As return-to-work orders begin to take effect across the country, businesses have started to emerge from the shadow of COVID-19. This can be a daunting challenge. Extended shutdowns have put many companies on unsure financial footing, leading to a rush to reengage in revenue-generating activities. At the same time, the risk of disease transmission remains potentially high, and businesses must protect their workforces and customers from unnecessary exposure. Balancing these competing forces, while also remaining legally compliant, is no small task.

Thankfully, there are resources available to help navigate the uncertainty. While not exhaustive, the information and resources below are intended to provide a toolkit for businesses as they consider reestablishing commercial operations. For more detailed information on any of these topics, please visit our COVID-19 Resource Center.

Navigating State Government Orders

When and how businesses may reopen will depend on location, as states — and in some cases regions within states — implement individual return-to-work orders. Most state orders propose reopening in phases, limited to certain types of businesses or counties that meet certain criteria.

For example, Minnesota’s stay-at-home order expired on May 18 and was replaced with the Stay Safe Order, which allows gatherings of 10 people or less if social distancing measures are taken. Retail stores are permitted to open if they can operate at no more than 50% capacity. Employees of “non-critical” businesses are permitted to return to work when their employer has completed a COVID-19 Preparedness Plan.

By contrast, New York extended its stay-at-home order through May 28 for most of the state, permitting only certain regions to enter phase one of reopening. Phase one permits certain nonessential industries, such as construction and manufacturing, to resume operations if they can do so in compliance with requirements of the New York Department of Health. These requirements include, for example, enforcing social distancing in the workplace and requiring face masks to be worn.

Ahead of many other states, California has entered phase two of its reopening plan, which allows many nonessential businesses to reopen if, on a county-by-county basis, public health officials can prove that the county has adequate testing and tracing capabilities and hospital capacity. Additionally, each county must be able to show that it has had zero COVID-19 deaths in the prior two weeks and no more than one COVID-19 case per 10,000 residents.

Generally, although federal guidance has advised governors to consider lifting stay-at-home orders after 14 consecutive days of declining COVID-19 cases, many states have opted to extend such orders. And even if a state has acted to open, regions can proceed differently. For example, while most of Virginia entered phase one on May 15, the heavily populated Northern Virginia region only did so on May 28. Given the patchwork of policies, businesses should prioritize staying abreast of changes to federal, state and local policy.

Faegre Drinker is tracking executive orders, enacted legislation, and other actions related to COVID-19 by state and major locality. For more detailed information, please visit our state-specific tracking page here.

Understanding Federal Loan Programs for Small Businesses

The Coronavirus Aid, Relief and Economic Security (CARES) Act, signed into law on March 27, 2020, offers assistance and loan programs for businesses affected by the COVID-19 pandemic.

Under the CARES Act, the Paycheck Protection Loan Program (PPP) expands the number of businesses eligible for loans from the Small Business Administration (SBA) and aims to help employers continue to pay payroll costs, mortgages and utilities without resorting to layoffs. In addition to expanding SBA loan eligibility, the PPP increases the maximum amount available for loans and offers loan forgiveness, so it is worth considering even for businesses that would not traditionally meet the criteria to be a “small business concern.” Eligibility and forgiveness requirements continue to evolve, however, so continue to check available resources and consult counsel.

The CARES Act also provides funding to the Public Health and Social Services Emergency Fund for purposes of reimbursing health care-related expenses and losses incurred by health care providers as a result of COVID-19.

In addition to appropriating a second round of money for the popular program in late April, on June 3 the Senate passed legislation that cleared the House on May 28 and that would modify the PPP to further allow organizations that received loans from the program additional time to spend these funds. Key changes in the legislation that will now head to signature by President Trump include:

-

Deadline to apply for a PPP loan extended from June 30, 2020 to December 31, 2020.

-

Recipients of PPP loans would have 24 weeks after the loan is issued or until the end of the year (whichever comes first) to spend the funds and still have their loans forgiven.

-

PPP loan recipients who do not spend their money within that timeframe would have up to five years to repay the loan, an increase from the two-year deadline in the original PPP.

-

The percentage of funds that loan recipients must spend on payroll expenses would be reduced from 75% in the original bill to 60%.

