SELECTED COURT DECISIONS

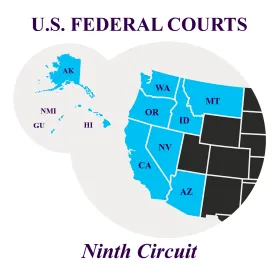

In Navajo Nation v. U.S. Department of the Interior, 2021 WL 1655885 (9th Cir. 2021), the Navajo Nation sued the Department of the Interior (Interior), the Secretary of the Interior (the Secretary), the Bureau of Reclamation, and the Bureau of Indian Affairs (collectively, the Federal Appellees) for breach of trust based on the government’s failure to consider the Nation’s as-yet-undetermined water rights under the Winters doctrine in managing the Colorado River. Several parties, including Arizona, Nevada, and various state water, irrigation, and agricultural districts and authorities (Intervenors), intervened to protect their interests in the Colorado’s waters. The district court dismissed for lack of jurisdiction on the ground that the Supreme Court had reserved jurisdiction over allocation of rights to the Colorado River in its 1963 decision in Arizona v. California (Arizona I), and also held that the Nation had failed to identify a specific treaty, statute, or regulation that imposed an enforceable trust duty on the federal government that could be vindicated in federal court. The Ninth Circuit Court of Appeals reversed: “Although the Supreme Court retained original jurisdiction over water rights claims to the Colorado River in Arizona I, the Nation’s complaint does not seek a judicial quantification of rights to the River, so we need not decide whether the Supreme Court’s retained jurisdiction is exclusive. And contrary to the Intervenors’ arguments on appeal, the Nation’s claim is not barred by res judicata, despite the federal government’s representation of the Nation in Arizona I. Finally, the district court erred in denying the Nation’s motion to amend and in dismissing the Nation’s complaint, because the complaint properly stated a breach of trust claim premised on the Nation’s treaties with the United States and the Nation’s federally reserved Winters rights, especially when considered along with the Federal Appellees’ pervasive control over the Colorado River. We remand to the district court with instructions to permit the Nation to amend its complaint.”

In Miller v. United States, 992 F.3d 878 (2021), Miller sued the federal government under the Federal Tort Claims Act (FTCA) after he was fired from his job as a police officer with the Reno-Sparks Indian Colony (Tribe), a position funded under a contract with the Bureau of Indian Affairs (BIA) under the Indian Self-Determination and Education Assistance Act (ISDEAA). The district court held that all of Miller’s claims were barred by the FTCA’s discretionary function exception but the Ninth Circuit Court of Appeals partially reversed, holding that the discretionary function exception barred Miller’s claims alleging he was terminated in retaliation for his complaints about workplace discrimination and harassment and barred his claims for tortious discharge but did not bar his claims alleging Tribe was negligent and grossly negligent in terminating him: “Miller’s proposed Third Amended Complaint included two new claims alleging, respectively, that the Tribe was negligent and grossly negligent in terminating him. The gravamen of these two new claims was Miller’s allegation, based on the DETR document discussed earlier, that the Tribe terminated him ‘despite being informed and having knowledge’ that Miller had been ‘the victim of identity theft and had not filed’ the fraudulent unemployment claim. We agree with Miller that, because the BIA Handbook mandated that tribal employees could ‘not be disciplined for allegations deemed unfounded, exonerated, or not sustained,’ the Tribe lacked discretion to fire him on grounds that it knew to be false and unsubstantiated.”

