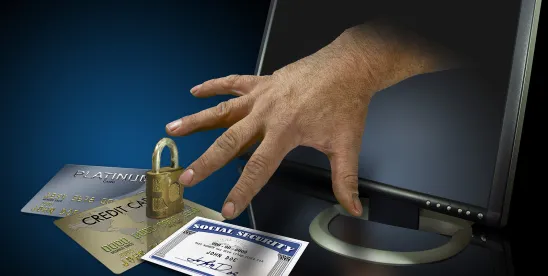

The CFPB is extending the comment periods for two proposed rulemakings under Regulation V, which implements the Fair Credit Reporting Act (FCRA). On March 5, the Bureau extended the comment period for its proposed rule on data brokers and consumer reports. Similarly, on March 7, the CFPB announced an extension for its Advance Notice of Proposed Rulemaking (ANPR) on identity theft and coerced debt.

The CFPB’s proposed rule on data brokers and consumer reports aims to clarify when data brokers qualify as “consumer reporting agencies” under the FCRA (previously discussed here). This rulemaking is intended to enhance consumer privacy protections and limit the use of consumer data without appropriate oversight. The Bureau is seeking feedback on:

- Defining consumer reporting agency coverage. The rule would establish clearer criteria for when data brokers meet the definition of a consumer reporting agency, making them subject to FCRA requirements.

- Restricting report access. The proposal seeks to regulate when consumer reporting agencies may furnish reports and when users may obtain them, aiming to prevent misuse of consumer information.

- Assessing compliance impact. Given the potential expansion of FCRA oversight, affected businesses are encouraged to assess the operational and compliance implications of these changes.

Comments are now due on April 2, 2025.

The CFPB’s proposed rule on identity theft and coerced debt (previously discussed here) seeks to clarify how these issues are defined under Regulation V. The Bureau is particularly focused on ensuring that consumers who have been forced into debt through fraud or abuse are not unfairly burdened in the credit reporting system. Key areas of interest include:

- Amending definitions. The CFPB is exploring revisions to the definitions of “identity theft” and “identity theft report” under Regulation V to better capture coerced debt situations.

- Consumer reporting implications. The rulemaking seeks input on how coerced debt is reported to consumer reporting agencies and whether additional safeguards are needed.

- Stakeholder participation. The extended comment period gives financial institutions, consumer advocates, and industry participants more time to provide input on potential regulatory changes.

Comments on this rule are now due by April 7, 2025.

Putting It Into Practice: The CFPB’s decision to extend both comment periods may provide insight into the new administration’s regulatory priorities, particularly in the consumer reporting space. The extensions suggest that the Bureau is taking a deliberate approach to gathering stakeholder input and is not doing away with rulemaking altogether. It will be interesting to see what Chopra-era rulemaking survives this new CFPB.

/>i

/>i