Last month, our post about art NFTs and the DMCA highlighted the distinction between non-fungible tokens and the copyrighted works they represent. In the context of copyright, this dichotomy is generally uncontroversial: In most cases, an NFT merely points to an underlying work but does not contain a copy of the work it represents, and so it is conceptually and legally separate from that work for copyright purposes. But NFTs can be used to signify ownership of products beyond digital artworks—and where those products involve trademarks, new legal issues arise.

Enter Nike: On February 3, the apparel and footwear giant sued StockX, an online resale marketplace for sneakers and other collectibles, in the US District Court for the Southern District of New York, alleging trademark infringement in connection with StockX’s issuance of NFTs featuring Nike sneakers. In the complaint, Nike asserts that these Nike-branded “Vault NFTs”—which StockX’s website says merely track ownership of a physical pair of sneakers in the company’s possession, like a virtual claims ticket or receipt—are in fact “new virtual products.” (Nike v. StockX LLC, No. 22-00983 (S.D.N.Y. filed Feb. 3, 2022)). In their March 31 answer, StockX reasserts their website’s position and insists that “Vault NFTs are absolutely not ‘virtual products’ or digital sneakers” (emphasis in original). StockX instead claims that the Vault NFTs are merely a convenient use of new technology that allows buyers to track ownership without having to possess the physical sneaker, such that the “owner can make a future trade without incurring transaction costs, delay, or risk of damage or loss associated with shipping physical sneakers to StockX and then to the ultimate recipients.”

In support of this “new virtual product” claim, Nike points out that StockX’s NFTs can be collected and displayed in a user’s portfolio, used to acquire additional StockX services and benefits, and sold or traded. Most critically, Nike purports to show consumer confusion about their origin—the necessary basis for a trademark infringement claim. StockX counters that “no one has been—or could be—confused,” opines that Nike’s complaint ignores “settled doctrines of trademark law, including the doctrines of first sale and nominative fair use,” and argues that their NFTs are more like claims tickets, title trackers, or receipts than products. Before looking more closely at the specifics of this suit, let’s consider why, from a trademark perspective, this distinction between product and receipt matters—and what might make StockX’s NFTs different from mere blockchain-based digital receipts.

Why the Product-Receipt Distinction Matters: First Sale and Fair Use

A trademark infringement claim has two basic requirements: (1) that the plaintiff has a valid mark, and (2) that the defendant is using that mark or a similar mark in a manner that is likely to cause consumer confusion. The basic idea, grounded in notions of consumer protection, is that when a consumer recognizes a trademark used in connection with a good or service and associates that mark with a specific company (the mark’s owner), that consumer should be able to assume that good or service is somehow associated with said company. But there is a critical exception for the resale of trademarked goods, known as the “First Sale” doctrine. When a lawfully-owned trademarked good is resold, the trademark owner cannot bring an infringement claim against the reseller. However, First Sale is limited to specific, individual lawfully purchased goods—buying a single trademark-bearing item does not give the buyer the right to use the mark on, or promote the sale of, other items that were not lawfully purchased (i.e., knockoff or counterfeit goods). This is why, without Nike’s permission, we can sell old Nike sneakers at garage sales, yet cannot manufacture and sell Nike-branded shoes. Relatedly, the “Nominative Fair Use” doctrine allows non-owners of trademarks to use those marks to refer to or identify trademarked goods, when doing so is necessary for consumers to identify the good (and the non-owner fulfills some other basic requirements like not improperly suggesting endorsement). Nominative Fair Use allows services like online auction sites or consignment stores to go beyond merely reselling trademarked goods by also publicizing their availability (e.g., in an advertisement stating, “we sell Nike shoes”).

