To ascertain which party in a commercial contract is responsible for tariffs, it is important to check whether the contract specifies the importer of record.

Importer of Record Responsibilities

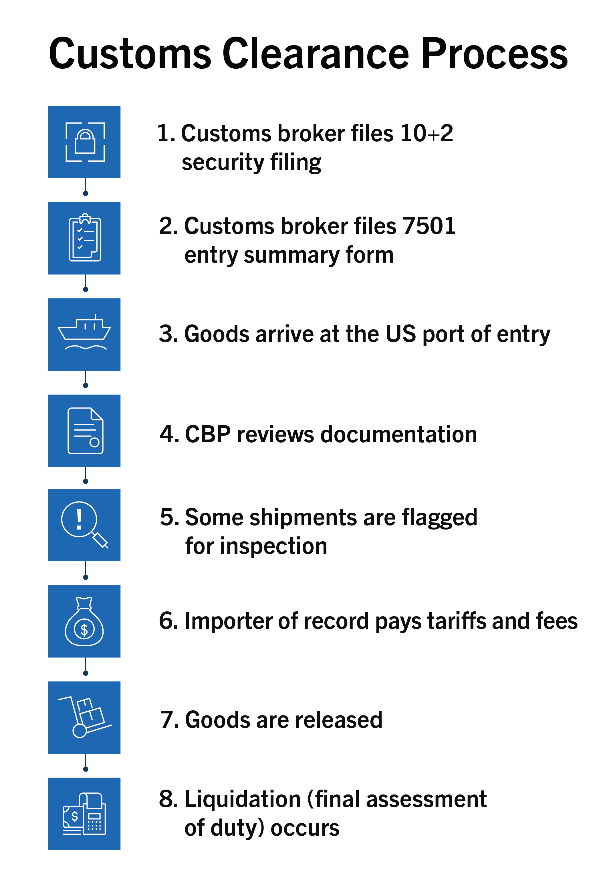

The importer of record is the party that ensures that imported goods comply with all customs and legal requirements of the importing country. US Customs and Border Protection (“CPB”) requires that the importer of record handle a number of tasks related to customs clearance, including paying the applicable duties, taxes, tariffs, and fees and ensuring the accuracy of all information submitted to Customs. The importer of record is required to use reasonable care in the discharge of all import matters, including ascertaining all elements needed to pay the correct amount of the tariff.

Contractually Identifying the Importer of Record

Because CPB permits the importer of record to be the owner, purchaser, or consignee of the imported goods, or alternatively, a licensed customs broker or third-party logistics provider acting on their behalf, the parties to a contract can decide which party should take on the role of importer of record. For clarity, the parties may indicate in their contract whether the buyer or the supplier is the importer of record for all sales of product under the agreement. Often, the role of importer of record is assigned through the choice of the relevant Incoterm.

Tariff Reimbursement Clauses

That said, regardless of who is importer of record, the parties may include language in the contract in which the importer of record is reimbursed by the other party for tariffs or to share responsibility for the tariffs. The sole exception to a contractual reimbursement strategy for tariffs is if the tariff is an antidumping duty (a protectionist tariff that is intended to offset the value of selling a product in the U.S. at a price below “normal value”)[1]. Importers are required to certify to Customs that they have not entered into any agreement for the reimbursement of antidumping duties, meaning that any contractual reimbursement provision should carve out antidumping duties.

Read Part 1 and Part 2

[1] “Antidumping and Countervailing Duties (AD/CVD) Frequently Asked Questions.” U.S. Customs and Border Protection, U.S. Department of Homeland Security, 21 Jan. 2025, https://www.cbp.gov/trade/priority-issues/adcvd/antidumping-and-countervailing-duties-adcvd-frequently-asked-questions.

/>i

/>i