In what is being widely viewed as a welcome breath of fresh air, the Commodity Futures Trading Commission (the Commission or CFTC) Division of Enforcement (the Division) released an advisory on February 25, detailing the factors under which the Division will evaluate self-reporting, cooperation, and remediation when recommending enforcement actions (the Advisory). CFTC Acting Chairman Caroline D. Pham described the Advisory as part of her commitment to provide transparency and due process in the agency's law enforcement function1 and a larger effort to implement the Trump administration's February 19 Executive Order ensuring lawful governance.2

Although the implementation of any cooperation policy is necessarily subjective, on its face, the new Advisory attempts to provide guidance regarding the factors that the CFTC will consider in evaluating self-reporting and cooperation and concrete discounts that will apply if certain circumstances are found to exist. Among other important improvements described in more detail below, (1) the Advisory revises past policy requiring registrants to report to the Division for credit to apply and now provides self-reporting credit for reports made to any division of the CFTC; and (2) opens the door for including disclosures made in annual chief compliance officer (CCO) reports as self-disclosure under the Advisory.3

The Division has long had an explicit policy of rewarding self-reporting and cooperation. However, the Division's prior practice in this regard varied greatly.4 That uncertainty has led individuals and firms (Market Participants) to question the value of engaging with and assisting the Division with its investigations.5 The Advisory introduces several important changes and reversals from prior Division practice that aim to encourage and reward prompt and voluntary self-reporting, cooperation with Division staff during an investigation, and timely remediation of rule violations, with the ultimate goal of preserving significant Division enforcement resources and allow the Division to focus on fraud and other bad actors in the marketplace. These welcome changes include:

- Providing clear and concrete guidance via the Mitigation Credit Matrix that Market Participants can use to assess the potential value of any self-reporting and cooperation credit and reduce the previous concerns about the value of any such credit.

- Allowing Market Participants to self-report to any relevant CFTC division, creating the opportunity for Market Participants to have discussions with division staff who may be more familiar with the registrant, aspects of market structure or a particular issue.

- Making disclosures in an annual chief compliance officer report eligible for self-reporting credit, streamlining the disclosure process and potentially changing the incentives related to chief compliance officer disclosures.

- Providing potential benefits to Market Participants who self-report (often a fact that is not subject to debate) but are not perceived to have provided appropriate cooperation (which may be contested), a direct departure from the Division's prior guidance on self-reporting and cooperation credit that only provided self-reporting benefits to Market Participants who also cooperated.

- Providing a safe harbor to Market Participants that amend or correct a self-report upon further investigation, reducing the risk of making a report while an issue remains under review.

- Revoking the Division's prior guidance on recidivism and admissions, relieving Market Participants of the uncertainty as to what qualifies as recidivism and the higher likelihood that an enforcement action would require factual or legal admissions.

While the Advisory addresses a number of concerns Market Participants have raised regarding the Division's prior practice, as with any new guidance, it raises additional questions about how the self-reporting and cooperation credits will operate moving forward. Market Participants would likely welcome additional guidance from the Division regarding (1) the scope of the self-reporting safe harbor provisions; (2) the baseline calculations of civil monetary penalties; (3) the Division's decision to decline to pursue enforcement actions; and (4) the difference between excellent and exceptional cooperation. The Division should be applauded for anticipating some of these questions and promising further guidance on how operating divisions assess matters for enforcement referrals.

Summary of the New Guidelines

In a first for the Commission — and for most other US financial regulators — the Advisory provides a new framework and "credit matrix" that clarifies how the Division will consider a Market Participant's self-reporting, cooperation and remediation in determining whether, and to what extent, to discount civil monetary penalties.

