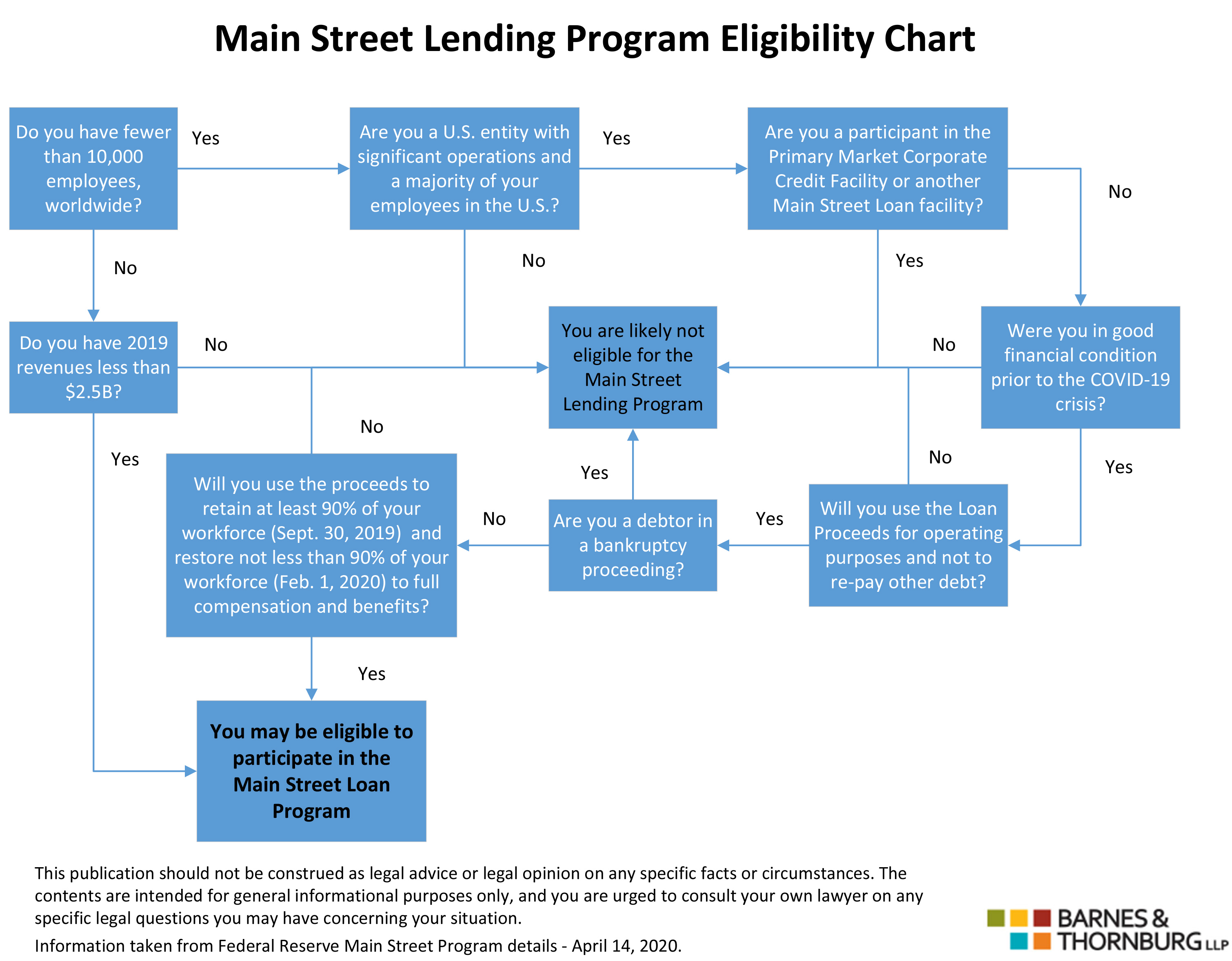

A new program announced by the Federal Reserve, aptly called the Main Street Program, will facilitate $600 billion in loans to businesses and nonprofit organizations that were in good financial standing before the COVID-19 crisis.

The programs offer four-year loans to companies and entities with up to 10,000 employees or with revenues less than $2.5 billion, with the express intent to help them maintain payroll and retain employees.

The Main Street Program consists of two facilities: the Main Street New Loan Facility (MSNLF) and the Main Street Expanded Loan Facility (MSELF), which have term sheets setting forth basic terms of the loans available. The MSNLF is for new loans originated on or after April 8, while the MSELF applies to loans existing before April 8 that will be “upsized” through the program.

No details regarding applications or procedures have been issued. We expect guidance on loan application procedures and logistics shortly after the end of the comment period, which expires April 16. The earliest lenders will start processing applications appears to be the week of April 20.

