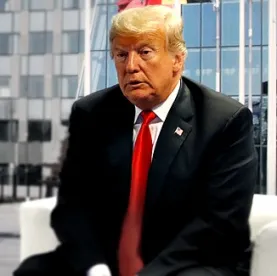

On September 21, 2022, the New York State Attorney General Tish James filed a civil lawsuit against former President Donald Trump and the Trump organization alleging fraud and misrepresentation. The Complaint described a widespread scheme to inflate the value of Trump’s assets when beneficial to his financial interests. New York claimed that evidence of the scheme was, in part, Trump and the Trump organization’s procurement of inflated appraisals for conservation easements donated in 2014 and 2015.

According to the filing, Trump created annual Statements of Financial Condition from 2011 through 2021, listing his assets and liabilities and calculating a net worth based on these amounts. Trump then allegedly used these Statements to secure loans like the one used to redevelop the Old Post Office in Washington, D.C. into the Trump International Hotel. The largest category of Trump’s assets, by far, was real estate holdings including the property used to create conservation easements. The Office of the Attorney General investigated the preparation of these Statements for three years leading up to the recent filing of the civil lawsuit.

The documents filed reveal that Trump donated several conservation easements on his properties. Conservation easements have been a recent focus of the Department of Justice and IRS. Unlike the “syndicated” conservation easement deals the DOJ recently charged with fraud, Trump and the Trump organization acted independently to create the easements and claim the resulting tax deductions. In separate cases, the government has alleged that syndicated conservation easements are “abusive” because they create tax shelters for the wealthy to cheat on their taxes and Congress has proposed restrictions on the deduction that would limit the profitability of syndicated conservation easement schemes. However, the strategies used in these deals, such as procuring high valuations of property based on its highest and best use is not limited to syndicates. It alleged that Trump, by cutting out the middleman, received an even higher deduction using the strategy.

The New York Complaint focused on two of Trump’s conservation easements. First, 212 acres owned by a Trump organization subsidiary in Westchester County, New York. The property was purchased in 1995 for $7.5 million and a conservation easement on the property was donated in 2015 with a claimed value of $56.5 million. This donation apparently reduced Trump’s tax liability by $3.5 million. Second, the driving range of the Trump National Golf Club in Los Angeles. Despite valuing the club at $214 million in the same year, the appraisal submitted to the IRS valued the donation at $25 million. The impact on Trump’s tax liability would depend on his tax rate for 2014 and was not disclosed in the filing.

James has said publicly that she intends to make a criminal referral to federal prosecutors in Manhattan and a tax fraud referral to the IRS for Trump’s actions. If the IRS and DOJ choose to pursue charges related to Trump’s deductions the resulting prosecution could be the first against an individual taxpayer for a noncash charitable deduction related to conservation easement deductions.

/>i

/>i