Self-Reporting

The Advisory identifies several key factors to determine whether self-reporting qualifies for mitigation credit. First, the self-report must be voluntary, meaning the disclosure was made "prior to an imminent threat of exposure."6 Considerations include whether the potential violation was known publicly or by another government actor.7 Importantly, a Market Participant may still be eligible for self-reporting credit even if the information would otherwise be required to be included in an annual chief compliance officer report.8 Second, the self-disclosure must be made to the "appropriate" division of the Commission, which includes the Division or another division "responsible for the interpretation and application of each [applicable] regulation."9 Unlike previous guidance, Market Participants may disclose to the operative CFTC divisions (e.g., the Market Participants Division, the Division of Market Oversight, and the Division of Clearing and Risk) instead of receiving credit only for disclosure to the Division of Enforcement.10 Third, the self-report must be timely or "reasonably prompt" after consideration of the efforts to determine the violation.11 In assessing timeliness, the Division will consider the extent of the firm's efforts to identify the violation, the violation's materiality, and whether the "escalation, investigation, management review, and governance requirements" were commensurate with the nature and magnitude of the violation.12 Fourth, the self-report must be complete, meaning the self-disclosure must include "all material information," including a "description of the issue, date, and method of discovery, available root cause analysis, and remediation."13 Recognizing the inherent tension between a timely and complete report, the Division encourages early, good-faith disclosure by promising full credit for Market Participants that make "best efforts" to investigate the issue, promptly disclose it and continue to investigate — leading to more disclosure if necessary.14 To further incentivize early self-reporting, the Advisory also provides a safe harbor provision that protects good-faith self-reports that are later determined to contain inaccuracies and promptly corrected from false-statement prosecution.15

The Division categorizes self-reporting into one of three tiers: No Self-Report; Satisfactory Self-Report; or Exemplary Self-Report. A disclosure qualifies as "No Self‑Report" if there was no disclosure, the disclosure was already known to the Division or the disclosure was not designed to notify the Division of the violation.16 A disclosure qualifies as a "Satisfactory Self-Report" if a self-report to the appropriate division identifies a potential violation but does not include all material information known to the disclosing person at the time of the report.17 A disclosure qualifies as an "Exemplary Self-Report" if there was a self-report to the appropriate division that identifies a potential violation, includes all material information related to the potential violation known at the time, and includes additional information that assisted the Division with conserving resources.18

Cooperation

The Division will also consider several elements when determining whether a Market Participant is eligible for cooperation credit, including whether cooperation: (1) materially assisted the Division; (2) was timely; (3) was "truthful, specific, complete, credible, and reliable;" (4) was voluntary; (5) involved adequate resources such as thorough and high-quality analysis, presentations, or submissions; and (6) was extensive, involving document preservation, timely disclosure and cooperation from directors, officers and employees, and where necessary, sworn statements or testimony.19 When considering remediation, the Division will evaluate the timeliness and scope of the remediation plan, considering its appropriateness and whether it is designed to prevent future violations. It may also recommend a monitor or consultant to oversee the remediation plan and deliver progress reports.20

The Division categorizes cooperation into four tiers: No Cooperation; Satisfactory Cooperation; Excellent Cooperation; and Exemplary Cooperation. "No Cooperation" would apply to a self-report that includes full compliance with subpoenas and other compulsory processes but lacks substantial assistance.21 "Satisfactory Cooperation" is available to self-reporters who voluntarily provide documents and presentations and make witnesses available beyond the compulsory process.22 "Excellent Cooperation" reflects consistent, substantial assistance to an investigation, and examples of such assistance might include internal investigations or reviews, thorough analysis of the potential violation and root cause, corrective action (including the use of experts or consultants where appropriate), and consistent voluntary disclosure of documents and information.23 The highest tier of cooperation, "Exemplary Cooperation," is available to self-reporters who "provided an exceptionally high degree of value" through their cooperation.24 This requires not only proactive engagement with the Commission but also completing a significant portion of the proposed remediation and accountability measures.25

Even if a self-reporter makes a complete and timely self-report and cooperates with the Division, any credit obtained will be offset by uncooperative conduct, such as bad faith actions that impeded its investigation, incurred significant resources, or involved willful ignorance to red flags or violations.26 The Division may also find noncooperation if the Market Participant failed to self-report serious, willful violations, customer harm, or significant financial loss.27

Determining the Mitigation Credit

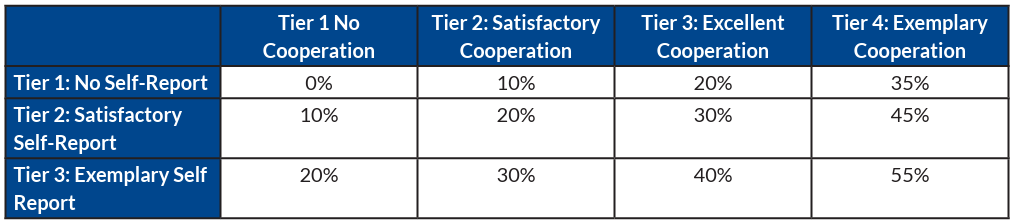

In determining the monetary offset for self-reporting and/or cooperation, the Division will first calculate a civil monetary penalty and then apply a discount according to the quality and extent of the self-report and subsequent cooperation. The Commission may, in its discretion, modify any discount recommendation in light of the facts and circumstances of the case.28 Then, the Commission will assess a Mitigation Credit according to this Mitigation Credit Matrix:

