Earlier this year, the Department of Labor (DOL) updated the prohibited transaction exemption for Qualified Professional Asset Managers, often referred to as the “QPAM exemption.” Included in the update is a new requirement that all QPAMs notify the DOL of an entity’s reliance on the QPAM exemption. The notice is due upon the later of (a) September 15, 2024 and (b) 90 days after first reliance on the exemption. This means that if you were relying on the QPAM exemption as of June 17, 2024, then your notice is due on September 15, 2024, which is only a week away!

Luckily, the notice is short and sweet – here are the requirements:

- The notice must be emailed to the following email address: QPAM@dol.gov

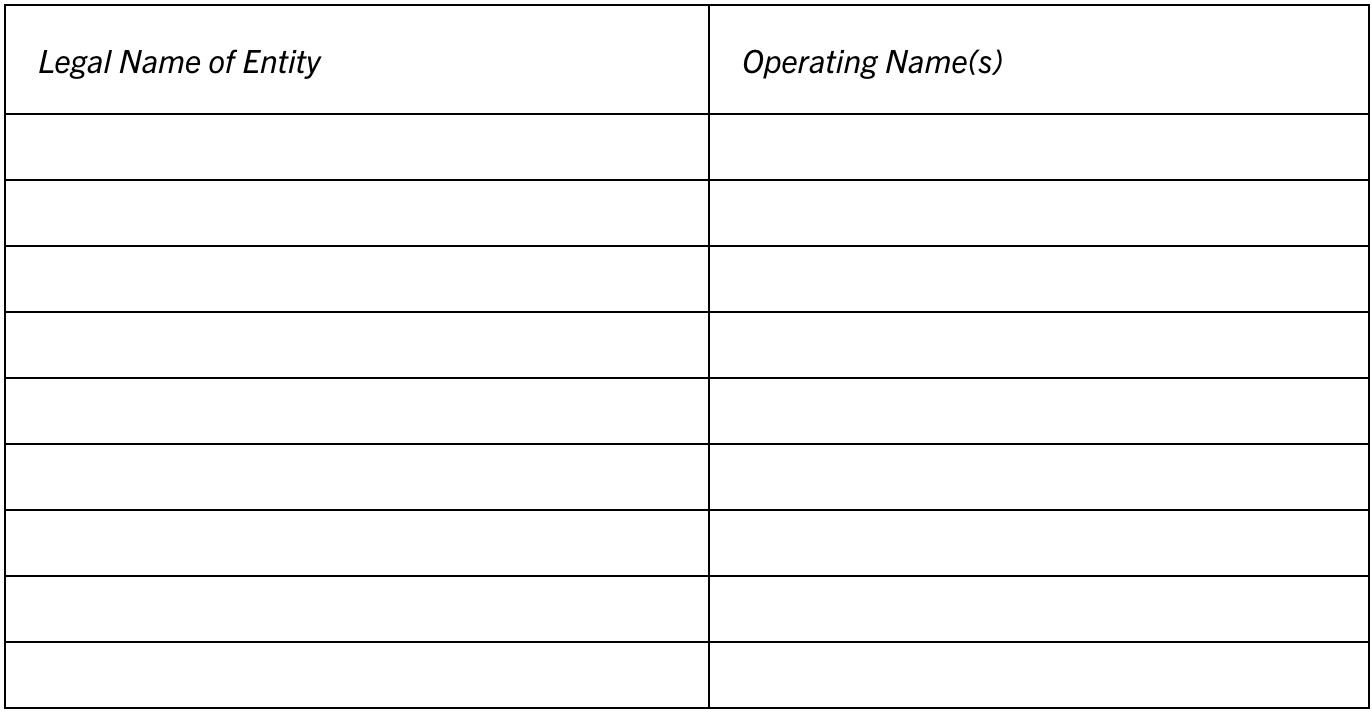

- The body of the email should state (1) the legal name and (2) the operating name (if different) for each entity relying on the QPAM exemption. Note that each entity that wants to rely on the QPAM exemption must be listed separately – you cannot make a blanket filling for all members in a single organization structure without listing each entity separately.

- A follow-up notice is required anytime there is a change in legal name or operating name, within 90 days of the date of such change. Note that other than a change in legal name or operating name, this is a “one-time” notice and does not need to be filed annually.

If you happen to miss the deadline, there is a 90-day grace period built into the rule. The only additional requirement is that you include in your filing a short statement of the reason for being late. So long as you do so, you will continue to be eligible to rely on the QPAM exemption without interruption. If you miss the original deadline and file outside the 90-day grace period, then it is possible that you would not be able to rely on the QPAM exemption until you complete the filing.

Here is a sample email body that you can use for your filing, though there are no “magic words” that you must use for the filing to be accepted as long as the required information is included:

We are providing this notice in accordance with Prohibited Transaction Class Exemption 84-14 to notify the DOL that the following entities may, from time to time, rely on the QPAM exemption set forth therein in managing assets subject to the prohibited transaction rules of ERISA and/or Section 4975 of the Internal Revenue Code:

[Insert reason for missing initial 90-day deadline, if needed.]

/>i

/>i