On April 10, 2020, the US Department of Health and Human Services (HHS) began distributing $30 billion from the $100 billion Public Health and Social Services Emergency Fund to Medicare Fee-for-Service (FFS) providers. The Coronavirus Aid, Relief, and Economic Security (CARES) Act (P.L. 116-136) established the fund to provide financial relief to and support for healthcare providers affected by the Coronavirus (COVID-19) pandemic.

Key Takeaways

- HHS distributed $30 billion, leaving $70 billion yet to distribute.

- Funds were allocated using a formula that generally conveyed 6.2% of an eligible recipient’s 2019 Medicare FFS revenue.

- Funds were directly deposited into accounts if providers have electronic fund transfer arrangements with Medicare; providers that are paid with paper checks will receive their share of the funds by paper checks, and that may take a few weeks to be processed and received.

- By accepting payment, a recipient must agree to a set of terms and conditions within 30 days of receipt of payment. The electronic portal for a fund recipient to accept these funds is not yet available, and the terms and conditions may change between now and when that portal becomes available. Fund recipients should carefully review the Terms and Conditions that they are asked to accept.

- HHS used 2019 Medicare revenues as both a proxy for allocating funds and a means for distributing funds quickly Providers with little or no Medicare FFS revenue were disadvantaged by this approach. HHS indicated that the distribution of the remaining $70 billion will focus on providers in hotspot COVID-19 areas, rural providers and providers that may not have been eligible for this first round of funding, including providers with lower shares of Medicare reimbursement or that predominantly serve the Medicaid population.

Helpful Links

- Press Release

- CARES Act Provider Relief Fund Website

- Relief Fund Payment Terms and Conditions

- State-by-State Breakdown: Delivery of Initial $30 Billion of CARES Act

- CARES Funding Opportunities

Eligible Recipients

Recipients of the first wave of funding included hospitals, physicians and others who had FFS Medicare reimbursement in 2019. According to the current version of the Terms and Conditions (TC), an eligible provider must meet the following criteria:

- The provider currently provides diagnoses, testing or care for individuals with possible or actual cases of COVID-19.

- The provider is not currently terminated from participation in Medicare and has billing privileges.

- The provider is not currently excluded from participation in Medicare, Medicaid and other federal healthcare programs.

