INTRODUCTION

The Indian government operationalised the Gujarat International Finance Tec-City (“GIFT City”) as India’s first International Finances Services Centre (“IFSC”). Since then several measures have been undertaken to incentivize overseas financial institutions and overseas branches / subsidiaries of Indian financial institutions to bring to Indian shores those financial services transactions that are currently carried on outside India. While the IFSC is technically located on Indian soil, it is considered an offshore jurisdiction for foreign exchange purposes, allowing investors to invest in businesses located within the IFSC without having to comply with India’s foreign exchange regime. Special tax incentives have also been provided to units located within the IFSC to further incentivize offshore investment and bring the IFSC at GIFT City on par with IFSCs globally. Several fund managers are exploring GIFT City to establish alternative investment funds (“AIFs”).1

The International Financial Services Authority (“IFSCA”) has been established as a single window clearance body to regulate all financial services and products in the GIFT City.2 Prior to the establishment of the IFSCA, the SEBI (International Financial Services Centre) Guidelines, 2015 (“2015 Guidelines”) and the Operating Guidelines for Alternative Investment Funds in International Financial Services Centres3 (“Operating Guidelines”) provided a broad framework for setting up AIFs in an IFSC (“IFSC AIF”). The IFSCA has been making structured efforts to boost global investments in the GIFT City, and to make the IFSC a global financial hub at par with other IFSC’s in the world. To boost the establishment of IFSC AIFs, the IFSCA released a circular providing benefits with respect to leveraging activities, co-investment opportunities and a relaxation of diversification norms for IFSC AIFs.4 The desire of the IFSCA to form regulations which are intended to quickly bring the funds set up in IFSC at par with offshore funds is an important consideration for both foreign and Indian GPs while deciding on the jurisdiction of the fund.

RELOCATION OF OFFSHORE FUNDS TO GIFT CITY

While the 2015 Guidelines and Operating Guidelines provided a framework for setting up of IFSC AIFs, there was no regulatory or taxation framework facilitating relocation of offshore funds to GIFT City. SEBI released a circular (“2021 Circular”) allowing one-time off-market transfer of securities by a Foreign Portfolio Investor to the IFSC.5 This 2021 Circular will allow relocation of foreign funds (set-up as FPIs) to set up Category-III AIFs in IFSC. Subsequently, the IFSCA released a circular providing that the requirement of continuing interest by the manager or sponsor provided in the Operating Guidelines shall be voluntary in case of relocation of offshore funds to IFSC.6 Alongside these regulatory changes, various changes have been brought to the tax regime to facilitate relocation of offshore funds to the GIFT City in a tax neutral manner.

TAXATION OF RELOCATION OF OFFSHORE FUNDS TO GIFT CITY

The Finance Act, 2021 amended several provisions of the Income-tax Act, 1961 (“ITA”) to facilitate the relocation of offshore funds to the IFSC in a tax neutral manner both for the offshore fund as well as investors. Such provisions are applicable where the assets of the ‘original fund’ are ‘relocated’ to a ‘resultant fund’ in GIFT City. For this purpose, the ITA defines the term ‘original fund’, ‘relocation’ and ‘resultant fund’ as under:

- Original fund:7 Original fund means a fund establish outside India which collects funds from its members for investing such funds for their benefit and fulfills the following conditions:

(i) the fund is not a person resident in India;

(ii) the fund is a resident of a country with which India has a tax treaty;

(iii) the fund and its activities are subject to applicable investor protection regulations in the country where it is established or incorporated; and

(iv) fulfils such other conditions as may be prescribed8

- Resultant fund:9 Resultant fund means a fund established or incorporated in India in the form of a trust or a company or a limited liability partnership, which:

(i) has been granted certificate of registration as a Category I or Category II or Category III AIF and is regulated by SEBI or IFSCA; and

(ii) is located in IFSC

- Relocation:10 Relocation means a transfer of assets of the original fund, or of its wholly owned special purpose vehicle, to a resultant fund on or before March 31, 2023 where consideration for such transfer is discharged in the form of share or unit or interest in the resulting fund to:

(i) shareholder or unit holder or interest holder of the original fund in the same proportion in which the share or unit or interest was held by such shareholder or unit holder or interest holder in such original fund, in lieu of their shares or units or interests in original fund; or

(ii) The original fund, in the same proportion as referred in sub-clause (i), in respect of which share or unit or interest is not issued by resultant fund to its shareholder or unit holder or interest holder.