Positive Signals From the Advisory

The Division's effort to provide more transparency and clarity in the self-reporting and cooperation process should be applauded. Against the backdrop of the Commission's broader effort of devoting more resources to pursuing fraudsters and other bad actors,29 this Advisory provides a comprehensive framework that could prove immensely useful in guiding Market Participants in evaluating how best to assess and manage potential violations via self-reporting and cooperation with the Division. It will likely decrease the amount of resources the Division must devote to a number of matters that traditionally occupied its time.

First, the fact that the Division took the time to set out a methodical approach to credit and provided a clear credit matrix suggests that this is a focus and top priority for the Division and the CFTC as a whole. By explicitly stating the expected discounts available to Market Participants for proactively engaging and cooperating with the Division, similar to guidelines from the Department of Justice and other federal regulators like the Office of Foreign Assets Control,30 the Advisory's new guidance provides structure and certainty to Market Participants. For example, a hypothetical Market Participant may uncover a potential swap reporting violation. After the initial assessment, the Market Participant determined that this type of violation has historically resulted in civil monetary penalties of around $10 million. Immediately, the Market Participant could see a savings of $2 million by putting together a prompt and comprehensive self-report. Additionally, the Market Participant could see savings of an additional of $2–3.5 million by engaging in extensive cooperation throughout the completion of the matter. Historically, the Division and other federal financial regulators, like the Securities and Exchange Commission (SEC), have not provided a clear credit matrix detailing the exact amounts of credit provided for certain conduct. This has led to uncertainty in the marketplace as to the value of self-reporting and cooperation. Market Participants will undoubtedly welcome this new effort to provide clarity and certainty.

Second, the Advisory provides further benefit to Market Participants by revoking prior guidance that required voluntary disclosures to be made to the Division to receive self-reporting credit. By encouraging Market Participants to make a voluntary disclosure to any operative CFTC division, not just the Division, the Advisory opens the door for Market Participants to have effective and practical conversations with CFTC staff with unique expertise related to the unique market structures relevant to the self-disclosure. This approach is far preferable to requiring Market Participants to disclose directly to the Division, which is narrowly focused on enforcement actions. This change also opens the door for the other operating divisions to receive a self-report and potentially not make an enforcement referral, as previewed in the Advisory, based on the operating division's expertise and understanding of the relevant rules and regulations.31

Third, by removing the barrier to self-reporting credit for voluntary disclosures that would also have been included in mandatory annual chief compliance officer reports, the Advisory may alter incentives relating to chief compliance officer report disclosures and result in further dialogue with Market Participants. While the prior practice ultimately resulted in the Commission learning of information through annual reports, by making this change, Market Participants now have a powerful incentive to engage directly and proactively with the relevant division to discuss and remediate the self-identified issue rather than merely include it in an annual compliance report.

Fourth, by restructuring the self-reporting and cooperation credit into two independent evaluations, the Advisory makes self-reporting more attractive to Market Participants. Under the Division's prior practice, partial credit was available for Market Participants who cooperated without self-reporting, but there was no credit available for a Market Participant who only self-reported.32 This practice likely disincentivized Market Participants from self-reporting because any potential benefit of doing so could be negated by the Division's later determination the Market Participant did not cooperate sufficiently to warrant a reduction in penalty. Moreover, a Market Participant understood that if they did not self-report, they still had the possibility to obtain a reduction, though likely smaller, by only cooperating if the Division discovered the issue. By opening an avenue for a Market Participant to receive up to a 20 percent reduction of a civil monetary penalty solely for self-reporting, Market Participants now have a stronger incentive to self-report to the Commission.

Fifth, the Advisory provides a safe harbor to Market Participants if they must correct a self-disclosure. The Division's previous guidance recognized that voluntary self-disclosures may require amending after additional investigation and provided an avenue to receive credit if the Division was kept abreast of new facts as they were discovered.33 As Acting Chairman Pham has previously noted, "the CFTC has sought to bring fraud charges against Market Participants for allegedly making false statements to the CFTC when a Market Participant later discovers that the information provided in a self-report was not entirely accurate — even when it thought the information was accurate at the time of the disclosure to the CFTC."34 By implementing a safe harbor provision, Market Participants no longer have to be concerned about any potential adverse consequences for making good-faith voluntary disclosures to the Division.

