In this issue:

- 12th Man Up in the First Half: Texas Court Rules that Aggies Athletic Foundation Owes No Fiduciary Duty to Football Boosters, Second Half to Reveal Winner on Contract Claims

- Shotgun Shell Designer’s Trademark Suit Did Not Miss the Starting Gun

- Hole-in-One for Badlands: Sin City Loses Big Against Developer of Former Golf Course after Nevada Supreme Court Denies Rehearing in Takings Litigation

12th Man Up in the First Half: Texas Court Rules that Aggies Athletic Foundation Owes No Fiduciary Duty to Football Boosters, Second Half to Reveal Winner on Contract Claims

There is perhaps no relationship stronger and no love greater than that between a Texan and their favorite college football program… or so we thought. In a legal twist this offseason — and on a Thursday, no less — a Texas appellate court dismissed claims for breach of fiduciary duty, good faith and fair dealing related to allegations that the Texas A&M University 12th Man Foundation (the “Foundation”) breached certain promises or agreements with its existing endowed donors (the “Plaintiffs” or “Permanently Endowed Donors”) when it relocated those donors from “the best available seats” and downgraded other game day perks in light of new fundraising priorities surrounding the redevelopment of the Aggies football stadium. (Texas A&M University 12th Man Foundation v. Hines, No. 09-23-00175-CV (Tex. App. – Beaumont June 13, 2024)). In so ruling, the court found that there is no special relationship giving rise to a fiduciary obligation between a group of endowed football program donors and the Texas A&M Foundation that the law would recognize in this case.

The Foundation is a non-profit affiliate of Texas A&M University that raises funds for the University's athletic programs and manages ticket and parking sales for University athletic events. As alleged in the Complaint, beginning in the 1970’s and through the mid-1990’s, the Foundation started a fundraising program and entered into purported oral or written endowment contracts with hundreds of Permanently Endowed Donors who offered financial support to the football program in exchange for, among other perks, season football tickets in “best available” seating locations and priority parking, in most cases for life and in some cases for 30 years, at no additional cost. The quality and quantity of seats the Foundation promised depended upon variables including the amount of the donation, the year the donation occurred and the duration of the endowment.

For decades, the Foundation kept its promises to such donors. But, according to the Complaint, the Foundation eventually changed the program by levying certain fees and otherwise allocating certain other benefits based on a new “Priority Point Program” for loyal boosters.

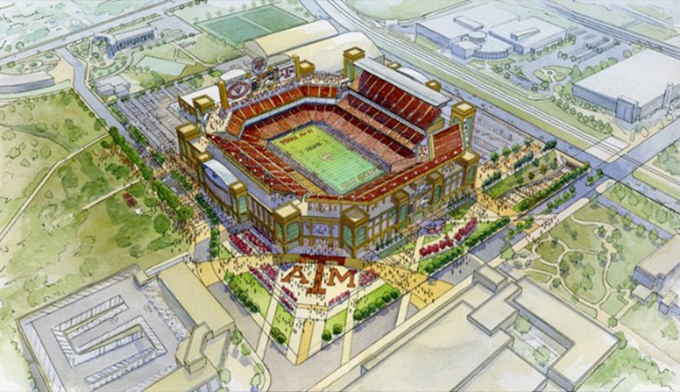

According to the Plaintiffs, a wholesale reseating plan concerning the donors took shape after 2013 when Texas A&M announced a $450 million stadium redevelopment plan for the Aggies stadium, Kyle Field. The announcement coincided with Texas A&M entering the Southeast Conference (or SEC). Per the Complaint, realizing that the Aggies would soon be in the same conference with some of the most successful football programs in the country and competing fiercely in game play, recruiting and fundraising, the University decided to upgrade its facilities and change Kyle Field’s existing donor endowment program to raise new funds for the stadium rebuild.

The renovation would proceed in two phases, each a year long. Kyle Field was scheduled for a grand reopening in August 2015. After redevelopment, Kyle Field would be the largest football stadium in Texas and would have the largest seating capacity in the SEC, topping out at over 102,000. In many ways, the reconstruction plans embodied an “everything’s bigger in Texas” ethos.

