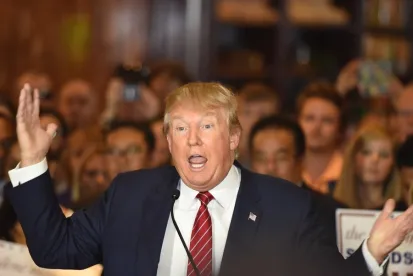

The Tax Cuts and Jobs Act (Act) signed into law by President Trump in December 2017, lowers the tax rate applicable to political activity of nonprofits organized under section 501(c)(4), (5) and (6) of the Internal Revenue Code (Code) from 35 percent to 21 percent. Other Code provisions related to political activity remain unchanged, including the prohibition on such activity by section 501(c)(3) charitable organizations such as churches.1

Corporations, including section 501(c) organizations, political action committees (PAC) and section 527 political organizations must structure their political activities in compliance with state and federal campaign finance laws as well as the Code. A for-profit organization may engage in unlimited political activity, but it may not deduct any of its political expenses. A section 501(c)(6) trade association, 501(c)(5) labor organization or a section 501(4) social welfare organization may engage in political activity as long as this is not its primary purpose2 and it reports expenditures to the Internal Revenue Service (IRS) and pays any taxes due.

An organization can avoid or limit tax liability by establishing a state or federal PAC or an affiliated section 527 political organization which may accept contributions and make expenditures in support of activities to influence the selection of elected or appointed officials. Under the Code, section 527 organizations include PACs and other political committees. However, a section 527 organization may structure its activities to be outside the scope of state or federal campaign finance law and not register as a PAC. PACs and section 527 organizations are tax exempt organizations under the Code but must comply with IRS regulations to maintain this status.

TAX ON POLITICAL ACTIVITY

Campaign finance laws generally regulate monetary and in-kind contributions3 to political committees, independent expenditures and, in some cases, electioneering communications. A trade association, labor organization or social welfare organization may be subject to tax under section 527(f) of the Code for such activities unless done through an affiliated PAC or section 527 organization. The transfer of general treasury funds by a section 501(c) organization to a section 527 organization is presumed to be taxable political activity unless rebutted.

Other activities not regulated by campaign finance laws may also be taxable political activities under the Code. The IRS has advised that a communication may be considered political if the message is “favoring or opposing a candidate” even when it does not “expressly tell an audience to vote for or against a specific candidate.”4

The 527(f) tax on political activity is levied at the highest corporate rate. Under the Act, the current rate is 21 percent for taxable years starting on Jan. 1, 2018 and after. A 35 percent rate applies to taxable years starting on or before Dec. 31, 2017. The tax is levied on the lesser of an entity’s political expenditures or its net investment income reported to the IRS. An organization without investment income generally will not owe a tax on its political activity.

PACS AND POLITICAL ORGANIZATIONS

Section 527 political organizations are tax exempt organizations permitted to engage in unlimited political activity. Some section 527 organizations register as PACs with campaign finance regulators. In either case, federal disclosure requirements apply:

-

A section 527 organization, including a PAC, must have a unique employer identification number (EIN).

-

A section 527 organization that is not a PAC must register with the IRS and file periodic reports of its activity. These reports are similar to reports filed by PACs with campaign finance regulators. A 527 organization may also be required to file reports with the Federal Election Commission (FEC) or state campaign finance regulators under certain circumstances.

-

A state PAC with annual receipts of $25,000 or more must notify the IRS of its tax exempt status by filing a registration form. A state PAC is not required to file periodic reports with the IRS as long as it reports its activity to state campaign finance regulators.

-

A federal PAC is required to register with and report its activity to the FEC only.

State PACs and section 527 organizations that fail to comply with IRS filing requirements may lose their tax exempt status.

CONCLUSION

The political activity of section 501(c)(4), (5) or (6) organization with no investment income will not be subject to the 527(f) tax as long such activity is not the organization’s primary purpose. Organizations can also avoid or limit tax liability by engaging in political activities through affiliated PACs or section 527 organizations if all activities comply with the Code. With a decrease in the tax rate applicable to political activity to 21 percent, a section 501(c)(4), (5) or (6) organization may choose to engage in limited political activity directly with general treasury funds.

1 The Tax Cuts and Jobs Act did not include the proposal to allow a charitable organization to make statements relating to political campaigns in the ordinary course of program activities when expenses are de minimums.

2 The IRS generally relies on a facts and circumstances analysis to determine the activity in which an organization is primarily engaged. If a section 501(c) organization’s primary purpose is political, it will lose its tax exempt status.

3 An electioneering communication is a category of political speech regulated based primarily on its timing i.e., its proximity to an election.

4 Revenue Ruling 2007-41 (June 1, 2007).

/>i

/>i