Businesses that have applied under the PPP may also take out a loan under the Main Street Program. Like with the Paycheck Protection Program (PPP), a business will apply to a private lender for a Main Street loan. The private lender will then sell 95 percent of the loan to the Main Street facility set up by the U.S. Department of Treasury to purchase up to $600 billion of loans. Principal and interest payments will be deferred for one year.

Unlike loans under the PPP, Main Street Program loans are not forgivable and borrowers will be responsible for up to 2 percent in origination and facility fees. Borrowers may not use proceeds under the Main Street loan programs to repay or refinance preexisting loans, but must strive to maintain payroll and retain employees during the term of the loan.

Eligible Businesses

To be eligible, a business organization (profit or nonprofit) must have 10,000 or fewer employees or a maximum of $2.5 billion in annual revenues for 2019 and must be

-

A U.S. entity with significant operations in and a majority of its employees based in the U.S.

-

In good financial condition prior to the crisis

-

Not also a participant in the Primary Market Corporate Credit Facility

-

Applying for either the MSNLF or MSELF (it may not participate in both)

Parameters of a Main Street New Loan Facility

-

Unsecured

-

Four-year maturity

-

Amortization of principal and interest deferred for one year

-

Adjustable rate of Secured Overnight Financing Rate (SOFR) plus 250-400 basis points

-

Minimum loan size of $1 million

-

Maximum loan size that is the lesser of (i) $25 million or (ii) an amount that, when added to the eligible borrower’s existing outstanding and committed but undrawn debt, does not exceed four times the eligible borrower’s 2019 earnings before interest, taxes, depreciation, and amortization (EBITDA)

-

Lender will pay a facility fee of 100 basis points of the loan participation purchased (95 percent), which may be passed through to the borrower

-

Borrower will pay lender an origination fee of 100 basis points of the principal loan amount

-

Prepayment permitted without penalty

Parameters of a Main Street Expanded Loan Facility

-

Unsecured

-

Four-year maturity

-

Amortization of principal and interest deferred for one year

-

Adjustable rate of SOFR plus 250-400 basis points

-

Minimum loan size of $1 million

-

Maximum loan size that is the lesser of (i) $150 million, (ii) 30% of the eligible borrower’s existing outstanding and committed but undrawn bank debt, or (iii) an amount that, when added to the eligible borrower’s existing outstanding and committed but undrawn debt, does not exceed six times the eligible borrower’s 2019 earnings before interest, taxes, depreciation, and amortization (EBITDA)

-

Borrower will pay lender a fee of 100 basis points on the amount of the upsized tranche

-

Prepayment permitted without penalty

Borrower Certifications Required for Main Street Loan Facilities

In order to receive a loan through the Main Street Program, the borrower will have to certify that:

-

The uncertainty of economic conditions makes necessary the loan request to support the ongoing operations of the borrower.

-

It will refrain from using the proceeds to repay other loan balances.

-

It will refrain from repaying other debt of equal or lower priority, except for mandatory principal payments, until the loan is repaid in full.

-

It meets the EBITDA leverage condition applicable to the facility.

-

It will use the proceeds to retain at least 90 percent of the borrower’s workforce at full compensation and benefits until Sept. 30, 2020.

-

It intends to restore not less than 90 percent of the workforce of the borrower that existed as of Feb. 1, 2020, and to restore all compensation and benefits to the borrower’s employees no later than four months after the termination of the public health emergency.

-

It is a business domiciled in the U.S. with significant operations and employees located in the U.S.

-

It is not a debtor in a bankruptcy proceeding.

-

It will not increase the annual compensation or make severance payments in excess of two times 2019 total compensation for any employee who earned over $425,000 in 2019.

-

It will not provide an employee with 2019 compensation over $3 million with an increase that is more than the annual compensation of $3 million plus 50 percent of the amount by which the employee’s 2019 total compensation exceeded $3 million.

-

It was created or organized in the U.S., or under the laws of the U.S., and has significant operations in and a majority of its employees based in the U.S.

-

It will not pay dividends with respect to common stock of the borrower or repurchase an equity security that is listed on a national securities exchange of the borrower (except to the extent required under contract in effect prior to the Act) until 12 months after the term of the loan.

-

It will not outsource or offshore jobs for the term of the loan and two years thereafter.

-

It will not abrogate existing collective bargaining agreements for the term of the loan and two years thereafter.

-

It will remain neutral in any union organizing effort for the term of the loan.

Further, the lender has to certify that it will not use proceeds to repay or refinance preexisting loans or lines of credit, that it will not cancel or reduce any existing lines of credit to the borrower, and that it is eligible to participate in the Main Street Program facility.

/>i

/>i