(Source: Kyle Field Redevelopment Approved by Texas A&M Board of Regents).

Of course, this redevelopment would be costly. Under the Kyle Field Redevelopment Plan, the Foundation, looking for additional revenue streams and a way to attract new Texas A&M alumni donations, began a “reseating” initiative with its endowed donors. For example, Plaintiffs claimed that Permanently Endowed Donors would have to pay a “significant” premium to keep their priority seating or else lose their “best available” rights in the rebuilt stadium. Even though the Foundation offered the displaced Permanently Endowed Donors the opportunity to have other seats and parking in the rebuilt Kyle Stadium, the Plaintiffs’ claimed those seats and parking were not what they were promised and were in less-desirable locations. Anticipating such dissatisfaction, the Foundation offered to return the Permanently Endowed Donors’ original donation (an offer which was allegedly accepted by some). The putative class of donors that refused this offer brought suit, alleging breach of contract, promissory estoppel and breach of good faith and fair dealing and fiduciary duty and asserting that the Foundation had no right to unilaterally alter the prior agreements with the donors and that the court should issue an injunction against the Foundation to prevent the Plaintiffs’ loss of long-time seat assignments, among other relief.

After running multiple plays and obtaining certain favorable rulings in the case, including a 2022 appellate state court ruling reversing a class certification designation, the Foundation moved under Texas state procedure law (akin to an anti-SLAAP motion in other states) to dismiss certain claims, contending that the evidence failed to support a prima facie claim for breach of a fiduciary obligation or duty of good faith and fair dealing. The trial court denied the motion.

The appellate court reversed and granted the motion regarding the fiduciary claims only and remanded the action to determine an award of attorney’s fees related to defending the claims. In particular, the appellate court rejected the Plaintiffs’ argument that a special relationship existed between the Foundation and the Plaintiffs that would have given rise to a fiduciary duty of care based upon “Aggie loyalty” and “Aggie core values.” Ultimately, the Plaintiffs could not establish that team pride and loyalty, manifest through monetary donations and statements that they would “be rewarded” with stadium perks for “generous, early and loyal support,” could create a prima facie showing of a fiduciary relationship between the parties. The court stated: “[M]erely because the parties may have expectations in relation to a gift or donation, or whether they had a contractual relationship does not create a duty of good faith and fair dealing, nor does it establish a formal or informal fiduciary relationship. Oral representations in connection with contract claims do not give rise to a ‘special relationship’ that creates a fiduciary duty.”

Due to a procedural issue, the court did not consider the Foundation’s petition to dismiss the Plaintiffs’ breach of contract claims, confirming that the donors may yet find the end zone — just not based simply on legal claims linked to Aggies team loyalty.

The takeaway? While donors’ loyal fandom and commitment to “core values” did not support a legal fiduciary duty in this case, it remains to be seen in the second half of this litigation how the lower court will rule on claims that the Foundation breached certain oral or written agreements with the donors. In this game of inches — and within the changing economics of college football — the biggest question that remains is who will earn the best seats at Kyle Field…the donors who loved the Aggies first or the new generation of fans who helped fund the rebuilt stadium.

Shotgun Shell Designer’s Trademark Suit Did Not Miss the Starting Gun

A group of online hunting and shooting supplies retailers recently failed to prove that Plaintiff — ammunition designer Polywad, Inc. (“Polywad”), owner of the Quik-Shok ammunition trademark — was slow on the draw in filing its trademark infringement lawsuit alleging that such retailers were selling an ammunition product that infringed on its mark. (Polywad, Inc. v. Able’s Sporting Inc., No. 23-00512 (M.D. Ga. June 25, 2024)). While the Georgia district court dismissed Polywad’s claim of trademark dilution, it denied a group of Defendants’ motion to dismiss on statute of limitations grounds Polywad’s federal trademark infringement claims and related claims under Georgia’s Fair Business Practices Act (“FBPA”) and Uniform Deceptive Trade Practices Act (“UDTPA”).

