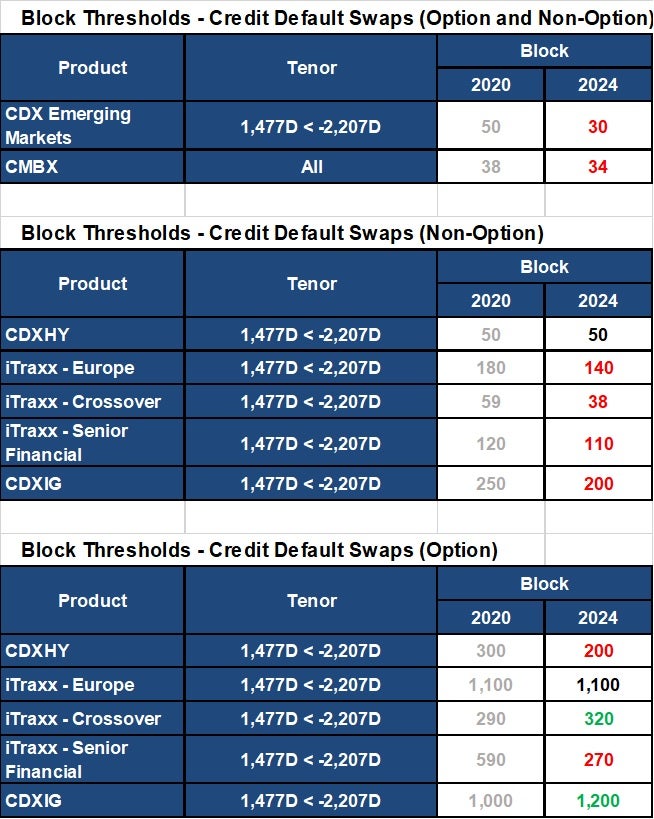

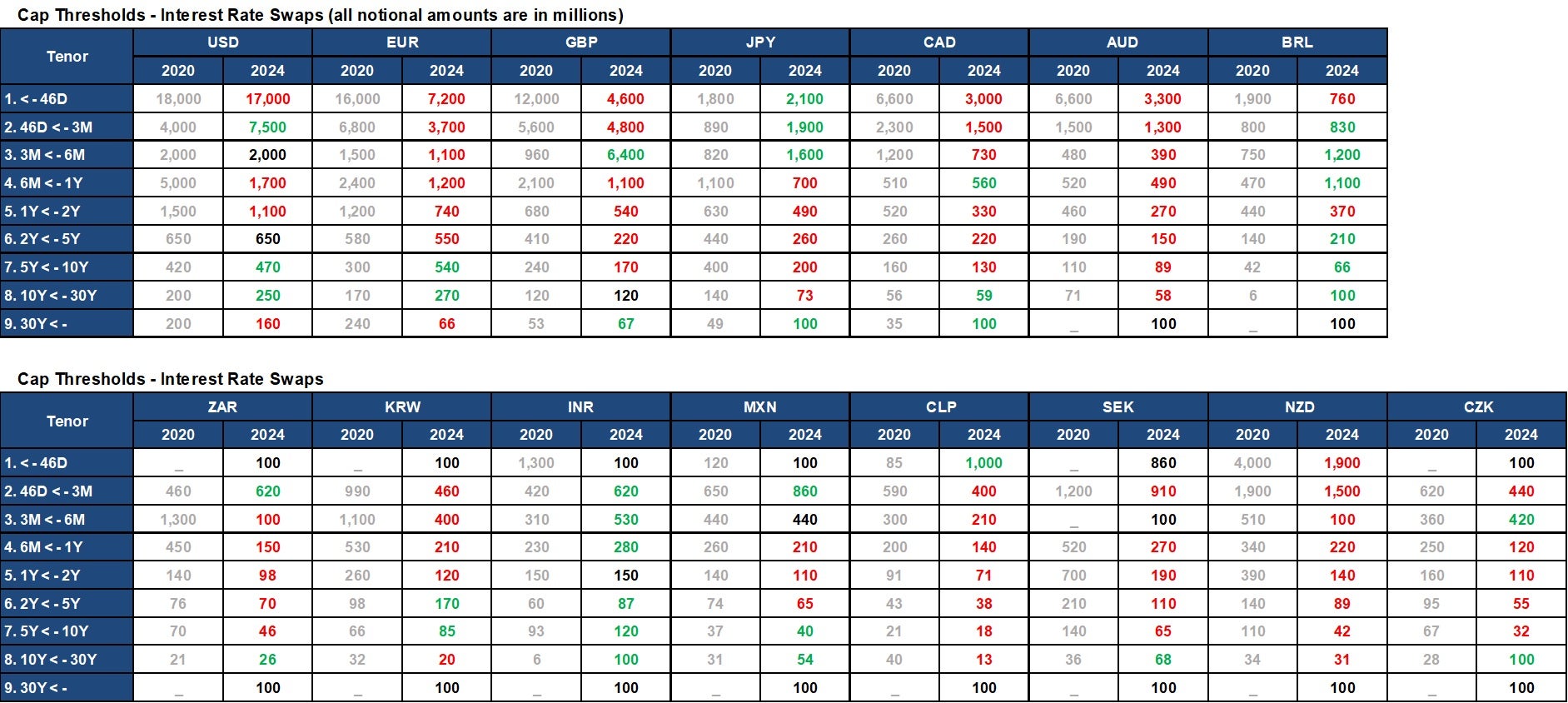

For example, an interest rate swap with a notional value of $10 billion with a tenor of less than 46 days in USD would exceed the 2023 block size of $8.8 billion, but it would not exceed the 2024 block size, which has risen to $12 billion. Another example would be a CMBX credit default swap with a notional value of $36 million, which would not meet the 2020 block size of $38 million but would exceed the 2024 block size, which has lowered to $34 million.

This is the second time the DMO has extended its no-action position, as CFTC Letter No. 23-15 responded to a request for an extension of CFTC Letter No. 22-03, which originally established the no-action position. This position ensures that market participants have adequate time for building and testing systems to implement the CFTC’s amended swap data reporting regulations.

For background, in 2020, the Commission amended Parts 43, 45, 46, and 49.2 that define swap data elements required to be reported to swap data repositories (SDRs). The Amendments reduced the overall number of swap data elements required to be reported; however, these Amendments added several new swap data elements and revised many existing swap data elements. Additionally, the Amendments created a new requirement that all swap data elements be reported to SDRs in the form and manner proscribed by the CFTC’s technical specification. The CFTC’s goal was to streamline and simplify data reporting to improve accuracy and reduce the burden placed on market participants.

DMO will not recommend that the Commission commence an enforcement action against an entity for failure to comply with the Block and Cap Amendments before October 7, given that the entity complies with the block trade and cap size requirements that were effective on January 1, 2021. DMO believes that its extended no-action position provides a reasonable period of time for entities to make the operational changes and avoid inefficiencies.

The 2024 post-initial appropriate minimum block and post-initial cap sizes are published here. The initial appropriate minimum block sizes by asset class for block trades and large notional off-facility swaps from 2013 are published in Appendix F to Part 43 here.

