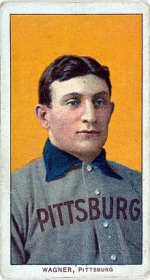

A vintage baseball card of Hall-of-Fame shortstop Honus Wagner reportedly sold for a record $3.25 million last October in the midst of a pandemic-fueled surge in collectibles and memorabilia sales. Produced by American Tobacco Company between 1909 and 1911 as a cigarette box insert, only around 50 copies of the card still exist in the world today as Wagner cut the production of his card short.

Two competing explanations exist of why: Wagner worried about the health of the children purchasing cigarettes to obtain his card or not receiving enough payment for the usage of his name, image and likeness by the tobacco company. Whichever explanation is true, the resulting rarity of this card and Wagner’s talent as a player have perennially made it one of the most valuable in the world. “The Card”, as it is known among collectors, is frequently subject to forgery and manipulation, including a well-publicized case in 2013, where a sports-memorabilia executive pled guilty in federal court to fraud, admitting that he trimmed the sides of a Wagner card to improve its appearance and increase its value.

Source: Wikipedia

In this environment of high prices and cards of dubious authenticity, collectors rely on third-party authentication service providers such as Professional Sports Authenticator, to confirm the provenance of the most valuable cards. Indeed, when it comes to collectible baseball cards, fine artwork or other unique assets, assessing the provenance and authenticity of the asset is paramount. A (relatively) new form of digital asset, the non-fungible token or NFT, promises to better provide proof of authenticity by ensuring that each NFT is uniquely identifiable, through code.

Around the same time as the sale of Wagner’s card last year, the open beta of NBA Top Shot, a digital collectibles marketplace of NFTs was launched by the National Basketball Association. The NBA partnered with a consumer blockchain company, Dapper Labs, to launch Top Shot and it has reportedly produced over $500 million in sales with more than 800,000 accounts.1 Fans may purchase packs of NFTs on the Top Shot website consisting of video highlights of NBA stars that are officially licensed by the NBA. These NFTs may be showcased or re-sold by fans.

Click here to watch video. Source: NBA Top Shot

Although Top Shot and other record setting NFT-sales, such as the $69 million sale by American digital artist Beeple in March 2021, have recently raised public awareness of NFTs to new levels, non-fungible tokens have been around since at least 2017 when Dapper Labs launched Cryptokitties allowing users to purchase, collect, breed and sell, unique virtual kittens on the Ethereum blockchain.

Source: CryptoKitties.co

University Athletes and Universities Are Looking at NFTs For New Revenue Sources

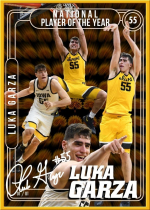

NFTs are drawing the attention of college athletes looking to exercise greater control over the use and commercialization of their own name, image and likeness. In April, University of Iowa senior Luke Garza auctioned off an NFT featuring multiple pictures of himself in action for approximately $41,000 on the NFT marketplace, Opensea. The sale also included a game of HORSE with Garza and other non-token perks. Importantly, the auction occurred after Garza’s four-season college career for which he was named best player in men’s college basketball. This is because until recently, college athletes have not been allowed to receive compensation for the use of their name, image or likeness under existing NCAA rules.2

Source: decrypt.co

Universities are also looking at NFTs as potential revenue sources. Last month, the University of California, Berkeley announced the sale of NFTs of invention disclosures forms filed by the creators of CRISPR and cancer immunology technology.3 It was reported that 85% proceeds of the auction proceeds would go to the university to fund research and it would receive 10% of any subsequent resale of the NFT. And, the pandemic has placed stress on the revenues of athletic departments. In light of this, other institutions may begin to review their own archives to determine what might be turned into an NFT.

As the landscape and laws around NIL rapidly evolve, universities and university athletes can be expected to utilize NFTs as a new, unique asset class, with the promise of allowing the school or athlete to exercise greater control over use of their respective NIL rights.

What is an NFT?

An NFT is a “unique digital asset whose ownership is tracked on a blockchain” according to Linda Xie, co-founder of Scalar Capital and former Coinbase product manager.4 Blockchains are immutable, decentralized databases supported by computer servers -- the most famous one being the Bitcoin network. NFTs differ from other fungible blockchain assets such as Bitcoin or Ether because no two NFTs are the same, whereas by definition any one Bitcoin is exchangeable for any other Bitcoin without any loss of value. Even if multiple copies of the same NFT are made, each would likely be numbered or otherwise uniquely identified from the others, enhancing its status as a singular collectible.

This enduring uniqueness by design is coupled with the other advantages of blockchain assets, such as the ability to control, transfer and issue ongoing royalties or other payments streams to the creator or other third parties from such digital assets such as Berkeley’s ongoing right to receive proceeds from the resale of its NFTs. The ability to create an asset or property with such characteristics, and have such characteristics regulated by computer code, is unprecedented and indeed the use cases for blockchain are still evolving. Digital collectibles, artwork, and tokenized real estate are only a few of the many potential use cases. Ethereum, the blockchain on which most NFTs are currently hosted, is a fully-functional programming language and has been described as a decentralized world computer.