Together, First Sale and Nominative Fair Use are why the product-receipt distinction matters: A new product, including a virtual product bearing another entity’s trademark, cannot be offered for sale without permission from the mark’s owner, whereas a mere receipt (which could take the form of a physical piece of paper, an email, or a digital token on a blockchain) requires no such permissions. It is the essence of First Sale and Fair Use that a purchaser who does no more than stock, display, and resell a producer’s product under the producer’s trademark does not commit infringement. But when each product is authenticated by a unique virtual token, how should one characterize that token—a mere receipt, or a distinct product? What exactly is the difference?[1]

The Traditional Distinction between Receipts and Products

When a consumer buys a physical product and receives a receipt, the distinction between the former and the latter—in terms of function as well as physical form—is generally clear and uncontroversial. The consumer makes the purchase in order to acquire the good; the receipt serves auxiliary functions such as proving ownership, facilitating return if necessary, and, where the receipt doubles as a claims ticket, allowing the bearer to take possession of property at a later time. Perhaps because they traditionally have such a basic and unglamorous purpose, receipts rarely contain many trademarks, except as necessary to identify the seller and the products sold (an example of Nominative Fair Use). Similarly and crucially, even where the contents of the receipt go beyond mere documentation of the transaction and offer enviable benefits to the consumer (think coupons, free sweepstakes entry, et cetera), it is not common for the consumer to purchase a physical good as a pretext for obtaining the receipt; accordingly the receipt is generally not considered a distinct product or service. The same is true for other forms of ownership documentation, such as title certificates and land deeds: These documents are spare utilitarian signifiers of ownership of something else.

How NFTs Blur the Traditional Line

NFTs complicate this traditional dichotomy. Like a title certificate or a claims ticket, an NFT often signifies ownership of something not contained in the NFT itself, such as a digital artwork or a virtual or physical good. In this sense, NFTs can function as blockchain’s analog to a simple receipt (of course, because they are publicly recorded on a blockchain, NFTs can be used to track changes in ownership and so have more utility than a slip of paper). But unlike a receipt, certificate or ticket, for many consumers, the property that an NFT tracks is hardly the point. Often, it is ownership of the NFT itself—and the associated benefits, such as entry into specific communities, self-branding on social media, or participation in business ventures, not to mention potential for return on investment—that the purchaser desires. This is well demonstrated by art NFTs, whose associated artworks are often easily viewed (and even copied) by non-owners, and whose sellers often retain nearly all of the pertinent IP rights to said artworks, such as the right to license the works for commercial purposes or create derivative works. Where possessing documentation of ownership is the consumer’s central desire (as opposed to possessing the property itself, or any fruits of ownership), the humble receipt suddenly becomes the star of the show, eclipsing even the very property to which it points. These nebulous concepts take concrete form in the case of StockX’s shoe NFTs, which, in some cases, may be listed for hundreds or thousands of dollars more than the physical sneakers whose ownership they incidentally claim to document.

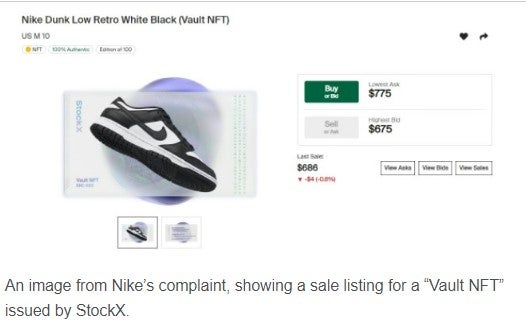

Of course, NFTs have other important distinctions from traditional receipts that help explain their high price relative to any underlying property. For one thing, as mentioned above, they often grant exclusive access to events, services, online communities, or even other NFT sales, as Nike alleges is the case with StockX’s sneaker NFTs. While these are in some ways analogous to a paper receipt’s coupons or other offerings, rarely if ever are consumers solicited to purchase physical goods by the prospect of receiving coupons, at least not in the same manner that NFT buyers are enticed to buy NFTs by the prospect of NFT ownership exclusive benefits. Secondly, unlike the starkly utilitarian traditional receipt, NFTs usually contain an eye-catching visual element or virtual representation of the associated physical good, such as, in the case of StockX, an image of the sneaker in question (see above). Again, NFTs are not unique in this respect. The internet is replete with functionally useless novelty property primarily sold so that the buyer can receive a colorful certificate of ownership (for example, the associate author himself once received as a birthday gift a uselessly tiny piece of land in Ireland, documented by a gaudy bright green title certificate). But with the metaverse impending, the largely functionless aesthetic features of an NFT may soon serve various branding, trading or identity functions within virtual worlds. This may explain why a StockX sneaker NFT is, for some, more valuable than the physical-world-only pair of shoes whose ownership it documents. But even where NFTs are not used as goods in the metaverse and are considered mere receipts for the purchase of trademarked physical goods, their aesthetic attributes may also push the boundaries of Nominative Fair Use, which traditionally requires that a non-owner of a mark use that mark as minimally as possible to identify the trademarked good in question.