-

Businesses whose loans are forgiven would be able to defer payroll taxes.

For more detail on the CARES Act and SBA loan eligibility, please see the following Faegre Drinker client alerts, or visit our COVID-19 Resource Center for the latest updates:

-

Congress Nears Passage of $2 Trillion COVID-19 Relief Package

-

The HEROES Act: Policy Overview and Political Prospects for the Latest COVID-19 Relief Bill

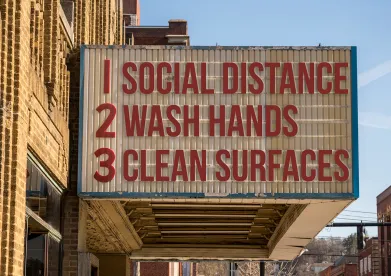

Ensuring Workplace Safety

For businesses with employees who continue to come to the workplace or in states that begin to ease stay-at-home orders, workplace safety and monitoring employee health are vital.

Per recent guidance published by the U.S. Equal Employment Opportunity Commission (EEOC), employers may ask employees if they are experiencing COVID-19 symptoms, take the body temperature of employees, require symptomatic employees to stay home, and even require employees to undergo COVID-19 testing. The EEOC’s What You Should Know About COVID-19 and the ADA, the Rehabilitation Act, and Other EEO Laws and the Occupational Safety and Health Administration (OSHA)’s Guidance on Preparing Workplaces for COVID-19 are useful resources to confirm that your business’s policies align with federal guidelines.

Following the Centers for Disease Control and Prevention (CDC) recommendation that cloth face coverings be worn “in public settings where other social distancing measures are difficult to maintain,” several states have begun to mandate use of such face coverings.

Employers that fail to follow CDC guidelines by providing adequate personal protective equipment or otherwise implement proper screening, distancing, sanitization, hygiene, training and communication procedures face potential lawsuits from employees alleging unsafe workplace conditions that resulted in COVID-19 exposure. Workers’ compensation laws offer some statutory protection, although such laws vary state-by-state. The CDC and OSHA recently released guidance aimed at the meatpacking industry that may offer helpful recommendations for other organizations allowing employees to return to work.

For more detailed information on such mandates and other workplace protections, Faegre Drinker has published the following additional resources:

-

More States and Municipalities Impose Mandatory Face Covering and Other Workplace Protections

-

Question & Answer Employer Guide: Return to Work in the Time of COVID-19

-

Testing Employees for COVID-19: Responses to FAQs From Employers

Reviewing Insurance Policies for Potentially Applicable Coverage

As COVID-19 continues to disrupt daily life, businesses may seek to rely on insurance policies in order to offset some costs and losses. Whether a particular policy provides coverage for a loss depends on the specific terms, conditions and exclusions in that policy. Businesses should carefully review their insurance policies to determine whether there is potential coverage for event cancellation or business interruption. Additionally, many insurers are adding virus, pandemic, and similar exclusions to policies that are up for renewal. Thus, businesses should carefully review their policies during renewal to understand whether such exclusions have been added to the renewed policy.

Additionally, if employees who return to the workplace later become infected with COVID-19, they may seek coverage from the employer through workers’ compensation. In general, an employee would have to be able to demonstrate that the infection occurred in the course of employment. As causation may be difficult to prove, employers should keep detailed records of any potential exposure. Moreover, some states have taken action to extend workers’ compensation coverage to some or all employees infected with COVID-19. Businesses must review the applicable state policies and regulations in the states in which they operate in preparation for potential workers’ compensation claims, and should carefully review their insurance policies to determine whether there is potential coverage for such claims.

For more detailed information on reviewing insurance coverages that may be affected by COVID-19, Faegre Drinker has published the following additional resources:

Understanding Challenges to State Government Orders and Court Orders

In response to state government stay-at-home orders, a number of businesses and religious organizations have initiated lawsuits on various grounds. The responses by courts across the nation have varied depending on the rights infringed and the provisions of the challenged order. For example, claims by religious organizations that stay-at-home orders violate the First Amendment on free exercise grounds have largely been denied, with courts finding that executive orders limiting public gatherings due to an extraordinary public health emergency do not discriminate against religious activities or organizations. The U.S. Supreme Court recently denied a request for injunctive relief filed by a Pentecostal Church in California, which challenged a restriction limiting church attendance to 25% of building capacity. However, challenges by religious organizations in Kansas and Kentucky have been successful. The District Court for the Western District of Kentucky, for example, issued a temporary restraining order against the enforcement of an executive order that would have prohibited drive-in church services because the same order did not prevent other non-essential and non-religious drive-in services. The court concluded, “But if beer is ‘essential,’ so is Easter.”

