On February 10, 2022, the SEC proposed significant amendments to the rules governing beneficial ownership reporting. The SEC’s proposed changes seek to modernize reporting on Schedules 13D and 13G by updating filing deadlines, expanding the rule’s application to derivative securities, clarifying aggregation concepts and requiring use of structured, machine-readable data language.

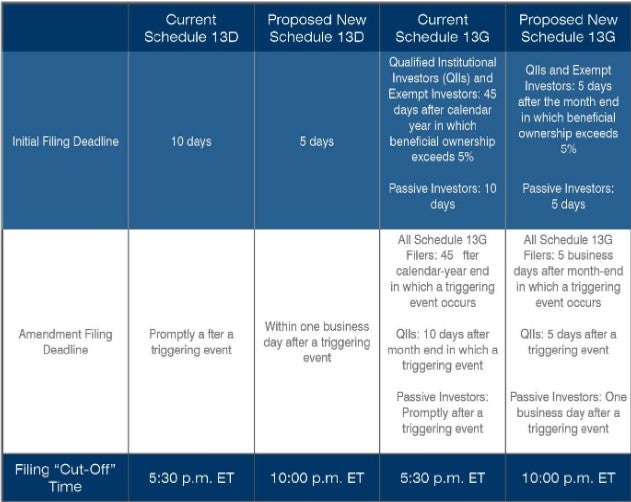

Proposed Schedules 13D and 13G Filing Deadlines

The following table compares the current and proposed filing deadlines for initial and amendment filings, as well as proposed adjustments to the SEC’s “cut-off” time each business day.

The proposed amendments also provide that only material changes—instead of any change—to the information previously reported on Schedule 13G will require an amendment.

Reporting of Certain Derivative Securities

The proposed amendments would provide that a holder of a cash-settled derivative security (other than a security-based swap) will be deemed the beneficial owner of the reference equity securities for the purposes of Schedule 13D and 13G filings, provided that the derivative is held with the purpose or effect of changing or influencing the control of the issuer of the reference security. In addition, Item 6 of Schedule 13D would require disclosure of interests in all derivative securities (including cash-settled derivative securities) that use the issuer’s security as a reference security.

Clarification of Aggregation Rules

The proposed amendments would outline circumstances under which two or more persons have formed a “group” such that beneficial ownership must be aggregated for the purpose of Schedule 13D or 13G filings, including “tippertippee” relationships where non-public information concerning upcoming Schedule 13D filings precedes the purchase of the issuer’s security by another person. The proposed amendments also would expand on exemptions from deemed “group” formation where (i) investors communicate with one another or the issuer without the purpose or effect of influencing control of the issuer and (ii) investors enter into derivative security agreements with financial institutions.

Structured Data Requirement

The proposed amendments would require that Schedule 13D and 13G filings use structured, machine-readable data language.

Comments on the proposed changes to beneficial ownership reporting are due by April 11, 2022. The SEC’s proposing release is available here.

/>i

/>i