On Ethereum, NFTs are frequentlycreated using the ERC-721 standard, which is an open standard that describes how to build non-fungible tokens. Conversely, fungible tokens are created using the ERC-20 standard, which is an open standard that describes how to build fungible tokens. These two tokens could be used together – for example, Luke Garza could create a new NFT of a video of his first dunk as a professional player and sell that as an ERC-721 non-fungible token or he could sell ownership interests in the NFT, through sale of ERC-20 tokens representing an ownership interest in such NFT.

One key challenge in the NFT space is “linking” or “binding” of off-chain non-fungible assets (such as a Honus Wagner card or a painting by Picasso) to the equivalent on-chain blockchain asset (the NFT itself). This challenge also presents itself in trying to put real property title records on a digital blockchain registry. Governmental registries such as the title system have historically provided the legal “technology” and authority that binds parcels of real property to abstract notations signifying ownership, such as written entries in the land registry. There does not yet exist a non-contractual means for ensuring that ownership of an NFT is equivalent to ownership of the real-world asset itself.

What are the Legal Implications of NFTs?

While NFTs can create valuable revenue opportunities for universities and athletes, those opportunities involve legal concerns that need to be understood and addressed. We focus below on two of these concerns, securities laws and intellectual property.

Securities Laws

The legal framework around blockchain and cryptocurrencies assets in general, and NFTs in particular, is still evolving as governments around the world decide on how best to regulate this emerging asset class.

In the U.S., under the legal test articulated in SEC v. Howey, a 1946 ruling from the U.S. Supreme Court concerning how to define a security for purposes of the 1934 Securities Exchange Act, NFTs could be deemed to be securities if they are deemed to represent an investment in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The rule from this case is sometimes referred to as the “Howey test”. Thus, depending on how an NFT is created, structured, marketed and sold or distributed, such NFTs could be deemed securities. Any sale of securities in the U.S. would be subject to the existing securities law framework requiring registration before the sale of securities to the public, unless there is an applicable exemption from such registration. Accordingly, though it may be possible to mint and sell NFTs from one’s dorm room, it is certainly not advisable without legal counsel.

The Securities and Exchange Commission (the “SEC”) has not enacted express regulations regarding NFTs. The SEC has, however, has provided some guidance around cryptocurrencies and blockchains over the years. In it’s 2019 Framework for “Investment Contract” Analysis of Digital Assets (the “Framework”), the SEC provided details on how it applied the Howey test in analyzing whether digital assets constituted one type of security – the “investment contract.” And while whether a particular digital asset at the time of offer or sale satisfies the Howey test depends on the specific facts and circumstances, one key area of analysis is usually whether a purchaser of an NFT has a reasonable expectation of profit (or other financial returns) derived from the efforts of others. The SEC noted in the Framework that “[p]rice appreciation resulting solely from external market forces (such as general inflationary trends or the economy) impacting the supply and demand for an underlying asset is generally not considered “profit” under the Howey test. Another relevant consideration is that, unlike the many initial coin offerings launched in 2017, in the case of NFTs the network and digital asset are typically fully developed and operational. Therefore, an NFT collectible sold on an established network whose value is derived from its own scarcity and uniqueness (and not from promotion or other efforts of others) would seem less likely to qualify as an “investment contract” under the Framework. The sale of baseball cards or other collectibles is typically not deemed to be a sale of securities.

Clearer laws and regulations around NFTs and cryptocurrencies would help the industry better grow and develop. The blockchain and cryptocurrency community is hopeful that the new Chairman, Gary Gensler, will provide greater clarity and certainty to the law as he is rejoining government after a stint as a fintech professor at M.I.T.

The public is also watching the outcome of SEC v. Ripple Labs, Inc., Bradley Garlinghouse and Christian A. Larsen, one of the leading cases regarding whether the sale of digital currencies constituted the sale of unregistered securities. The SEC’s complaint alleges that Ripple raised over $1.3 billion in funds, beginning in 2013, through the sale of digital assets known as XRP in an unregistered securities offering to investors in the U.S. and worldwide. There have not yet been any decisions in this case.

Intellectual Property

NFTs are most often used with artwork or photographs that physically exist. For example, the most expensive sports-related NFT sold was an photo of LeBron James sold on Opensea for 10,000 Ether (currently worth approximately $25 million).

The manner in which this NFT was marketed and sold illustrates the current shortcomings around intellectual property ownership and NFTs – specifically that ownership of an NFT does not automatically grant ownership of the related underlying intellectual property rights in the work being reproduced in the NFT. Indeed, for the James photo, the intellectual property rights to the original work needed to be transferred to the NFT by use of contract law. The purchaser of this NFT was only granted the right to own the NFT for personal use and not commercialization purposes. The RAW digital photo file of James was included in the transaction as the NFT sale page stated “This is the only time this particular shot will ever be listed on any exchange”. The page contains a disclaimer clarifying that the user is “trading for the full non-commercial rights to this creation – anything past that, you’ll have to work with LeBron. Tell him Kimani says hi.”