Polywad is a Georgia corporation run by its sole employee, Jay Menefee. Polywad consults with ammunition manufacturing companies and designs ammunition, including products bearing the federally registered trademark “Quik-Shok.” Polywad has sold and marketed Quik-Shok products since 1997 and held the trademark registration since 1999. In 2001, Polywad entered into a licensing agreement with Cascade Cartridge, Inc. (“CCI”) allowing CCI to sell a product using the Quik-Shok mark. Polywad and CCI terminated the agreement in 2007, leaving CCI without a license to use the Quik-Shok mark from that point forward.

Polywad did not allege that any CCI products bearing the Quik-Shok mark were physically sold after 2007, but in a suit filed in December 2023, Polywad alleged that a group of retailers of hunting and shooting supplies (“the Defendants”) continued to advertise and offer for sale the CCI product online using outdated pictures still bearing the Quik-Shok mark, allegedly in violation of state and federal law. Thus, while the Quik-Shok mark was removed from the actual product, Polywad took aim at the retailers’ continued online advertising using the old Quik-Shok packaging photos, alleging trademark dilution and trademark infringement under the FBPA, the UDTPA and the Lanham Act. Numerous defendants claimed that they removed the allegedly infringing advertising images from their sites after receiving a cease-and-desist letter from Polywad.

In further response to the claims, a number of the Defendants filed motions to dismiss under various theories. A group of six defendants moved to dismiss the claims on grounds that the court had no personal jurisdiction over them. In June 2024, the court granted the motion to dismiss for five parties but found that one Defendant regularly conducts business in Georgia and was therefore subject to personal jurisdiction there. On the same day, it dismissed the claims against one more Defendant, also on personal jurisdiction grounds. Earlier, in April 2024, another Defendant had the claims against it dismissed without prejudice, similarly on personal jurisdiction grounds.

A separate group of Defendants countered by filing a motion to dismiss Polywad’s trademark infringement-related claims based on the defenses of statutes of limitations and laches and Polywad’s trademark dilution claim on the merits. The court issued an order on this group of Defendants’ motion on June 25, 2024. Regarding the claim of trademark dilution under the Lanham Act, the court ruled the Defendants hit the bullseye with the argument that Quik-Shok was not “famous” enough to qualify for statutory protection under 15 U.S.C. § 1125(c) and dismissed the complaint for failure to state a claim. Under the Lanham Act, an owner of a famous mark is entitled to injunctive relief against any person using the mark, after the mark has become famous, in commerce, which use is likely to cause “dilution by blurring or dilution by tarnishment of the famous mark.” Thus, one of the key elements of a dilution claim is a showing that the mark is famous. As the court stated, a mark must be considered a household name or “widely recognized by the general consuming public” to be deemed famous under the statute. Polywad argued that it has had a registered mark for decades and may not be famous generally, but is famous within a particular market segment. The Georgia court noted that some courts in the Eleventh Circuit have accepted a narrower conception of niche-market fame as sufficient for a dilution claim in certain cases, but the court declined to enter this debate and found that the Quik-Shok owner missed the target completely by failing to adequately plead any type of fame in the complaint and granted the Defendants’ motion to dismiss the trademark dilution claim.

However, the Defendants’ argument that laches or the relevant statutes of limitation precluded Polywad’s remaining trademark infringement claims proved to be no silver bullet in the eyes of the court, which allowed federal infringement and related state claims to continue. The FBPA has a statute of limitations forbidding a private right of action to be brought more than two years after the person bringing the action “knew or should have known of the occurrence of the alleged violation.” O.C.G.A. § 10-1-401(a). The UDTPA has a four-year statute of limitations. The Defendants argued that the clock started running on the statutes of limitations in 2007 when the CCI license granting use of the trademark was terminated and therefore Polywad’s claims filed in 2023 were time-barred.

The Defendants failed to account for the possibility that, while Polywad’s owner Mr. Menefee might be an expert on the range, he apparently lacked the skills on how to train his aim on internet search engines. The complaint admits that Mr. Menefee, who is in his seventies, “is not particularly ‘computer-savvy.’” While he would regularly check retail shops that sold ammunition for any infringing products, it was not until June 2023 that Mr. Menefee allegedly first searched the internet for the Quik-Shok mark. He promptly sent cease-and-desist letters and filed this lawsuit after that.

