Last week the Ninth Circuit issued a win for taxpayers in US v. Boyd, limiting penalties for non-willful violations of the requirement to file a Report of Foreign Bank and Financial Accounts (FBAR). The FBAR requirement applies to all United States persons with interest in or authority over a foreign financial account where the aggregate value of all such accounts is more than $10,000. Jane Boyd, a United States citizen, was required to file an FBAR due to her multiple bank accounts in the United Kingdom but failed to do so in 2010. After voluntarily disclosing the accounts through the IRS’s Offshore Voluntary Disclosure Program, the IRS found that she had committed thirteen FBAR violations, one for each overseas account.

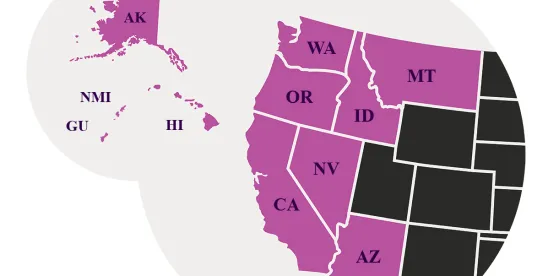

The dispute over non-willful FBAR violation calculations has been ongoing in federal courts. Federal regulations state that the penalty for a non-willful violation of the reporting statute shall not exceed $10,000. The dispute arises in considering what constitutes one violation. In some federal districts, the courts have held that a penalty may be assessed for each FBAR form the taxpayer non-willfully fails to file on time. In other districts, each individual account required to be reported on the FBAR creates a separate violation of the filing requirement. In US v. Bittner, a district court case decided last year, the government attempted to use the latter method to calculate a taxpayer’s failure to file forms five years in a row. The resulting penalty was nearly $3 million, rather than $50,000. In support of that argument, the government used the now-overturned district court decision in Boyd. After the government lost this argument in both Bittner and Boyd, it is appealing the former to the Fifth Circuit, arguing just two days after the Boyd decision that it was based on a “faulty rationale.” If successful, the appeal in Bittner would create a circuit split and a significant disparity in treatment between taxpayers in different regions of the United States.

While it stands as the only Circuit court decision on the issue, Boyd is undoubtedly a win for taxpayers facing large penalty assessments for non-willful FBAR violations. However, this victory was undercut two days prior by the Court of Federal Claims making it much easier for the IRS to upgrade non-willful violations to willful FBAR violations. Willful violations are subject to much higher penalties of up to $100,000 or 50% of the account balance. In Kimble, the appellate court held that where taxpayers fail to review their tax returns, which would have revealed the FBAR requirement, this is sufficient to show willfulness in violation of FBAR requirements. This decision makes essentially all violations willful and subject to the higher penalties.

Where willful penalties are assessed, taxpayers have not been so successful at avoiding higher penalties. In 2018, a dispute over the penalty limits of willful FBAR violations arose in district courts following the decisions in Colliot and Wadhan, holding that the penalties were capped by Treasury regulations at $100,000. Since then, both the Federal Circuit and Fourth Circuit courts of appeals have opposed this limitation, upholding large penalties equal to multiple times the account balances of the unreported foreign accounts. Following Kimble, these larger penalties will be available to the IRS in most cases of a failure to timely file an FBAR.

Overall, taxpayers should take care to understand their informational filing requirements. Filing an FBAR does not increase the tax obligation, and increasing penalties have heightened the risks of an inadvertent error leading to significant financial losses. Prosecution of these violations is unlikely to slow down following continued actions of the United States government against foreign banks and the expanded whistleblower statutes. The next FBAR filing deadline is April 15, 2021, with different extensions applying to certain taxpayers. Any United States taxpayer with questions about their filing obligations should contact a licensed tax attorney for legal advice specific to their situation.

/>i

/>i