As expected, this week, the Biden administration has formally withdrawn a Trump administration rule that was set to change the standard applicable to independent contractors. Whether a worker is an independent contractor or an employee has long been determined by the “economic realities” of the relationship. Several factors are considered in this analysis: the nature and degree of the employer’s control and the permanency of the worker’s relationship with the employer; the worker’s investment in facilities, equipment or helpers; the amount of skill; the worker’s opportunities for profit or loss; the extent of the integration of the worker’s services into the employer’s business.

The Trump administration’s proposed rule would have elevated two of the factors of the “economic realities” above the others by deeming the nature and degree of the worker’s control over the work and the worker’s opportunity for profit or loss as “probative.” This would have been a marked departure from past practice as previously, none of the factors were dispositive or more probative. The Biden administration’s Department of Labor noted that the Trump administration rule had not been used by any court or any wage and hour agency. The Department further questioned whether the rule was fully aligned with the Fair Labor Standards Act’s text and purpose or case law describing the economic realities test.

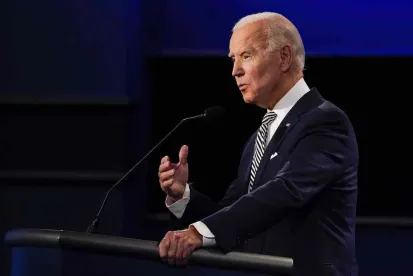

In withdrawing the rule promulgated under the Trump administration, the Department of Labor specifically said it “is not creating a new test, but is instead leaving in place the current economic realities test, which allows for determinations that some workers are independent contractors.” While not issuing a new test in this repeal, it is widely expected that the Biden Administration will eventually issue a new rule for evaluating independent contractor status. Secretary of Labor Marty Walsh recently has gone as far as to say “in a lot of cases, gig workers should be classified as employees.”

Employers should continue to be cognizant of and comply with any applicable state and local laws regarding worker classification, which may not be identical to the economic realities test.

/>i

/>i