As noted above, the Defendants argued that the statutes of limitations started running in 2007, when the original contract was terminated. But not all the Defendants even existed in 2007, and the court noted that there was a lack of discovery showing exactly when each defendant first started using or displaying Polywad’s mark in product listings, leaving the court no choice but to reject that argument. Since the court stated that it must accept the plaintiff’s factual allegations set forth in the complaint as true when considering a motion to dismiss, that left June 2023, when Menefee first searched the internet for infringements, as the only other date on the face of the complaint. Therefore, with no factual clarity regarding when Polywad should have known of the alleged infringement, the court was obligated to reject the Defendants’ motion to dismiss. Regarding the federal Lanham Act claims, the court denied Defendants’ laches defense (or inexcusable delay in bringing suit that results in undue prejudice to the Defendants), finding that because laches is a “fact-intensive affirmative defense” the court could not grant the Defendants’ motion at this early stage, particularly given the aforementioned factual issues surrounding Polywad’s knowledge of the alleged infringement.

The court commented that factual evidence may come to light as the case progresses that indicates that Polywad should have known about the Defendants’ use of the mark at an earlier date, but for now Mr. Menefee’s slow draw on searching the internet for infringing uses of his mark won the day. As the case heads to discovery, expect renewed motions to dismiss if the record shows that Polywad pulled the trigger on the lawsuit too late.

Hole-in-One for Badlands: Sin City Loses Big Against Developer of Former Golf Course after Nevada Supreme Court Denies Rehearing in Takings Litigation

The City of Las Vegas (the “City”) cannot seem to escape the bad luck of Badlands (a former golf course in Nevada and not the Bruce Springsteen song). Most recently, the Nevada Supreme Court denied the City’s petition for rehearing in a consolidated appeal challenging the lower court’s ruling in favor of the developer of the acreage of the defunct Badlands golf course, with the court refusing to take a mulligan and reconsider its prior ruling that a per se regulatory taking occurred when City land use actions deprived the developer of all of the economic value of the 35-acre parcel at issue. With its June 12th order, the Nevada Supreme Court declined to set aside a final judgment that ordered the City to pay $48 million plus interest to the land developer. (City of Las Vegas v. 180 Land Co., LLC, 140 Nev. Adv. Op. 29, No. 84345 (Nev. Apr. 18, 2024), reh’g denied (June 12, 2024)).

Trouble on the green began back in 2015. The operator of the Badlands golf course in northwest Las Vegas determined it was no longer a profitable operation and terminated its lease with the landowner soon after. The land was eventually acquired by Yohan Lowie, land developer and manager of 180 Land Co., LLC (“180 Land”). The original 250-acre golf course was broken down by 180 Land into four segments for development purposes. One of those segments is the 35-acre site at issue in this case. [note: Litigation against the City involving other Badlands parcels are currently pending or on appeal and are beyond the scope of this article].

Issues with the zoning designations for the land at issue started even earlier. In 1990, the proposed Badlands golf course acreage was zoned as R-PD7 (or a residential planned-unit development) and the original golf course was built between 1992 and 1995. In the meantime, the City adopted a new Las Vegas General Plan classifying the golf course acreage as Parks/Schools/Recreation/Open Space (PR-OS), yet the land was not re-zoned and the ordinance passed concerning the general plan stated that it “shall not be deemed to modify or invalidate any…zoning designation.”

In 2016, 180 Land submitted a plan for residential development on the 35-acre site and petitioned to change the PR-OS designation to low-density residential. For the 35-acre site, they filed a site development review for 61 lots, a plan which the City’s staff recommended approving.

However, the planning staff’s recommendations landed in the bunker. The City Council denied 180 Land’s applications after a contentious hearing held in June 2017 to discuss the proposed development. The City claimed its final decision was due to “significant public opposition” from the nearby upscale Queensridge suburban neighborhood, which has been home to many celebrities, including tennis greats and basketball stars. The City also expressed concern over “piecemeal development” (though, the City also rejected 180 Land’s Master Development application that would have covered development of the entire area). In all, the City denied multiple 180 Land applications that were necessary for the redevelopment of the defunct golf course.