Back to Nike v. StockX: Are StockX’s NFTs Distinct Virtual Goods or Mere Receipts?

With the above in mind, we can generate some questions that might, on a case-by-case basis, help determine whether an NFT associated with a trademarked physical good should be considered (a) a distinct virtual good subject to the full force of trademark protection, or (b) a mere receipt for the physical good that, despite its digital appeal, is ultimately just documentation of a physical resale and so is protected by First Sale and/or Nominative Fair Use. These include:

-

To what degree does ownership of the NFT convey benefits or costs beyond or separate from those associated with ownership of the physical good?

-

To what degree does ownership of the NFT convey (or fail to convey) benefits or costs associated with the physical good, such as possession of the good?

-

How much does the NFT exceed the minimal necessary use of the mark to identify the physical good?

-

Does the use of the mark in the NFT suggest endorsement by the mark’s owner or otherwise incorrectly suggest an association? (Note that this and the previous question are standard factors in a Nominative Fair Use analysis.)

-

How much is consumer interest in the joint NFT-physical good offering driven by interest in the NFT and how much is it driven by interest in the physical good? In other words, how much is the NFT incidental to the physical good, and vice versa?

Note that these questions are not drawn directly from case law, as these are novel issues—that is, a court could consider entirely different factors in determining whether an NFT is a product or a receipt. Still, using these questions, one can look at the Nike-StockX conflict and begin to ponder how a court might consider the overarching issue:

-

To what degree does ownership of the NFT convey benefits or costs beyond or separate from those associated with ownership of the physical good?

According to its website, StockX offers “owners of Vault NFTs… certain incentives and rewards that StockX provides to its users from time to time for using StockX services.” It isn’t clear how much, if at all, benefits extended to NFTs owners exceed those extended to other StockX customers who purchase goods without NFTs, nor it is obvious how much these offerings exceed those commonly found on traditional paper receipts.

-

To what degree does ownership of the NFT convey (or fail to convey) benefits or costs associated with the physical good, such as possession of the good?

StockX’s website says that purchasers of the Vault NFTs can “redeem” their token and receive the associated physical pair of shoes after paying some fees such as shipping costs and a “withdrawal fee,” at which point the NFT is “burned.” (Nike’s complaint alleges that redemption is “not currently available,” but StockX provided an active web form that suggests the contrary. StockX may have updated its site in a few different areas since Nike’s complaint was filed). According to StockX, the ability to redeem suggests that NFT ownership conveys the same benefits as physical ownership of the shoes, albeit in an attenuated form, like a “claims ticket.” However, StockX does not charge sales tax until an NFT is redeemed, which could imply a distinction between the sale of the NFT and sale of the underlying shoe (it is not clear whether this tax is calculated based on the NFT price, or something else). It is also notable that “burn” is something of a misnomer, since tokens on a blockchain generally cannot be destroyed or deleted, unlike physical receipts or claims tickets (though their ownership can be terminated).

Nike’s complaint also claims that StockX’s website terms allow it to unilaterally redeem an NFT for an “Experiential Component,” presumably preventing the NFT owner from ever receiving the physical shoes—but as of the date of writing, StockX’s terms and conditions distinguish between “Vault NFTs” (the ones at issue here) and “Experiential NFTs.” Still, StockX advertises the benefits of its Vault NFTs as including the ability to buy and sell shoes without ever having to ship or store them—indeed, their answer leans into this as the chief advantage of the NFTs—which could show that this NFT-sneaker offering is not intended to convey what is usually the chief benefit associated with personal property: possession (though, as StockX’s answer points out, this is often not true for collectors who buy goods solely for investment purposes, some of whom may prefer to handle a NFT and let StockX store their physical property, at least for now).

Lastly, StockX’s terms and conditions subject Vault NFT buyers to extensive terms and conditions, such as a mandate that resale of the NFTs take place on their platform and remain subject to their terms. This subjects buyers to significantly more controls than buyers of physical sneakers, who would generally be able to do whatever they wanted with shoes they purchase, including resell them, without any oversight from the original retailer. On the other hand, Vault NFT owners could always avoid these restrictions by redeeming their NFT and reselling the physical shoes.