Payment Calculation and Distribution

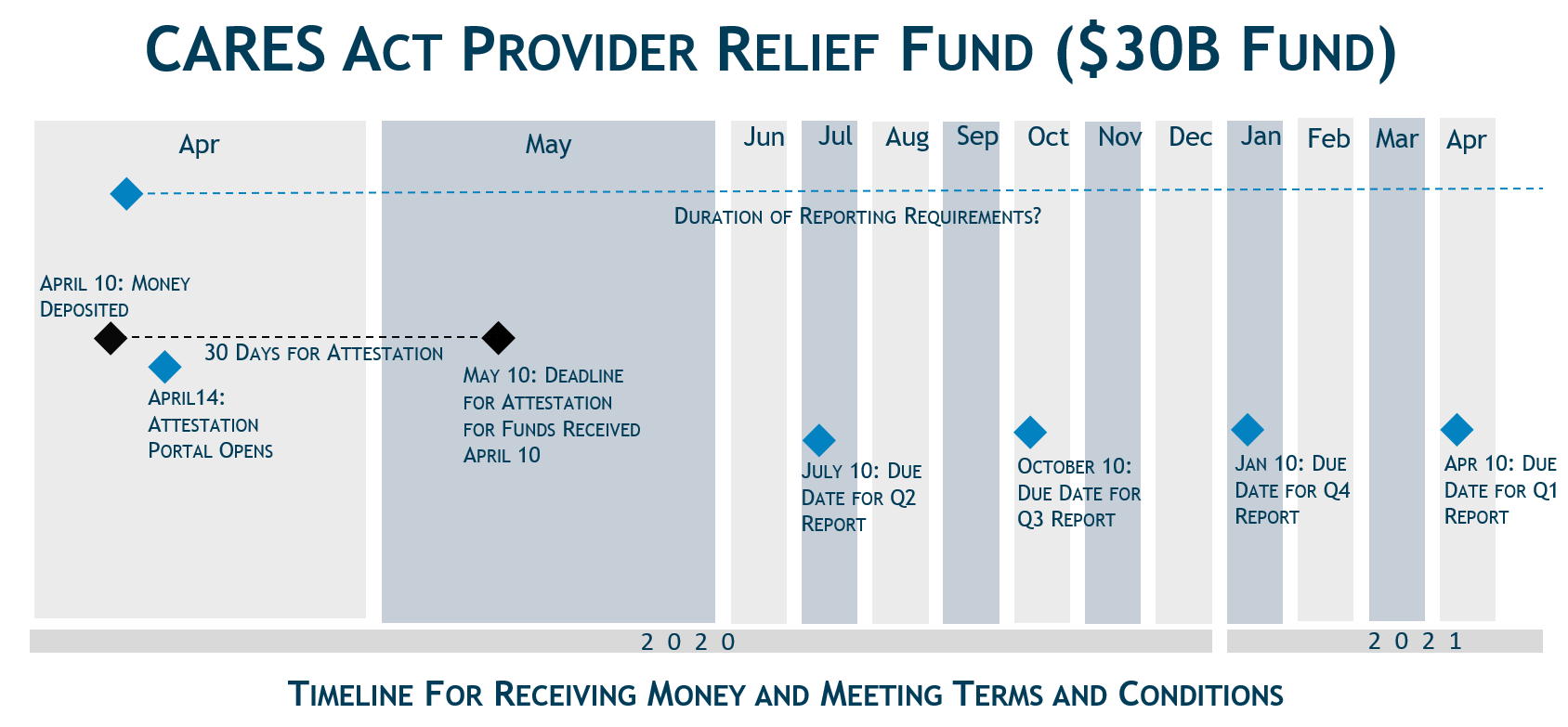

Unlike some of the other funding sources available to providers in response to the COVID-19 pandemic (e.g., Medicare Accelerated and Advance Payment Program), the payments from the fund are not loans, and providers will not be required to repay them. HHS is distributing the funds in a rapid fashion, with payment generally arriving through direct deposit on April 10.[1] Providers must certify to the TC within 30 days of accepting the funds.

Payment Calculation

For the distribution of the $30 billion, HHS has calculated payments based on the recipient’s share of 2019 Medicare FFS payments relative to total 2019 Medicare FFS payments ($484 billion). Recipients can estimate their payment by dividing their 2019 Medicare FFS payments by $484 billion and multiplying that ratio by $30 billion.

Payment FormulaTotal 2019 Medicare FFS Reimbursement x 0.062 |

As an example, HHS estimated that a hospital that received $121 million in Medicare FFS payments in in 2019 would receive a payment of $7.5 million ($121 million x 0.062 = $7.5 million).

The calculation of the $30 billion targeted at Medicare FFS providers was relatively straightforward, but HHS may face challenges as it tries to expand the distribution beyond this initial group of providers for the remaining $70 billion where the Administration has indicated that non-Medicare FFS providers will be a priority. Medicare claims data provides a data-driven, relatively straightforward and transparent means to allocate funds. HHS likely opted for this approach because there is no similar data source for Medicaid providers or Medicare Advantage providers, or for services provided to the uninsured. HHS may need to get creative to devise a methodology to target some portion of future allocations towards providers that do not typically bill original Medicare.

Distribution Mechanism

HHS is partnering with UnitedHealth Group to distribute the funds. Providers were paid via Automated Clearing House account information on file with UnitedHealth Group, UnitedHealthcare or Optum Bank, or information used for reimbursements from the Centers for Medicare & Medicaid Services. All relief payments are made to providers according to their tax identification number (TIN). Large organizations and physician group practices will receive relief payments from their billing TINs. Physician group practices will receive payments under the TIN at which they receive payments from Medicare. Employed physicians will not receive an individual payment; the payment will go to their billing organization.