The City’s denial of 180 Land’s development proposals was not only in contrast to the planning staff’s recommendations, but also allegedly disregarded previous statements from the City’s attorney. In 2016, an attorney for Las Vegas and a public works employee purportedly confirmed that the master plan was changed after the zoning, but that the area was “hard zoned R-PD7,” which allowed residential development. This zoning designation for the 35-acre parcel was not disputed by the City.

Despite the zoning designation, the City refused to fold.

After the City’s denials left 180 Land without a viable path to develop the 35-acre parcel, the developers, once again, took the fight from the course to court. 180 Land sued the City for inverse condemnation, claiming the city government improperly took its property without compensation. In late 2021, the district court granted summary judgment in favor of 180 Land on its takings claims, finding that the hard zoning for the site was R-PD7, which permits single-family and multi-residential development. After adding up the just compensation figure determined by a land expert’s valuation, plus reimbursement of property taxes, prejudgment interest and attorney fees, the City was facing a whopping $48 million judgment on its scorecard.

The City took its appeal to the Nevada Supreme Court, which examined several questions: the interaction between the PR-OS designation on the 35-acre parcel and the R-PD7 zoning, the issue of whether a taking occurred and the challenges to the final just compensation award. The Nevada Supreme Court ultimately affirmed the district court’s findings in April 2024. (City of Las Vegas v. 180 Land Co., LLC, 140 Nev. Adv. Op. 29, No. 84345 (Nev. Apr. 18, 2024)).

The Nevada Supreme Court found that, despite the City’s arguments emphasizing the significance of the PR-OS designation in the general plan and why zoning should comply with the general plan, the court ruled that the 35-acre site’s R-PD7 zoning predated the general plan designation and governed 180 Land’s ability to develop the parcel, allowing residential development. Importantly, the court concluded that the zoning ordinance took precedence over the inconsistent PR-OS designation in the City’s master plan.

The Nevada Supreme Court also affirmed the district court’s findings regarding the takings claim. While the developer asserted four theories to support its takings claim, the court focused only on the per se regulatory taking theory. The Fifth Amendment’s Takings Clause prohibits the government from taking private property for public use without just compensation; Nevada’s state constitution has a similar provision. Previous Nevada cases have interpreted these provisions as not only protecting against a property owner’s deprivation of possession, but also against state regulation that is so oppressive that its effect is virtually the same as that of a direct appropriation.

The court found that the City’s denials of 180 Land’s applications effectively left the 35-acre parcel valueless. The court stated that the City Council’s actions showed “no meaningful indication that the City would allow any development” on the 35 acres and that any further attempts by 180 Land to develop the 35-acre site would have been “futile.” The court also noted that the City did not provide any “regulatory basis for its denials that would allow 180 Land to seek a variance or submit an amended application….”

Because the court found that the City’s actions deprived the developers of all the economic value of the 35-acre site, it affirmed the district court’s ruling that a taking did occur.

In regard to just compensation, the Nevada Supreme Court affirmed the district court’s adoption of the land expert’s determination of the golf course acreage’s value for its “highest and best use,” an expert report that was not rebutted by the City. The court also affirmed the additional awards of damages, finding the amounts determined by the district court to be proper.

Following the April 18, 2024 Nevada Supreme Court en banc ruling in this case, the City sought to play one more round and submitted a petition for rehearing, supported by amicus briefs from the county and other cities. The City argued that the court overlooked material facts, disregarded controlling authority, misapplied precedent and relied on extra-record materials and the developer’s misrepresentations to reach its conclusion. However, the Nevada Supreme Court denied the rehearing without further discussion, leaving the City on the hook for its bet against redevelopment. So, what started as a shuttered golf course ended in stalled development, a protracted legal battle and several sizeable judgments against the City, likely prompting city council members to have to consider next steps and shuffle some chips around to satisfy the judgments in this and other Badlands-related litigations.

Jason Krochak, Christine G. Lazatin, Joseph M. Leccese, Adam M. Lupion, Jon H. Oram, Kevin J. Perra, Bernard M. Plum, Howard Z. Robbins, Bradley I. Ruskin, Bart H. Williams, Allyson L. Swartzberg, Evan T. Rodgers, and Joanna C. LaCoppola contributed to this article

/>i

/>i