In Waln v. Dysart School District, 2021 WL 1255521 (D. Ariz. 2021), Waln and her father Bryan Waln, members of the Sisseton Wahpeton Oyate and Rosebud Sioux, respectively, sued Dysart School District under 42 U.S.C. § 1983 after school officials denied her request to attend her 2019 graduation ceremony wearing a beaded cap crowned with an eagle feather in accordance with her religious beliefs. Plaintiffs charged Defendants with violating Waln’s First Amendment rights to free speech and the free exercise of her religion and her Fourteenth Amendment right to equal protection, and also assert state constitutional and statutory claims. The district court granted the defendant’s motion to dismiss: “Plaintiffs allege the Governing Board members, acting as final policymakers, violated her First Amendment rights by enacting a policy which did not allow for expressive speech or the free exercise of her religion. Plaintiffs also allege Superintendent Kellis violated her constitutional rights by enforcing the policy and not exempting her from the policy, and the Valley Vista Principal and Assistant Principals also violated her constitutional rights by enforcing the policy and not exempting her from the policy. The Governing Board’s graduation dress code policy was content-neutral, not an official policy of unconstitutionally denying students their rights to free speech or free expression. The facts alleged in the Amended Complaint do not support a finding that the District had a longstanding custom or practice of violating students’ rights to free expression or freedom of speech by means of a commencement dress code. … The Court concludes the named individual Defendants, as sued in their individual capacities, are immune from suit for monetary damages under the doctrine of qualified immunity. Government officials acting in their individual capacities are entitled to qualified immunity from suit for monetary damages pursuant to § 1983 unless they personally violated the plaintiff’s constitutional rights and the unlawfulness of their conduct was clearly established at the time of the alleged violation. The Court concludes the named individual Defendants, as sued in their individual capacities, are immune from suit for monetary damages under the doctrine of qualified immunity. Government officials acting in their individual capacities are entitled to qualified immunity from suit for monetary damages pursuant to § 1983 unless they personally violated the plaintiff’s constitutional rights and the unlawfulness of their conduct was clearly established at the time of the alleged violation”.

In Eastern Band of Cherokee Indians v. United States, 2021 WL 1518379 (D.D.C. 2021), the Catawba Indian Nation (Catawba) had been restored to federal recognition in 1993 under South Carolina’s Catawba Indian Claims Settlement Act, which provided that the Nation’s gaming would be subject to state law or specific agreement with the state rather than under the Indian Gaming Regulatory Act (IGRA), and the federal Catawba Indian Tribe of South Carolina Land Claims Settlement Act, which required the United States Department of Interior to put into trust land that the Nation might subsequently acquire in South Carolina. In 2020, the U.S. Department of Interior (DOI) acquired sixteen acres of land in North Carolina in trust for Catawba for gaming purposes, relying on Section 5 of the Indian Reorganization Act rather than the Settlement Act for authority. The Eastern Band of Cherokee Indians (EBCI) and the Cherokee Nation of Oklahoma (CNO) sued the DOI under the Administrative Procedure Act, alleging that the 1993 Settlement Act barred Catawba from operating a casino under IGRA and from having land taken into trust under the IRA, that the proposed site was not eligible for gaming activities under IGRA’s implementing regulations and that DOI violated the National Environmental Policy Act (NEPA) and the National Historic Preservation Act (NHPA). Catawba intervened as a defendant and the District Court granted summary judgment to both defendants: “[T]he intent of the Settlement Agreement seems to have been to establish a specific regime for Catawba gambling in South Carolina that would supersede IGRA’s more Tribe-friendly framework — hence the need to clarify that an otherwise preemptive federal law, IGRA, would not apply. Put differently, the Settlement Agreement made clear that IGRA would not apply to the Tribe because tribal gambling would instead be covered by specific rules set out in the Settlement Agreement and/or state law. … [T]he Agreement has nothing to say about whether the Tribe would be permitted to game under IGRA outside of South Carolina. … The Settlement Act was enacted expressly ‘in recognition of the United States’ obligation to the Catawba … and it implements a bargain between the Tribe and South Carolina in which the Tribe accepted specific burdens in exchange for other benefits. Those burdens are inflicted on the Catawba and the Catawba alone, and the Court’s task here is to determine the extent of one of them: did Congress deprive the Tribe of their IGRA rights on lands nationwide or only in South Carolina? Given the principles behind the Indian canon, the Court must assume Congress meant to do less, not more, damage to the only tribe directly harmed by the provision at issue. … On EBCI’s view, … the 1993 Settlement Act renders the Catawba ineligible to benefit from that provision. It contends that, properly understood, the Act displaces Section 5’s general federal land-into-trust authority by creating a specific land-acquisition scheme that governs the Tribe in its place. … the Court may fall back once again on the Indian canon. Because the Settlement Act’s bespoke land-acquisition scheme can at the very least be reasonably read as applying (and therefore supplanting the IRA) only as to South Carolina lands, the Court must read it that way. … [EBCI] insists that, because the 1993 Settlement Act ‘restored the Catawba to Federal recognition,” and that Act expressly authorized Interior to take certain lands into trust for the Tribe as part of its existing or expanded reservation, only those lands can be thought of as “part of the restoration of the Catawba’s lands.’ This argument flies in the face of numerous cases squarely holding that where legislation restoring a tribe to recognition identifies specific parcels to be taken into trust, that does not preclude other lands from also qualifying as restored.” (Internal quotations and emendations omitted.)