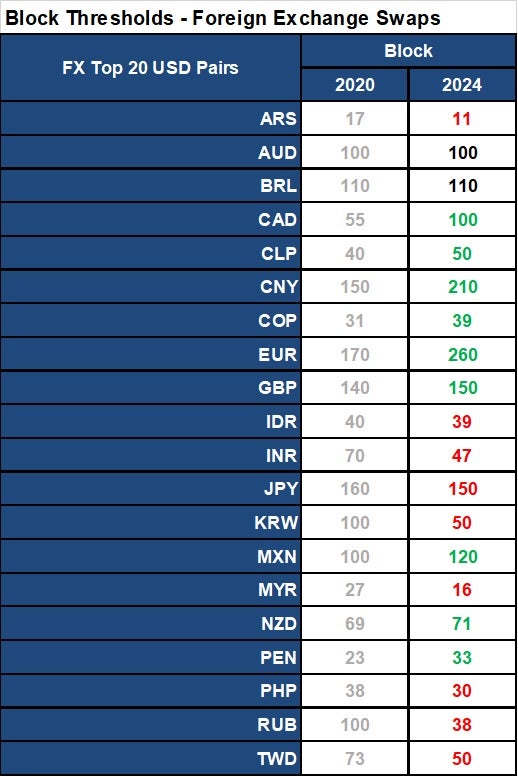

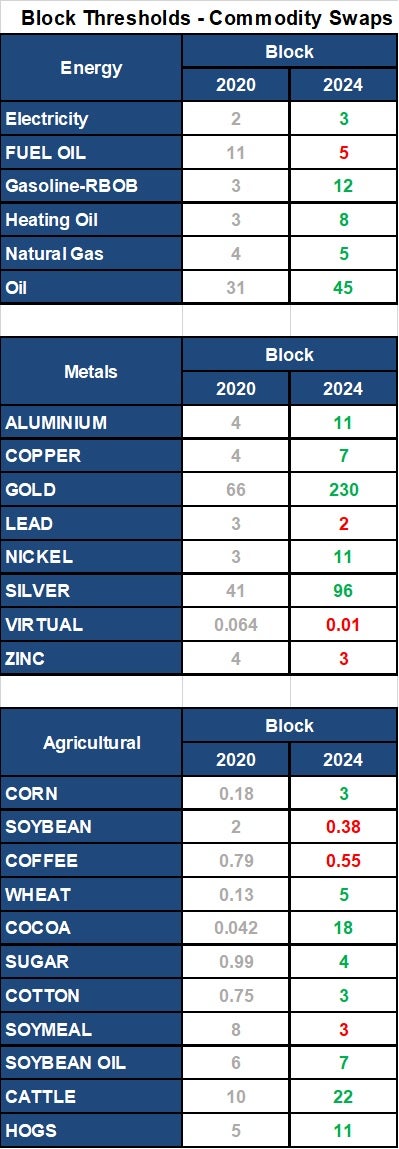

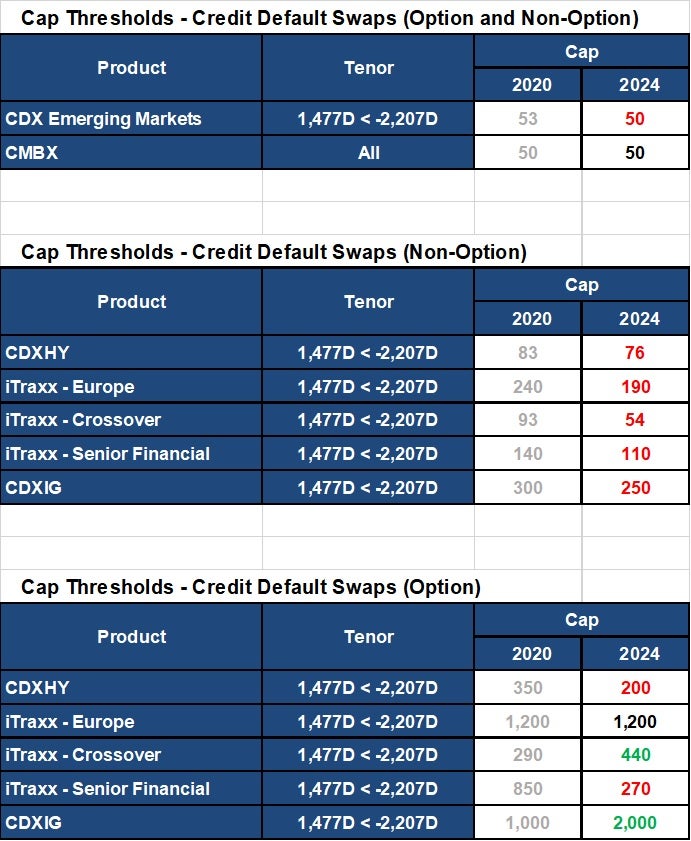

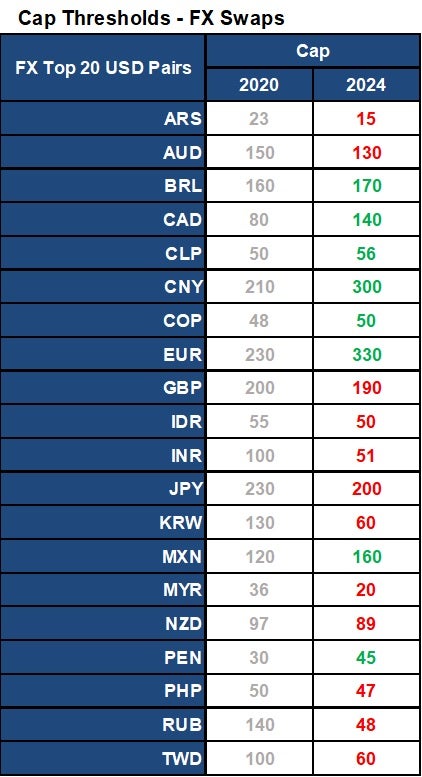

