New class action and California Private Attorneys General Act (PAGA) filings have grown exponentially in recent years and reached record numbers in 2023. This trend is raising concerns for California employers as the state courts have expanded liability risks for more claims and further restricted the applicability of arbitration agreements to PAGA claims.

Quick Hits

- Tracking data of class and PAGA notice filings shows that the number of cases has risen rapidly in recent years with an increase since the pandemic.

- The increasing number of cases could be spurred by several factors, including recent California high court decisions that have expanded liability risks for several types of claims against employers for often technical labor law violations.

No Signs of Slowing Down

According to data tracking new class and PAGA notice filings compiled by Ogletree Deakins, the number of claims filed has increased since the COVID-19 pandemic with no end in sight as the California courts have not curtailed PAGA and have opened the door for class claims against employers for more reasons.

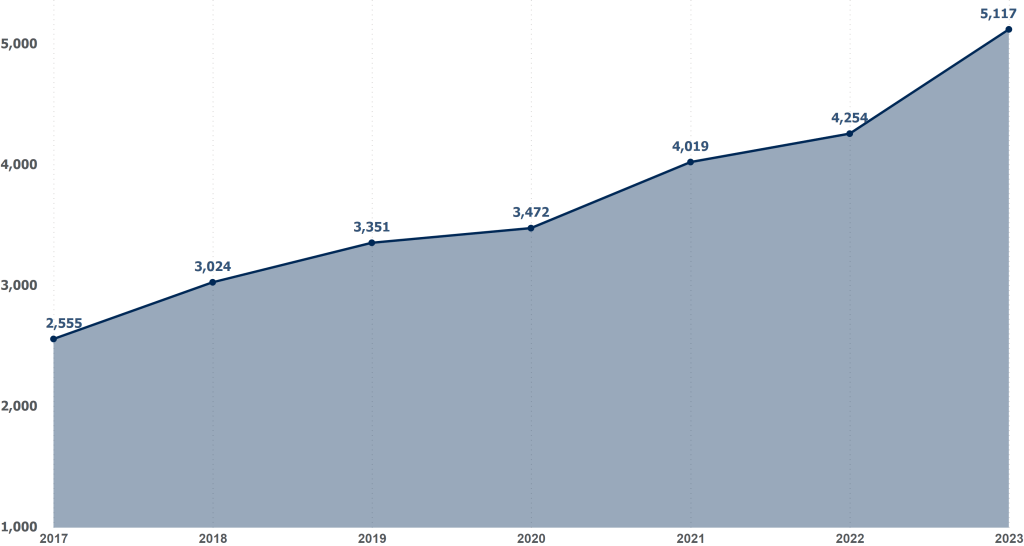

In particular, class action filings in California have steadily increased each year going back through 2017 with a staggering increase in the number of filings in 2023. According to the data, through the end of 2023, there have been more than 5,000 employment class action filings, marking a 20 percent increase from the total number of filings in 2022 and more than doubling of the number of filings in 2017. The year 2023 also set a new high-water mark in class action employment filings in California.

Further, while the data indicates that class action filings shot up during the pandemic, there has been no slowing down since the loosening of pandemic-related restrictions. To the contrary, the number of class action filings per year has skyrocketed 47 percent over the past three years from 2020 to 2023.

Class Action Filings per Year

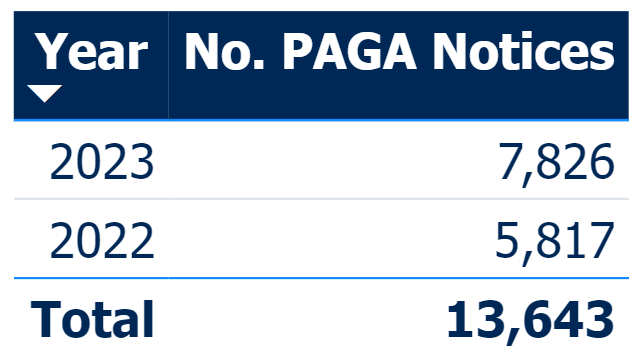

The data for PAGA notices filed with the California Labor and Workforce Development Agency (LWDA) show an even more significant uptick in 2023 compared to the prior year. More than 2,000 more PAGA notices were filed in 2023 compared to 2022.

