Earlier this week, I wrote about a recent article by Professor Douglas K. Moll that argues that treating contractual disclaimers of partnership as dispositive is inconsistent with modern statutes, including the Revised Uniform Partnership Act. Among other things, Professor Moll points to Section 202(a) of RUPA which indicates that “the association of two or more persons to carry on as co-owners a business for profit forms a partnership, whether or not the persons intend to form a partnership.” California has adopted this language as Corporations Code Section 16202(a).

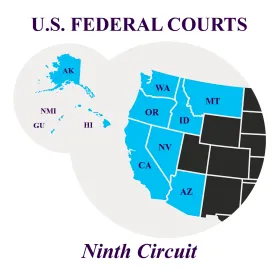

If intent to form a partnership is not determinative, then the converse would also seem to be true. The parties' intent to form some other type of relationship will not negate the formation of a partnership. However, the Ninth Circuit Court of Appeals recently espoused a different view. U.S. Sec. & Exch. Comm'n v. Murphy, 2022 WL 4866712 (9th Cir. Oct. 4, 2022). The case involved an enforcement action by the Securities and Exchange Commission alleging that the defendants were unregistered brokers. The defendants argued, among other things, that they traded in "partnership" and thus were not trading for another. Under the Securities Exchange Act of 1934, 15 U.S.C. § 78c(a)(4)(A), a broker is anyone who trades securities for the account of other. By claiming that a partnership existed, the defendants were essentially arguing that there was no trading for no "other".

The Court of Appeals failed to prove their claim:

They claim that a partnership is presumed because they shared profits and losses with Riccardi. See Cal. Corp. Code § 16202(c)(3)(B). But Appellants neglect an important qualification: profit sharing creates a partnership presumption unless “profits were received . . . [in] payment for services as an independent contractor.” Id. (emphasis added). When the Murphys were first deposed by the SEC in 2016, they testified that they were “independent contracto[rs]” for RMR. (Jocelyn: “I'm an independent contractor . . . [f]or RMR Group.”); (Sean states three times: “I'm an independent contractor for RMR.”). And in Gounaud's response to an SEC questionnaire, he claimed to be self-employed and “associated with Ralph Riccardi,” but did not claim to be in a partnership.

In effect, the Court is saying that intent matters when negating the formation of a partnership.

/>i

/>i