The Securities and Exchange Commission (SEC) Whistleblower Program was created to protect investors by incentivizing whistleblowers to provide evidence of violations of the securities laws, and establishing rules and procedures for administering the program.

“Whistleblowers play a valuable role in helping to protect the U.S. financial markets by bringing the Commission information about potential securities law violations,” said Creola Kelly, Chief of the Office of the Whistleblower (OWB). “The Commission sent a strong message that agreements and conduct that impede communication with the SEC will not be tolerated.”

This program provides monetary awards to insiders who provide the Commission with information about potential securities law violations, such as market manipulation, offering fraud, insider trading, foreign bribery, and other frauds related to digital assets or corporate disclosures.

The SEC Whistleblower Program has proven to be highly effective in detecting and sanctioning securities fraud. Since the program’s inception in 2011, the SEC has awarded more than $2.2 billion to 444 individual whistleblowers. In fiscal year 2024, the Commission awarded over $255 million to 47 individual whistleblowers, the third highest annual amount for the program.

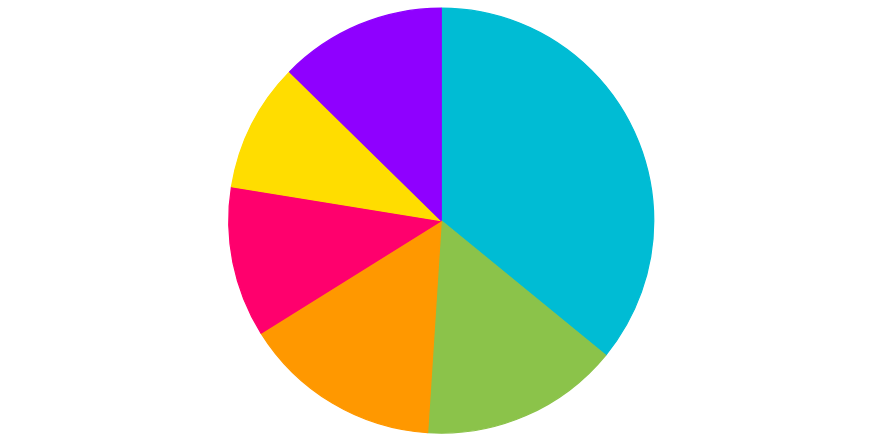

Top 5 SEC Awards of 2024

Below is an overview of the top five whistleblower awards for FY 2024, which together total $224 million:

$98 Million to Two Whistleblowers

Two whistleblowers, whose combined efforts led to enforcement actions by the SEC and other agencies, received a $98 million award. The first whistleblower’s initial tip triggered the investigations, and their ongoing assistance was crucial. This whistleblower received $82 million. The second whistleblower’s later submission significantly contributed to one aspect of the actions, earning a $16 million award. This is the fifth largest award in the history of the SEC Whistleblower Program.

$37 Million to One Whistleblower

A whistleblower who persisted in reporting misconduct internally, despite retaliation, received a $37 million award from the SEC. Their information and assistance were crucial in uncovering the full extent of the employer’s misconduct, leading to a successful enforcement action.

$37 Million to One Whistleblower

A whistleblower who provided previously unknown information to the SEC, significantly contributing to a successful enforcement action, received a $37 million award. Their additional efforts, such as identifying potential witnesses and documents, helped save time and resources.

$28 Million Combined to Seven Whistleblowers

Seven whistleblowers shared a $28 million award for information that led to an enforcement action, recovering millions for harmed investors. Their early, detailed, and highly significant tip advanced the investigation, saving time and resources, and directly related to the charges brought. The seven whistleblowers were composed of a single claimant and two sets of joint claimants.

$24 Million to Two Whistleblowers

Two whistleblowers received a combined $24 million award for their information and assistance in SEC and other agency enforcement actions. The first whistleblower, who initiated the investigation, received $4 million, while the second whistleblower, whose information and cooperation were crucial to the success of the actions, received $20 million. In making the award, the SEC emphasized the invaluable role of whistleblowers in uncovering misconduct, especially when it occurs abroad.

Whistleblower Confidentiality

The SEC upholds strict confidentiality to encourage whistleblowers to come forward with information. Information such as award percentage, enforcement action name, and other details are redacted in the award orders to protect a whistleblower’s identity.

Whistleblowers can file an anonymous compliant, but they must do so with a U.S.-based attorney. This attorney can help you file an anonymous complaint, shielding your identity from the SEC and the person or company being investigated.

Award Eligibility

A whistleblower is an individual who reports potential securities law violations to the SEC. To qualify for an award, the information provided must be original and lead to successful enforcement actions resulting in monetary sanctions exceeding $1 million. Whistleblowers can be insiders or outsiders, such as investors, competitors, or market observers.

To be eligible for an award, a whistleblower must provide “original information.” This means, non-public information derived from “independent knowledge” or “independent analysis,” information that is not already be known to the Commission (unless you were indirectly the source) and not made known in the media, before Congress or other public venues like a court.

Determining Awards

The Whistleblower Rule Amendments of 2020 introduced a presumption of a maximum 30% award for certain cases with anticipated maximum awards below $5 million. In FY 2023, this presumption was applied to nearly 90% of eligible cases.

For cases exceeding the $5 million threshold, or when the presumption doesn’t apply, the Commission determines the award percentage based on several factors, including:

Factors Increasing Award Percentage

- Significance of Information: The quality and timeliness of information provided by the whistleblower.

- Level of Assistance: The extent to which the whistleblower aids in the investigation, such as identifying key witnesses or documents.

- Law Enforcement Interest: The severity of the misconduct and its potential impact on investors.

- Internal Reporting: Participation in internal compliance or reporting systems.

Factors Decreasing Award Percentage

- Unreasonable Delay: Significant delays in reporting misconduct.

- Culpability: Involvement in or benefit from misconduct.

- Interference with Internal Reporting: Actions hindering internal reporting systems.

By carefully considering these factors, the Commission strives to fairly reward whistleblowers who contribute to the protection of investors and the integrity of the markets. Overall, the SEC Whistleblower Program has become a powerful tool for protecting investors and ensuring fair markets. It has demonstrated its effectiveness in uncovering fraud, holding wrongdoers accountable, and rewarding those who come forward to report misconduct.

Seeking Legal Assistance

Whistleblowers who have information about a potential securities law violation exceeding $1 million may report their concerns to the SEC and become eligible for an award and protection against reprisal. However, we recommend getting in touch with an attorney for assistance, as they can help you remain anonymous, maximize award amounts, and navigate the legal process.

This article was authored by Joseph Orr

/>i

/>i