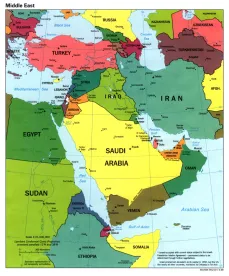

Setting up operations in the Middle East comes with a unique set of challenges and considerations requiring knowledge of regional legal obligations and cultural practices that can affect workplaces—from the necessity of establishing a physical presence to navigating the distinct workweek structures. In addition to these, employers may need to take into account factors such as the region’s taxation policies, the requirements for hiring local nationals, the role of public relations officers (PROs), the specifics of employment agreements, statutory benefits, and the procedures for discharging expat employees. Below is a round-up of eight of the most common and critical issues employers may face when doing business in Israel, Kuwait, Lebanon, Qatar, Saudi Arabia, and the United Arab Emirates (UAE)—which have all become very popular countries with expat populations.

Quick Hits

- Expanding business into the Middle East may require global employers to navigate unique challenges such as establishing a physical office presence, adhering to distinct workweek structures, and understanding regional tax policies.

- Employers must comply with requirements around hiring local nationals, employing public relations officers (PROs) for government interactions, and providing specific statutory benefits like reduced Ramadan hours and end-of-service gratuity.

- Additionally, the process of discharging expat employees involves several steps, including visa cancellation and ensuring all statutory payments are settled.

1. Physical Presence Requirements

One of the first things employers need to consider when setting up operations in the Middle East is the relevant countries’ physical presence requirements on employers. Unlike many regions where remote work is becoming the norm, the Middle East still places significant importance on maintaining brick-and-mortar offices. Specifically, some countries require that employers have a certain square footage of real estate in the country to do business. Moreover, this requirement is directly tied to the number of visas granted for expat employees.

Countries like the UAE, Saudi Arabia, Kuwait, and Qatar each have specific criteria regarding the amount of local real estate a company must lease, which correlates with the number of visas they can obtain. Thus, employers may need to pay particular attention to how they plan to structure their physical workspaces in each of these countries in accordance with local requirements.

2. Workweek Structure

Another unique aspect of doing business in the Middle East is the workweek structure. In Islamic countries, the workweek runs from Sunday to Thursday, with Friday and Saturday as the weekend. This schedule is mandatory in countries like Saudi Arabia, Kuwait, and Qatar because Friday is a day of rest in Islam, which is the national religion in those countries. Notably, the UAE has recently placed its public-sector workforce on a Monday-to-Friday workweek to align more closely with Western business practices. This change has influenced many private businesses to follow suit and shift their workweeks to align with the government calendar.

3. Taxation Nuances in the UAE

The UAE stands out among the countries in the Middle East in that it does not impose personal income taxes on workers, making it an attractive destination for expats, who make up the majority of the workforce. Thus, employees in the UAE take home their full gross pay without deductions for social contributions or pensions. Additionally, employers are responsible for providing medical insurance to their employees, but not for providing pensions.

While there are no personal income taxes, the UAE requires businesses to pay corporate taxes based on the revenue they generate, albeit at a relatively low rate, which continues to attract businesses to the region.

4. Localization Requirements

With a significant expat population, some Middle Eastern countries are implementing Saudization or emiratisation rates to protect local workforces requiring employers to hire a certain number of local nationals as a protective measure. For instance, the UAE has an emiratisation rate requiring companies to employ a certain number of local nationals. Similar laws exist in Saudi Arabia, where finding local employees can be challenging due to the government’s strong support for its citizens, often resulting in many locals holding government jobs.

5. Public Relations Officers (PROs)

A unique requirement in the Middle East is for companies to have a public relations officer (PRO), which is an individual who interacts with the government on behalf of the company. This role, which is sometimes outsourced, must be filled by a local. PROs handle various administrative tasks, including obtaining no objection certificates (NOCs) for expat employees. NOCs are formal letters from employers stating that they do not object to the relevant employee doing certain activities in the country, such as getting a driver’s license, opening a bank account, or even getting a mortgage.

6. Employment Agreements

Employment agreements in the Middle East are also distinctive. There are two types of employment agreements used in the Middle East. One is a template agreement, which is a government form filed at the same time of a visa application. Examples include the UAE’s Ministry of Human Resources and Emiratisation (MoHRE) agreement and template employment agreements available in Saudi Arabia’s Qiwa portal.

Employers must submit a government-issued template agreement when applying for employment visas. However, they often supplement these template agreements with more detailed private employment agreements that include additional protections and clauses not covered in government forms. These robust agreements include the provisions one might see in a typical employment agreement, such as intellectual property rights, more detail and context on noncompetition agreements, the obligation to return company property when employees leave, statutory benefits, and provisions regarding the handling of trade secrets.

7. Statutory Benefits

The Middle East offers several unique statutory benefits. In addition to statutory annual leave and statutory maternity leave, the Middle East often has requirements for Ramadan hours and Hajj leave. For example, during Ramadan, all employees, regardless of their religion, are entitled to reduced work hours. Muslim employees are also entitled to Hajj leave for their pilgrimage to Mecca.

8. Termination Procedures

The processes around terminating the employment of expat employees can vary from country to country in the Middle East. One universal feature among many countries in the Middle East is an end-of-service gratuity. These gratuities are a significant benefit for expats, serving as a quasi-pension that accrues over their employment period and is paid out upon termination, regardless of the reason for leaving.

Another feature of terminations in the Middle East is the cancellation of employees’ visas. In the UAE, even when transferring between employers, the current employer must cancel the visa before the new employer can apply for a new one. This process includes obtaining a clearance form to ensure all statutory payments are settled.

Key Takeaways

The Middle East presents a unique landscape for global employers, with specific requirements and cultural nuances that must be navigated carefully. From setting up a physical presence to understanding workweek structures, tax implications, local national hiring rates, and statutory benefits, there are many factors for global employers to consider.

/>i

/>i