Sixth, the industry will appreciate the Division's express withdrawal of its prior guidance on recidivism and admissions.35 The Division's prior guidance, which threatened Market Participants with higher fines for recidivists without providing clarity about what conduct was subject to the recidivism amplifier, recommended the imposition of third-party monitors and admissions of fact and/or violations of law as part of settlements and was not well received by the industry.36 While the Advisory does not abandon those tools as part of the enforcement toolbox, the Division's tone has shifted. The Advisory makes no mention of mandatory admissions of facts and/or violations of laws. It now indicates that the Division has discretion to consider recidivism if it relates to "the same specific violation and facts and circumstances not involving fraud, manipulation, or other abuse."37 While the Advisory does envision the continued use of monitors or consultants, it pares back the conditions in which the Division would recommend the use of a monitor or consultant.

The Advisory Raises a Few New Questions and Acknowledges That Further Guidance Is Forthcoming

In addressing a significant number of industry concerns arising from prior enforcement activity by the Division, the Advisory necessarily introduces a degree of uncertainty that Market Participants must navigate. In the near term, there is no precedent for how the Division will apply the credit matrix, so it may take time for firms to sense how the matrix operates and how the Division categorizes conduct into the various categories outlined in the Advisory. Commissioner Johnson's Statement noted that Market Participants rely upon "clear, consistent guidance" in order to develop effective internal compliance programs.38

Thankfully, the Division recognizes that this Advisory is only the beginning, that additional clarification and guidance from the Division will be necessary, and that such guidance is already in development.39 In the interim, until the industry receives additional guidance or future precedent applying the credit matrix, Market Participants may expend additional, unnecessary resources to assess and advocate for where they fall within this new credit matrix.

At first glance, there are a few areas where Market Participants would welcome further clarification and guidance from the Division.

First, additional guidance would be welcome on the scope of the self-reporting safe harbor. The Advisory's safe harbor provision provides to a Market Participant that self-reports in good faith protection from a potential false reporting charge if, following the self-report, the Market Participant corrects or supplements the self-report after learning additional information following an investigation. While the Advisory indicates that this safe harbor would apply to a number of traditional false reporting rules or regulations, it also indicates that the safe harbor could extend to violations under 7 U.S.C. § 13(a)(2) and CFTC Regulation 180.1. Both of those provisions relate to making false statements while addressing manipulation. The Advisory does not seem to indicate that a self-reporting Market Participant may obtain safe harbor protection from a potential manipulation charge, additional clarity from the Division would be welcome to avoid any potential confusion.

Additionally, Market Participants would likely welcome additional guidance regarding the conduct a Market Participant must undertake to benefit from the safe harbor for good-faith self-reporting. The Advisory provides that a Market Participant will only benefit from the safe harbor provision if the self-report or voluntary disclosure was made in good faith and any inaccuracies are supplemented or corrected "promptly" after discovering the inaccuracy. However, uncertainty remains regarding whether the Division would:

- Provide safe harbor protection to a Market Participant that makes an initial self-report, makes no further inquiry, only discovers the earlier inaccuracy after prodding from the Division, and then reports the inaccuracy?

- Provide safe harbor protection to a large global firm that makes a self-report and, through further inquiry, learns of an earlier inaccuracy but also learns that the earlier inaccuracy was known by one employee prior to the firm's self-report?

- Provide the same level of safe harbor protection to a firm that makes a self-report, devotes extensive resources to an internal investigation, and then makes a correction, as it would to a firm that makes a self-report, devotes limited resources to an internal investigation, and then makes a correction?

- Provide self-reporting credit to a firm that discloses a single potential violation to the Division and later, after investigation, discovers and then discloses other potential violations to the Division?

This potential uncertainty regarding these conditions could diminish the value of safe harbor protection. While the answers to these questions may depend on the facts and circumstances of each instance, any additional guidance from the Division about how safe harbor treatment will be applied will likely provide more comfort to the industry and potentially promote further self-reporting and cooperation.

