A drastic reduction in greenhouse gas (GHG) emissions is required to limit global warming. Transport is the largest contributor to UK domestic GHG emissions (27% in 2019, equivalent to 122 mega tonnes of carbon dioxide). The UK has implemented ambitious legislation requiring that UK’s GHG emissions be net zero by 2050. An equally ambitious roadmap has been set out in respect of decarbonising transport with the sale of new petrol and diesel cars and vans now scheduled to end by 2030 and all new cars and vans to be fully zero emission at the tailpipe by 2035. The UK Government has also launched consultations on the phase-out of new internal combustion engines (ICE) in heavy-goods vehicles and ending the sale of new ICE buses in England.

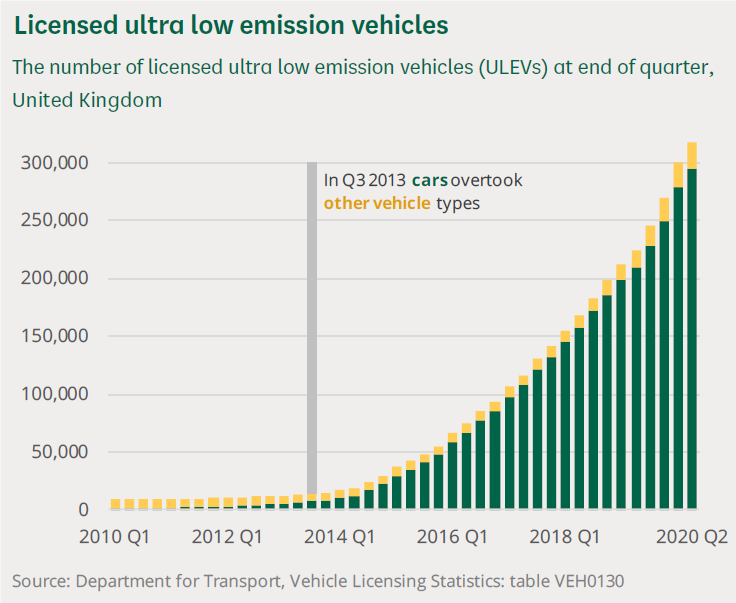

The introduction of electric vehicles (EVs), which are included in the category of ultra-low emission vehicles (ULEVs)) is a key aspect of the UK Government’s strategy in reducing transport related GHG emissions. An EV runs, partially or wholly, on electricity, whether stored on board the vehicle in batteries (a battery EV, or BEV) or produced from hydrogen (a fuel-cell EV, or FCEV). EVs accounted for 1.1% of all licensed vehicles at the end of 2020. While the current number of EVs is small, the growth rate over the last decade has been dramatic (an increase of 4,799% since 2010). 2020 saw the biggest annual increase in the number of registrations with more than 175,000 electric vehicles registered, representing a growth of 66% on 2019 (data source: Electric Vehicle Market Stats). The UK’s Committee for Climate Change (CCC) suggests that all new vehicles should be EVs by 2035 at the latest (and ideally by 2030) if the 2050 net zero target is to be achieved.

Even with the organic increase in the purchasing of EVs, additional legislation may be required to further encourage uptake. One such strategy is to implement Zero Emission Vehicle (ZEV) legislation that requires vehicle manufacturers to sell a minimum number of EVs as a proportion of overall sales. This proportion is increased over time until it reaches 100%. The legislation could be applied to both commercial and private vehicles along with any grants or subsidies that may be available to the purchasers of the vehicles. Such schemes have been implemented in the United States, China, and Canada. In the UK, targets for manufacturers to produce a growing proportion of ZEVs will be introduced from 2024. The exact UK targets have not yet been set and are expected to be set out for consultation in early 2022.

Recharging Infrastructure for BEVs

Recharging the battery of a BEV takes significantly longer than refueling an ICE vehicle. While the exact time for recharging is dependent on various factors (e.g., battery size and charge power), rapid chargers can provide approximately 80% of total charge capacity in 30-40 minutes, and home-charging systems normally provide a full charge within 6-12 hours.

The length of time it takes to charge a BEV is offset by the fact that BEV range has significantly increased to meet the needs of most users. This fits with the UK Government strategy of most charging being undertaken at home for public owned BEVs. However, range anxiety continues to be a major reason given for not purchasing a BEV, as:

(a) BEV range does not meet the needs of all users; and

(b) a significant number of homes do not have off-street parking (estimated at approximately 30% of homes), so the current strategy is not suitable for the occupiers of these homes.

The continued improvement of battery technology will go some way in alleviating range anxiety. However, the availability of public rapid chargers will also need to be increased. There is no certainty as to how many chargepoints are needed in the UK (e.g., at home, on the road network, in streetlamps, etc.). As of March 2020, there were 11,293 public charging points in Great Britain (ZapMap). The CCC’s analysis anticipates that by 2030, over 27,000 public chargers will be needed. What is certain is that without sufficient chargepoints, the uptake of EV ownership (from both a commercial and private perspective) will not meet UK Government targets.

The recharging infrastructure requirements in relation to public transport EVs and commercial EVs are likely to require tailored recharging infrastructure solutions that satisfy the demands of these vehicles. Most charging in relation to these vehicles likely will be undertaken at specific locations. For example, bus fleets are likely to be charged (or potentially have fast swap of batteries) at depots while commercial fleet vehicles may have central hubs for charging. A recent development by BP Pulse (BP’s EV charging initiative) is the first dedicated rapid charging hub for fleet vehicles which is intended to service multiple fleet customers. We may see more of these hubs as the demand from fleet EVs increases. Therefore, the absence of a developed public chargepoint infrastructure is not as much of a hindrance to the migration of public transport and commercial fleets to EVs. However, public chargepoint infrastructure may still be useful for public transport and commercial EVs where top-up charging may be required to extend operational range.

