On May 22, South Carolina Governor Henry McMaster signed into law H.B. 4243 ,known colloquially as the “Panthers Bill,” as the primary buzz surrounding the bill arose from the provisions aimed at assisting the Carolina Panthers football team with the potential relocation of its headquarters into South Carolina. Another significant impact of H.B. 4243 was the dramatic increase in the amount of available job tax credits (JTCs) for qualifying jobs created in lower-income Tier III and Tier IV counties. The law increases JTCs for new, full-time jobs from $4,000 to $20,250 per job in Tier III counties and from $8,000 to $25,000 per job in Tier IV counties.

JTCs are governed by statute and are not awarded at the discretion of any state or local governing body. The incentives come in the form of a tax credit against South Carolina income tax, bank tax or insurance premium tax to reward a qualifying business for creating new jobs. The statute governing Job Tax Credits (S.C. Code Section 12-63360) provides detailed guidance on which types of business may qualify, but it generally includes manufacturing and processing, warehousing and distribution, research and development, agribusiness operations, corporate headquarters, qualifying technology intensive facilities and certain qualifying service-related facilities.

In order to qualify, companies must create and maintain a certain number of net new jobs in a taxable year. The number of new jobs is calculated as the increase in the average monthly employment from one year to the next. In general, a taxpayer must increase employment by a monthly average of 10 new, full time jobs to qualify for the credit, regardless of the county in which the employer is located, but there are certain exceptions described in further detail in the statutes.

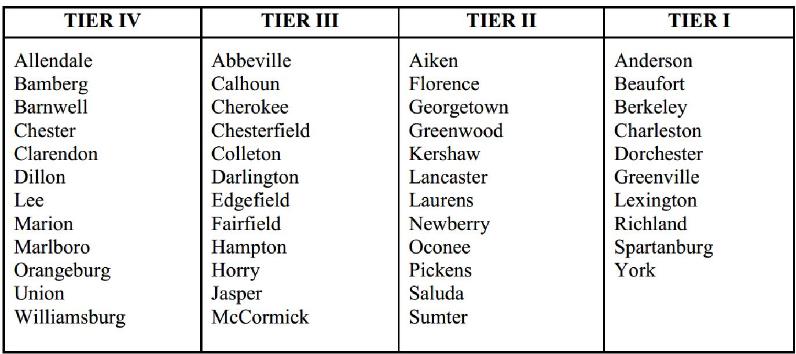

The amount of JTCs awarded per job is determined based on the development tier of the county in which the facility is located. Counties are re-ranked every year based on unemployment rates and per capita income, and the ranking of a county may change from year to year. The current development tiers of South Carolina Counties are set forth below:

In general, the amount is based on the county designation during the year new jobs are created. However, a company may file a Form SC616 prior to the time initial staffing begins in order to lock in the county’s tier, in which case the credit is based on the more advantageous of (1) the county designation at the time the SC616 is filed, or (2) the county designation at the time the new jobs are created. The basic credit amounts for each tier are set forth below:

- $1,500 per job per year for new, full-time jobs in a Tier I county;

- $2,750 per job per year for new, full-time jobs in a Tier II county;

- $20,250 per job per year for new, full-time jobs in a Tier III county; and

- $25,000 per job per year for new, full-time jobs in a Tier IV county.

South Carolina also allows for enhanced JTCs for projects located in a multi-county industrial park (MCIP). Each MCIP is established by agreement between two or more counties, whereby the counties designate a number of parcels and agree to split property tax revenues generated by the specified parcels. If a project is located within an MCIP, it will be eligible for an additional $1,000 per job per year in Job Tax Credits, making the MCIP designation a valuable incentive offered by South Carolina counties.

JTCs are claimed using South Carolina Tax Form TC-4. The JTC is available for a five-year period and is first claimed on the taxpayer’s tax return for the year following the creation of the new jobs (Year 2, as Year 1 is used to establish the created job levels), provided the jobs are maintained.

/>i

/>i