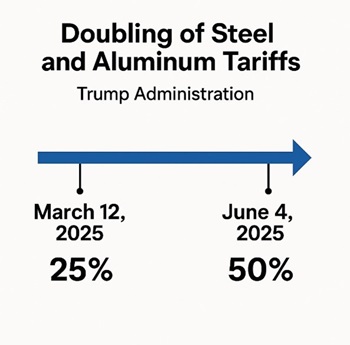

The doubling of steel and aluminum tariffs by the Trump administration—from 25% to 50% within just three months—is a significant escalation in trade policy and the fulfillment of a Trump campaign promise.

The U.S. also removed country and product exemptions and imposed stricter definitions to ensure tariff coverage and enforcement. The main objective for the shift in U.S. policy—increase domestic supply to meet defense and critical infrastructure demands.

In April 2025, Bradley’s Corporate & Securities Practice Group offered insights on how foreign steel and aluminum producers can navigate the new landscape: U.S. Tariffs on Steel and Aluminum: Navigating the Changing Landscape in 2025 | Insights & Events | Bradley.

Higher tariff rates have prompted some foreign producers to look to make substantial investments in U.S. assets as a possible strategy for reducing their overall tariff burden.

Tariff Workaround Attempt Stifled

The most significant example of a tariff workaround strategy is Nippon Steel’s attempted acquisition of U.S. Steel Corporation. In early comments on the deal, the parties said they aimed to improve global steelmaking by producing more efficient, eco-friendly products and advancing industry technology. If successful, the acquisition would also have granted Nippon tariff-free access as a U.S.-based producer.

Almost immediately, the proposed transaction encountered bipartisan resistance—primarily for national security concerns—as well as an outcry from American steelworker groups, like the United Steelworkers Union, who expressed concern that American jobs would be lost in the acquisition.

Trump changes “acquisition” to “partnership” to make room for government control.

President Donald Trump intervened and pressured Nippon and U.S. Steel to reframe the terms of the transaction in a manner more favorable to United States’ interests. Nippon Steel was eventually permitted to enter into a “partnership” with U.S. Steel under the close eye of the U.S. government, but not purchase U.S. Steel outright. The partnership was consummated on June 18, 2025—shortly after Trump’s approval. A key component of the final approval was the execution of a National Security Agreement (NSA) providing for the following:

- Nippon Steel will invest $14 billion in U.S. Steel ($11 billion to be invested by 2028).

- The bulk of Nippon Steel’s investment will be used for renovating and upgrading existing U.S. Steel facilities and building new and improved facilities in the United States.

- The headquarters of U.S. Steel will remain in Pittsburgh, Pennsylvania.

- An independent director of the board of U.S. Steel must be appointed or approved by the U.S. government.

- The CEO, the management team and a majority of the board of U.S. Steel must be U.S. citizens.

- The United States government must be able to exercise veto power over certain corporate functions, including reincorporating U.S. Steel overseas and company name changes.

- Nippon Steel must not initiate layoffs of U.S. Steel employees, shutdowns of existing U.S. Steel facilities, or other offshoring of U.S. jobs.

- Nippon Steel is prohibited from conducting trade activities adverse to the best interests of U.S. Steel.

- Nippon Steel must refrain from importing steel products that compete with American suppliers and must otherwise comply with government recommendations.

- Nippon Steel must uphold all union agreements with the United Steelworkers Union.

Lessons Learned from the Nippon Steel–U.S. Steel transaction:

- The U.S. government has signaled its intentions to play an increasingly proactive role as gatekeeper in shaping and even dictating the terms of foreign investment in critical sectors, such as steel and aluminum.

- Direct investment in U.S. assets can provide a path to tariff-free status — but it comes with the "cost" of political alignment and regulatory entanglement. Companies must decide if such an investment is a lucrative entry strategy.

- A shift is underway: Rather than pure acquisitions, future deals may take the form of joint ventures, alliances, or co-developed assets, especially in areas like infrastructure, shipbuilding, and green steel.

- Public statements from Nippon and U.S. Steel echoing Trump-era slogans ("make American steelmaking and manufacturing great again") show that embracing U.S. political rhetoric may be increasingly necessary to gain approval. A broader trend toward economic patriotism, where deals must align with administration policy goals, not just market economics, seems to be in full swing.

- For companies with sufficient capital, building new U.S. plants may be preferable to acquisitions burdened by national security agreements. This option allows companies to retain control and shape operations from inception while still benefiting from U.S. presence—though at a higher upfront cost.

Conclusion

The Nippon Steel deal is not a universal template, but it proves foreign steelmakers can still enter the U.S. market—if they are willing to align with national interests. The model is promising but intricate, requiring each company to weigh its risk tolerance, strategic priorities, and willingness to navigate regulatory trade-offs.

/>i

/>i