Private Sector Investment

The UK Government’s current policy in implementing the chargepoint infrastructure is “to encourage and leverage private sector investment to build and operate a self-sustaining public network supported by the right policy framework”.1 With the UK Government advocating the involvement of private financing, there are opportunities for investment in both the public chargepoint infrastructure and bespoke solutions for commercial fleets.

In order to take advantage of the opportunities available in investing in EV charging infrastructure, investors will need to consider the following:

1. Identifying Suitable Real Estate:

a. For public chargepoint infrastructure, investors will be looking for potential sites that will benefit from the maximum amount of EV traffic and ideally locations where vehicles are left for a period of time (at least 40 minutes). Given that the prime accessible sites will be in or close to urban environments and/or near busy roads and interchanges, it is likely that the land will already be in use (e.g., filling stations, motorway service stations, car parks including park & ride, supermarkets, railway stations, offices, shopping centres, etc.) and that the recharging infrastructure will need to be co-located on the site currently in use. Once a potential site has been identified, investors will need to consider:

i. whether the land is to be purchased or leased;

ii. any restrictions relating to the land, planning permissions or other consents required, particularly where batteries or solar panels are to be co-located and/or where there will be a significant increase in volume of traffic;

iii. access to adjoining land in relation to public access to the chargepoints and also for the grid connection and maintenance of cable routes;

iv. any environmental implications (especially relevant for sites located on filling stations); and

v. adequate insurance cover.

b. For public transport operators and commercial fleet vehicles, all of the above considerations continue to be relevant along with:

i. whether the chargepoints will be accessible to users other than the primary operator. Depending on the extent of the access for other users, there may be additional revenue streams available to the investor; and

ii. whether the infrastructure is being provided alongside other EV services to the transport or commercial fleet operator (e.g., Battery-as-a-service or “BaaS” – see September 2021 GT Alert). If so, there may be incentives for the investor to subsidise or fund entirely the installation of the charging infrastructure as part of the wider commercial package.

2. Initial Investment Amount:

Investing in the implementation of public or commercial chargepoints requires a large initial outlay before any tangible returns can be achieved. This is a significant barrier to entry for some investors who would find it challenging carrying the financing costs for an extended period. Potential avenues for reducing the initial outlay could include investigating opportunities to:

a. utilise UK Government support. As part of the November 2020 Spending Review, the UK Government announced it would provide £950 million to support the rollout of rapid EV charging hubs at every station on England’s motorways and major A-roads;

b. work with local authorities. Coventry and Oxford will potentially benefit from up to £50 million under the All-Electric Bus Town or City competition. In addition, the Zero Emission Bus Regional Areas scheme has been launched by the DfT, which will provide up to £120 million for local transport authorities to support the introduction of up to 500 zero-emission buses and associated infrastructure; and

c. utilise tax incentives and capital allowances such as the accelerated allowances announced earlier this year and available until Spring 2023.

3. Investment at Scale:

Given the initial investment required to develop recharging infrastructure, there is little incentive for investors in developing single sites on an ad-hoc basis. Investors will need to investigate whether there are opportunities to:

a. acquire a suitable portfolio of sites (potentially from large scale providers of filling stations, motorway service stations, car parks including park & ride, supermarkets, stations, offices, etc.);

b. work with residential and commercial property developers. The UK Government has already consulted on whether there should be a requirement under Building Regulations for developers of both residential and commercial property to provide EV chargepoints. However, it is not feasible to install chargepoints at or within the vicinity of many existing residential and commercial properties. Therefore, some form of hub charging solution may continue to be the main charging option for EV owners. Investors should consider whether additional revenue streams could be obtained from hub locations by providing other services to customers (e.g., partnering with logistics providers to allow the collection and return of deliveries); and

c. identifying public transport operators and commercial fleet providers actively seeking to replace their fleets with EVs.

4. Recharging Technology:

EV technology is advancing, and obsolescence of the technology is a risk. From a mitigation perspective:

a. there does appear to be movement towards the adoption of a common standard, the “Combined Charging System (CCS)”;

b. from a legislative perspective, the Alternative Fuel Infrastructure Regulations 2017 seek to further standardise the charging infrastructure by providing that all publicly accessible chargepoints installed since 17 November 2017 must offer a “Type 2” recharging connector (the Type 2 recharging connector utilises CCS); and

c. while not applicable to public chargepoints, the installation of charging infrastructure at a transport or commercial fleet operator’s site may be undertaken as a package that includes the financing of the infrastructure, vehicles and batteries. The linking of the charging technology with the transport solution provides the transport or commercial fleet with an incentive to continue to use the charging technology during the operational life of the vehicles.

Conclusion

A significant amount of EV charging infrastructure is required if the UK is to achieve the target of the UK’s GHG emissions being net zero by 2050. While there has been a substantial increase in the number of chargepoints available, there needs to be a dramatic step change to achieve UK Government targets. The complexity of investing in charging infrastructure may challenge some investors in getting approval to invest from their credit committees. However, for investors who have the fortitude to tackle the current high barriers to entry and are equipped with the appropriate teams of advisors, there are potential long-term rewards for establishing an early lead in this market.

1 Baroness Vere of Norbiton, PQ HL15730 [Electric Vehicles] 29 May 2019

/>i

/>i