In Stand Up for California! v. United States Department of the Interior, 2021 WL 1437196 (D.C. Cir. 2021), plaintiffs challenged the federal government’s 2017 acquisition of land in trust for the Wilton Rancheria, for gaming purposes. The plaintiff sued, contending that the Interior Department’s redelegation of final decision-making authority from the Assistant Secretary – Indian Affairs to the Principal Deputy, who made the decision, was unlawful under applicable regulations. The district court rejected the challenge and the D.C. Circuit affirmed: “[T]he text, structure, and purpose of the regulation confirm that the Department has the power to redelegate final decision-making authority.”

In Hudson v. Haaland, 2021 WL 1439794 Fed Appx. (D.C. Cir. 2021), the Secretary of the Interior certified the results of a 2013 election held by the Secretary of Interior under the Indian Reorganization Act (IRA) at which members of the Three Affiliated Tribes of the Fort Berthold Reservation amended the Tribe’s constitution (i) to expand the number of members of the Tribal Business Council, (ii) to require the Business Council to vote on the removal of any member convicted of a felony, and (iii) to allow members of the Three Tribes to recall sitting members of the Business Council. Just 5% of tribal members, but more than 30% of members registered to vote, participated in the election. Hudson, a tribal member, sued under the Administrative Procedure Act, contending that the certification was arbitrary and capricious because the Tribe’s constitution required that at least 30 percent of tribal members vote on any constitutional amendment. The district court granted Hudson summary judgment but the D.C. Circuit Court of Appeals dismissed for lack of jurisdiction, holding that Hudson had no standing to challenge the election: “Hudson lacks standing because he has not suffered a cognizable injury-in-fact. He provides no explanation as to how the certification of the 2013 election harmed him in a concrete and particularized manner. … [T]his case is altogether different from cases in which a plaintiff’s ability to serve in office is diminished by an election, or her individual interests have otherwise been uniquely affected. … Hudson alleges no such personalized injury here. … At bottom, Hudson is asserting an interest in the proper administration of the law by the Secretary of the Interior. But a plaintiff cannot establish standing by asserting an abstract general interest common to all members of the public, no matter how sincere or deeply committed a plaintiff is to vindicating that general interest on behalf of the public.” (Internal citation and quotation omitted.)

In Hawkins v. Haaland, 991 F.3d 216 (D.C. Cir. 2021), landowners sued the Bureau of Indian Affairs (BIA) and Department of Interior officials, seeking declaratory and injunctive relief to prevent enforcement of the Klamath Tribe’s water rights in the Klamath River basin. The district court dismissed for lack of standing and the D.C. Circuit affirmed: “The ranchers frame their claims in terms of procedural injury. They concede that as junior appropriators they have no right to water that infringes the Tribes’ instream rights … and priority enforcement of water rights through a call system is in accordance with the nature of those rights under Oregon law, … The ranchers maintain that requiring the concurrence of the legal title holder (i.e., the trustee) is a state procedural rule to which the McCarran Amendment subjects the Tribes’ reserved water rights. The federal government suggests that even if there were such a rule, it would be a substantive one that flows from the nature of the trust relationship, not state procedure. … We need not resolve that question because none of the four sources of an Oregon-law concurrence requirement offered by the ranchers show that Oregon law requires the federal government to concur in the Tribes’ calls for their reserved water rights held in trust.”

In Swinomish Indian Tribal Community v. Becerra, 2021 WL 1376986 (D.C. Cir. 2021), the D.C. Circuit rejected a claim by the Swinomish Indian Tribal Community (Tribe) that the Indian Health Service (IHS) violated the Indian Self-Determination and Education Assistance Act (ISDEAA) by failing to fully fund the Tribe’s indirect costs associated with health services provided by the Tribe through funds received by third-party insurers: “The scope of contract support costs is thus limited to those under one ‘contract’ — the one between a ‘contractor’ (the Tribe) and the contracting agency (Indian Health Service). In that contract, a Tribe promises to provide certain services to its community. In exchange, the government promises to provide the Tribe with a certain amount of money — the secretarial amount — for those services. Then, on top of that, the Act requires additional government funding to cover a Tribe’s cost of complying with the terms of that contract. … But the Act doesn’t require the government to pay for contract support costs on money generated from those other contracts — just for money paid by Indian Health Service for ‘the contract.’”

