Challenging economic conditions have made it even more attractive for certain General Partners (GPs) to seek to maintain existing assets owned by fund vehicles. Continuation funds offer GPs a mechanism for doing this by moving assets owned by an existing fund vehicle to a new vehicle also managed by the GP. Against this backdrop, the Institutional Limited Partners Association (ILPA) recently published a guidance paper (Guidance) on continuation funds. The Guidance is available here. This follows ILPA's previous guidance on GP-led secondary fund restructurings published in April 2019. ILPA is a global organisation dedicated to advancing the interests of limited partners (LPs) in private funds.

ILPA developed the Guidance alongside GPs, LPs and industry experts. While the Guidance may not be appropriate for all continuation fund transactions due to the highly unique nature and broad scope of these deals, it is intended to provide general parameters for a well-run transaction that will encourage dialogue and informed decision-making by LPs. The Guidance seeks to address growing LP frustrations, and sets out principles that GPs and LPs should implement to reduce the misalignment of interests in continuation fund transactions.

What is a continuation fund?

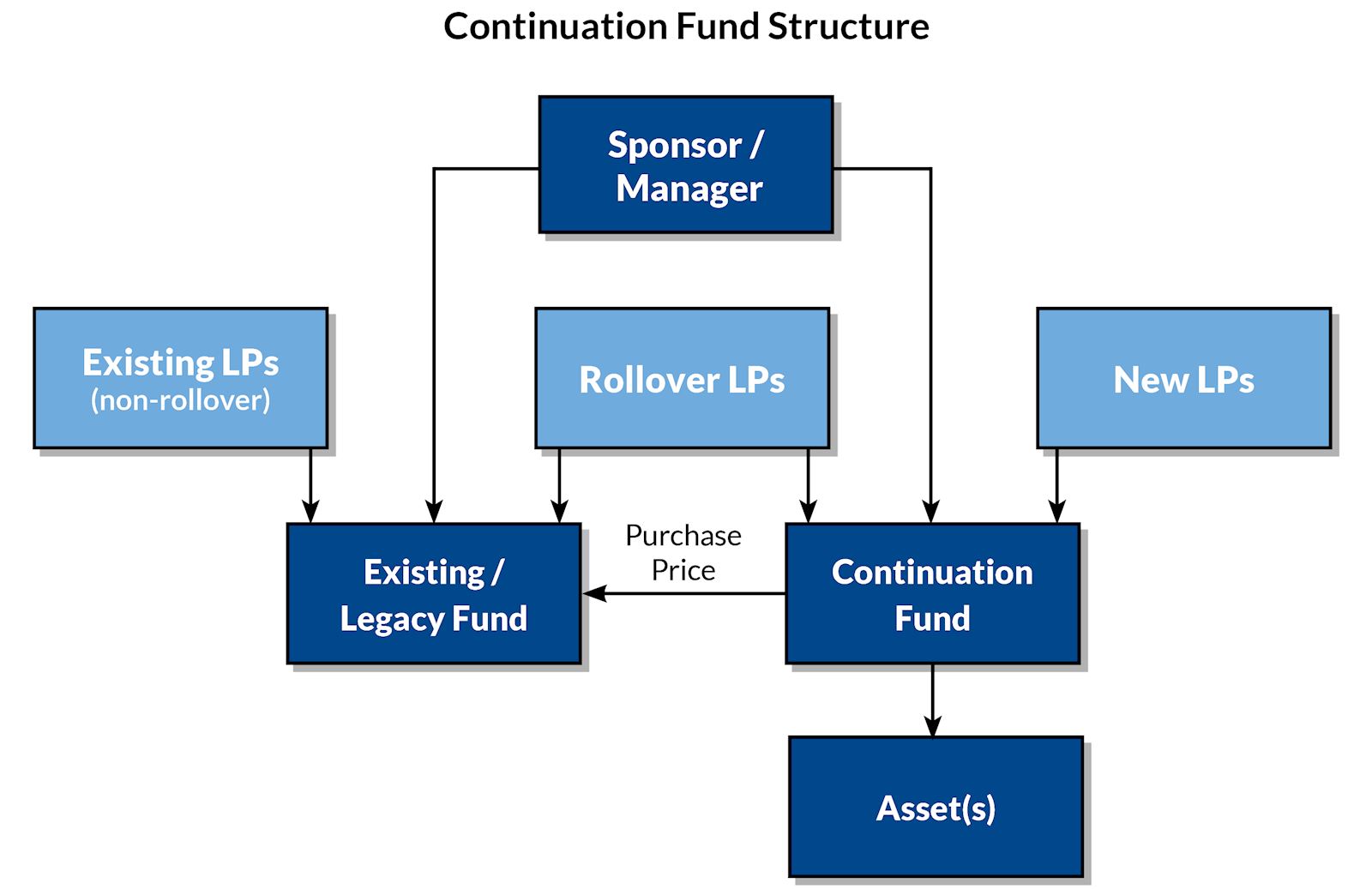

In its simplest form, a continuation fund transaction involves a sponsor setting up a new fund vehicle to purchase one or more selected assets from an existing fund. The same sponsor manages both the existing fund and continuation fund. For illustrative purposes, we have set out below a diagram of a typical continuation fund structure.

