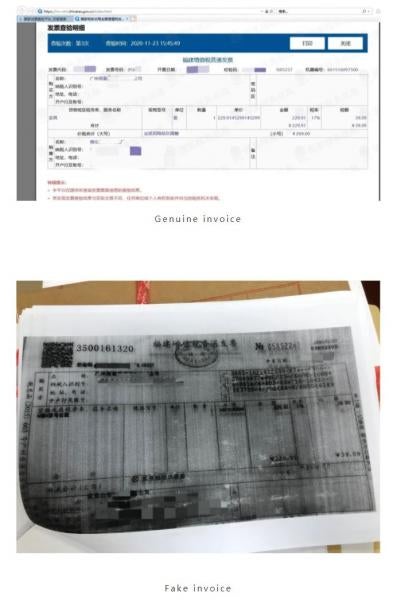

On December 21, 2020, the Beijing Intellectual Property Court announced that on December 18, 2020, the Court ruled in several administrative trademark cases that the trademark registrants forged evidence to prove use in trademark cancellation proceedings. The registrants had provided fake tax invoices to prove use via the sales. However, the tax invoices didn’t match queries with the National Value-Added Tax Invoice Inspection Platform of the State Administration of Taxation. Accordingly, the Court reversed the earlier rulings based on the forged evidence and fined the registrants.

There was a total of eight administrative litigations.

The plaintiff Dongguan Jinji Environmental Technology Co., Ltd. (东莞市金基环保科技有限公司) sued the China National Intellectual Property Administration (CNIPA) and the third party (trademark registrant) Jilin Province Green Forest Environmental Protection Technology Co., Ltd. (吉林省绿森林环保科技有限公司) for trademark cancellation administrative review.

The plaintiff Zhang XX sued the defendant CNIPA and the third party (trademark registrant) Tianjin Zhongying Health Food Co., Ltd. (天津中英保健食品股份有限公司) for trademark cancellation administrative review.

The plaintiff Yao sued the defendant CNIPA and the third party (trademark registrant) Mao (毛) for trademark cancellation administrative review in six cases.

In the above-mentioned eight trademark revocation and review administrative dispute cases, the third parties are the rights holder of the trademark No. 8403409 “Green Forest House”, the trademark No. 8072396 “Yuan Sha”, and the trademark No. 3084001 “Tea Horse Road and Map” .

The above-mentioned trademarks were all subject to cancellation proceedings for non-use for three consecutive years and the CNIPA ruled to maintain the registration of the above-mentioned trademarks. The applicant for revocation was dissatisfied with the above decision and sued the Beijing Intellectual Property Court.

The Beijing Intellectual Property Court found that the invoice evidence submitted during the administrative proceedings were inconsistent with the query results of the National Value-Added Tax Invoice Inspection Platform of the State Administration of Taxation. Specifically, the product name, product brand, seller and taxpayer identification number in the online query do not match the evidence submitted, indicating it was forged.

The Beijing Intellectual Property Court ordered Jilin Green Forest Company, Tianjin Zhongying Company, and Mao to submit the original evidence and explain. None of the above entities gave a reasonable explanation for the “inaccuracy.”

Accordingly, the Beijing Intellectual Property Court determined that the above-mentioned evidence was forged and the registrants could not prove the use of the trademark involved in the case. Therefore, the Court revoked the decision made by the CNIPA to maintain the trademarks. The Beijing Intellectual Property Court fined Jilin Green Forest Company and Tianjin Zhongying 10,000 RMB (~$1,500 USD) each and fined Mao a total of 30,000 RMB.

The Beijing IP Court stated,

In administrative litigation for reexamination of trademark rights, whether trademark rights should be revoked due to non-use for three consecutive years, commercial documents such as invoices issued by tax authorities are the key basis for proving the actual use of trademarks in such cases. The parties that commit fraud in these cases reflects the lack of integrity and indifference to rules, and violates the integrity of the trademark registration and use system. The Beijing Intellectual Property Court has intensified its review of evidence in such cases, and strictly dealt with fraud in accordance with the law, creating an honest trademark registration and use system, and maintained legal dignity and judicial authority.

While this case represents a positive development in the integrity of the trademark system, it would be preferable for CNIPA to verify tax invoice evidence going forward instead of requiring litigants to sue CNIPA for failing to perform a relatively simple query, especially as it is unlikely that such a small fine alone would discourage future forgery.

/>i

/>i