In Ute Indian Tribe of the Uintah and Ouray Reservation v. United States, 2021 WL 1602876, Not reported (Fed. Cl. 2021), the Ute Indian Tribe of the Uintah and Ouray Reservation (Tribe) had previously settled its breach of trust water rights claims against the United States under a Settlement Agreement that reserved the Tribe’s right to sue for claims related to alleged loss of the Tribe’s water resources caused by any alleged failure by the United States to establish, acquire, enforce, or protect such water rights. In the instant case, the Tribe sued in the Federal Claims Court for monetary compensation for various alleged breaches of trust and contract. The Court dismissed the Tribe’s claims for lack of jurisdiction, finding that the Tribe had failed to identify a money-mandating act of Congress with respect to certain claims and failure to file within the statute of limitations with respect to others.

In Jensen v. Budreau, 2021 WL 1546055 (W.D. Wis. 2021), Jensen sued the Red Cliff Chippewa Tribe, Swan, a tribal police officer, and Budreau, a Bayfield County deputy sheriff, for alleged violations of the civil rights act of 1871, 42 U.S.C. § 1983, arising out of her arrest at her home on the Red Cliff reservation. The plaintiff alleged that the Tribe waived its sovereign immunity by participating in a joint law enforcement program with the State under a state law, Wis. Stat. § 165.92(3m)(a), providing that the tribe must either (1) waive sovereign immunity to the extent necessary to allow the enforcement in state court of its liability under state law or (2) maintain liability insurance through a policy in which the insurer waives sovereign immunity defense up policy limits. The Court dismissed Jensen’s claims against the Tribe and her official capacity claim against Swan but declined to dismiss Jensen’s individual capacity claim against Swan: “Plaintiff does not argue that Congress has unequivocally expressed a waiver of tribal sovereign immunity in 42 U.S.C. § 1983 or with respect to constitutional claims brought under that statute. … At most, the tribe has consented to liability in state court. The Wisconsin statutes say nothing about § 1983 actions in federal court. … Because claims brought against employees in their official capacity are considered claims against the entity of which the employee is an agent, Lewis v. Clarke, 137 S. Ct. 1285, 1290-91 (2017), plaintiff’s official capacity claim against defendant Swan also will be dismissed. … On the other hand, ‘officers sued in their personal capacity come to court as individuals,’ Hafer v. Melo, 502 U.S. 21, 27 (1991), and the real party in interest is the individual, not the sovereign.’ Lewis, 137 S. Ct. at 1291. Therefore, ‘sovereign immunity ‘does not erect a barrier against suits to impose individual and personal liability.’ … Plaintiff’s allegations that the Tribe and county were engaged in a joint law enforcement plan, that all defendants were acting under state law and that plaintiff was transported to and booked in the Bayfield County jail are sufficient to suggest that defendant Swan was acting under state and not tribal law during the incident in question.”

In Mohawk Gaming Enterprises, LLC v. Affiliated FM Insurance Co., 2021 WL 1419782 (N.D.N.Y.), Mohawk Gaming Enterprises, LLC, a subsidiary of the St. Regis Mohawk Tribe that operated the Tribe’s casino (Casino), sued its insurer, Affiliated FM Insurance Co. (Affiliated FM), after Affiliated FM refused to cover the Casino’s losses resulting in the interruption of business caused by the COVID-19 pandemic. The Court granted Affiliated FM’s motion for judgment on the pleadings: “Mohawk Gaming alleged that the Tribe issued the closure order to prevent the spread of the novel coronavirus after it was detected at the nearby College in Kingston, Ontario. … However, as other courts have explained, the inclusion of the modifier ‘physical’ in a phrase such as ‘direct result of physical damage’ clearly imposes a requirement that the damage actually be tangible in nature; i.e., this language unambiguously requires some form of physical harm to the location (or to a location within five miles). … Indeed, numerous courts around the country—including those that have applied New York law—have routinely held that the mere presence or spread of the novel coronavirus is insufficient to trigger coverage when the policy’s language requires physical loss or physical damage.”

