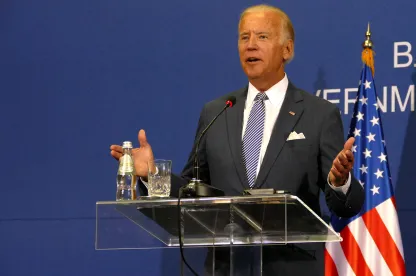

This week, President Biden takes office, making combatting COVID-19 his top priority. Employers are also planning ways to incentivize employee vaccination.

Biden Proposes $1.9 Trillion Spending Package

Last week, President Biden released a wide-ranging plan for combating the next medical and economic stages of the COVID-19 pandemic. His “American Rescue Plan” includes $400 billion for testing and vaccines, direct payments of $1,400 per eligible individual, and a $400/week unemployment benefit supplement extended through September. Congress authorized direct stimulus payments of $600 in December 2020. Biden’s proposal would add to that and increase to $2,000 the total direct financial assistance for eligible individuals. Read about the details of the plan.

Dollar General to Pay Employees to Get Vaccinated

Dollar General announced last week that employees who are vaccinated against COVID-19 will receive four hours of extra pay. With 157,000 employees, the dollar store giant is the first large company to incentivize vaccinations with direct cash payments, and now a number of companies are following suit. Plan your vaccination program and policies.

New EEOC Conciliation Process

The Equal Employment Opportunity Commission (EEOC) aims to settle more cases through conciliation with a new final rule. The rule requires the agency to disclose during presuit settlement talks which violations an employer is alleged to have committed, the legal basis for those allegations, and the rationale behind the dollar amounts the EEOC would accept in settlement.

Other Highlights

“ABC” Test Applies Retroactively in CA

Last week, the California Supreme Court concluded that the “ABC” test for determining independent contractor status that was established in the court’s 2018 Dynamex decision applies retroactively. Read more about what this means for pending lawsuits.

Plan Now for the CPRA’s Enhanced Cybersecurity Safeguards

Compliance with the California Privacy Rights Act’s (CPRA’s) enhanced cybersecurity safeguards will require significant lead time and should include an analysis of supply chain, internal system, and workforce risks to all categories of personal information. Organizations should consider the need for contractual safeguards, as well as determine the cybersecurity safeguards and risk assessment and audit processes that may need to be adopted in light of the CPRA. Learn more.

Employers Can Help Pay Student Loans

The $900 billion stimulus package signed on December 27, 2020, known as the “Heroes Act,” extends student loan assistance under Internal Revenue Code Section 127 for five years. Accordingly, employers may now pay employees up to $5,250 per year towards qualified educational expenses, student loan repayments (both principal and interest), or a combination of both—tax free—until December 31, 2025. Click for more.

Video: YouTube, Vimeo, Instagram.

Podcast: Apple Podcasts, Google Podcasts, Overcast, Spotify, Stitcher.

/>i

/>i