Source: OpenSea

Application of existing intellectual property law suggests that creation of on-chain or digital-native assets would result in a stronger claim to the ownership of the intellectual property rights with respect to such assets – as compared to existing physical assets being linked to digital tokens. For example, in the e-sports realm, an artist may create a one-of-a-kind digital “skin” NFT that one player may purchase to use in an online game by wearing on his or her online avatar. This digital artist would likely hold the copyright over the skin. However, the intellectual property ownership claim has not yet been adjudicated. There are also complicated laws around derivative works which may also be relevant.

Thus, for NFTs of off-chain assets (or non-digital native NFTs), the attendant intellectual property rights such as copyright or design rights remain in effect in the underlying work and are not automatically inherent, and do not reside, in the NFTs themselves. The general rule is that an artist will own the copyright and design rights in any work that they produce.

However, it has yet to be determined whether an NFT is transformative and thus stands alone with its own new copyright or rather will be deemed a translation or other derivative work of the original copyright, which would significantly limit the commercialization of NFTs based on off-chain assets where the creator of the NFT does not own the intellectual property rights to the underlying work. In general, theNFT owner has no claim to underlying intellectual property rights in the original work.

Student-Athletes Have an Opportunity to Use NFTs To Profit from Their NIL Rights

Luke Garza has stated in interviews that he wants to be a trailblazer and set an example for his younger teammates:

“Now that I’m not a college athlete anymore, I’m not representing the University of Iowa as a basketball player,” he says. “I definitely am in favor, in the future, of college athletes being able to do this, and I see this as a potential way for college athletes to profit off their name, image, and likeness. Hopefully I can help show people the way... I think in the future, people can look at NFTs as an opportunity for college athletes when Name, Image, and Likeness is passed, because I’m very confident it will be.” 5

There will be more athletes like Luke Garza who may want to monetize their NIL rights with more control over the use of those rights. The open source nature and composability of NFTs could be created in dorm rooms on existing platforms such as Opensea or Top Shot. The technology exists and NFTs are a topic of the moment.

The sale or licensing of NFTs by student-athletes has attendant legal issues. For student-athletes, these may include whether the NFTs are securities that must be registered and what intellectual property rights the student-athlete has and may convey. For universities, there also are concerns about their student-athletes including what liability may exist for the university if a student sells NFTs from, for example, her dorm room – potentially implicating elements of the Howey test. Another concern is how will the university monitor the sale or licensing by students of NFTs that include university trademarks. Luke Garza’s NFT shows him wearing the University of Iowa’s yellow and blue jersey. Presumably, he received permission or a license from the University of Iowa to include such branding in his NFT. And, universities need to understand what role they will take in educating and empowering their student-athletes and any consequent risk.

Colleges and Universities Have An Opportunity to Create New Revenue Channels, With Legal Implications

As shown by Berkeley, colleges and universities also recognize that the sale of NFTs can create significant new revenue sources. This is also true with university athletic departments with their iconic photo collections that may be converted into NFTs.

Depending on the precise facts and circumstances, the sale of NFTs, however, may be prohibited by federal securities laws restricting the sale of unregistered securities. Ongoing litigation and coming pronouncements from the SEC and other governmental bodies will shape an evolving regulatory landscape around NFTs. There are also are unique intellectual property issues surrounding NFTs: for example, ownership of an NFT does not grant ownership of the underlying intellectual property. Thus, the owner of the NFT sold by Berkeley does not have any claim to the underlying cancer immunotherapy patent.

Over one hundred years ago, Honus Wagner could not possibly have conceived of NFTs and the digital simulacrum being constructed today. He may have appreciated that his own name, image and likeness had considerable value, and that value could be increased with scarcity and uniqueness by design. One would think he would also see the promise in non-fungible tokens as a new asset class – one that does not rely on any third party to authenticate its value by having to prove its uniqueness. Although NFTs represent a new, emerging asset class, the ingenuity of the underlying technology could make NFT collectibles as important in the next century as baseball cards were in the last.

NFTs represent a unique opportunity to create new sources of revenue for any college or university allowing it to burnish and celebrate its history and culture. At the same time, University administrators, Athletic Directors and general counsel need to be aware of the complex legal issues surrounding this new asset class with the help of Goulston & Storrs.

1 https://www.espn.com/nba/story/_/id/31164860/dapper-labs-creators-nba-top-shot-get-305m-funding

2 But this is changing. Over thirty (30) states have enacted laws that enable a student-athlete to monetize his or her NIL rights without loss of eligibility. This number includes 7 states which have NIL laws going into effect in 2021. [cite to GS NIL state chart]

3 https://www.nytimes.com/2021/05/27/science/nobel-prize-nft-berkeley.html

4 https://a16z.com/2021/03/27/nfts-explainer-faqs-hype-reality-innovation-crypto-creator-economy/

5 https://decrypt.co/63989/iowa-college-basketball-ncaa-player-luka-garza-selling-nft

/>i

/>i