The U.S. Congress has passed legislation requiring companies that utilize “conflict minerals” to conduct due diligence and demonstrate that their products are not fuelling conflict in the Democratic Republic of the Congo (“DRC”). The legislation was added as an amendment to the Wall Street Reform and Consumer Protection Act, which was sponsored by Senator Christopher Dodd (D-CT) and Representative Barney Frank (D-MA), and voted into law on July 15, 2010.

The conflict minerals legislation is intended to address the ongoing conflict in the eastern DRC. The premise of the bill is that the sale of certain minerals are helping armed groups continue to buy weapons and fund their fighting. These minerals are frequently referred to as “conflict minerals,” and are comprised of tantalum (coltan), cassiterite (tin), wolframite (tungsten), and gold. These minerals are commonly utilized in a variety of commercial products, such as automobiles, cellular phones, and airplane engines. The legislation therefore affects a large spectrum of industries, including technology, automotive, mining, jewelry, and aerospace.

The aim of the legislation is not to ban the use of these minerals if they originate from the DRC, but rather to ensure that the minerals do not come from conflict areas of the DRC or otherwise help fund the conflict. To this end, the legislation requires annual disclosure to the Securities and Exchange Commission (“SEC”) regarding whether potential conflict minerals originated in the DRC or an adjoining country. If the minerals originated in these countries, companies must report on the due diligence measures that they utilize to identify the source and chain of custody. These measures are expected to include an audit by an independent professional audit company.

In the SEC report, companies also must submit a description of products that they manufacture that are not DRC conflict-free. Products are conflict-free if they do not contain minerals that directly or indirectly finance or benefit armed groups in the DRC or an adjoining country. Products are considered to benefit such groups if they come from areas where armed groups physically control mines or force civilians to mine, transport, or sell conflict minerals; tax, extort, or control any part of trade routes for the minerals up to the point of export; or tax, extort, or control trading facilities, in whole or in part.

The Department of Commerce can designate specific independent private sector auditors and due diligence processes as “unreliable.” If, in its reporting, an entity relies on a determination of an independent private sector audit or other due diligence process that is deemed unreliable, the report does not satisfy the SEC reporting requirement. Therefore, it is particularly important that due diligence processes are robust.

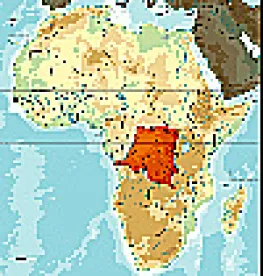

The U.S. State Department is required by the legislation to develop a conflict map that is to be updated every 180 days, and the State Department has already developed the first such map. The legislation does not specify whether companies can simply rely on the map to demonstrate that their products come from conflict-free areas. Companies should, therefore, consider how they will demonstrate that they conducted due diligence to ensure that the mines from which their minerals emanate, as well as the routes and trading depots through which the minerals travel, are conflict-free. For end-user companies, this will mean ensuring, at a minimum, that smelters have robust due diligence processes on the ground, and obtaining an independent audit of those due diligence processes.

/>i

/>i