The Coronavirus Aid, Relief and Economic Security Act (CARES Act) signed by President Trump on March 27 is a $2 trillion stimulus package intended to provide financial aid to individuals and businesses negatively impacted by the COVID-19 global pandemic.1

Among many other provisions, the CARES Act provides relief to certain participants in employer-sponsored retirement plans2 in the form of expanded tax-preferred distribution and “re-contribution” rules, enhanced plan loan availability and repayment terms, and the optional waiver of certain required minimum distributions. The CARES Act also aids employers who sponsor retirement plans by delaying the minimum funding contributions for single-employer defined benefit plans until Jan. 1, 2021.

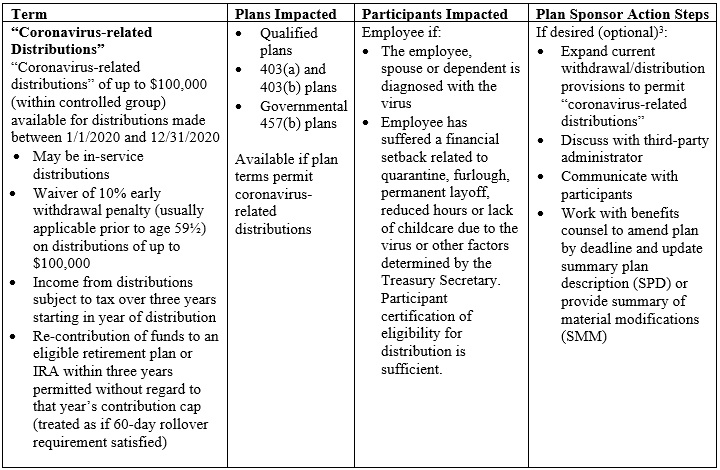

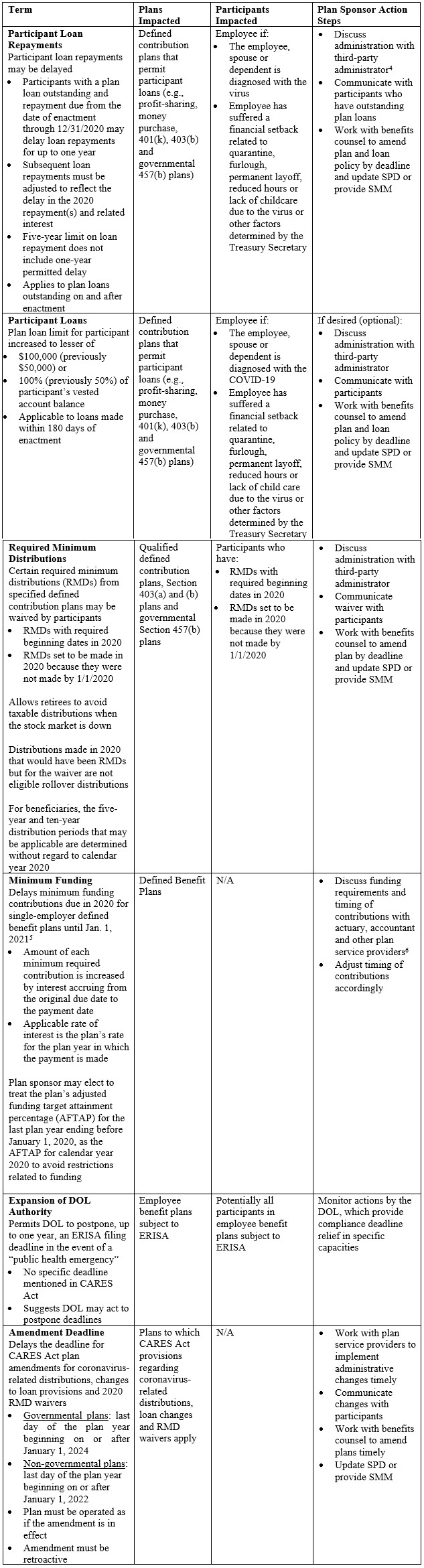

The following chart summarizes key terms of the CARES Act applicable to employer-sponsored retirement plans, identifies the types of plans and participants impacted and includes recommended action steps for plan sponsors.

/>i

/>i