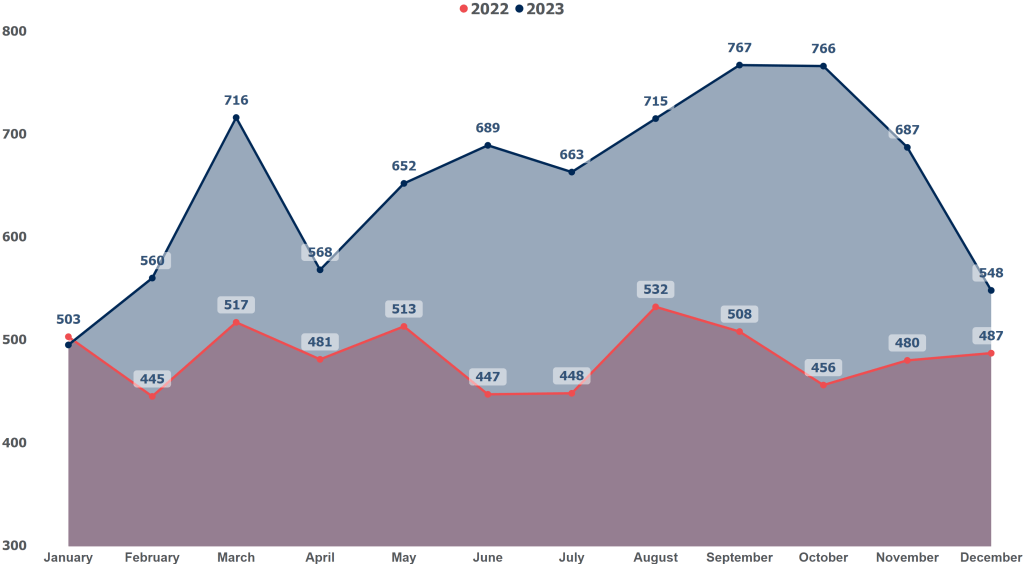

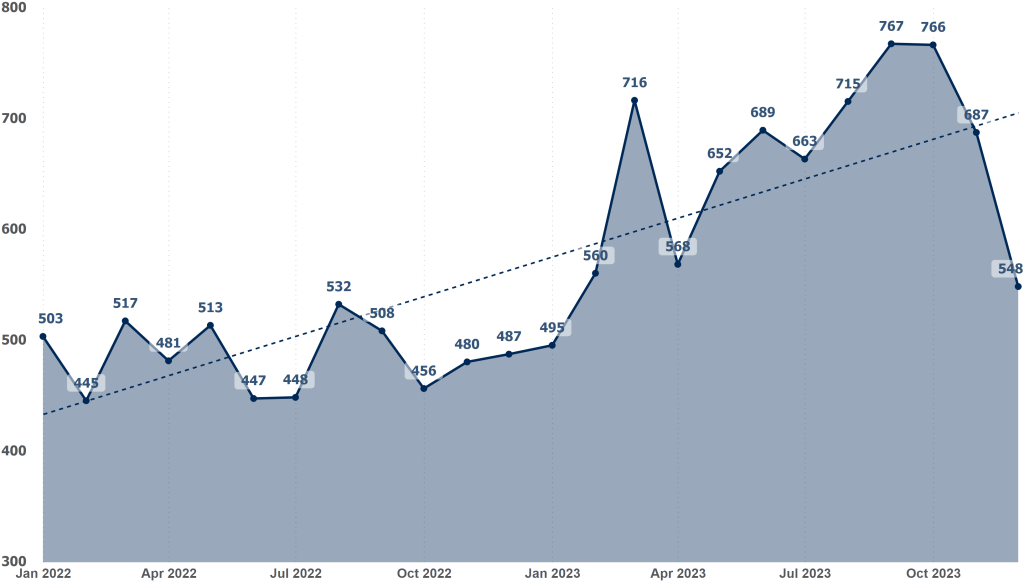

Further, whereas the data for 2022 showed an overall flat trend in PAGA notices (averaging 480 filings per month), the data for 2023 shows a steady rise in the number of notices per month over the course of the year (growing from 495 total filings in January 2023 to 766 total filings as in October), with only a slight drop at the end of the year in December.

PAGA Notices per Month

PAGA Notices per Month 2022-2023

Possible Reasons

There are multiple potential reasons for the increase in class action and PAGA notice filings in California. First, the Supreme Court of California has issued several decisions in recent years favorable to employee plaintiffs, opening the door for more claims against employers.

These decisions include the following rulings.

- Meal and rest break premiums are now designated as “wages” that implicate related wage statement and final pay penalties.

- Meal period time records may not be rounded and timekeeping discrepancies (showing meal periods as short, late, or missed) are presumed to be violations.

- Meal and rest break premium wages must be paid at the employee’s “regular rate of pay” as opposed to the employee’s base hourly rate of pay.

- Flat sum bonuses must be calculated differently under California law from the federal Fair Labor Standards Act (FLSA).

Moreover, on the arbitration front, the California Supreme Court in July 2023 ruled that PAGA plaintiffs do not lack standing to pursue representative claims even when the individual claim is compelled to arbitration, departing from a finding by the Supreme Court of the United States issued a year prior. The ruling permits collective PAGA actions to survive even if a plaintiff’s individual claims are compelled to arbitration.

Additionally, more plaintiffs’ law firms appear to be entering the California wage and hour class action and PAGA space, resulting in the generation of a larger volume of claims. It appears the paradigm of bringing a smaller volume of cases against “big” deep-pocketed defendants has shifted to a strategy of bringing a higher volume of cases against medium- and even smaller-sized businesses in the state.

Changes on the Way

The rise in class action and PAGA filings could have significant implications for California employers, increasing the risk of liability and potentially costly litigation. Particularly, PAGA enables one disgruntled employee to bring claims on behalf of all employees at the business often for technical violations of California’s extensively detailed labor code.

That being said, there is some good news for employers and businesses in California. First, while PAGA plaintiffs may have standing to pursue collective claims even if their individual claims are covered by arbitration agreements, the California high court noted that trial courts may stay those nonindividual claims pending the outcome for the individual arbitration, which still may impact whether standing exists to pursue nonindividual claims.

Second, California voters will consider a ballot measure in November 2024 to enact the California Fair Pay and Employer Accountability Act (FPEAA), which would repeal PAGA and replace it with increased enforcement tools for the LWDA. If enacted, the FPEAA would take enforcement of the labor code out of the hands of private plaintiffs’ attorneys and remove the threat of attorneys’ fees as an incentive for filing claims.

Next Steps

Employers in California may want to take notice of the increasing number of class and PAGA notice filings and the recent decisions by the California Supreme Court providing increased liability risks for California employers. It will be interesting to see how California voters respond to the FPEAA.

In the meantime, employers may want to consider reviewing the language of their arbitration agreements as to the scope of the class action and PAGA collective action waivers in light of the evolving legal landscape and rise in class and PAGA action filings. Employers may also want to consider an audit of their wage and hour practices, especially those practices that are the primary targets of class and PAGA litigation.

/>i

/>i