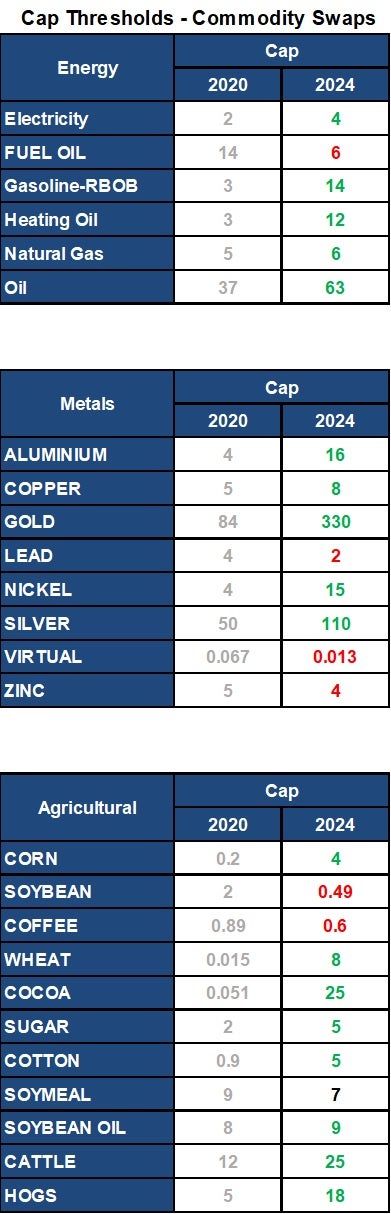

The tables below compare the post-initial block and cap sizes from 2020 to 2024:

/>i

/>i