In Bad River Band v. Enbridge Energy Company, 2021 WL 1425352 (W.D. Wis. 2021), the Bad River Chippewa Band refused to renew expired easements held by Enbridge Energy Company, Inc., and Enbridge Energy, L.P. (collectively, Enbridge) for operation of a pipeline on eleven parcels of reservation land in which it held an ownership interest of at least 40% jointly with 168 other co-owners. The Tribe sued, alleging causes of action based on public nuisance under federal and state law, trespass, ejectment, violation of the Band’s regulatory authority, unjust enrichment, and seeking money damages for trespass. Enbridge moved to join the 168 co-tenants as necessary parties under Federal Rule of Civil Procedure 19 and to hold a separate trial for damages. The court denied both motions: “[D]efendants contend that the absent co-tenants’ interests would be impaired regardless of the outcome of this lawsuit, because the co-tenants’ ability to recover damages will be impacted. However, this argument ignores the Band’s actual position in this lawsuit, as well as the well-established, unilateral rights of tenants in common to exercise their respective rights of ownership. As defendants acknowledge in their brief, the Band is only seeking to enforce its property rights; the Band is not seeking to enforce the rights of the absent co-tenants or any collective rights in the property. … [W]hile the court agrees -- and plaintiff concedes -- that joinder would be required if the Band were attempting to recover damages based on the co-tenant’s interest in the property or if it were attempting to invalidate a third party’s claim to title on jointly-owned property, the Band is not seeking either. Instead, as described above, the Band is simply seeking to secure damages based on its fractional ownership of any parcel for the time period during which it has held that fractional interest. The court will not assume overreach in order to find a threatened interest on the part of third parties.”

In Lac Courte Oreilles v. Evers, (W.D. Wis. 2021), the Lac Courte Oreilles, Lac du Flambeau, Bad River and Red Cliff bands of Lake Superior Chippewa sued state, county and town officials to enjoin the imposition of property taxes on land owned by the tribes or their members in fee simple title within the boundaries of the reservations established for the tribes under the 1854 Treaty of La Pointe. The Tribes argued that state taxation of Indians in Indian country was prohibited in the absence of express congressional authorization and that the U.S. Supreme Court’s holding that the General Allotment Act constituted congressional authorization did not apply to the plaintiff tribes because their reservations had been allotted under the Treaty. The district court held that the 1854 treaty did not authorize taxation and rejected the State’s argument that all allotments after the enactment of the General Allotment Act were necessarily made under the authority of that act. The Court also held, however, that any protections against taxation were irretrievably lost when any allotted parcel passed into non-Indian hands and could not be revived upon reacquisition by a tribe or tribal member: “In [Cass County, Minnesota v. Leech Lake Band of Chippewa Indians, 524 U.S. 103 (1998)], the Court explicitly rejected the tribe’s argument that ‘although its tax immunity lay dormant during the period when the eight parcels were held by non-Indians, its reacquisition of the lands in fee rendered them nontaxable once again.’” … Under Cass County, transfer to non-Indian ownership permanently severs the tie between the land and the treaty.” The Court also declined to address the Tribes’ argument that land owned in fee by a tribe or tribal member was Indian country and that taxation, if permitted, would lead to an alienation without federal approval in violation of the Nonintercourse Act.

In Brackeen v. Haaland, 2021 WL 1263721 (5th Cir. 2021), plaintiffs had challenged the Indian Child Welfare Act (ICWA) on constitutional and other grounds. A panel of the Fifth Circuit Court of Appeals had upheld the law but on rehearing en banc, the court split into two major opinions. A pro-ICWA majority held that (1) Congress had the authority, by enacting the ICWA, to protect the best interests of Indian children and to promote the stability and security of Indian tribes and families by imposing federal standards for state child custody cases involving Native American children, (2) the law’s classification of “Indian child” was not a racial classification that violated the equal protection provisions of the Constitution, (3) certain ICWA provisions did not illegally commandeer states and (4) BIA did not exceed its authority in issuing regulations binding state courts. An anti-ICWA majority, however, held that several of the “active efforts” ICWA requires to states to undertake to prevent the breakup of Indian families unconstitutionally commandeered state officials. Significantly, the court split evenly – thereby leaving in place - on the district court’s holdings that ICWA’s preferences for placing children with “other Indian families” or with a licensed “Indian foster home” violated equal protection. The Fifth Circuit, which covers the states of Texas, Louisiana and Mississippi, is not binding on courts within the other federal circuits.