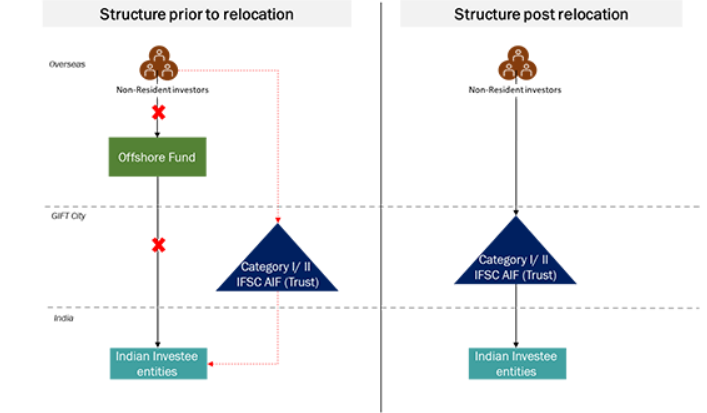

Essentially, relocation will encompass transfer of assets of an offshore fund (say in Mauritius or Delaware) to an IFSC AIF the consideration of which would be discharged by way of a swap. The swap will include proportionate issuance of units by the IFSC AIF to either the unit holders of the offshore fund in lieu of units held in the offshore fund or to the offshore fund (in case where share or unit or interest is not issued by IFSC AIF to shareholder or unit holder or interest holder of offshore fund).

The diagram below depicts a typical relocation transaction:

Pursuant to the Finance Act, 2021, the ITA has also been amended to provide the following provisions for ensuring tax neutrality of relocation:

-

Exemption from capital gains tax on capital gains arising from transfer of capital asset in a relocation by the offshore fund to the IFSC AIF.11 This provision essentially seeks to exempt capital gains tax arising on transfer of shares of Indian companies and other Indian securities held by an offshore fund to an IFSC AIF. The ITA levies capital gains tax on gains arising on transfer of shares or securities of an Indian company. In absence of this exemption transfer of shares or securities of an Indian company by an offshore fund to IFSC AIF pursuant to relocation would have been subject to tax in India;

-

Exemption from capital gains tax on capital gains arising from transfer by a shareholder / unit holder, in a relocation, of capital asset being share / unit held by him in the offshore fund in consideration for share / unit in the resultant fund.12 This provision seeks to exempt the transfer at the shareholder level from capital gains tax on account of indirect transfer provisions;

-

Exemption from capital gains tax on capital gain income arising or received by a non-resident investor or a specified fund, on account of transfer of shares of an Indian company by the IFSC AIF or specified fund which were acquired by the IFSC AIF or specified fund pursuant to relocation and where the capital gains on such shares were not been chargeable to tax had the relocation not taken place.13 This provision seeks protect grandfathered investments of offshore fund. It ensures that the outcome for the non-resident investor remains the same whether the exit from Indian company takes place by the offshore fund or the IFSC AIF;

-

Cost of acquisition of shares of an Indian company acquired by the IFSC AIF upon the relocation is deemed to be the cost of the previous owner i.e. cost base of shares of Indian company in hands of offshore fund is available to IFSC AIF;14

-

Cost of acquisition of units of the IFSC AIF acquired by the unit holders on relocation of the offshore fund is deemed to be the cost of the previous owner;15

-

The period of holding of shares of an Indian company acquired by the IFSC AIF upon the relocation is deemed to be include the period for which the shares of the Indian company were held by the offshore fund;16

-

The period of holding of units of IFSC AIF acquired by the unit holders upon the relocation is deemed to be include the period for which such unit holders held the units of the offshore fund;17

-

Section 79 has also been amended to allow the Indian company the benefit of set off and carry forward of loss to the extent the change in shareholding has taken place on account of relocation;

-

Lastly, corresponding changes have also been made to the provisions of Section 56(2)(x) to ensure that the IFSC AIF or the unit holders of the offshore fund are not subject to tax on account of the swap transaction.

The above provisions ensure that no adverse tax consequences arise on either the investors of the offshore fund or the offshore fund on account of relocation of the offshore fund to IFSC.

CONCLUSION

The changes brought by the ISFCA and the Finance Act, 2021 display the commitment of the Indian Government in promoting the IFSC as a global financial hub. The amendments to regulatory and taxation framework facilitating relocation of offshore funds to GIFT City coupled with the existing relaxations of IFSC AIFs is likely to boost fund industry in the GIFT City. While the tax provisions permit the IFSC AIF to issue units to investors directly on relocation, the permissibility of this will have to be examined in accordance with the provisions of the jurisdiction where the offshore fund is set up. For example, corporate laws of the jurisdiction where the offshore fund is set up will have to checked to examine whether the unit holders of the offshore fund (and not the offshore fund itself) can directly be issued units of the IFSC AIF. In case this is not possible, distribution of units of IFSC AIF to original investors will also need to be examined from tax perspective

