Changes to overtime rules under the Fair Labor Standards Act (FLSA) announced on April 23, 2023 affect most U.S. employers. The Final Rule substantially increases the number of employees eligible for overtime pay. It is critical that employers understand the rule and its implications for their business.

Current FLSA Overtime Regulations: The Basics

The FLSA requires employers to pay overtime pay of at least 1.5 times an employee’s standard pay rate for hours worked in excess of 40 hours per week. However, “white collar” and “highly compensated” employees are exempt from this overtime pay requirement if they meet a three-part test:

- Salary Basis Test – an employee must be paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

- Salary Level Test – the amount of salary paid must meet a minimum specified amount. (Spoiler Alert: The new rules change the salary level.)

- Duties Test – the employee’s job duties must primarily involve executive, administrative, or professional duties.

The White Collar Exemption

The white-collar exemption applies to employees who perform primarily executive, administrative, and professional tasks. Workers who perform these tasks are considered to have more autonomous, managerial, or specialized roles justifying exemption from overtime. Therefore, if an employee’s duties are executive, administrative, and professional, and they satisfy the salary basis and salary level tests in the FLSA, they are not entitled to overtime pay under the FLSA.

Highly Compensated Employees

A highly compensated employee (HCE) is someone who earns a high annual compensation (according to salary thresholds in the FLSA) and whose role includes one or more executive, administrative, or professional duties. The FLSA exempts “highly compensated employees” from the overtime pay requirement.

Key Changes to the FLSA Overtime Rules

The new rule increases the salary thresholds in the salary level test for highly compensated and white collar employees. As a result of the changes, less employees will be considered exempt and employers will be liable for significantly more overtime pay. Notably, the types of duties eligible for exemption are not impacted.

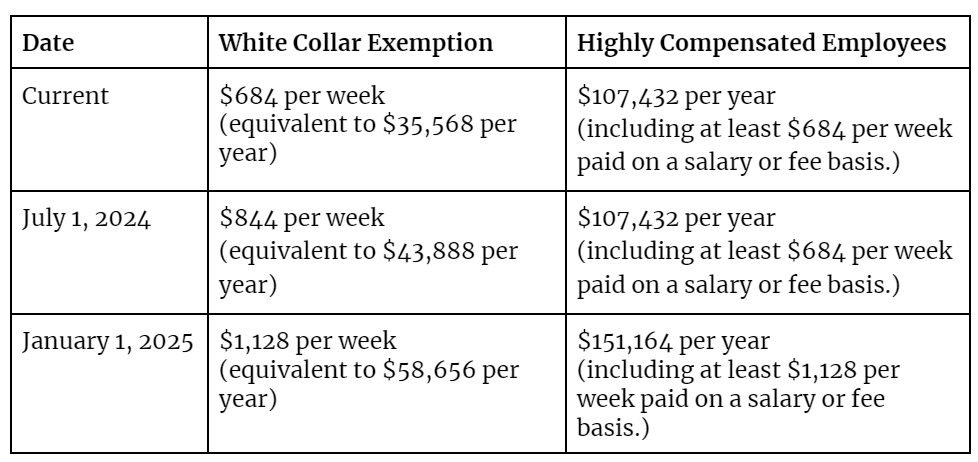

The new salary thresholds are introduced in two phases with the first increase becoming effective on July 1, 2024, and the second occurring on January 1, 2025. Importantly, the new rule also includes a mechanism for automatically updating these salary thresholds every three years based on current wage data. This means employers will need to stay vigilant for future increases.

The New Salary Thresholds

In general, the minimum annual salary to qualify for the white collar exemption is increasing from $35,568 to $58,656 and the total annual compensation requirement for the highly compensated employee exemption is increased from $107,432 to $151,164. Here’s a detailed breakdown of the higher salary thresholds and their effective dates:

Why This Rule Matters: Essential Steps for Employers

This rule will have a significant impact on Pennsylvania employers, potentially reclassifying millions of currently exempt employees as non-exempt and eligible for overtime pay. Employers who fail to comply risk costly back pay, penalties, and lawsuits.

There are practical steps that employers can consider to ensure compliance with the new FLSA rule:

- Review Current Employee Salaries, Hours, and Duties: Audit current salaries, hours, and job duties. This review will help identify which employees’ status may be affected by the new salary thresholds for exempt status under the FLSA.

- Reclassify Employees as Non-Exempt as Necessary: Based on the review, determine which employees will need to be reclassified from exempt to non-exempt, or awarded a salary increase, to comply with the new rules. This reclassification will make them eligible for overtime pay, altering how their work hours are managed and compensated. It is advisable to consider an employee’s perception of this reclassification when taking this step.

- Time Recording Policies and Processes: For employees who are reclassified as non-exempt, implement or update timekeeping procedures to accurately track hours worked. This may also require training employees on time-keeping systems. Effective and accurate time recording is essential for managing overtime and ensuring compliance.

- Update Overtime Policies: Revise company overtime policies to reflect changes in employee classifications. Include clear procedures for overtime approval to manage overtime work more effectively and ensure it aligns with budget constraints and business needs.

- Bonuses, Incentive Pay, Commissions: Evaluate how non-salary forms of compensation will factor into the new salary thresholds for exempt status. The FLSA determines how this compensation should be treated in determining total annual compensation, which could influence exemption status.

- Remember Contractual Obligations: The FLSA is a federal law which applies to all U.S. employers. However, any additional salary commitments in an employment contract still legally bind the employer. These should not be ignored.

Despite the quickly approaching compliance date, we also anticipate legal challenges to this rule, which could delay or change the rules. For now, though, employers should proceed on that basis that the updated regulations will take effect on July 1, 2024. Preparing for this deadline ensures that employers will not be caught off guard and can avoid any potential legal and financial repercussions.

/>i

/>i