In Chicken Ranch Rancheria of Me-Wuk Indians v. Newsom, 2021 WL 1212712 (E.D. Cal. 2021), a number of tribes had entered into compacts with the State of California in 1999 in order to be able to conduct Class III gaming under the Indian Gaming Regulatory Act (IGRA). In connection with the scheduled expiration of the 1999 compacts in 2022, the tribes conducted negotiations with the State for new compacts. The State sought to include in the negotiations provisions for sharing of revenue with non-gaming tribes, as well as provisions dealing with employment standards, anti-discrimination and minimum wage, labor relations, tort remedies, child support, environmental review and other topics. The court granted the Tribe’s motion for summary judgment, finding, in particular, that the State had failed to offer the meaningful State concessions required to support the proposed revenue sharing provisions. The court ordered the parties to follow the procedure laid out in the IGRA following a determination of failure to negotiate in good faith, which provides for a mediator to determine the final compact by choosing between the parties’ “last best offer.”

In Cherokee Nation v. United States, 2021 WL 1232712 (D.D.C. 2021), the Cherokee Nation sued the United States for declaratory and injunctive relief, alleging that the government had mismanaged funds that it has long held in trust for the Nation from a wide variety of sources, including proceeds from the sale of land or profits from the land, surface leases for agriculture, surface, oil and gas mining leases, coal leases, sand and gravel leases, businesses, and town lots, income from property owned by the Nation, etc. The Nation sought an accounting. The magistrate judge denied the government’s motion to dismiss: “[T]he Nation heavily cites the American Indian Trust Fund Management Reform Act of 1994 (the ‘1994 Act’). … The 1994 Act requires ‘as full and complete accounting as possible of the [Nation’s] funds to the earliest possible date.’ … [T]he Government again argues that there is no common law of Indian trusts. … But the Government does not allege that the Nation failed to identify a rights-creating statute, as it concedes that the Nation relies in part on statutes and treaties. … Rather, it argues that to the extent the Nation’s claims rest on asserted common law trust obligation, those claims fail as a matter of law and must be dismissed. … This hypothetical argument is incorrect because Plaintiffs rely upon the statutory obligations found in 25 U.S.C. §§ 162a(d), 4011. … The Nation is entitled to seek enforcement of its statutory rights provided for in the 1994 Act.” (Internal quotations, citations and emendations omitted.)

In State v. Evans, 956 N.W.2d 68 (S.D. 2021), Evans, a non-Indian, challenged his conviction of rape, kidnapping, aggravated assault, and burglary on multiple grounds, including arguing that state law enforcement officials lacked jurisdiction to execute a search of his motor vehicle in the parking lot of the Oglala Sioux Tribe’s casino on the Pine Ridge reservation. The trial court denied the motion and the South Dakota Supreme Court affirmed: “[A]s the Court in Hicks explained, the state’s execution of a state warrant on a reservation for the violation of state laws occurring off the reservation does not impair the tribe’s right to self-govern. … If such is the case with respect to Indian defendants, then surely this same concept holds true when, like here, the state warrant authorizes the search and seizure of property owned by a non-Indian for crimes committed against another non-Indian outside the reservation. Evans has not directed this Court to a single case supporting the contrary proposition. … Even if we presume the Tribe has an interest in all law enforcement activity occurring within reservation borders, the state officers here respected such an interest, not only by way of notification, but also by seeking the assistance of tribal law enforcement. In fact, tribal officers were present during the execution of the arrest warrant and were invited to assist in the execution of the search warrant.”