As mentioned above, the provisions of the ITA seek to protect grandfathered investments of offshore fund such that the non-resident investors are not subject to tax in India merely due to relocation of offshore fund to GIFT City. However, such exemption is available where the capital gains on such shares were not been chargeable to tax had the relocation not taken. In this regard, determination of whether capital gains on such shares were chargeable to tax had the relocation not taken place will be key. In case where an offshore fund decides to relocate to GIFT City, it is likely for the offshore fund to be wound up post such relocation. Historically, capital gains on transfer of shares of Indian company by Mauritius / Singapore based funds have been exempt from tax in India under the relevant tax treaties. However, the exemption is subject to availability of tax residency certificate in the year of transfer, demonstration of appropriate substance at offshore fund level etc. Therefore, in order to ensure that the grandfathered investments are protected upon relocation of the offshore fund to GIFT City, it will be essential to ensure that these conditions are satisfied.

Relocation of offshore funds to GIFT City should be seriously explored by India centric offshore funds with Indian GPs. Relocation to GIFT City should enable Indian GPs to effectively manage the fund from GIFT City and mitigate potential permanent establishment and place of effective management issues which are otherwise present in case of offshore funds. Due to other incentives provided to units set up in IFSC under the ITA (like tax holiday, reduced minimum alternate tax rate), innovative structures may be considered for carry structuring for Indian GPs from GIFT City. Given that entities set up in GIFT City are considered to be resident from tax perspective, payment by investment manager to Indian advisor may not be subject to transfer pricing rules which reduces litigation risk on pay-outs. Ongoing compliances and on boarding of investors to an offshore fund are typically a pain point for Indian GPs. This may be easier in case of an IFSC AIF thereby reducing timelines for fund raising. Setting up and operating fund from GIFT City may be more cost effective for the GPs.

Apart from the above, the relocated offshore fund should be able to undertake leverage without any restrictions, investment in domestic AIFs, invest in offshore companies without any approval just like an offshore fund. The IFSC AIF will also have the ability to co-invest through creation of segregated portfolio. It will be relevant to note that pursuant to relocation of offshore fund to GIFT City, the IFSC AIF will be managed by an investment manager in GIFT City. In this regard, it will be important for Indian GPs to assess the manner of setting up of the investment manager in GIFT City prior to taking a decision of relocation of the offshore fund.

From an investor’s perspective also, relocation of offshore fund to GIFT City should not have any adverse impact. The Central Board of Direct Taxes (“CBDT”) has relaxed the requirement to obtain a Permanent Account Number (“PAN”) for non-resident investors investing in the units of the IFSC AIF subject to satisfaction of certain conditions.18 The CBDT has also exempted non-residents having income chargeable under the ITA from any investment in IFSC AIF (Category-I / Category-II) from filing of income-tax return in India. However, such exemption is available only if tax has been appropriately deducted and deposited to the government by the IFSC AIF as per provisions of the ITA.19 Given the above, relocation of offshore funds would definitely be worth exploring. Having said this, given the increased interest of GPs and LPs in GIFT City, probably the next step for CBDT and Reserve Bank of India would also be to allow domestic AIFs to relocate to GIFT City.

FOOTNOTES

1 BW Online Bureau. (2021, June 16). AIF Activity Picks Up Steam in IFSC at GIFT City; Half Dozen Entities Apply to Set Up Shops. Business World.

2 IFSCA has been established under the International Financial Services Centres Authority Act, 2019. It is empowered to exercise the power of various counterpart regulatory bodies in India such as the Securities and Exchange Board of India (“SEBI”), Reserve Bank of India, Insurance Regulatory and Development Authority of India, and Pension Fund Regulatory and Development Authority of India

3 SEBI/HO/IMD/DF1/CIR/P/143/2018 dated November 26, 2018

4 F. No. 81/IFSCA/AIFs/2020-21 dated December 09, 2020;

5 SEBI circular no. SEBI/HO/FPI&C/P/CIR/2021/0569 dated June 01, 2021

6 Circular No. 81/IFSCA/AIFs/2020-21/03 dated June 25, 2021

7 Explanation to clause (viiac) and clause (viiad) of section 47

8 No such conditions have been prescribed as of the date of this hotline

9 Explanation to clause (viiac) and clause (viiad) of section 47

10 Explanation to clause (viiac) and clause (viiad) of section 47

11 Section 47(viiac)

12 Section 47(viiiad)

13 Section 10(23FF)

14 Section 49(1)(iii)(e)

15 ibid

16 Section 2(42A)(b)

17 Section 2(42A)(b)

18 CBDT Notification No. 58/2020/F. No. 370133/08/2020-TPL dated August 10, 2020

19 Notification S.O. 2672(E) dated July 26, 2019

/>i

/>i