Second, additional guidance from the Division would be welcome regarding how charging decisions and civil monetary penalty calculations are determined. While registrants will welcome the potential to receive significant discounts on civil monetary penalties, the benefit of these potential discounts is dependent upon a predictable and consistent application of charges and calculations of civil monetary penalties.

Historically, the Division staff has exercised enormous discretion over how many violations are charged and their view of the severity of those violations. That variability, and many other factors, create uncertainty regarding the starting points for calculating civil monetary penalties. Continued use of that discretion, without further clarity and guidance from the Division, could diminish the intended disciplined approach sought in the Advisory if line staff and supervisors are not equally disciplined in deciding which charges to bring against Market Participants.

In addition to concerns about which charges are brought, the industry also has observed for years, as detailed in the Division's previous fiscal year reports, that civil monetary penalties for violations have steadily risen over the years for similar conduct and similar charges.40 Market Participants may be confused or concerned if, after self-reporting and cooperating, the Division selects a starting civil monetary penalty significantly higher, such that any discount ultimately results in a proposed penalty similar to settlements entered into prior to the Advisory. Moving forward, the industry would welcome further guidance as to how the Division decides which charges to bring and how it calculates civil monetary penalties, which would give Market Participants the ability to better assess and rely upon the benefits of self-reporting and cooperation.

Third, additional guidance would be welcome regarding whether an Operating Division could choose not to recommend enforcement and when the Division will decline to pursue enforcement. In addition to the extensive guidance provided by the Advisory regarding the qualifications for potential self-reporting and cooperation credit, the industry would similarly welcome detailed guidance outlining the conditions under which the Division will not pursue an enforcement action. The Division should be commended for anticipating this need, as it already indicated in the Advisory that there will be future guidance as to whether and how the Operating Divisions will make enforcement referrals. It has indicated that the Division may recommend declination in "extraordinary circumstances."41

Further guidance on how these decisions will be made could be critical in establishing a robust framework for encouraging self-reporting and cooperation. Market Participants must weigh the expected costs and benefits of self-reporting a potential violation, and most often, one of the costs of self-reporting is the high likelihood of charges and a penalty. However, if the Division were to publish clear guidance to the industry outlining the circumstances in which it, or another Operating Division, would decline to recommend enforcement, Market Participants could be incentivized to self-report and cooperate at an exemplary level in hopes of obtaining such relief. While the Advisory indicates that such declinations are possible, providing additional guidance as to what "extraordinary circumstances" would qualify for declination eligibility may further increase Market Participants' willingness to self-report and cooperate.

Fourth, additional guidance on the difference between "excellent" and "exemplary cooperation" would be welcome. By providing an additional 15 percent credit benefit for Market Participants who engage in exemplary cooperation, the Division is incentivizing Market Participants to strive for as much cooperation as possible. While many Market Participants may pursue that level of cooperation, it is unclear from the Advisory how exactly they can confirm their conduct qualifies for exemplary, as opposed to merely excellent cooperation. The Division provides a helpful table that distinguishes the factors for excellent versus exemplary cooperation, but those factors are inherently subjective and may be applied inconsistently. For example, Market Participants would benefit from further guidance as to what distinguishes substantial assistance from material assistance, what conduct beyond the use of internal or external expert resources and consultants would qualify for "proactive engagement and use of significant resources," or how to effectively distinguish between corrective action for remediation and significant completion of remediation. Additionally, guidance would be helpful as to how excellent and exemplary cooperation are distinguished in different factual circumstances. For example, how would the Division distinguish cooperative conduct in matters that have simple underlying facts, which may not necessitate the expenditure of significant resources to investigate and remediate, from more complex matters that require extensive analysis and complex remediation plans?

Understandably, these questions will likely be addressed on a case-by-case basis, as they depend on each matter's facts and circumstances. With that in mind, the industry would welcome settlement orders that explicitly detail how the Division evaluated the Market Participants' conduct in determining which tier of self-reporting and cooperation credit was appropriate, as well as specific facts about the cooperative conduct, so that Market Participants may better understand the types of conduct the Division would like to see moving forward.

Conclusion

Overall, the new guidance provides greater clarity and will be much appreciated by the industry. The Division acknowledges that further guidance will be issued that supplements the Advisory in order to address certain unanswered questions. In the meantime, the Advisory will allow Market Participants to better understand the structure and function of the Division's self-reporting, cooperation, and remediation policy.

/>i

/>i