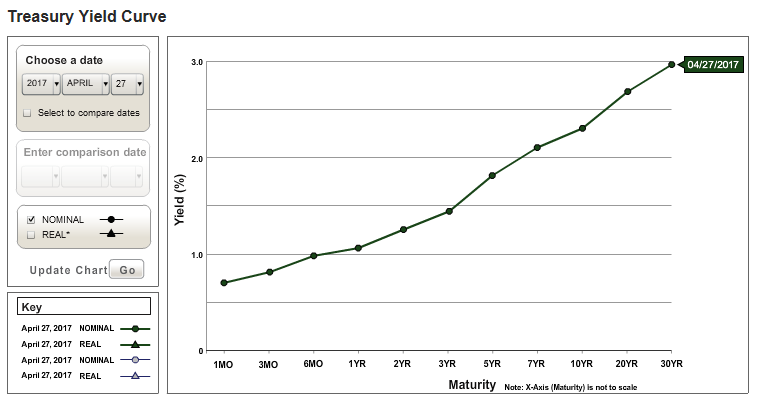

For those of you new to bonds and not generally familiar with financial terms, you may hear the term “yield curve” thrown around and be wondering what it means and why it matters. The yield curve is a chart showing the yield of debt instruments (such as U.S. treasuries or notes) on the y-axis and the maturity (on the x-axis). So why does it matter? It can be a crystal ball into the future of interest rates.

Here is a typical and recent yield curve chart:

https://www.treasury.gov/resource-center/data-chart-center/Pages/index.aspx

This is a “normal” yield curve because the longer the maturity, the higher the interest rate. That makes sense for a lot of reasons. The longer an investor lends money for, the riskier it is. Naturally, investors want to be rewarded for that risk.

Below is a comparison showing the yield curve above to that on November 1, 2006.

https://www.treasury.gov/resource-center/data-chart-center/Pages/index.aspx

On November 1, 2006, the curve was “inverted” – short term rates were higher than long term rates. For more information on inverted yield curves and yield curves generally, see this post here by Professor Mankiw, which provides a nice explanation.

November 1, 2006 was about a year before the U.S. recession, which officially lasted from December 2007 to June 2009. As explained in this New York Fed article from 2006, “[b]efore each of the last six recessions, short term interest rates rose above long-term rates.” And below is a chart from the same New York Fed article showing the probability of U.S. recession twelve months into the future, as predicted by the Treasury spread. In this case, the “Treasury Spread” is that between the Treasury’s ten-year bond rate and three month bill rate.

So other than predicting recessions (no big deal), why would a tax lawyer be interested in yields and spreads? Quite simply, because changes in the shape of the yield curve can lead to opportunities for arbitrage. And that, of course, triggers lots and lots of rules that haven’t been too important during the last few years, but which will surely come into play again in the years ahead.

/>i

/>i