On April 9, 2020, the Board of Governors of the Federal Reserve System released term sheets outlining two new lending programs under the CARES Act: (1) the Main Street New Loan Facility, and (2) the Main Street Expanded Loan Facility.

These programs are aimed at paving the way for increased lending to small and medium-sized businesses impacted by COVID-19. Under these facilities, a Federal Reserve Bank will commit to lend to SPVs, who in turn will purchase 95% participations in certain eligible loans made by U.S. banks and savings and loan institutions. Eligible lenders would hold 5% of each eligible loan. The combined size of the facilities will be up to $600 billion.

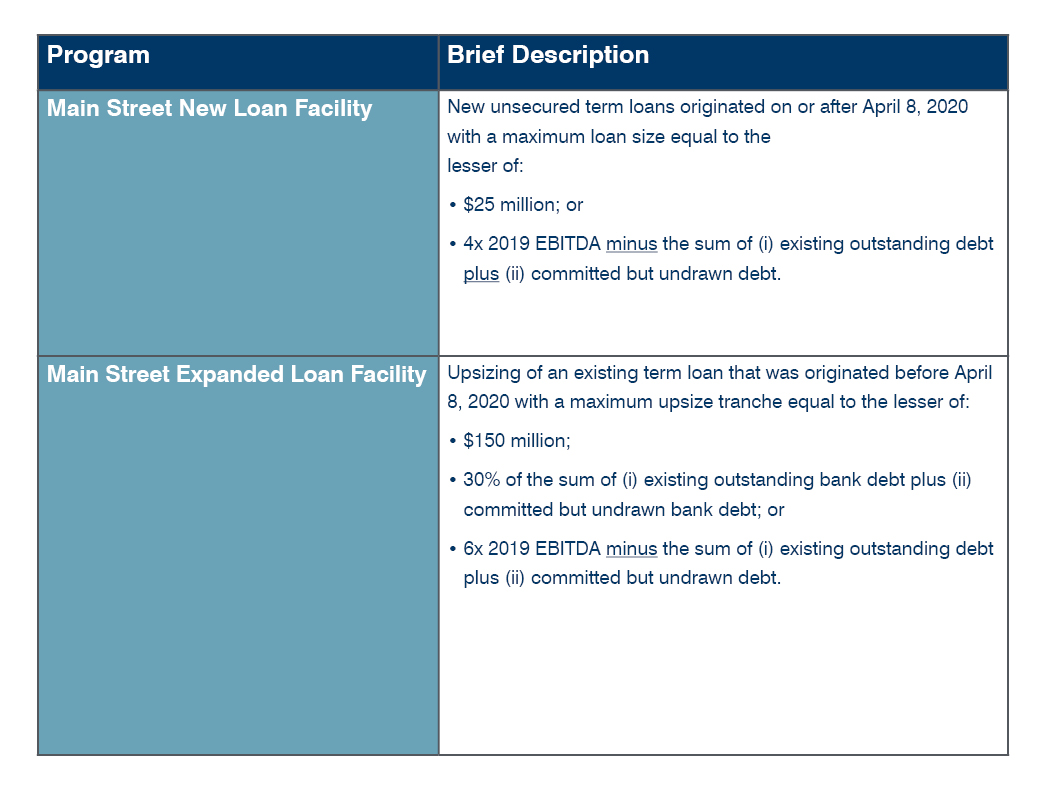

This summary briefly describes the lending programs, and compares and details them in an easy-to-digest chart. We note that adjustments to these programs may be made in the future.

Please click the image below for an in-depth look at the loan facilities.

/>i

/>i