Another hotbed of contentious litigation has sprung up around orders that limit, or in some cases prohibit, abortion procedures during the pandemic. Again, courts’ rulings have varied depending on the jurisdiction and the order at issue. Abortion providers in Alabama successfully pursued injunctive relief after the district court found that the restrictions “would operate as a prohibition of abortion, entirely nullifying [women’s] right to terminate their pregnancies, or would impose a substantial burden on their ability to access an abortion.” However, the Fifth Circuit issued a writ of mandamus vacating another district court’s temporary restraining order. The circuit court determined the order had not created an “outright ban” on pre-viability abortions, and that the executive order was an appropriate exercise of state power during a health crisis.

A suit by an Ohio bridal shop challenging a stay-at-home order was dismissed because the order was a law of general applicability. Similarly, a suit by an individual in Arizona alleging that the order infringed his due process right to “wander without any specific purpose” was denied, with the court finding a “real or substantial relation” between the stay-at-home order and the public health emergency.

While courts have generally upheld stay-at-home orders as valid exercises of states’ police powers, these types of suits continue to evolve, so businesses should monitor the responses from their applicable judiciaries.

For further guidance on this subject, Faegre Drinker has published the following resources:

Plan Adequately for Effects of Layoffs and Furloughs, Including Possible Litigation

Many businesses have been forced to layoff or furlough employees as COVID-19 impacts their bottom-lines, often for indefinite periods of time. As time passes, they will need to consider how best to bring employees back to work or to address obligations triggered by workforce reductions, such as compliance with collective bargaining agreements, proper notice regarding rights to continuation of health insurance coverage and directions for payment of related premiums, availability of retirement benefits including employer matching contributions, and eligibility for other benefits which employers may offer to their employees.

Reductions in workforces have brought about labor and employment litigation, including claims of violation of the federal Worker Adjustment and Retraining Notification (WARN) Act or various state WARN acts, which require certain employers to provide advance notice before carrying out sizeable mass layoffs or operational facility closures. Employers should carefully consider these as well as potential additional obligations under the Equal Employment Opportunity Act (Title VII), Americans with Disabilities Act, Age Discrimination in Employment Act, Families First Coronavirus Response Act, Family and Medical Leave Act, Fair Labor Standards Act, Occupational Safety and Health Act, National Labor Relation Act, and a wide variety of state and local requirements in order to prevent and prepare for the possibility of employment litigation.

For more detailed information on potential risks related to layoffs and furloughs, Faegre Drinker has published the following resources:

-

Coronavirus Lawsuits on the Horizon: Termination and Discrimination

-

Question & Answer Employer Guide: Return to Work in the Time of COVID-19

Review Customer and Supplier Contracts

Preserving key business relationships with customers and suppliers is always important, but now it is critical. Many of those relationships may be under strain as the crisis continues without a clear end date. Now is the time to review existing contracts to evaluate how the pandemic is affecting performance and what rights the parties may have to renegotiate, delay or alter their obligations. Force majeure clauses and common law doctrines may provide avenues for excusing performance, if necessary, or they may provide leverage in negotiations.

Disputes over invoking force majeure clauses due to the pandemic have begun to make their way through the courts. Recently, in deciding a dispute between a medical device manufacturer and a distributor, the Seventh Circuit ruled that force majeure clauses which do not address foreseeability may apply regardless of whether the contracting parties could have reasonably foreseen the events. Therefore, foreseeability is likely to be a hotly-debated issue in COVID-related contract disputes.

For further guidance on this subject, Faegre Drinker has published the following resources:

COVID-19 considerations at the federal, state, and local level are constantly changing. Businesses should monitor developments and consult counsel for advice based on their specific circumstances.

/>i

/>i