In Sizemore v. State of Oklahoma, 2021 WL 1231493 (Okla. App. 2021), Sizemore, an enrolled member of the Choctaw Nation, had been convicted in an Oklahoma court of committing murder and assault on an officer within the boundaries of the reservation established for the Choctaw Nation by treaty in the nineteenth century. The State had exercised jurisdiction based on a century-old assumption that reservations of the “Five Civilized Tribes,” including the Creek, Cherokee, Chickasaw, Choctaw and Seminole, had been disestablished at the turn of the twentieth century by congressional acts applying equally to those reservations. In 2020, the Supreme Court held in McGirt v. Oklahoma that the Muscogee Creek Nation reservation had never been disestablished and that the State lacked criminal jurisdiction over crimes committed by Indians within the reservation. Based on its determination that the holding of McGirt applied equally to the Choctaw Reservation, the Oklahoma Court of Appeals vacated Sizemore’s conviction for lack of jurisdiction.

In South Point Energy Center LLC v. Arizona Department of Revenue, 2021 WL 1623343 (Ariz. App. 2021), South Point Energy Center, LLC (SPEC), a non-Indian entity, owned and operated an electrical generating plant (Facility) in Mohave County on land leased from the Fort Mojave Indian Tribe (Tribe). The lease (Lease) provided that SPEC owned the Facility and required SPEC, at the end of the Lease term, to “remove any and all above ground Improvements and personal property from the Leased Land,” except for certain roads, foundations, and underground piping and equipment. The Arizona Department of Revenue and Mohave County (collectively, ADOR) both imposed property taxes on SPEC, which paid the taxes and sued to recover the payments. SPEC argued that the taxes were barred by Section 5 of the Indian Reorganization Act (IRA), 25 U.S.C. § 5108, which authorizes the Secretary of Interior to acquire land in trust for Indians and provides that lands so acquired “shall be exempt from State and local taxation” and the Supreme Court’s holding in Mescalero Apache Tribe v. Jones, that permanent improvements to lands acquired under Section 5 are subject to the tax exemption. The trial court granted summary judgment to ADOR but the Arizona Court of Appeals reversed, rejecting ADOR’s argument that the tax should be evaluated under the rule of White Mountain Apache v. Bracker and holding that Section 5’s exemption applies to permanent improvements without regard to their ownership. The Appellate Court also rejected the trial court’s determination that the improvements installed by SPEC were necessarily personal property rather than permanent improvements due to the Lease requirement that they be removed at the end of the Lease term: “Under federal tax law, whether an asset is a permanent improvement or personal property turns on six factors set out in Whiteco Indus., Inc. v. Comm’r, 65 T.C. 664 (1975). … The factors are: (1) ‘Is the property capable of being moved, and has it in fact been moved?’; (2) ‘Is the property designed or constructed to remain permanently in place?’; (3) ‘Are there circumstances which tend to show the expected or intended length of affixation, i.e., are there circumstances which show that the property may or will have to be moved?’; (4) ‘How substantial a job is removal of the property and how time-consuming is it? Is it ‘readily removable’?; (5) ‘How much damage will the property sustain upon its removal?’; and (6) ‘What is the manner of affixation of the property to the land?’ … Because we conclude that 25 U.S.C. § 5108 establishes a categorical exemption for permanent improvements on Indian land held in trust by the United States, and that the tax court erred by concluding the Facility was entirely personal property without conducting the proper analysis, we vacate the court’s grant of summary judgment to ADOR. We remand this case to the tax court to conduct a Whiteco analysis to determine which, if any, of the assets that make up the Facility are permanent improvements that therefore are exempt from taxation under § 5108. The court then should consider whether property taxes on the assets that are not permanent improvements are preempted under Bracker.”

In Spears v. State of Oklahoma, 2021 WL 1231542 (Okla. App. 2021), Spears, an enrolled member of the Cherokee Nation, had been convicted in an Oklahoma court of committing murder within the boundaries of the reservation established for the Cherokee Nation by treaty in the nineteenth century. The State had exercised jurisdiction based on a century-old assumption that reservations of the “Five Civilized Tribes,” including the Creek, Cherokee, Chickasaw, Choctaw and Seminole, had been disestablished at the turn of the twentieth century by congressional acts applying equally to those reservations. In 2020, the Supreme Court held in McGirt v. Oklahoma that the Muscogee Creek Nation reservation had never been disestablished and that the State lacked criminal jurisdiction over crimes committed by Indians within the reservation. Based on its determination that the holding of McGirt applied equally to the Cherokee Reservation, the Oklahoma Court of Appeals vacated Sizemore’s conviction for lack of jurisdiction.

/>i

/>i