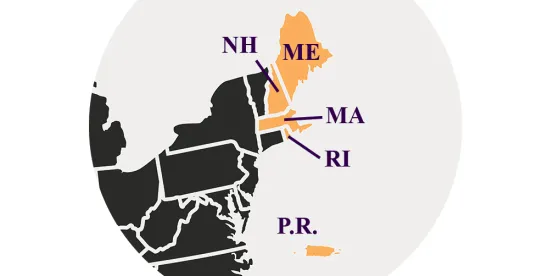

The U.S Court of Appeals for the First Circuit (covering Maine, Massachusetts, New Hampshire, Puerto Rico, and Rhode Island) recently awarded a victory to employers litigating claims “related to” certain employer-sponsored benefit plans.

On June 16, 2025, the court affirmed an award of summary judgment in favor of Santander Bank N.A. (“Santander”) in Orabona vs. Santander Bank, N.A., an action brought by a former employee who alleged the company terminated her employment in an effort to avoid paying her severance benefits. In rendering its decision, the First Circuit reaffirmed that employees cannot assert state law claims against employers if the resolution of such claims requires the analysis or interpretation of an Employee Retirement Income Security Act (ERISA) plan. The court reasoned that because Congress has promulgated federal laws governing the legal standards and enforcement remedies for disputes concerning ERISA benefits, any state law claim related to such benefits is “preempted,” i.e., superseded, by federal law, and therefore nonviable.

I. Background

Plaintiff Lorna Orabona began working as a high-earning mortgage development officer for Santander’s predecessor in 2008. In 2022, the company terminated her employment “for cause” after it determined that she had sent company emails to her private email address in violation of Santander’s Code of Conduct. Around the time of Orabona’s termination, Santander also instituted a large-scale national layoff — which Orabona was not a part of. The “for cause” nature of Orabona’s termination rendered her ineligible for severance benefits under the company’s ERISA Severance Policy.

Though the Severance Policy included a mandatory administrative grievance procedure, Orabona did not take any steps to appeal her termination or apply for benefits. Instead, she brought various state law claims, including wrongful termination, against Santander which were premised upon the allegation that Santander terminated her employment to avoid paying her severance benefits. Orabona claimed that her failure to appeal her termination or apply for benefits was caused by her reliance on certain statements by Santander to the effect that the company would report her to the licensing board if she attempted to do so.

II. The First Circuit’s Decision

On appeal, the First Circuit Court of Appeals affirmed the District Court’s finding in favor of Santander, agreeing with the lower court that all of Orabona’s claims were preempted by section 514(a) of ERISA. ERISA, the federal law that sets minimum legal standards for most voluntarily established retirement and health plans in the private sector, provides that the federal statute “shall supersede any and all State laws insofar as they may now or hereafter relate to any” ERISA plan. A claim “relates to” an ERISA plan when a court must evaluate or interpret the terms of the plan to determine liability. The Supreme Court, the First Circuit Court of Appeals, and other federal courts of appeals have concluded that state law claims “relate to” ERISA where the employer is alleged to have taken actions to prevent the employee from receiving ERISA plan benefits.

Because determination of both liability and damages in this matter would require the review of the Severance Policy, each of Orabona’s claims “relate[d] to” the Severance Policy such that they were superseded by federal law. In particular, reference to the ERISA plan would be necessary to determine, among other things, whether:

- Orabona was ineligible for benefits because of the grounds Santander gave for her termination;

- Orabona violated the Code of Conduct; and

- Orabona would have been eligible for benefits had her employment been terminated as part of the national layoff rather than for cause.

The court further concluded that Orabona’s claims seeking recovery of damages were separately preempted by the civil enforcement provision of ERISA. In so doing, the court categorized Orabona’s assertion that her failure to exhaust the remedies set forth in the Severance Policy was caused by Santander’s misrepresentations as an “attempt[ed]… end run around ERISA” and rejected her effort to escape ERISA’s “exclusive cause of action.” The fact that Orabona sought remedies, including punitive damages, beyond the scope of the statute did not save her claims. Rather, the court explained, the issue of punitive damages actually supported a finding of preemption to achieve Congress’ intent to make the ERISA civil enforcement mechanism the exclusive remedy for such claims.

The decision serves as a reminder to employers to review their employer-sponsored benefit plans for compliance with federal law and to beware of ERISA considerations when deciding whether a particular employment termination is in the context of a severance-triggering layoff. Given the complexity of the ERISA statutory scheme, employers are encouraged to consult with legal counsel for guidance in such matters.

/>i

/>i