-

How much does the NFT exceed the minimal necessary use of the mark to identify the physical good?

StockX’s NFTs do not merely and minimally use the Nike mark to identify their associated sneakers (as would a traditional receipt), but instead feature an image of the shoe itself. However, StockX could argue that because the shoes are desirable because of their aesthetics, such an image is necessary to meaningfully and effectively identify each pair. Indeed, their answer notes that their NFTs look “much like a product page or advertisement on any other e-commerce site.”

-

Does the use of the mark in the NFT suggest endorsement by the mark’s owner or otherwise incorrectly suggest an association?

StockX includes a disclaimer that each Vault NFT is not officially connected to Nike in the product description of each NFT’s sale listing—yet each listing is also tagged as “StockX verified.” In its complaint, Nike identifies a handful of consumers who allegedly expressed the belief that Nike was affiliated with StockX’s NFTs on social media. StockX asserts that “no one has been—or could be—confused.”

-

How much is consumer interest in the joint NFT-physical good offering driven by interest in the NFT and how much is it driven by interest in the physical good? In other words, how much is acquisition of the NFT incidental to the physical good, and vice versa?

It is unclear how much consumer interest in the NFT-sneaker offering is driven by desire to obtain the sneakers, as opposed to being driven by the potential investment value of the NFTs. On the one hand, sneakers are well-established as genuine collectibles and routinely resold on website marketplaces, and the shoes at issue here are undoubtedly desirable in this market. Yet, Nike’s complaint points out that StockX’s NFTs are often bought and sold at prices well above the retail prices of the physical shoes, which may suggest that ownership of the shoes is incidental. On the other hand, StockX points out in their answer that some of its NFTs sell for prices below the prices commanded by corresponding pairs of sneakers sold the old-fashioned way on their site (to the extent that we can now call selling sneakers on a website “old-fashioned”). An interesting wrinkle here is the fact that since the launch of the Vault NFTs, the prices for many of these NFTs seem to have been trending downwards. Courts that consider an NFT’s price to be an important data point in determining consumer interest (or important for other reasons) will have to factor price fluctuations—common in NFT markets—into their analysis.

Another fact that might help reveal whether, and how much, the sneakers are incidental to the NFTs could be their redemption rate. How often does the “Vault” in “Vault NFT” actually come up? This we do not know: StockX’s answer alleges that 2,853 Vault NFT transactions have taken place on its platform, but notes only that “redemptions have, in fact, occurred.” Even if we had the numbers, their suggestive value might be undercut by the wrinkle that, as StockX points out in its answer, for some collectors who purchase physical sneakers purely as investments, physical acquisition is already incidental to the collector-investor’s purpose. In other words, a low redemption rate might not indicate that consumers holding onto their NFTs are any less interested in the associated sneakers than collectors who buy them from a shoe store and never even open the box.

It is hard to say how the court will rule on Nike’s trademark claims—or whether they will consider the questions that we have raised here at all. But we can say that Nike thinks it was important to seek judicial redress in this case, perhaps because the company is actively expanding its presence in digital artwork, NFTs, virtual products and metaverse/blockchain related experiences. With its defiant answer, StockX, too, seems to be indicating that they—and potentially other marketplaces like them—are determined to plant a flag in this new space. Given the novel nature of the suit and the waterfall of implications for intellectual property and blockchain law, we will watch closely for the Southern District’s ultimate decision.

FOOTNOTES

[1] We note that there is some question as to whether First Sale applies to virtual goods in addition to physical ones. In the copyright context, the Second Circuit has held that because reselling a digital music file inevitably involves making a copy of that file, First Sale is inapplicable to digital works—even where a seller uses a service that automatically deletes the original digital file. See Capitol Records LLC v. ReDigi Inc. One might argue that because trademark protects against consumer confusion, not copying, this reasoning may not apply in a trademark context (note also that consumer confusion may be more easily avoided in the NFT context, where the source of the NFT is publicly tracked on the blockchain). Moreover, NFTs are sold without being copied—their change in ownership is simply recorded on a blockchain. Still, the outcome of any virtual goods trademark litigation involving a First Sale defense would likely depend on the specific facts of the situation, such as how the virtual good was marketed and how the mark at issue was used. We will save further consideration of this issue for another day.

/>i

/>i