Payment Terms and Conditions

Within 30 days of receiving the payment, providers must sign an attestation on a portal (opening the week of April 13, 2020) confirming receipt of the funds and agreeing to the TC of payment. If a provider receives payment and does not wish to comply with the TC, the provider must contact HHS within 30 days of receipt of payment and return the full payment to HHS.

Key highlights from the currently posted TC include:

- Recipient currently provides diagnoses, testing or care for individuals with possible or actual cases of COVID-19.

- Recipient will use these funds either to prevent, prepare for and respond to COVID-19, or for healthcare-related expenses or lost revenues.

- Recipients who receive funds totaling more than $150,000 from various COVID-19 funding streams will report quarterly on the use of these funds.[2]

- Recipient will not use the payment to reimburse expenses or losses that have been reimbursed from other sources or that other sources are obligated to reimburse.

- Recipient will charge patients for care associated with a possible or actual case of COVID-19 only the amount that the patient would have otherwise been required to pay if the care had been provided by an in-network provider, and the Recipient will not seek to collect from the patient out-of-pocket expenses in a greater amount..

Many of the TC are ambiguous and confusing; others may be perceived as onerous. We expect that stakeholders will continue to seek clarification and changes before the web portal goes live. Recipients should carefully consider the gravity of the TC, and may wish to delay acceptance to see if they further evolve.

While the first distribution may provide some relief to a subset of the healthcare industry, it is clear that more is needed. We expect additional information about the next $70 billion in the days to come, and are monitoring congressional activity for additional funding for the healthcare industry.

What’s Ahead

The CARES Act was enacted on March 27th. For two weeks, providers anxiously awaited the distribution of money from the $100 billion Public Health and Social Services Emergency Fund to both enable providers treating active cases to save lives and quell the spread of disease and to provide relief to providers financially struggling from decreased volumes and associated lost revenues. During those weeks, HHS heard from a wide variety of stakeholders but clearly struggled to thread the needle between rapidly distributing funds and standing up a program intended to reimburse providers for coronavirus attributable expenses incurred and revenues lost. HHS apparently used 2019 Medicare FFS revenues as an initial, but preliminary proxy for both expenses incurred and revenues lost, and as a way to use existing mechanisms (i.e., existing Medicare enrollment and payment pathways) to distribute money quickly and efficiently.

As HHS prepares to distribute the remaining $70 billion, it remains unclear whether the agency will adhere to formulaic distributions, e.g., flat sums using Medicare Advantage and Medicaid enrollment or revenue, or shift to an application process that requires greater documentation of incurred expenses and losses. There are pros and cons to both strategies. Formulaic distributions tend to be faster, but can leave certain cohorts behind. An application process may be more accurate, but is also time-consuming and potentially burdensome for both the applicant and the reviewer.

It is also reasonable to conclude that HHS will account for the funds already distributed as it prepares to make future distributions. In this way, providers with lower Medicare FFS – e.g., because they have high Medicaid or Medicare Advantage penetration or treat fundamentally different patient populations, like children’s hospitals – should begin to feel better compensated, and may receive a bigger share of the next tranche than those who received payments in the April 10th distribution.

The avenues for immediate financial relief for physicians and hospitals have been somewhat limited, mostly focused on distribution of these funds, the Accelerated and Advance Payments Program (which allows Part A and B providers and suppliers to receive pre-payment of Medicare claims), and to some degree the Paycheck Protection Program. We expect that Congress will come together to provide additional relief to bolster the health care industry in the future, including potentially adding to the $100 billion fund or forgiving repayment or lowering interest under the Accelerated and Advanced Payment Program. Those who need additional immediate relief should continue to communicate their unmet needs to Congress and the Trump Administration.

[1] Providers that normally receive a paper check for reimbursement from the Centers for Medicare & Medicaid Services will receive a paper check in the mail within the next few weeks.

[2] These funding streams include the Coronavirus Aid, Relief, and Economics Security Act (P.L. 116-136), the Coronavirus Preparedness and Response Supplemental Appropriations Act (P.L. 116-123), the Families First Coronavirus Response Act (P.L. 116-127), or any other act primarily making appropriations for the COVID-19 response and related activities.

For more analysis on Covid-19 from McDermottPlus, please click here.

/>i

/>i