In order to decide whether to participate in continuation funds, LPs must evaluate complex transaction details within set timeframes. The structure of these deals are unique and differ between managers, increasing the difficulty of consistently evaluating the impact of an election to roll into the new vehicle or sell their interest in an existing fund. Additionally, such transactions are inherently conflicted, with GPs sitting on both sides of the transaction. Generally, this means that these deals can be difficult for LPs to navigate.

Historically, continuation funds were a novel method for liquidating funds late or past their term. However, these deals have become increasingly popular as GPs look to move one or more selected assets into a new vehicle which they can continue to manage to maximise returns. GPs can benefit from continuation fund transactions as they can retain assets until the market rebounds in a downturn while, in an upturn, they can continue to share in the profit from the performing asset. That said, there appears to be a lack of industry consensus regarding what constitutes a well-run continuation fund process, reiterating the importance of ILPA's Guidance.

ILPA's Guidance

The Guidance sets out the following two general principles:

-

continuation fund transactions should maximize value for existing LPs; and

-

rolling LPs should be no worse off than if a transaction had not occurred.

The Guidance sets out a recommended structure for continuation fund transactions taking into account these principles and the fees that should be charged. The Guidance recommends that, among other things:

-

Role of the LP Advisory Committee (LPAC). There should be early, regular and comprehensive communication with the LPAC. For example, the LPAC should be engaged at an early stage on the deal to review the business rationale behind the proposed transaction, the GP's selection of the transaction advisors and the proposed acquisition agreement between the existing fund and the continuation fund. Any such acquisition agreement should be provided no less than 10 business days prior to finalising such agreement. Additionally, the GP should ensure that the LPAC has access to the advisor (if requested) and, more specifically, the LPAC may choose to obtain independent advice, both of which should be treated as a fund expense.

-

Conflicts. The LPAC should seek to optimise value for all investors in the selling fund. However, this can be difficult where there are conflicts of interest between multiple LPAC members and/or the non-LPAC investor base. The GP should mitigate all conflicts, all of which should be presented and then approved by the LPAC. GPs should also avoid Limited Partnership Agreement (LPA) provisions that pre-clear conflicts of interest associated with continuation fund transactions.

-

Price. A competitive process should be undertaken to determine the price, involving a third-party price validation.

-

Timing. LPs should be afforded sufficient time to review the proposed terms of participation in the continuation fund, i.e., no less than 30 calendar days or 20 business days for existing LPs to confirm whether they will participate or cash out.

-

Side letters. The continuation fund formation and offering process should align with any side letter agreements entered into between the GP and LP. Additionally, for any LP rolling their interest into the continuation fund, the terms within the LP's negotiated side letter for the existing fund should continue to apply to the continuation fund, either by way of a new side letter specific to the continuation fund or express language in the continuation fund LPA.

-

Fees. There should be clear disclosure of the allocation methodology for transaction fees and expenses, and the GP should share transaction costs where the GP benefits from additional fee revenue or a stapled commitment. Any management fees charged to LPs participating in the continuation vehicle should be proportionate to the operational requirements of managing the specific assets to be acquired by such vehicle.

-

Economics. LPs must be provided with the option to participate in the continuation fund with no change in economic terms, i.e., a "status quo" option. Such option should not increase management fee rate and carried interest rate or reduce the preferred return hurdle, and no crystallisation of carried interest.

-

Carried interest. GPs should roll all carried interest accruing into the new continuation vehicle to ensure an alignment of interest. If not all carry is rolled, the GP should provide an explanation why it did not roll all accrued carry. For funds with European waterfalls which are not yet in the carry, it is accepted that LPs will need to obtain alignment based on the GP's commitment to the continuation fund.

Concluding Remarks

Given the apparent increase in popularity of continuation fund transactions, enhanced transparency and consistency in these transactions will be essential to their efficiency and quality of execution. Notably, ILPA sets out recommendations in the Guidance to participate actively in the continuation fund process, suggesting that ILPA also believes these transactions will continue as a popular exit strategy for certain assets. As with previous ILPA guidance, we expect that it is likely that LPs and GPs will use the Guidance to support their commercial and legal preferences, rather than strictly adhering to the recommendations in the Guidance.

/>i

/>i